Welcome, ambitious investors and aspiring venture capitalists!

If you are eyeing the exciting world of venture capital, then you are in the right place.

Venture capital investing is one of the most fascinating financial markets.

With an opportunity to strike rich on up-and-coming businesses, it is no wonder that so many investors are attracted to it.

But how do you get into venture capital, exactly?

In this article, we’ll explore the ins and outs of venture capital investing, from its advantages and disadvantages to practical steps you can take to break into this dynamic field.

Whether you are an amateur looking to strengthen your portfolio or a seasoned vet seeking new challenges, we’ll provide you with everything you need to get into venture capital.

Let’s dive in.

What is Venture Capital?

Venture capitalists invest in early-stage and high-potential startups.

These companies benefit from venture capital investments since the partnership provides much-needed capital and guidance, thus allowing them to grow and compete more effectively in the marketplace.

In return, venture capitalists typically receive an equity stake in the company, which, when successful, provides a substantial return on investment that is uncharacteristic of publicly traded companies.

This high-risk, high-reward relationship between founders and investors plays an important role in society, given that it fosters innovation and fuels economic growth.

All in all, venture capital is a great way to get in on the bottom floor of a promising business venture.

What is a Venture Capital Firm?

Image courtesy of: TAdviser

A venture capital firm is an investment organization that pools shareholders’ funds and invests in early-stage companies on their behalf.

These firms combine their analytical expertise and understanding of emerging market trends to spot high-caliber startups before the rest of the market.

One of the main benefits of investing in a VC firm is that you no longer have to spend time and energy searching for worthwhile investment opportunities.

Instead, the venture firms do all of the dirty work while you sit back and reap the rewards of great portfolio companies.

What’s more, pooling your resources with other investors often opens you up to better opportunities compared to those who choose to do it alone.

However, one drawback is that most of the time, these venture capital firms are reserved for affluent and institutional investors due to the high risk involved.

This makes it almost impossible for the average Joe to participate, meaning that you must earn a certain amount before you can even have a seat at the table.

Some of the most well-known and successful VC firms include Sequoia Capital, and Sound Ventures, Ashton Kutcher’s investment company.

Venture Capital Advantages and Disadvantages

The venture capital industry offers investors several opportunities and risks, including:

Opportunity #1: Higher Returns of Investment

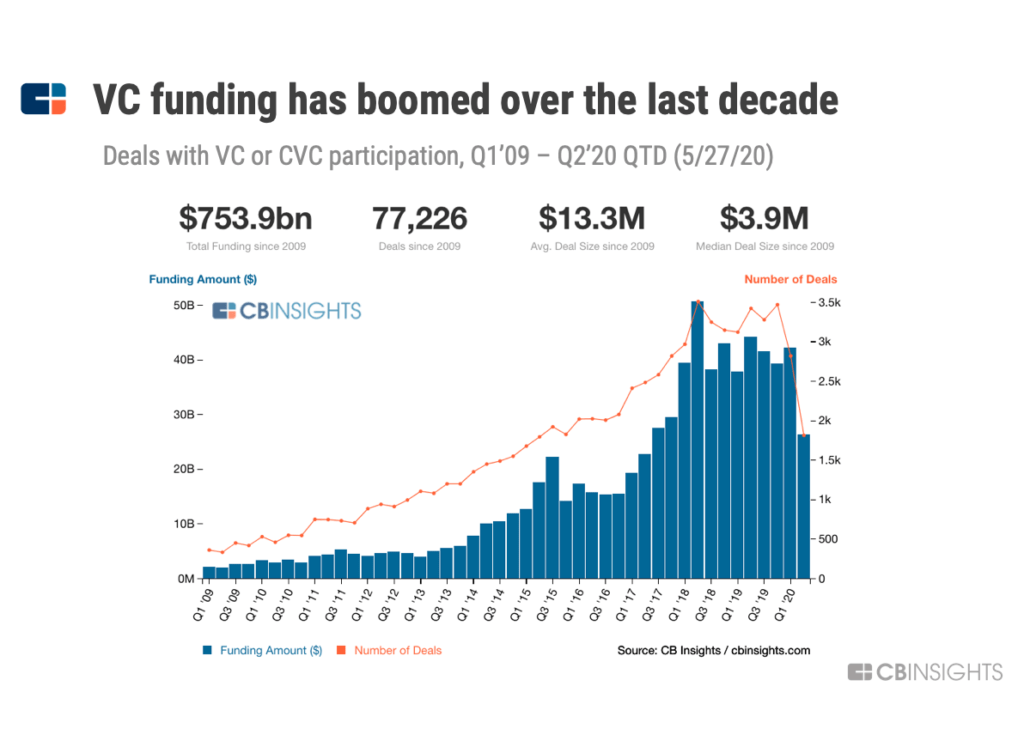

Image courtesy of: CB Insights

By buying into an early-stage business, you are gaining a significant stake in the company for relatively cheap.

That is because the company’s valuation is still small, so your buying power is a lot stronger—even $100k can mean a lot to a small business.

Then, as the company begins to grow and strengthen its competitive position, so too will the value of the company and your investment, thus netting you some fantastic returns.

As more investors pile in, that original investment will be worth a lot more than when you first put up the money.

Opportunity #2: Exposure to Up-and-Coming Technologies

Another reason why venture capital investing is so appealing is that you gain exposure to companies and technologies attempting to disrupt the status quo.

If you are someone who enjoys being a contrarian, this is a great way to challenge the norm and support businesses that are changing the world.

Of course, it doesn’t hurt to make significant sums of money in the process.

Risk #1: Greater Risk of Failure

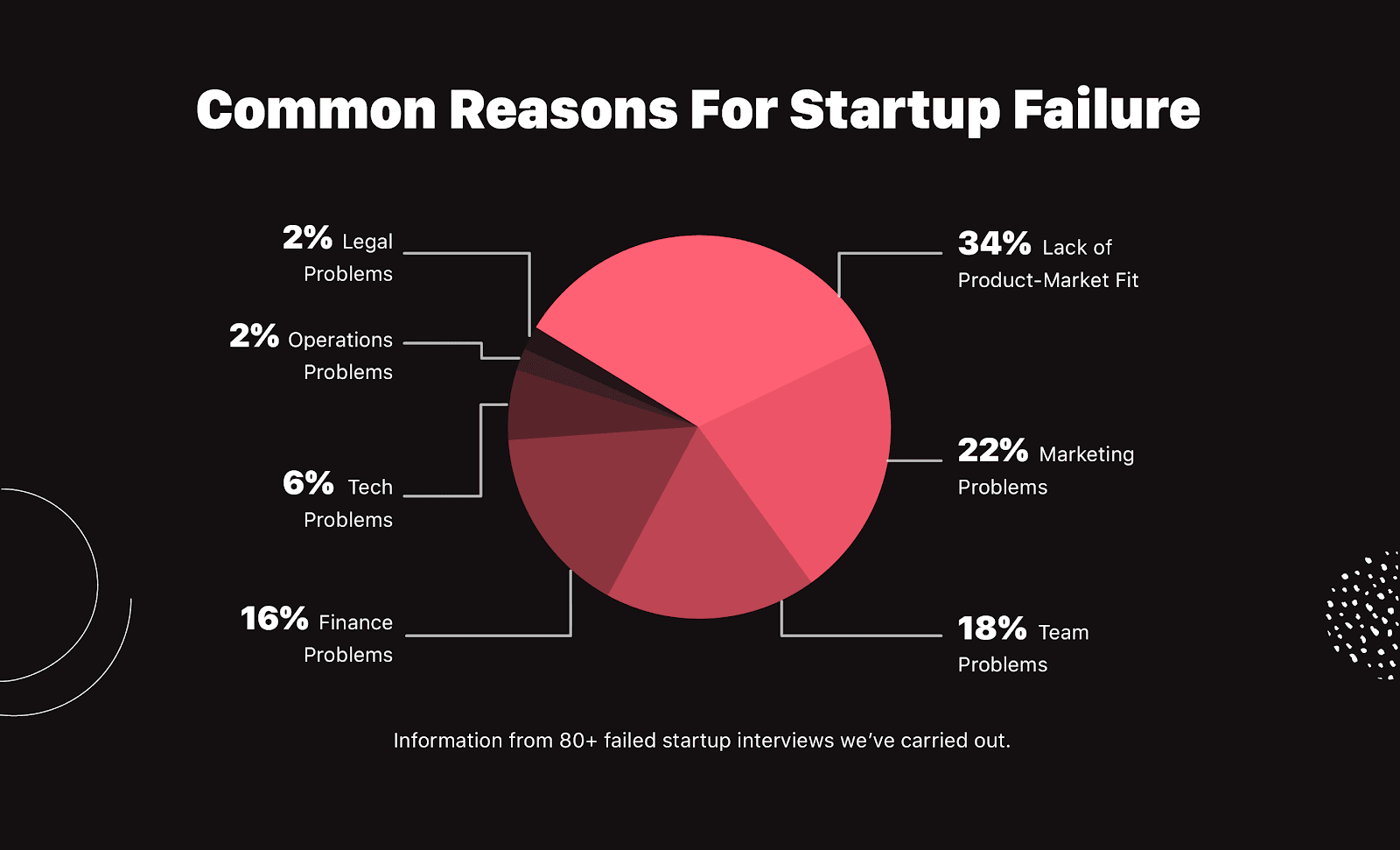

Image courtesy of: Failory

If you are searching for safe and stable investments, you should probably avoid venture capital altogether.

With up to 90% of startups failing, there is a high probability that your investment will fail too.

Therefore, it is generally recommended that you invest in more established companies unless you are comfortable with the risks or have sufficient funds at your disposal.

For this reason, venture capital is typically reserved for affluent individuals only since it probably won’t harm their net worth too significantly.

Risk #2: Lack of Liquidity

Since early-stage companies do not trade on the public market, it can be quite difficult to exit a position unless the business is bought or goes public.

In difficult periods, when the company is struggling to raise capital, you will likely lose your money and not be able to recover it.

Moreover, if you ever require the capital that you put in, you’ll likely have a difficult time selling your stake.

That is because private companies are exposed to fewer investors, thus making it challenging to raise capital or exit positions.

As such, it is important to understand that this is a long-term investment that you will need to embrace entirely or not at all.

How to get into Venture Capital?

So now that you know a little more about VC, it’s time to explore how you can begin a venture capital career.

Becoming a VC requires a combination of relevant skills, industry knowledge, a strong network, and sufficient capital.

Here are a few practical steps to help you land that venture capital job:

Step #1: Invest in Yourself

If you want to be a successful VC, you have to love the journey, not just the end results.

That means committing significant time toward strengthening your skills as a person and investor.

You need to have a knack for spotting the latest trends, technologies, and emerging sectors, and the easiest way to do so is by investing in yourself.

If you are unsure of what you should be doing, begin by reading business and investing books, attending VC conferences, watching venture capital interviews, and exposing yourself to the startup ecosystem.

In doing so, you’ll slowly start to understand what it takes to be one of the best.

Step #2: Build a Track Record

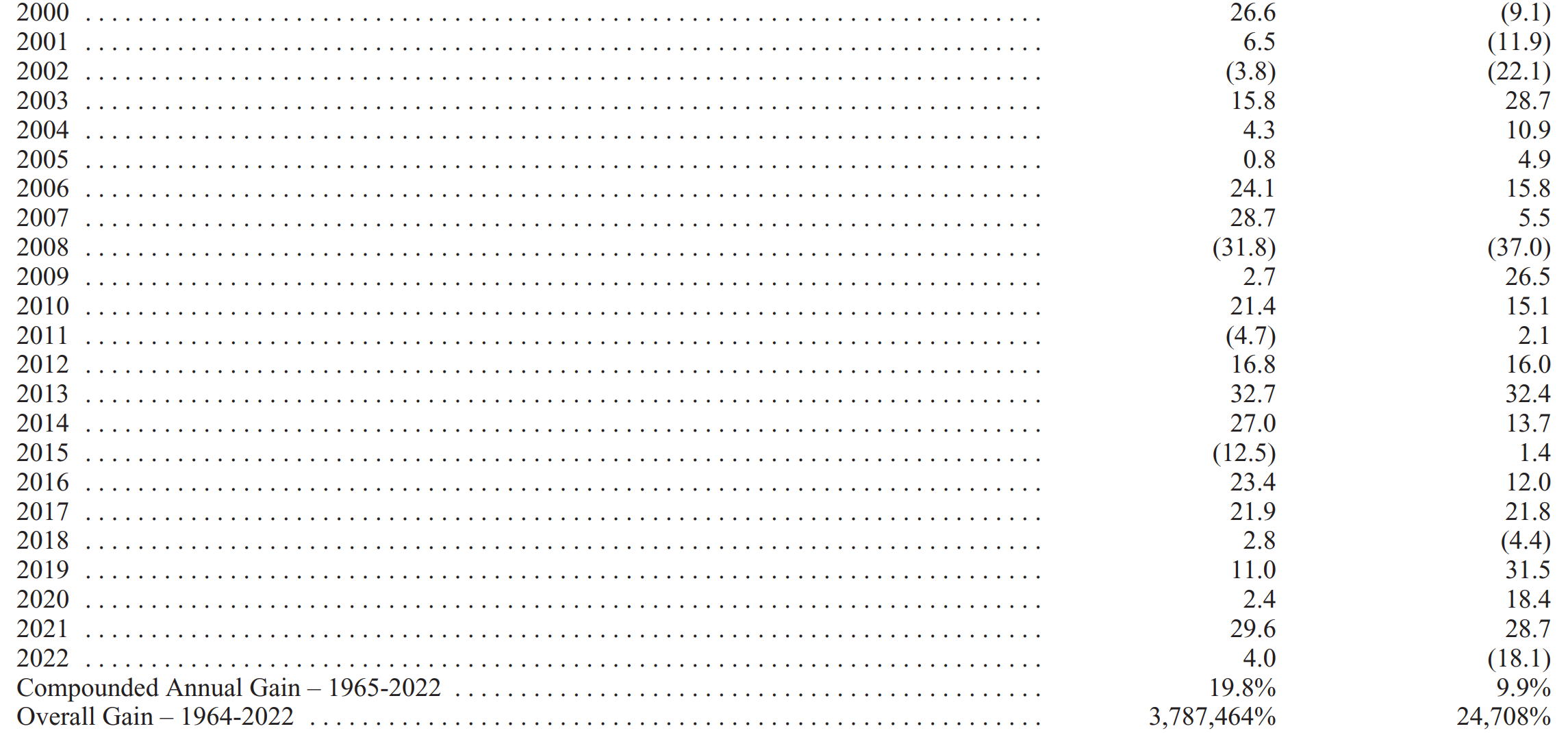

Image courtesy of: Berkshire Hathaway

Now that you have improved your abilities as an investor, you will need to demonstrate what you’ve learned by investing.

Though you may not be able to invest in VC right away, you can still take advantage of the financial markets by investing in public companies instead.

This is a great way to immerse yourself in investing and for you to learn what makes a great investment versus a bad one.

Ultimately, startup companies are seeking out smart capital whereby they can benefit from an investor beyond their money.

If you can prove you are a successful investor through historical investments, it should open you up to even more opportunities, especially in the VC space.

Step #3: Grow Your Network

Alongside building your track record is the need to expand your network as well.

If you really want to capitalize on the wonders of venture capital, then you’ll need to expose yourself to people who already have a way in.

Not only will they introduce you to new investment opportunities, but they may also teach you invaluable lessons about investing in this market.

Having investing mentors is a tremendous advantage for a young investor since they can help save you a lot of time and money by bringing you under their wing.

To begin expanding your network, reach out to people you admire on platforms like LinkedIn.

It doesn’t hurt to ask for advice, and the worst they can do is say no.

Aside from that, you can also attend networking events that pop up in your community, where you will be exposed to many like-minded people who could hold the keys to your VC future.

Step #4: Develop Relevant Skills & Consider Advanced Education

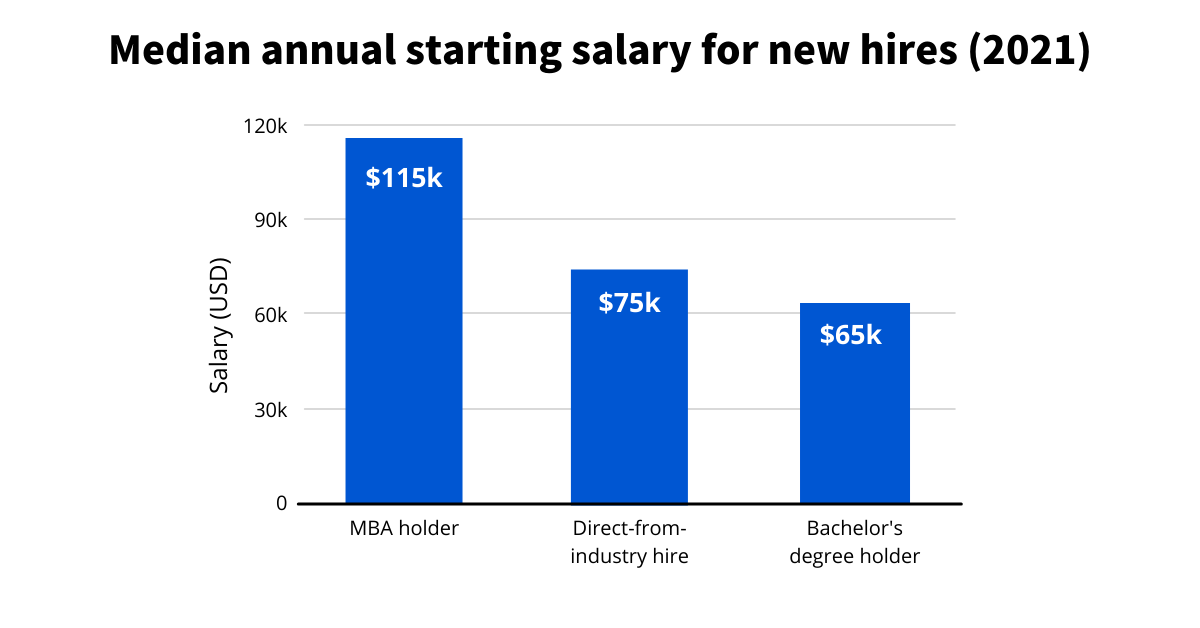

Image courtesy of: Coursera

Now that you have experience as an investor and have the network to back it up, the final step is to gain advanced skills that take your expertise to the next level.

These include developing proficiencies in financial analysis, business development, corporate due diligence, and negotiating while also pursuing higher education like a bachelor’s or master’s degree in business and finance.

In doing so, you will begin to understand the important nuances that are discussed in the capital markets while also being a valuable asset to the founders themselves.

If you can demonstrate a wealth of knowledge, a record of success, and a high-quality network, then there is nothing stopping you from investing in the best opportunities money can buy.

How to Get Venture Capital Funding

If you are an early-stage company seeking out venture capital partners to help fuel the growth of your business, here are a few tips to help you get started.

Tip #1: Develop a Comprehensive Business Plan

Before beginning to raise capital, you will need to create a comprehensive business plan that outlines the company’s roadmap, marketing strategy, financial projections, and scalability.

It will be difficult for venture capital funds to take your business seriously if you don’t explain the opportunity you are trying to exploit, how you plan to do it, and the risks you expect to face along the way.

Taking it a step further, it is even more promising when you have already tested your product or service in the marketplace and demonstrated its ability to generate revenue.

A prime example of this is from the hit show Shark Tank, where oftentimes, “The Sharks” grill entrepreneurs who just have an idea and not a tangible business.

This holds true in VC as well since there are very few people who will take a chance on a company that has yet to prove itself.

Tip #2: Assemble An All-Star Team

While your business is only in the beginning stages, it is still important to build a highly-skilled team that can execute your mission.

Even if it’s just 3-5 employees, having a group of people working together to build a successful business is a strong indication that you are committed to the company.

As an investor, we need to have confidence that you are serious about this business and that you are in it for the long haul.

If not, it’s pretty difficult to get excited about an investment if you’re unsure it will last.

But more importantly, the essence of a successful startup is knowing that you can’t do it all on your own.

If you can find a group of talented people who are as invested in the company’s success as you, then you can create something that is far beyond people’s expectations.

As it is often said, your team is your greatest asset.

Tip #3: Build Your Network

Similar to how venture capitalists must grow their network, a startup company and its team must also begin familiarizing themselves with potential investors, partners, competitors, and customers.

In those early stages, it is crucial that you get your name out there to as many valuable stakeholders as you can.

While marketing can certainly help, it is those direct interactions, good or bad, that will help take you over the top.

As a general rule of thumb, it doesn’t hurt to explore as many channels as possible so that you can expose yourself to anyone who may have the slightest interest in your business.

Because you never know, you might just find that person who helps guide you to the stratosphere.

What Do Venture Capitalists Look For?

Whether you are a venture capitalist or a startup seeking VC funds, it is valuable to understand what venture capitalists look for when adding a portfolio company so that you can improve your chances of success.

Here are five important factors to keep in mind…

How Does the Business Make Money?

Before anything else, most VC firms will want to ensure that the business can make money or, at the very least, provide a clear and well-thought-out strategy for how to get there.

At the end of the day, it all comes down to money, and if you cannot prove the worth of your product, then there is no need to continue the discussion.

In some instances, a VC may only be interested in specific markets that they are attracted to or feel they have a competitive advantage in.

Therefore, it is important to understand your market and those who are naturally drawn to your business. Otherwise, you may struggle to find worthwhile opportunities.

What is the Company’s Growth Potential?

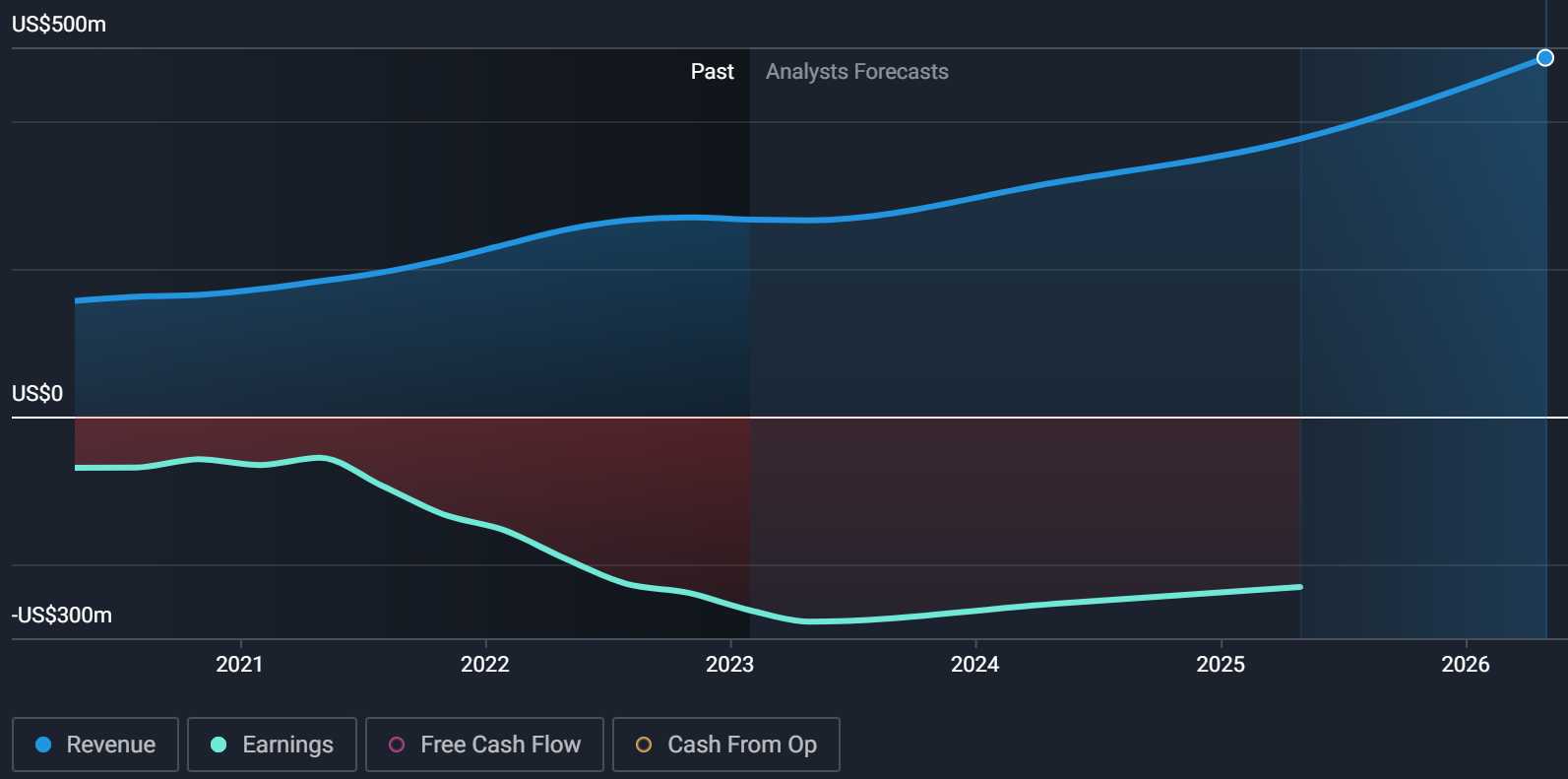

Image courtesy of: Simply Wall St

Beyond learning how a business makes money, it is valuable to know a company’s market, competitors, and cash flow-generating potential.

All of these play an important role in the company’s growth potential, which is a direct indication of its success over the long run.

While you may be fascinated with a particular industry, the reality is that some businesses have a better chance of growing than others.

For example, software companies are likely to produce more free cash than an airline or biotech business.

However, the software industry is also highly competitive and disruptive, thus making it difficult to reach the top or sustain success.

As such, an investor or entrepreneur will want to understand the growth potential of a business since it is likely to produce within those market constraints.

How Does the Business Differentiate Itself?

One of the best ways to improve the likelihood of success for a business is to create a competitive advantage and do everything possible to sustain it.

If it is evident that a company is doing something different that is helping it produce superior results, not only will investors be more attracted to the company, but so too will the customers using the product or service.

Of course, customers don’t view it as a competitive advantage, but it will be reflected in their purchase decisions since they perceive the company as better than the rest.

If you explore some of the best businesses in the world today, you will often find that they have more than just one competitive advantage in their business model.

Who is the Management Team?

While a company’s leaders are important at all stages, it is especially important when a business is just starting out.

Venture capitalists will want to ensure that the leadership team is competent, motivated, proven, and trustworthy.

They need to be confident that their money is in good hands and that the decision-makers are doing everything they can to generate the best results.

As such, someone who has proven to be exceptional in the past is likely to garner more attention and respect than someone starting a business for the first time.

However, there are exceptions where a new team produces exceptional results during their first attempt.

Therefore, it pays to keep an open mind and seek out those who are driven and put stakeholders first.

Is It Worth the Price?

Lastly, venture capitalists will put special emphasis on the amount of money being asked of them and what they will receive in return.

This is likely to be negotiated, but it’s important that both parties understand what the business is worth so that they can make the most of the investment.

Ultimately, a business and its founder will want to raise as much capital as they can without giving up too much equity in the business, but they may be willing to if the investor has something more to offer.

Overall, it is best to create a win-win relationship with the other party since you’ll be partnering together for quite some time.

What is the Difference Between Private Equity and Venture Capital

There are many fine nuances in the world of investing, with one of them being the type of investing you do.

While every strategy often shares similarities, it is their differences that make them special.

In this section, we’ll help you understand the differences between private equity, angel investing, growth equity, and investment banking and how they compare to venture capital.

To begin, let’s figure out the difference between private equity and venture capital.

While both invest in privately held companies, private equity firms prefer established businesses that have a track record of stable revenue and cash flow.

This is compared to venture capitalists who focus on early-stage companies and startups that may not have any revenues yet.

What’s more, private equity tends to have a longer time horizon, lower risk appetite, and a focus on generating steady cash flows and an attractive return.

You can think of it like owning private blue chip stocks.

Angel Investors vs. Venture Capital

Moving on to angel investing: this investment strategy falls closely in line with one key difference.

While venture capital is the pooling of shareholder capital in the form of a fund, angel investing is performed by an individual investor looking to capitalize on an early-stage startup.

This strategy of becoming an angel investor comes with many benefits, including greater flexibility and freedom to decide which businesses to invest in, as well as potentially higher returns.

However, it is also riskier since you alone will be on the hook for investing in a bad business, and you may be exposed to fewer opportunities given that you are working with less capital.

Overall, angel investing is best for the individual investor who has confidence in their abilities and temperament to deal with risk.

Growth Equity vs. Venture Capital

Next up, growth equity is somewhat a combination of venture capital and private equity.

Essentially, growth equity investors are searching for established privately held companies that are seeking to expand their business and strengthen their competitive position.

This means that they are attempting to capture the higher return potential of early-stage companies while also ensuring a certain level of stability and predictability from the investment.

If we were to compare growth equity to Edge Investments’ strategy, the two would be quite similar, with the only key difference being that we primarily focus on publicly traded companies rather than private businesses.

Investment Banking vs. Venture Capital

Lastly, investment banking is a different breed of its own.

While both fields operate within the finance industry, they have distinct roles and functions.

For example, investment banking primarily deals with providing financial advisory services, facilitating capital raising through initial public offerings (IPOs), mergers and acquisitions (M&A), and other corporate transactions.

Essentially, investment bankers act as intermediaries between companies seeking funding and investors looking for investment opportunities.

This is in contrast to venture capitalists who act as the investors themselves by purchasing stakes in the company.

Final Thoughts

Venture capital is a thrilling and rewarding field that allows you to be at the forefront of innovation and economic growth.

Not only will you expose yourself to the fastest-growing businesses in the world, but you will also get to work alongside some of the brightest minds in history.

While there certainly are risks, by following the steps outlined in this article, you can increase your chances of success and make your mark in this exciting industry.

So, get ready to embrace the opportunities, take calculated risks, and embark on an exhilarating journey as a venture capitalist.

Best of luck!