In the world of investing, it can be overwhelming trying to understand the complexities of investment regulations and offerings.

Among the avenues available to companies relying on capital infusion, Regulation A offerings stand out as an increasingly popular and accessible way to sell securities.

In this article, we’ll dive into the essence of Regulation A offerings and explore their potential impact on the investment landscape.

If you wish to understand the nuances of raising capital and what it takes for a business to secure funds, you must see what we have in store.

What is a Regulation A Offering?

Regulation A, aka Reg A, is a provision under the Securities Act that allows companies offering securities to raise capital from the public without having to go through the rigorous and expensive process of a traditional initial public offering (IPO).

Essentially, it offers an exemption from the full registration requirements mandated by the Securities and Exchange Commission (SEC), enabling companies to raise funds through a simplified and less demanding procedure.

Image By: Barton LLP

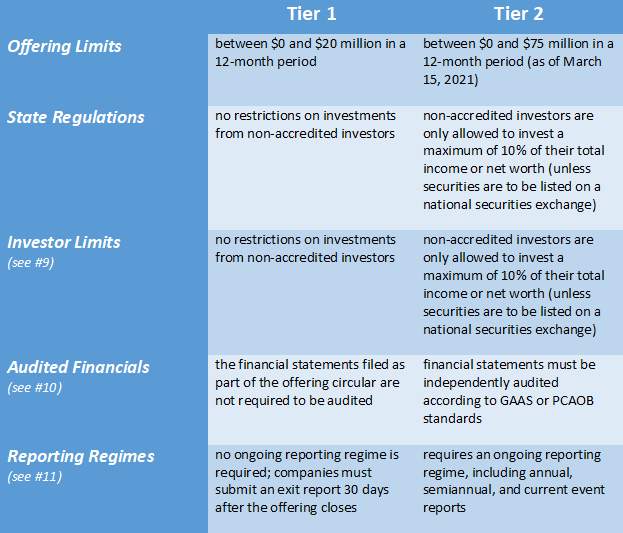

The Regulation A offering statement is divided into two tiers: Tier 1 for offerings of up to $20 million in a 12-month period and Tier 2 for offerings of up to $75 million within the same timeframe.

These offerings grant companies the ability to generate investment capital from both accredited and non-accredited investors, thereby broadening their potential investor base.

However, you should be aware that non-accredited investors have investment limits, meaning that they can only invest up to 10% of their annual income or 10% of their net worth, whichever is greater.

On the other hand, accredited investors have no investment limitations.

Either way, these public offerings allow one to bypass the typical constraints imposed on private businesses and venture capital, making them a great option for those companies seeking to access the public markets.

Understanding Regulation A Tier 1:

Regulation A Tier 1 is one of the two tiers established within Regulation A offerings, specifically designed for companies seeking a more modest capital raise.

This tier allows businesses to access the public markets by offering securities to potential investors without the extensive and stringent requirements typically associated with traditional IPOs.

What distinguishes Tier 1 from its counterpart, Tier 2, is the offering size limitation.

Tier 1 of Regulation A permits companies to raise up to $20 million in a 12-month period.

This tier caters to smaller-scale enterprises or startups with more modest capital requirements, providing them with a viable avenue to access public capital markets without the exhaustive regulatory demands of larger-scale offerings.

Understanding Regulation A Tier 2:

Regulation A Tier 2 stands as the higher tier among the two established tiers within Regulation A offerings.

It caters to companies seeking a larger capital raise while maintaining a balance between regulatory compliance and accessibility to a broader investor base.

The defining feature of Regulation A Tier 2 is its allowance for larger offerings, enabling companies to raise up to $75 million within a 12-month period.

This tier caters to mid-sized enterprises or established businesses looking to scale up, providing an alternative to the traditional IPO route.

One additional thing to note is that Tier 2 businesses must submit audited financial statements and are subjected to ongoing reporting requirements, while Tier 1 companies are not.

Essentially, the more money you plan to raise, the greater responsibility you must bear.

What is the maximum offering size under Regulation A?

Under Regulation A offering statement, the maximum offering size differs based on the tier chosen by the issuer.

As stated previously, Tier 1 permits offerings of up to $20 million in a 12-month period, while Tier 2 allows for larger offerings of up to $75 million within the same timeframe. This flexibility in offering size provides companies with options tailored to their capital needs and growth aspirations.

What is the difference between Reg A and IPO?

Image By: Investing.com

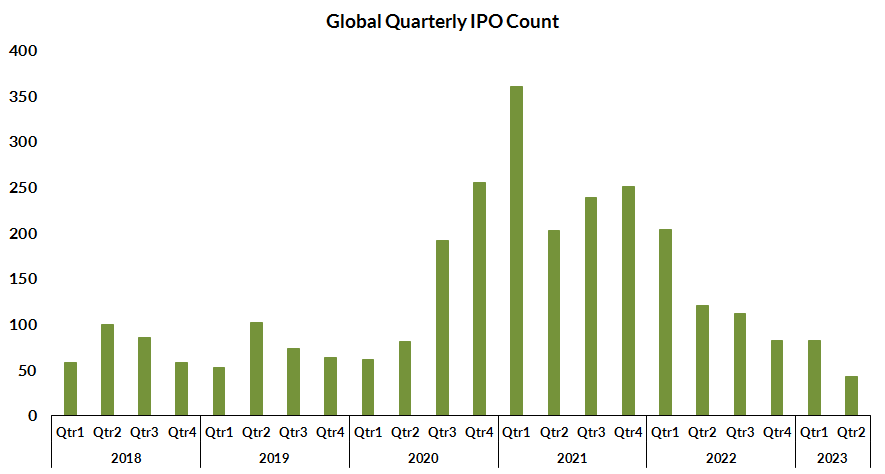

While both Regulation A offerings and IPOs serve as mechanisms for companies to raise capital, they differ significantly in their regulatory requirements and cost implications.

IPOs are generally more complex and expensive, involving comprehensive disclosures, extensive due diligence, and compliance with stringent regulations, including the need to register with state securities regulators.

Conversely, Reg A offerings offer a streamlined and cost-effective alternative, allowing companies to access capital markets with fewer regulatory burdens.

Moreover, IPOs typically involve larger capital raises and are often pursued by well-established companies seeking substantial funding.

In contrast, Regulation A offerings cater to smaller and mid-sized enterprises looking to raise moderate amounts of capital while maintaining regulatory compliance.

What is the difference between Reg A and Reg D offerings?

Regulation D (Reg D) offerings, unlike Reg A, are exemptions from the full SEC registration requirements and allow companies to raise capital from accredited investors and a limited number of non-accredited investors without undergoing the rigorous SEC registration process.

Reg D offerings have two main rules: 504 and 506, each with its own set of criteria and limitations regarding the amount of capital that can be raised and the type of investors allowed.

For example, Rule 506 allows a business to sell to an unlimited number of accredited investors but to no more than 35 non-accredited investors.

On the other hand, Rule 504 allows certain businesses to sell up to $10 million worth of shares in any 12-month period.

But, rather than diving too deep into the weeds, all you really need to know is that the key distinction between Reg A and Reg D lies in their investor accessibility.

While Reg A offerings open doors to both accredited and non-accredited investors, Reg D offerings primarily target accredited investors and a limited number of non-accredited individuals.

The Bottom Line

If you are a business owner seeking to raise public capital while avoiding the stringent regulations surrounding an initial public offering, Regulation A financing is an effective way to achieve your goals.

By eluding the strict requirements, you can build the funds you need and introduce your business to a larger pool of potential investors.

Though there are still some limitations imposed, including the amount of money you can raise, Regulation A offers many advantages that are worth considering.

In all, it seems like an excellent opportunity to grow your business, especially if you are in the early stages of development.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.