Venture capital investing is thrilling, bold, and brilliant.

One day you may go from owning nothing to making millions of dollars in your sleep.

But it isn’t all that easy.

To be a great venture capitalist, it requires patience, intelligence, and an uncanny ability to act when others are fearful.

So, as a VC, how do you acquire these skills and what should you look for so that you can find the next great business?

In this article, we’ll break down what venture capitalists spend time looking for when investing in start-ups, including how these businesses make money, how a leader should behave, and what separates a great business from a bad one.

If you are considering investing in start-up companies as a venture capitalist, and want to make the most of your money when doing so, check out what we have in store.

What is Venture Capital Investment?

If you are unfamiliar with VC, here is a quick explanation to help you better understand this investment strategy.

VC investing is an investment strategy that involves an investor providing capital to an early-stage company or start-up–think Shark Tank investors like Mark Cuban.

They provide this capital because it gives them an early opportunity to buy a stake in a business, which often results in astronomical returns if the company is successful.

Not only that, but VC is often perceived by investors as sexy and exhilarating, given that those who succeed in it look like geniuses when they invest in a company before anyone else.

Venture firms typically enjoy being more hands-on with a company, and this style of investing gives them that opportunity without much pushback from other shareholders.

But VC isn’t always sunshine and rainbows. To shed light on the industry, the reality is that 90% of startups fail. That’s because oftentimes, a business is simply an idea and nothing more.

Though this sounds quite depressing, as an investor, you should understand that, in the end, the market will always determine whether something is valuable or not.

Therefore if you want to be one of those venture capitalists who master the market, then you are going to have to embrace the facts and force yourself to only invest in companies that are well-positioned to succeed.

To help make this a little easier, in the next section, we will cover all the important questions you should ask before investing in an early-stage company.

Also, if you want to learn more about the advantages and disadvantages of venture capital, check out this article.

Key Questions Venture Capitalists Ask Before Investing

In this section, we will outline the key factors venture capitalists look for before investing in a start-up.

As an investor, your number one priority should be not to lose money.

Like investor George Soros once said, “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

If you focus on not losing money above all else, then your investment gains will usually speak for themselves.

Here are the top ten questions you should ask when conducting the due diligence process on an early-stage investment.

-

How does the business make money?

Above all else, the company should have a business model that is making money from its product or service already or at the least growing its consumer base.

If the startup has yet to demonstrate its value in the marketplace, how will you know if the model is feasible?

Sometimes as investors, we get carried away with the potential of an investment, but what we should be focusing on is what they have achieved already and what they are accomplishing at the moment.

Not only do paying customers demonstrate that a product has value, but it’s also a great way to ensure that the business won’t go under in the event of a slowing economy or a tight funding environment.

Personally, I will never consider an investment unless it’s making money organically from its product or service and is a proven financial success.

As a general rule of thumb, the more years of sales a business has, the better.

-

Does it have a trustworthy leader?

For new ventures, a lot of the success rides on the abilities of its leader(s).

During those early years, times can be extremely difficult and uncertain.

One day you’re seeing your business grow exponentially, and the next, you are wondering whether it will survive the week.

Having an intelligent, accountable, adaptable, and decisive CEO in these moments is crucial because you need someone who can stay even keel no matter how things are going.

Though it’s somewhat difficult to determine one’s true character, it is important that you learn what characteristics separate the best CEOs from the pack.

An effective way to do so is by reading books on the greatest leaders in history and analyzing their company’s annual reports.

For example, every investor, no matter the investment style, should read all of Warren Buffett’s annual reports.

Within them, Buffett demonstrates a degree of humility, rationality, and competence that few people on this planet are capable of.

When reading them, pay close attention to how he acknowledges his mistakes and how adamant he is on not overpromising anything to shareholders.

Through this modesty and integrity, Buffett and his company Berkshire Hathaway have earned one of the most loyal shareholder-base ever.

All-in-all, there is a lot unknown about how a startup will turn out, but finding companies with leaders that embrace the principles demonstrated by Buffett and others, is a great start.

-

Who is the management team, and what is their track record?

As a compliment to Question Two, a venture capitalist should dive into a startup’s management team, learning about its background and measuring its capabilities.

This can be a tricky one because, in most instances, the entrepreneurs running the business are talented individuals with many years of experience, but they may not be suited to run a company.

When exploring a management team, look for individuals who have previous success in starting a business.

Furthermore, find those who have already achieved financial independence and are motivated primarily by the problem they are facing or the culture they are creating.

The last thing you want is to invest in a founder that is unable to support themselves and is banking on the success of the company to survive.

-

What problem does the startup solve?

One of the key things to consider as a venture firm is the problem that the business is attempting to solve and the business plan in place to accomplish it.

There are many entrepreneurs out there with a “brilliant idea.” However, most of these ideas are usually not feasible or meaningful enough to the market that they make a significant difference in the customers’ lives.

When analyzing this aspect of a potential investment, prioritize companies targeting markets with a large and lucrative demographic that do not require a lot of capital to succeed.

Moreover, it’s a good idea to approach each solution with skepticism by challenging the likelihood of it succeeding and how capable competitors are of replicating it.

Since the goal of any business is to achieve sustainable long-term success, you will need to know that the problem they are solving will endure for many years to come.

-

How big is the market opportunity?

Beyond studying the business itself, it’s valuable to understand the market or industry and whether the investment opportunity is worthwhile.

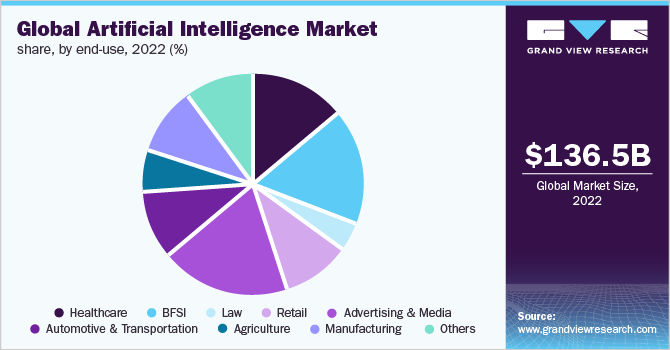

In general, the easiest way to achieve success is to find markets that are growing quickly and require many problems that need solving–think artificial intelligence or software companies.

That being said, there are times when a company can penetrate a more mature market and change its landscape entirely-think Spotify or Netflix.

A great way to evaluate the profitability of a market is by using Porter’s Five Forces model, which evaluates the competitive landscape of an industry, the threat of new entrants, the power of suppliers, the power of customers, and the threat of substitute products.

Then, attempt to determine where the start-up you are evaluating fits into this picture.

If the opportunity it is pursuing seems achievable and valuable, then it gives you all the more reason to consider investing in them.

-

What is the competitive landscape?

“Keep your friends close and your enemies closer.” – Sun Tzu

Knowing your competitors is a massive advantage as an entrepreneur and investor.

If you are aware of a competitor’s strengths and weaknesses, you can position yourself in a way that protects you from their strengths while capitalizing on their weaknesses.

Take Facebook, or Meta, for example. The company constantly observes its competitors and does everything in its power to limit its potential.

Whether it is by copying a product or buying the business entirely, Meta understands that there is a lot to be gained from studying your enemy.

The same goes for investing.

When analyzing a start-up, also consider analyzing its competitors in the same fashion.

Not only will you gain more industry knowledge, but you may also discover that there is a better company out there.

In the end, you want to find the one business in an industry whose product or service offers the most value and whose business model has the strongest competitive edge.

If you do, invest in them, but only if it’s trading at a reasonable price.

-

How much funding has the startup already raised?

Capital is the lifeblood of any business, especially for a start-up.

Without cash, a company is unable to pursue new projects, hire employees, or strengthen its competitive advantage.

Therefore, a company must have ample resources by successfully raising capital before the average investor makes their move.

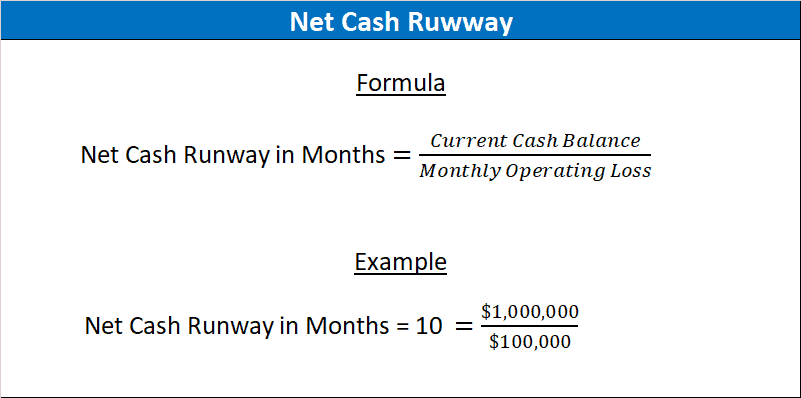

To gauge the quality of a cash pile, analyze the company’s burn rate.

In a recent YouTube video, our CEO Kevan Matheson recommends that you use this formula to determine how long an unprofitable company, like a start-up, has before its cash reserves run dry.

Ideally, a business should have at least 6 months before its cash pile runs dry.

However, an even better position to be in is one where the business is producing cash flows organically via its products or services because it means that do not need to depend solely on financing, which can sometimes be difficult during a tight market.

Remember, cash is king.

The more you have, the more you can do with it, and the more likely the business will survive.

-

What are the startup’s growth trajectory and expected milestones?

In close relationship to Question Five, it’s important to figure out the startup’s trajectory.

Be conservative in these financial projections, as you don’t want to find yourself overpaying for a company that under delivers.

To determine a startup’s growth trajectory, consider the cash flows it is currently bringing in and what they are doing to reinvest that cash into the business.

Since there is typically very little financial information available, another way to figure this out is by leaning on established clients or partnerships to see what kind of money they are pulling in.

For example, if a startup publishes a press release announcing a new partnership and provides the financial details of the deal, you, as an investor, can use this information to gain a better idea about how much customers are willing to pay for the product, and whether the company can acquire more partnerships like it.

Then, you can project how many of these deals they will likely have in the coming years and what kind of cash they will bring in.

To supplement this, you may also want to view a company’s investor presentation and determine any future milestones they have laid out.

As time passes, you can refer back to these milestones to see whether they accomplished them. Then, you can measure the level of success they have achieved in reaching those objectives and use it to see if they are capable of meeting the financial goals in the coming years.

But be careful.

If you haven’t figured it out already, the answer to this question is often quite ambiguous. Therefore, focusing on the facts is better than getting excited about a startup’s potential.

Overall, the more historical financial information a company has, the easier it will be to predict its growth potential.

-

What are the risks and potential downsides of the investment?

As we mentioned at the beginning of this article, first and foremost, the goal is not to lose money.

Therefore, you must put heavy emphasis on the negative events and threats that could affect the success of a company so that you avoid making the mistake of investing in a business that was destined to fail.

Every business and industry has its unique risks and opportunities, and as such, you must understand how likely a negative event may occur so that you can effectively adjust your portfolio companies to account for these risks.

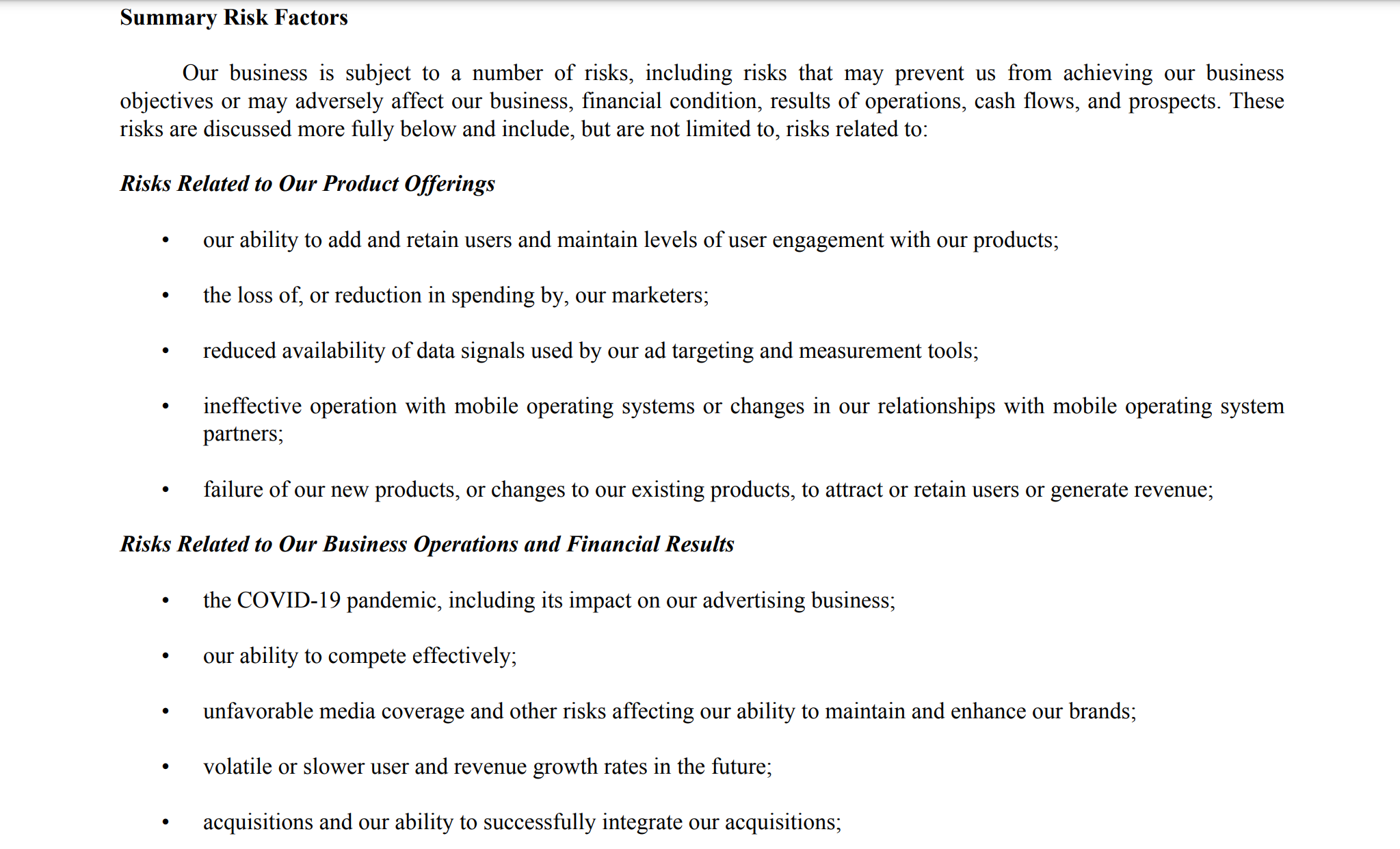

Since most startups don’t have financial reports yet, a good way to learn about the risks of a business is to study the threats that affect more established companies in the same industry.

For example, in a publicly traded company’s 10-K annual report, there should be a list of all the specific risks associated with the business.

These risks are often quite detailed, allowing an investor to understand what may affect a business negatively. You can apply these risks to the startup you are evaluating.

If it appears that most of the risks listed will most likely affect the company in a limited capacity, then it may imply that this is a worthwhile investment.

Keep in mind that there are many Black Swan events that you may not be able to predict or foresee.

To mitigate their effects, make sure that you never overpay for a company and include a margin of safety to protect your downside.

To learn more about how to value a company, check out this article.

-

What is the exit strategy for the investment?

Lastly, you will want to shift your focus away from the company itself and determine an appropriate exit strategy.

Oftentimes, investors plan for the millions they are going to make on an investment but fail to figure out an exit plan.

Depending on your time horizon, you may want to sell an investment if you have generated ample return on investment or consider the company overvalued.

On the other hand, another reasonable time to exit is if the company’s story changes for the worst.

This often happens when one of the major risks determined in Question Nine comes to fruition and is now impacting the success of the business.

In that case, it’s best to try and get out while you still can before you get crushed.

Keep in mind that VC investing is a form of investing that aims to buy private companies, not publicly listed businesses like stocks.

As such, these markets are often more illiquid, meaning that it can be more difficult to sell a start-up than it would be to sell a stock.

To protect yourself from unanticipated or risky events, it is always smart to have an exit strategy in place.

Otherwise, you may end up losing it all.

Final Thoughts: How to be a Successful VC Investor

As you can see, VC investing requires a lot of due diligence before an investment is made, but it is worth it.

Though investing in companies in their early stages can be quite exciting for a multitude of reasons, it can also be quite risky.

So, to be a successful VC investor, you must pay close attention to the fundamentals of the business and its team and determine whether they have the secret sauce to make it all worth your while.

As an investor, don’t ever hesitate to be skeptical because it will allow you to analyze things carefully and rationally.

Since it is all of our goals to make more money than we put in, the best way to do so is by limiting your losses and protecting your downside.

All-in-all, the best way to make money when investing is to find companies that are destined to make a lot of money themselves.

Because if the money keeps pouring in, it means that the good times will keep ‘a’ rolling.