Online investing is democratizing financial markets for retail investors.

No longer must you go through the painstaking process of paying a professional broker to purchase stocks on your behalf.

Instead, you can simply create an account, deposit your funds, and select the stocks you want to buy, all at a fraction of the cost.

But be careful—not all online brokerages are created equal.

You will want to find a broker that meets your needs, providing you with the tools, stocks, and features required to help you achieve your financial goals.

Fortunately, two of Canada’s top online investment brokerages, Questrade and Wealthsimple, offer the perfect solution for Canadian retail investors.

In this article, we’ll break down both, listing their pros and cons while helping you determine which brokerage is right for you.

It is time to take control of your finances, and this is how to make it happen.

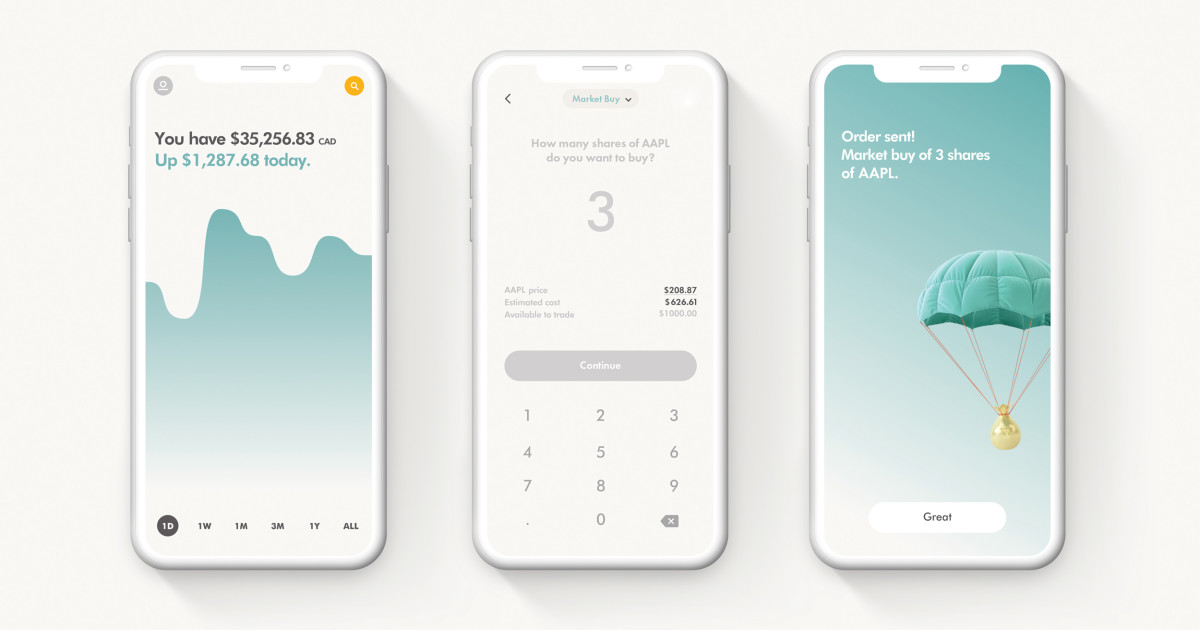

What is Wealthsimple?

Image By: Wealthsimple

If you are a beginner or experienced investor searching for an intuitive and low-cost investment online brokerage, the Wealthsimple trade platform is an excellent option.

Founded in 2014, Wealthsimple began in Canada, providing investors with a smart, simple, and cost-effective investment strategy that enables retail investors to invest just like the ultra-rich.

Now, the company provides both brokerage services and wealth management solutions, including robo-advisor services, that are difficult to match.

For one, a Wealthsimple trade account offers commission-free trading and requires no minimum investment or account balance, making it perfect for those investors wanting to minimize costs and maximize returns.

What’s more, its brokerage platform allows you to buy and sell fractional shares, which have proven quite advantageous for those who may want to own a quality business, but may not have the capital to acquire full shares (i.e., think Constellation Software (CSU).

One potential drawback of Wealthsimple Invest is that it requires you to pay 1.5% currency exchange fees every time you trade U.S. stocks.

To overcome this, the company offers a Wealthsimple Plus ($10/month) program that provides commission-free trading on U.S. stocks, as well as unlimited price alerts, real-time quotes, and $5,000 instant deposits.

Aside from its equity trading platform, Wealthsimple offers exchange-traded funds (ETFs), options trading, and select cryptocurrencies, but does offer mutual funds and IPOs.

In addition, the platform allows investors to open both a tax-free savings account (TFSA) and a registered retirement savings plan (RRSP), making it suitable for those Canadians looking to take advantage of Canada’s tax-free accounts.

Plus, its high-interest savings account, called Wealthsimple Cash, makes it easier to send, store, and receive money all in one place.

As such, Wealthsimple meets the demands of most retail investors offering the perfect low-cost solution for their investment needs.

And with $15 billion as of 2022, you can have confidence knowing that your money is in good hands.

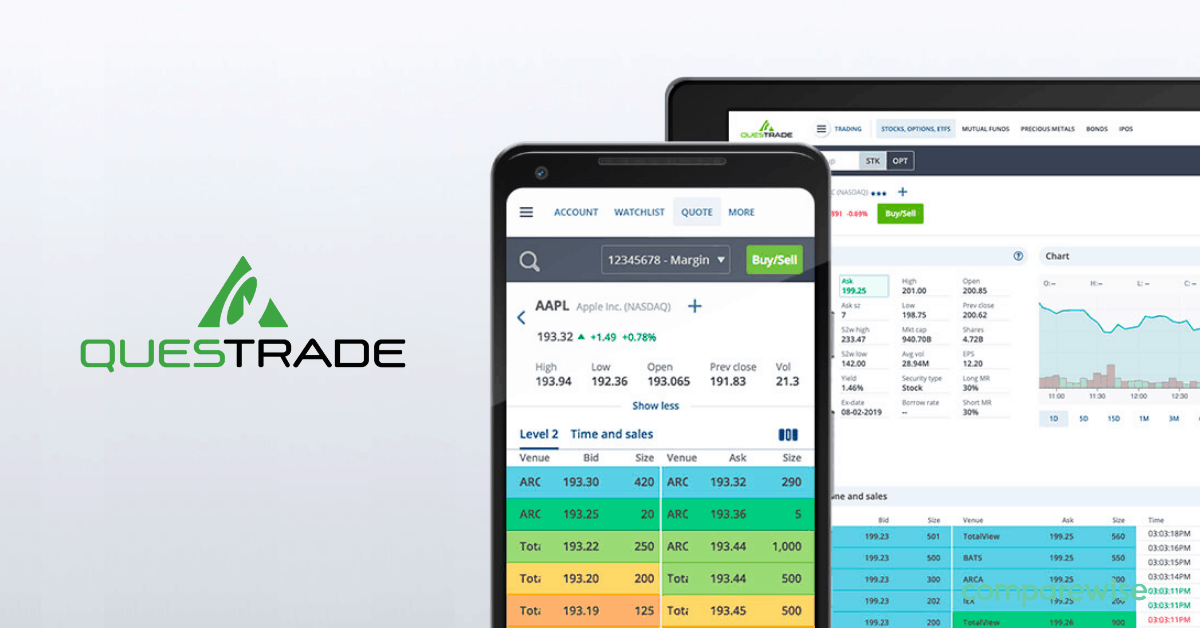

What is Questrade?

Image By: Comparewise

Questrade is another leading online Canadian brokerage and is one of the most prominent and well-established platforms for self-directed investors in Canada.

The company offers a wide range of investment products and services, giving investors the tools to succeed and empowering them to take control of their financial future.

When you open an account on Questrade, you gain access to a plethora of stocks, options, exchange-traded funds, mutual funds, bonds, forex, commodities (i.e., precious metals), and more.

This diverse range of offerings is perfect for those wanting to build a diversified portfolio that is tailored to their financial goals and risk tolerance.

One thing to keep in mind is that Questrade charges a commission fee on all investment transactions and also requires you to make a minimum deposit of $1,000 before trading.

While it can add up, these trading fees are among the lowest in Canada, making them a viable option for those wanting to limit their expenses.

For context, Questrade charges low fees of $4.95 to $9.95 per transaction on stocks, 1% of the trade value on international equities, $9.95 on mutual funds, $9.95 on options, and a trading fee of $4.95 to $9.95 when you sell an ETF (note that there is no fee when buying ETFs).

Another one of Questrade’s key advantages is the sheer number of self-directed trading accounts you can open on the platform.

This includes tax-sheltered registered accounts like registered retirement savings plans (RRSPs), tax-free savings accounts (TFSAs), registered education savings plans (RESPs), locked-in retirement accounts (LIRAs), registered retirement income funds (RRIFs), life income fund (LIFs), and first home savings accounts (FHSAs), as well as non-registered accounts like margin accounts, foreign exchange market accounts, and corporate investment accounts.

With so many account options and investing products, it is difficult to see why an investor would want to go anywhere else for their investing needs.

Pros and Cons of Questrade vs. Wealthsimple

Wealthsimple Pros

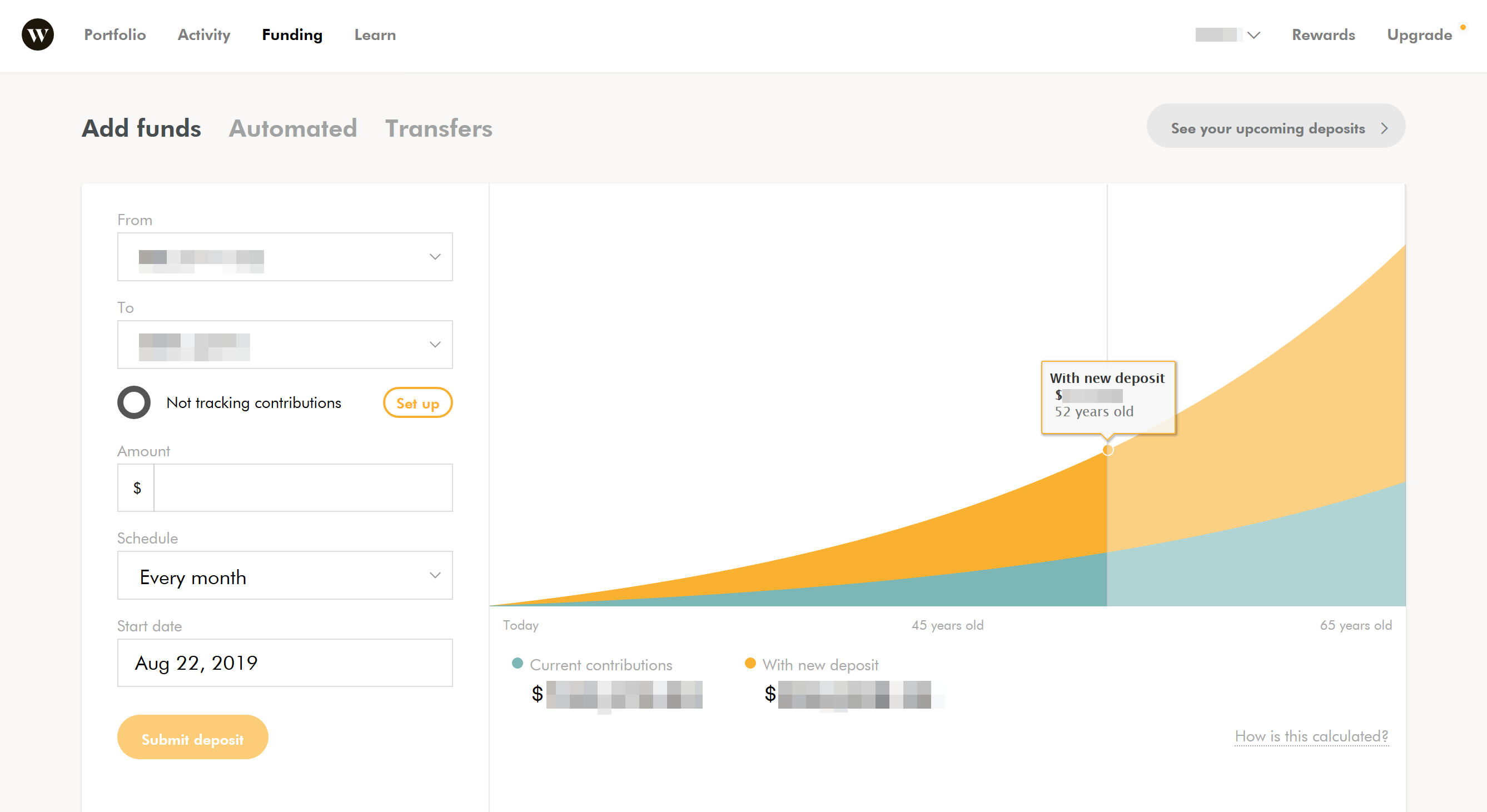

Image By: BrokerChooser

- Commission-Free Trading: Wealthsimple Trade stands out as one of the pioneering commission-free trading platforms in Canada. Moreover, users benefit from the absence of annual account fees or minimum requirements.

- Fractional Shares: The introduction of fractional investing on Wealthsimple Trade allows investors to own small portions of companies, even if they don’t possess sufficient funds to purchase whole shares.

- User-Friendly Mobile App: The Wealthsimple Trade app boasts an appealing, clean, and intuitive interface, making it accessible even to novice investors. Notably, the app’s “browse” feature conveniently organizes trending stocks by different markets and categories.

- Tax-Sheltered Registered Accounts: Wealthsimple Trade provides a variety of registered accounts, such as Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs), in addition to non-registered accounts.

- Drip Investing: Wealthsimple Trade allows users to automate dividend reinvestments, making it easier for investors to dollar cost average and compound their wealth.

- CIPF Protection and IIROC Member: Wealthsimple is backed by the Canadian Investor Protection Fund and is a member of the Investment Industry Regulatory Organization of Canada.

Wealthsimple Cons

- Restricted Investment Selection: At present, users on this platform can only trade stocks, ETFs, and certain cryptocurrencies. Unfortunately, mutual funds and IPOs are not accessible.

- US Conversion and Holding Fees: If you want to invest in U.S. stocks, be aware that a currency conversion fee of 1.5% per transaction applies to the basic no-fee account. Moreover, if you want to hold U.S. dollars in your account, you’ll be required to pay $10/month.

- Management Fees: 0.5% management fee for those who invest under $100,000 and a 0.4% fee for those who invest more.

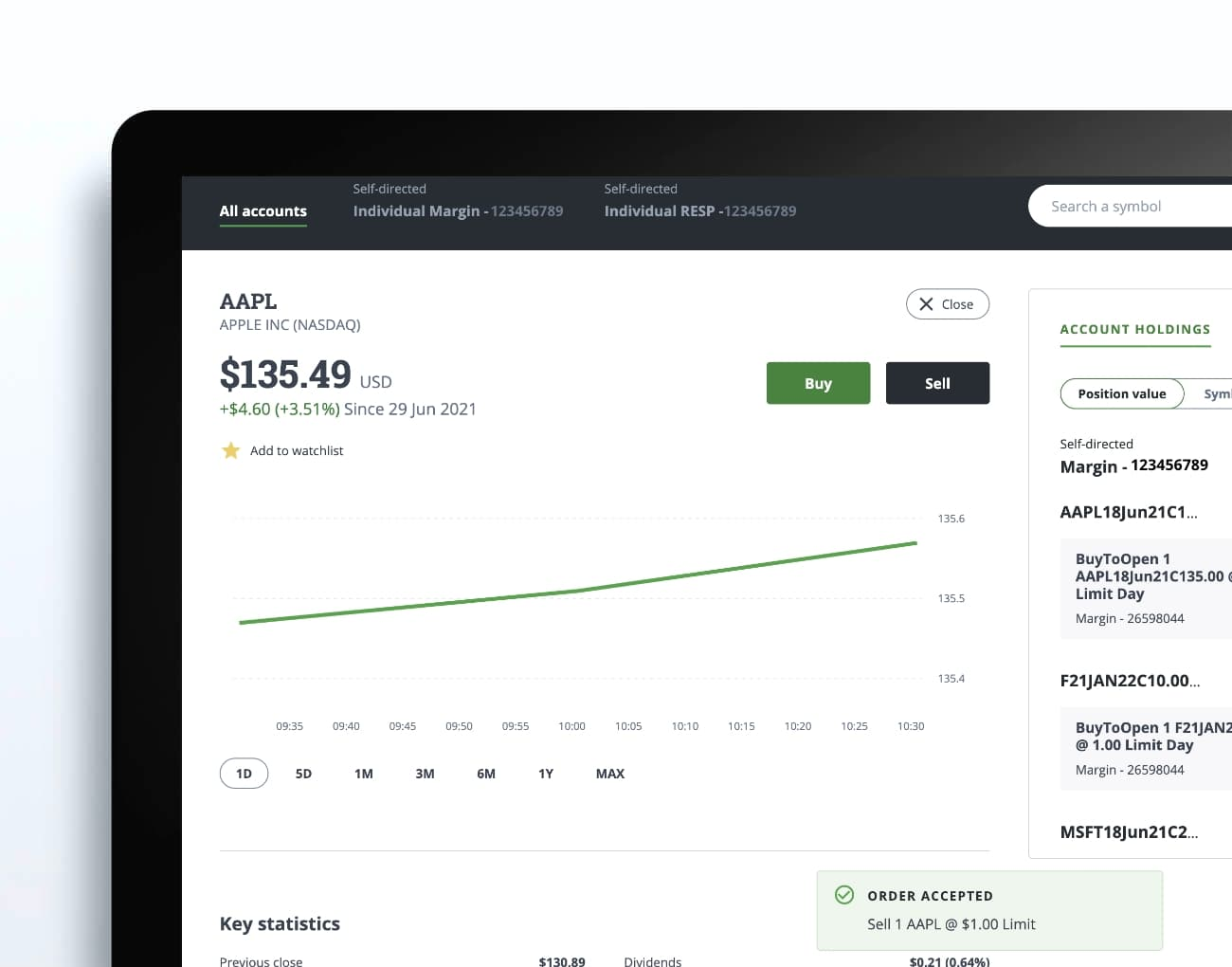

Questrade Pros

Image By: Questrade

- Competitive Fees: Questrade stands out among Canadian online brokers and robo-advisors for its remarkably low trading and administration fees. Notably, it offers free ETF purchases, giving it a clear edge in the market.

- Diverse Account Options: With an extensive range of account types, including margin accounts, Questrade has proven to be a versatile financial institution. Notably, it was the pioneer in offering FHSA accounts in Canada.

- Wide Investment Selection: While starting with stocks and ETFs is common for investors, Questrade provides a comprehensive suite of investment products, encompassing bonds, GICs, and IPOs, to cater to diverse investment strategies.

- Improved Customer Service: Questrade’s customer service has seen notable improvements over time, according to various reviews. Our test of their chat support yielded a positive experience. They offer support via online chat, phone, and email.

- Extended Trading Hours: Questrade offers extended trading hours for US markets, enabling investors to trade from 7 am to 8 pm ET, providing more flexibility for managing their investments.

- US Dollar Accounts: Questrade allows investors to hold and trade U.S. dollars within registered accounts, which can be beneficial for those looking to invest directly in U.S. markets without currency conversion fees.

- CIPF Protection and IIROC Member: Questrade is backed by the Canadian Investor Protection Fund and is a member of the Investment Industry Regulatory Organization of Canada.

Questrade Cons

- Minimum Account Balance Requirement: To activate your account, Questrade has set a minimum funding amount of $1,000.

- Subpar Mobile Platform: Questrade’s mobile app falls short in terms of interface quality compared to other internet brokerages. As a result, it may not be as convenient for investors who prefer managing their investments on the go.

- Management Fees: 0.25% management fee for those who invest under $100,000 and a 0.20% fee for those who invest more.

Who is Wealthsimple vs. Questrade For?

Who is Wealthsimple For?

Wealthsimple is built for the individual cost-conscious investor.

This can be anyone interested in investing more simply and straightforwardly.

More specifically, Wealthsimple is suitable for beginners or those who prefer a hands-off approach to investing.

With an intuitive mobile app and web interface, it is the perfect option for those seeking an effective and user-friendly experience.

While it may not offer complex trading tools or access to smaller financial markets, Wealthsimple meets the needs of most retail investors, making it an excellent choice for the Canadian individual investor.

In all, it is hard not to be pleased with the commission-free trading and high-quality user experience it offers.

Who is Questrade For?

Questrade’s online brokerage platform is a suitable choice for a diverse range of investors and traders.

It caters to self-directed investors and experienced traders who want to actively manage their investments with a wide range of options, including stocks, ETFs, mutual funds, and more.

Where Questrade truly sets itself apart by allowing Canadian investors to trade US stocks on their platform through registered accounts.

While its commission fees are more expensive than Wealthsimple, Questrade’s competitive fee structure, access to international markets, and multiple trading accounts make it one of the best online brokers today.

Overall, you’d be hard-pressed to find a brokerage account that satisfies your as well as Questrade.

When to Use Wealthsimple vs Questrade?

-

User Experience: Wealthsimple

Wealthsimple’s user-friendly interface takes the cake on this one. Though Questrade’s platform isn’t bad, it is not as intuitive as Wealthsimple’s mobile and web platforms. Therefore, if you are seeking to make your investment process as simple as possible, Wealthsimple trade is the way to go!

-

Investment Approach: Both

Both Wealthsimple Trade and Questrade are suitable options for retail investors, offering them all the basic tools and assets needed to become a successful retail investor. However, Wealthsimple might have a slight advantage due to the fact that you can trade fractional shares on the platform. This makes it easier to buy all stocks on the brokerage but plays a relatively minor factor overall.

-

Fees and Costs: Both

Wealthsimple’s commission-free trading is hard to beat, given the volume of savings you will achieve over the long run. However, if you plan on investing in US stocks primarily, it is probably best that you go with Questrade since you can hold US dollars for free in registered accounts. Of course, both charge a currency exchange fee, but the $10 per month Wealthsimple charges for US currency accounts will likely balance out the difference that the commission-free stock trading almost makes up for.

-

Investment Options: Questrade

Questrade is unmatched when it comes to investment options. They offer stocks, ETFs, bonds, GICs, IPOs, derivatives, commodities, and more. On top of that, investors have access to a variety of international markets, exposing them to everything the world has to offer. On the other hand, Wealthsimple only allows you to buy and sell stocks and ETFs on the largest North American exchanges.

-

Account Types: Questrade

Once again, Questrade steals the prize based on the number of account types it offers. Though Wealthsimple offers TFSAs, FSHAs, and RRSPs, Questrade offers RRSPs, TFSAs, RESPs, LIRAs, RRIFs, LIFs, and FHSAs, as well as joint cash accounts such as non-registered accounts like margin accounts, foreign exchange market accounts, and corporate investment accounts.

Final Thoughts: Which is Better?

Wealthsimple and Questrade are two of the best online investment brokerages in the Canadian market today.

Both are low-cost platforms that offer self-directed investors everything they need to achieve investment success on their own.

However, due to the number of assets one can trade and the types of accounts one can open, Questrade receives our vote as the top online investment brokerage in Canada.

Ultimately, we want to expose ourselves to as many meaningful investment opportunities as possible, and Questrade allows us to do just that.

That being said, both platforms are a solid choice for investors, allowing you to manage your investment portfolio simply and effectively.

Therefore, take the time to understand both so that you can set up a brokerage account that is right for you.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.