Investing in the stock market and taking control of one’s financial future is an incredibly empowering feeling. However, a common problem many investors face is finding the time and resources to perform adequate research. The financial world moves fast, and trying to keep up with a company’s latest financial performance, price action, and industry news is almost impossible for most investors today.

To help make one’s research more efficient and accurate, there are multiple stock and fund research platforms designed to help investors make informed investment decisions.

And two of the most popular (and respected) stock research sites today are The Motley Fool and Morningstar, which are both geared towards making investors’ decision making processes easier.

Though a common question investors ask is which one is better?

To answer this question, today we’ll be conducting a deep-dive comparison between The Motley Fool vs. Morningstar, looking at the strategy behind both, their key features, cost structure, and some pros and cons of each, with the end goal in mind of helping investors decide which one is best suited for their specific investment goals and style.

The Motley Fool Overview

The Motley Fool was founded by brothers David and Tom Gardener in 1993, first giving investment advice through a paper-copy newsletter sent through the mail.

Since then, the two brothers have grown the Motley Fool to be a premier stock picking service, offering over 40 different portfolios for investors to choose from.

The Motley Fool Stock Advisor service is the company’s flagship product, where subscribers gain access to regular stock recommendations hand-picked by David and Tom Gardner themselves.

The Motley Fool prides itself on performing in-depth research for investors so they don’t have to. And with multiple services and portfolios available, investors can pick and choose which investment style and industry focus works best for them.

Some of the most popular Motley Fool services consist of:

- Stock Advisor: This subscription offers a monthly selection of stock picks from the Motley Fool’s co-founders, Tom and David Gardner, along with updates on previous picks. This is their flagship service, and investors can expect a wide range of stock recommendations from different industries with varying market capitalizations.

- Rule Breakers: Focused on high-growth, disruptive companies that have the potential to outperform the market, Rule Breakers provides stock recommendations from a team of analysts always on the lookout for the next big thing.

- Firecrackers: This service is all about identifying small-cap companies with explosive growth potential. Subscribers receive an entire portfolio worth of stock picks from a team of experts who specialize in researching and recommending high-growth small/micro-cap stocks.

- Digital Explorers: This is the company’s blockchain and cryptocurrency asset portfolio service identifying new tokens for investors to choose from.

- Blast Off: This subscription focuses on identifying and recommending companies that have the potential to grow exponentially over the next 10-15 years. There is no bias towards a specific industry or company size; they only care that a company is exhibiting signs of extreme growth potential.

- Biotech Breakthroughs: This service is dedicated to identifying companies on the cutting-edge of medical research, including biotech, genomics, and personalized medicine. Subscribers receive monthly updates from a team of analysts who are experts in the field.

- Nextgen Supercycle: This subscription service focuses on identifying stocks of companies that are at the forefront of technological trends and innovations, including the cloud, 5G, and artificial intelligence.

- 10x: One of Motley Fool’s premium subscription services, investors gain access to recommendations for disruptive companies that have the potential to generate 10 times or more returns on investment in a 10-year time frame.

- IPO Trailblazers: For those interested in investing in companies going public, this Motley Fool subscription service provides well-researched recommendations on IPOs.

- Real Estate Winners: This is one of Motley Fool’s only service offerings giving recommendations for investing in companies involved in the real estate industry, including real estate developers, REITs, and other firms related to the industry.

The Motley Fool Strategy & Key Features

As we previously mentioned, the Motley Fool aims to provide a full-fledged stock investment research service to their subscribers. By both identifying stocks to investing in, as well as creating simple-to-read research reports, the Motley Fool gives subscribers quality investment research on a monthly basis.

The investment strategy of the Motley Fool tends to focus on smaller, high growth companies who are disrupting traditional industries or expanding into new ones. More specifically, the Motley Fool believes in long term investing, encouraging their subscribers to hold their recommendations for a minimum of five years.

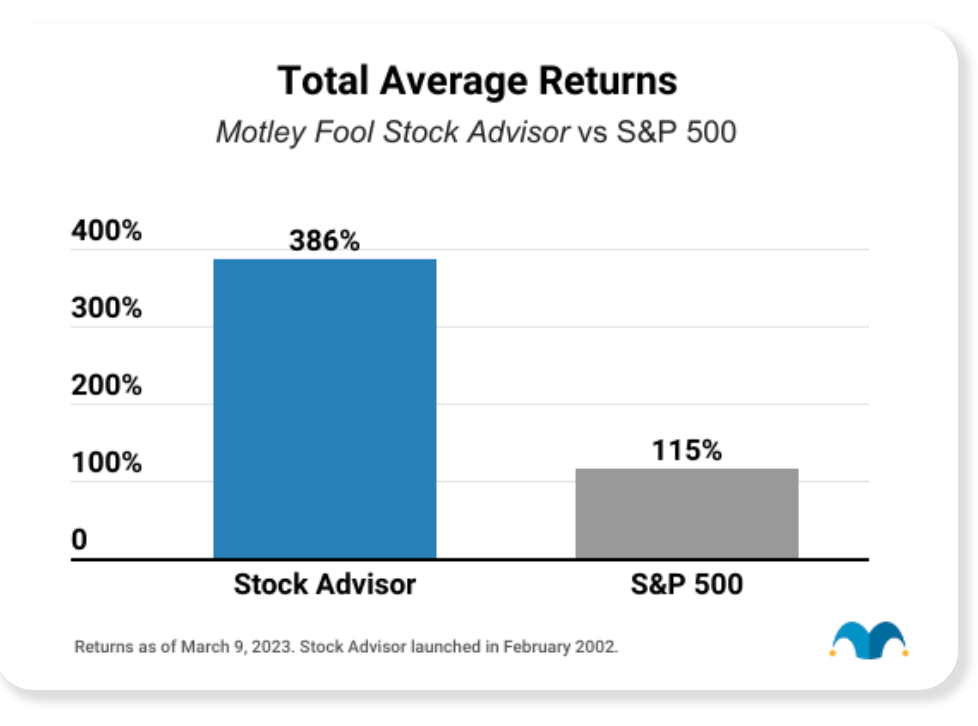

This focus on small to mid cap growth stocks has proven to be very effective, with the Motley Fool’s flagship Stock Advisor service reporting a total average return of 386% over the last 20 years – trouncing that of the S&P 5oo over the same time period.

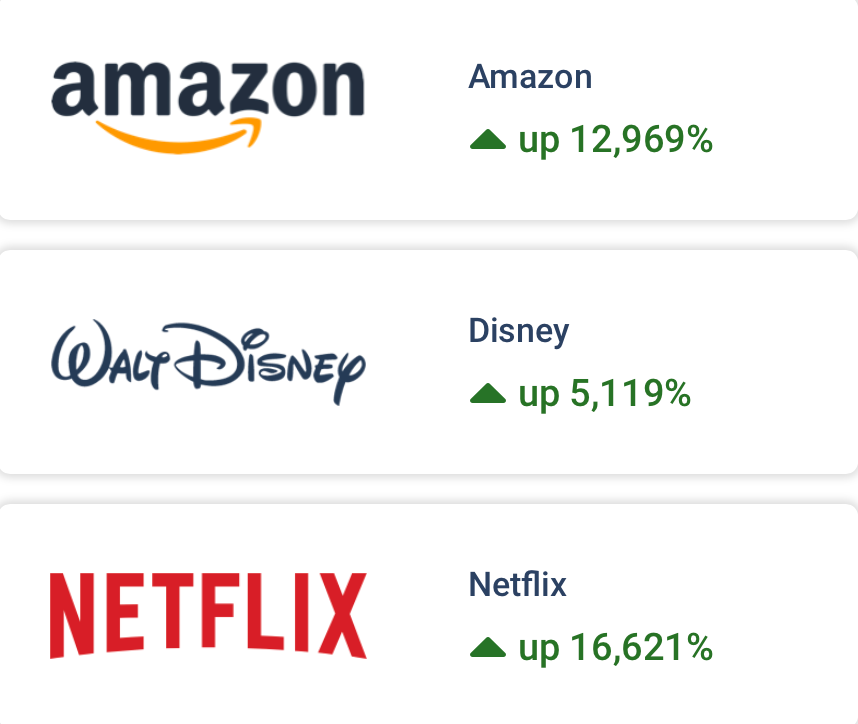

Some of their most successful stock picks include Amazon, Netflix, and Disney, which were first recommended to subscribers when the companies were only just beginning their meteoric rise. Therein lies the advantage of the Motley Fool’s investment research strategy; focusing on promising companies at the early stage of their growth trajectory provides the opportunity for outsized gains in the long term.

On top of getting access to new stock picks each month, there are some other key features the Motley Fool offers to their subscribers:

Portfolio Tracking

One of the most valuable investment tools the Motley Fool offers is allowing users to build a portfolio of their holdings directly on their site, effectively tracking performance, price movements, asset allocation, and more. This gives users quick access to the stocks they currently own, making it easier to manage their Motley Fool stock picks and other investment holdings.

Bonus Reports

While the Motley Fool offers many different premium investment services, they also provide timely bonus reports focused on specific trends or sectors. For example, providing comprehensive reports (which include investment ideas) on the future of clean energy or shifting dynamics within the real estate market allows users to capitalize on developing trends quickly and effectively.

Educational content

Not only does the Motley Fool provide stock picks, but they also hold an incredibly large library of investment educational content. Covering topics like retirement planning, investing psychology, filing taxes, budgeting, options trading, and more, users have all the information they will need to set themselves up for long-term financial success.

access to large investor community

The Motley Fool has also built a community platform for investors, allowing subscribers to discuss stock picks, share fundamental analysis research, and give their own investment thesis for specific companies. These community rooms is one of the most valuable features of the Motley Fool, as it gives investors a chance to hear differing opinions and viewpoints on Motley Fool picks.

Motley Fool Cost

Motley Fool’s Stock Advisor service runs at $199 a year, with first time subscribers getting the reduced rate of $99 for their first year. Their premium services like 10x, Digital Explorers, or IPO Trailblazers will cost considerably more, running upwards of $1,000.

Here is a breakdown of the cost for Motley Fool’s most popular services:

- Stock Advisor: $199/year – with a first time deal of $99/year

- Rule Breakers: $299/year

- Epic Bundle (Stock Advisor & Rule Breakers Combined): $499/year

- Firecrackers: $1,999/year

- Digital Explorers: $1,999/year

- Blast Off: $1,999/year

- Biotech Breakthroughs: $1,999/year

- Nextgen Supercycle: $1,999/year

- 10x: $1,999/year

- IPO Trailblazers: $1,999/year

- Real Estate Winners: $249/year

Pros and Cons of The Motley Fool

The Motley Fool is definitely a legitimate investment research company, focused on giving readers sound investment advice and a steady stream of stock picks for investors to choose from.

Motley fool pros

- Many different services for investors to pick from

- Research reports explain complex financial topics in easy-to-understand language

- Steady supply of stock picks each month

- Ideal for investors who don’t have time to perform their own research

- Community platform to engage with other investors

Motley Fool cons

- Premium service memberships are expensive

- Not ideal for day traders or more active investors

- Some Motley Fool stock picks carry considerable risk

- Slow to issue sell guidance on stock picks which have underperformed

Morningstar Overview

Morningstar is a popular alternative to the Motley Fool, and was founded by Joe Mansueto in 1984. The investment research company has become one of the most widely used tools by professional investors and financial advisors around the world.

Morningstar provides its subscribers with unmatched analysis, research, and tools to help investors make informed decisions. Covering more than just stocks, Morningstar also covers mutual funds, exchange traded funds, and other investment classes.

Instead of providing specific stock recommendations to their users, Morningstar provides various services like mutual fund ratings, stock reports, analyst coverage, and fair value estimates of stocks. All this gives investors the ability to make their own investment decisions based on the most up-to-date and relevant information.

Morningstar Strategy & Key Features

Morningstar’s strategy is to empower investors to make their own financial decisions. Providing comprehensive reports geared towards covering industry trends, specific company-focused financial information, stock screener options, price targets, and portfolio management tools let’s investors perform their own research on various funds and stocks.

Morningstar takes an objective view to making investing decisions, compiling information from multiple sources and providing it to users in one place.

And just like the Motley Fool, Morningstar also has multiple key features investors should know about:

Analyst coverage

Morningstar compiles analyst coverage, information, and analysis into one single document for investors, cutting through the noise and providing subscribers actionable analysis through objective data. Covering both buy and sell side analysis, users are able to understand catalysts for growth, as well as potential risks to a company’s success.

Comprehensive Ratings

Morningstar gives regularly updated and detailed ratings on whether or not a stock or mutual fund is under/overvalued, as well as rates a company’s business model, ESG initiatives, and management effectiveness to give users a digestible way to assess investment opportunities.

Morningstar has a defined methodology and system to valuing assets, providing investors an unbiased approach to assessing if a stock or fund offers value at current prices.

Customized stock screener

Where the Motley Fool provides stock recommendations straight to their users, Morningstar offers customizable stock screeners for users to find their own investment opportunities. This allows you to find stocks based off your own investment strategy and can sort screeners based off valuation metrics, growth performance, and Morningstar ratings.

portfolio analysis

Perhaps one of the most unique features Morningstar provides is their portfolio x ray tool, which analyzes your current portfolio based off asset allocation, sector weightings, fees/expenses, stock stats, and more. This tool gives users insights into better understanding their current portfolio and identifies any risks investors may not be aware of.

Morningstar Cost

The Morningstar premium service for retail investors currently costs $249 for a yearly subscription or $34.95 for an ongoing monthly subscription. Additionally, Morningstar offers a 7-day free trial so investors can get a feel for the platform and decide if the service is right for them.

Pros and Cons of Morningstar

Morningstar is a common investment research tool used by thousands of professional investors worldwide, allowing its users the ability to conduct their own research on their own time.

Morningstar pros

- Provides a comprehensive investment research tool

- Affordable price tag for most investors

- Strong customization abilities

- Trusted by investment professionals

- Contains financial data on over 10,000 different stocks, mutual funds, and ETF’s

Morningstar cons

- Can be difficult to navigate for new investors

- Doesn’t recommend stocks for users

- May be overwhelming for beginner investors

- Limited free trial

Similarities & Differences

Morningstar and Motley Fool are both popular investment research and analysis companies that provide valuable information to investors. They are similar in that both offer analysis on individual stocks helping investors make informed decisions. Both companies provide comprehensive coverage of the stock market and regularly publish research reports for users, as well as various educational content.

However, there are also some key differences.

Morningstar is primarily focused on mutual funds and ETFs, and instead of actively recommending investment opportunities, they offer comprehensive information for investors to perform their own research to make their own decisions.

Conversely, the Motley Fool covers a different range of investments, including stocks, options, and cryptocurrencies by offering a variety of niche services for investors to choose from. In addition, whereas Morningstar aims to provide a research platform for subscribers to make their own investment decisions, the Motley Fool does the research for their users through active recommendations of stocks to buy each month.

Motley Fool vs. Morningstar: Which One is Better?

Motley Fool vs. Morningstar is a common comparison investors make when looking for resources to assist them in reaching their investing goals. And the question of which one is better is largely dependent on ones investing style, desire to perform research, financial goals, budget, and risk tolerance.

If you’re tight on time, want consistent investment ideas, are willing to hold long term, and are ok with investing in smaller sized companies, the Motley Fool is likely going to be a better fit. More specifically, the Motley Fool is a great tool for aggressive investors who are willing to take on higher risk through holding high growth firms which could sizably outperform financial markets in the long term.

However, those who choose the Motley Fool should be prepared for increased volatility and the reality that not every stock pick will work out.

For those who are looking to complete their own research and want accurate information at their fingertips so they can decide for themselves where to put their money, Morningstar premium is the way to go. Morningstar will significantly cut down investors’ research time by providing an all-in-one platform for investors to find and analyze potential investment opportunities.

Those who aren’t willing to put the work in or don’t yet understand various financial metrics and topics may want to consider another platform, as Morningstar requires their users to have a strong investing foundation to be successful.