In the world of fundraising and capital acquisition, two regulatory frameworks stand out: Regulation CF (Crowdfunding) and Regulation A (Reg A+).

Both mechanisms serve as gateways for companies seeking capital infusion, yet they differ significantly in their scopes, benefits, and limitations.

Understanding these distinctions is crucial for entrepreneurs and venture capital investors navigating the complex landscape of fundraising regulations.

To help, we’ve outlined both frameworks, distilled their risks and benefits, and determined how you can best use them to your advantage.

With that said, it is time to explore the nuances of Regulation CF and Regulation A offerings.

What is Regulation Crowdfunding/ Reg CF?

Regulation CF, or Regulation Crowdfunding, is a game-changer in the landscape of fundraising, offering a democratized approach for businesses to solicit investments, access capital and sell securities.

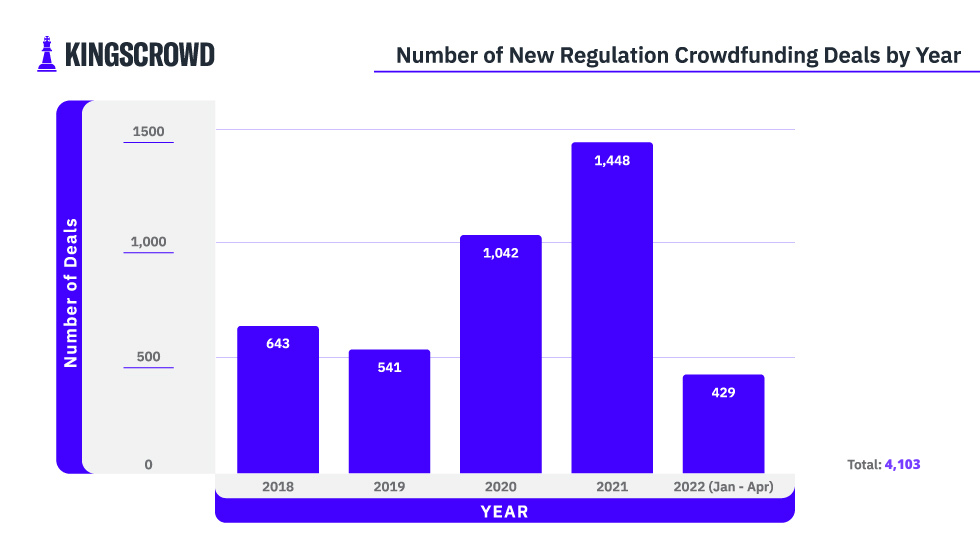

Enacted under Title III of the JOBS Act in 2016, Regulation CF revolutionized the fundraising scene by empowering small and medium-sized enterprises (SMEs) to secure funds from a diverse pool of investors through online platforms or intermediaries.

Image By: KingsCrowd

This regulatory framework was designed to facilitate capital formation for startups and emerging businesses while allowing everyday individuals, both accredited and non-accredited investors, to participate in the investment process.

It presents an opportunity for companies to raise funds through equity crowdfunding campaigns, with certain limitations on the maximum amount that can be raised within a 12-month period ($5 million).

One of the most compelling aspects of Regulation CF is its inclusivity. By enabling non-accredited investors to participate, it breaks down the traditional barriers that often restrict everyday individuals from investing in promising ventures.

Additionally, Regulation CF eases the financial burden on startups and SMEs. Compared to traditional fundraising methods or other regulatory frameworks, the costs associated with compliance are relatively lower. This aspect makes it more accessible and feasible for early-stage companies looking to kickstart their growth trajectory.

In all, Regulation CF embodies a transformative approach to fundraising, fostering accessibility, inclusivity, and affordability in the capital acquisition process.

This empowers both businesses and investors, opening doors for innovation and growth, and leading to a more prosperous future for all.

What are the benefits of Reg CF?

Regulation CF offers many benefits to small businesses and investors alike. Here is a list of the top advantages Reg CF has to offer:

Access to Diverse Investor Pool

The most compelling advantage is the ability to tap into a broad spectrum of investors, including both accredited and non-accredited individuals. This inclusivity broadens the potential investor base, enabling companies to attract a more diverse group of backers.

Lower Costs and Regulatory Requirements

Compared to traditional fundraising methods or other regulatory frameworks, Regulation CF comes with relatively lower compliance costs. To illustrate, the average IPO starts at around $750,000, or more. On the other hand, you can expect a Regulation CF to cost roughly $99,000, excluding commissions and ongoing reporting requirements. This aspect significantly reduces the financial burden for startups and small businesses, making fundraising more accessible.

Online Platform Utilization

Leveraging online platforms through a broker-dealer (i.e. Indiegogo, StartEngine, Patreon, etc.) allows companies to showcase their offerings to a wider audience. This heightened exposure can attract more potential investors and create substantial interest in the company’s mission and products/services.

Community Building and Brand Awareness

Companies can foster a community around their brand by engaging investors directly through crowdfunding campaigns. This not only aids in fundraising but also enhances brand visibility and loyalty among supporters.

What are the cons of Reg CF?

Though Reg CF has its many advantages, certain limitations may prevent a company from pursuing this capital-raising strategy. The top disadvantages of Regulation CF are:

Fundraising Cap Limits

One of the notable limitations of Regulation CF is the cap on the maximum amount that can be raised within a 12-month period. With only $5 million available per year, this limitation might restrict ambitious fundraising goals for companies seeking substantial capital injections.

Disclosure Requirements

Companies opting for Regulation CF are required to disclose financial information to potential investors and the Securities and Exchange Commission (SEC). This mandatory disclosure can include sensitive data, potentially exposing proprietary information to competitors or the public. That being said, this is a necessary step that ensures investor protection when dealing with early-stage companies.

Risk of Investor Fragmentation

The inclusivity of Regulation CF might lead to a large number of small investors. Managing relationships and communications with numerous investors could pose a challenge, potentially affecting decision-making processes.

Limited Investment Opportunities for Investors

From an investor perspective, despite the access granted by Regulation CF, there might be limitations on the individual investment amounts. This limitation might restrict the investment opportunities available to each participant.

What is Regulation A?

Regulation A, also known as Reg A+, is a regulatory provision that has transformed the fundraising landscape by offering companies a streamlined pathway to raise capital through public offerings without the exhaustive process of full SEC registration and the Securities Act.

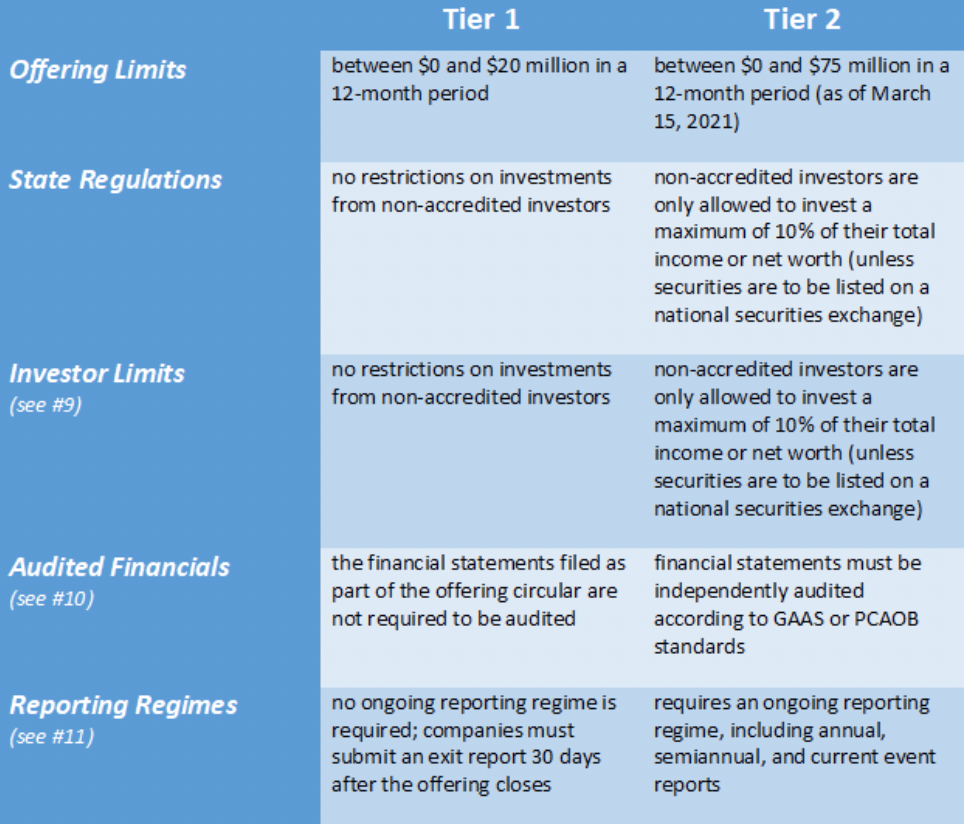

Enacted under Title IV of the JOBS Act, Regulation A+ provides two tiers—Tier 1 and Tier 2—each with its specific fundraising cap and regulatory requirements.

Image By: Moneywise

For example, under Tier 1, companies can raise up to $20 million within a 12-month period, while Tier 2 allows for up to $75 million, providing companies with the opportunity to secure more substantial capital injections.

However, you should note that Tier 2 compliance involves more stringent reporting requirements compared to Tier 1. But this is expected given the more capital and investors you have access to.

Either way, Reg A is a valuable tool for accessing accredited and non-accredited investors without having to comply with the sometimes painful and costly process of an initial public offering.

It is empowering businesses, particularly startups and growth-stage companies, to raise much-needed capital that can help fuel their growth and development in the long run.

What are the benefits of Reg A?

If you plan on raising capital for your startup, it goes without saying that you should consider Reg A funding. Here are the main benefits that this regulation has to offer:

Higher Fundraising Cap

Reg A offers significantly higher fundraising caps compared to other fundraising methods. Tier 1 allows companies to raise up to $20 million within a 12-month period, while Tier 2 permits fundraising up to $75 million. This higher cap provides businesses with the opportunity to secure substantial capital injections to fuel growth and expansion.

Public Offerings without Full SEC Registration

Perhaps one of the most enticing aspects of Reg A is the ability to conduct public offerings without the extensive process of full SEC registration. This streamlined approach reduces regulatory hurdles and facilitates a more efficient fundraising process.

Inclusive Investor Participation

Reg A allows for the participation of both accredited and non-accredited investors, expanding the potential investor base substantially. This inclusivity enhances access to diverse investment opportunities for a broader range of individuals.

Flexible Offering Structures

Companies have the flexibility to structure their offerings under Reg A, accommodating various investment instruments such as equity, debt, or convertible securities. This flexibility caters to different investor preferences and business needs.

What are the cons of Reg A?

Though promising, it is good to understand the limitations of Regulation A financing as well. Here are the top four reasons why Reg A may not be the best option for your business:

Higher Compliance Costs for Tier 2

While Tier 1 of Reg A offers a less burdensome compliance process, Tier 2 involves more stringent reporting requirements. This could lead to higher legal, accounting, and compliance costs for companies choosing this tier. According to JD Supra, you should expect all-in costs to be between $275,000 to $450,000, excluding sales commissions, if you pursue a Tier 2 offering.

Potential Time Consumption

Compliance with the regulatory requirements, particularly under Tier 2 of Reg A, might extend the fundraising timeline compared to other methods. Companies should consider the time implications and plan accordingly.

Market Perception and Recognition

Despite the benefits, companies opting for Reg A might face challenges in gaining recognition and acceptance in traditional investment markets. Public perception and acceptance of Reg A offerings compared to traditional IPOs could impact investor sentiment.

Limitations on Investment Amounts for Investors

From an investor’s perspective, Reg A may have limitations on the individual investment amounts. If you are an accredited investor, there are no limits to how much you can invest. But if you are non-accredited, the maximum you can invest is 10% of your net worth or annual income per offering. This can be frustrating if these limitations restrict the investment opportunities available to you.

Which is better: Reg A or Reg CF?

To determine which funding method is best for your business, you should consider your company’s specific fundraising goals, financial needs, and long-term strategies. Each regulatory framework offers distinct advantages and limitations, making them suitable for different scenarios.

Here is a quick summary of the advantages and disadvantages listed above to determine whether they meet your business’s funding objectives:

Regulation CF

Advantages:

- Inclusivity and Accessibility: Regulation CF allows both accredited and non-accredited investors to participate, fostering inclusivity and broadening the potential investor base.

- Lower Compliance Costs: Compared to other fundraising methods, Reg CF entails lower compliance costs, making it more accessible for startups and small businesses.

- Online Platform Exposure: Leveraging online platforms for fundraising enhances exposure, potentially attracting a larger audience and generating more interest.

Considerations:

- Fundraising Cap Limits: The maximum fundraising cap within a 12-month period might restrict companies seeking substantial capital injections.

- Disclosure Requirements: Mandatory disclosure of financial information to protect investors could expose sensitive data to competitors or the public.

Regulation A

Advantages

- Higher Fundraising Cap: Reg A+ offers higher fundraising caps (up to $75 million in Tier 2), catering to companies seeking larger capital rounds.

- Public Offerings without Full SEC Registration: Conducting public offerings without full SEC registration streamlines the fundraising process.

- Inclusive Investor Participation: Similar to Reg CF, Reg A allows both accredited and non-accredited investors to participate, widening the investor pool.

Considerations:

- Higher Compliance Costs for Tier 2: Compliance with Tier 2 involves more stringent reporting requirements, potentially leading to higher legal and accounting costs.

- Market Recognition and Investor Perception: Reg A offerings might face challenges in gaining recognition and acceptance in traditional investment markets, impacting investor sentiment.

Which is Better?

- For Smaller Fundraising Needs and Lower Compliance Hurdles: Regulation CF might be preferable due to its lower compliance costs and accessibility for startups and SMEs.

- For Larger Capital Requirements and Public Offerings: Regulation A could be more suitable, offering higher fundraising caps and the ability to conduct public offerings without full SEC registration.

The Bottom Line

Raising capital is an awesome way to propel your business to new heights.

With that said, it is necessary to explore every possible funding opportunity and determine which is the most appropriate for your business.

Make sure that you consider the regulatory requirements, costs, and investor pool, beyond the amount of capital you could potentially raise.

Once you do, the opportunities will be endless as you take this very important step in your entrepreneurial journey.

There is no more exciting time to be an entrepreneur than today.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.