Gone are the days of paying traditional advisors to do your investment bidding; robo-advisors are here.

Robo-advisors are a new, cost-effective way to meet your financial goals, all at the click of a button.

These artificial intelligence-driven systems are fast-paced decision-makers that can build you a well-diversified investment portfolio in seconds.

But are their services worth it?

In this article, we will help you understand robo-advisors, their risks and benefits, and whether it is worth having one manage your investment portfolio over a human professional.

Prepare to be amazed by one of the financial systems’ most innovative and practical investment solutions.

What is a Robo Advisor

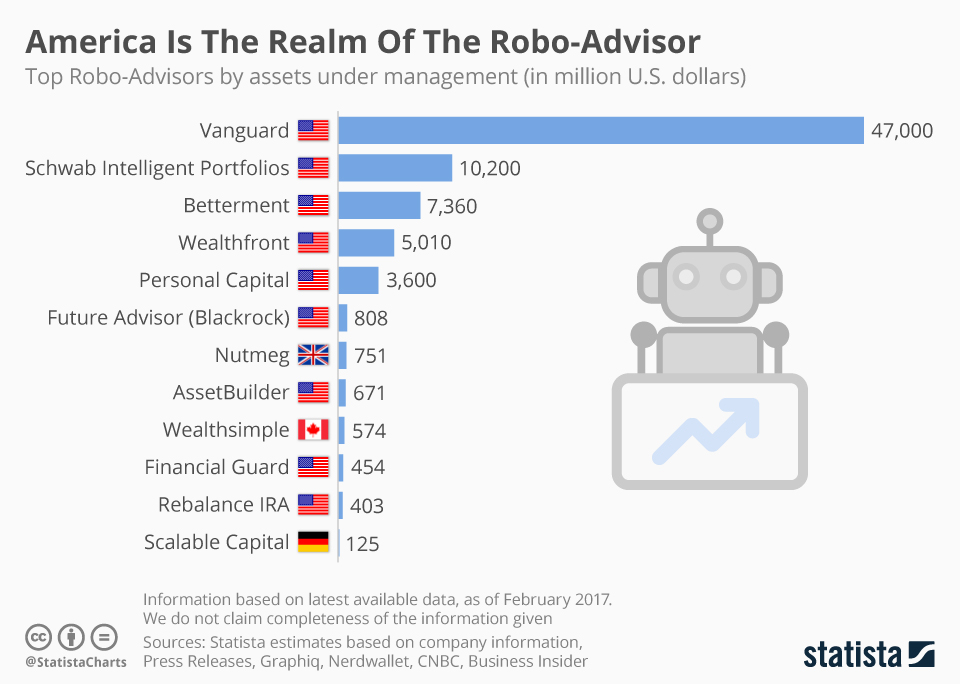

Image By: Statista

Before we dive into the nitty gritty, here is a brief overview of what robo-advisors have to offer.

A robo-advisor is an incredibly innovative and user-friendly form of financial technology (FinTech) platform that offers automated, algorithm-driven investment advisory services.

They were first introduced by Betterment in 2008, with the initial goal of rebalancing assets within target-date funds.

These sophisticated systems employ advanced computer algorithms to expertly craft and manage investment portfolios tailored precisely to an individual’s unique financial goals, risk tolerance, and time horizon.

The beauty of robo-advisors lies in their ability to deliver cost-effective, efficient, and readily accessible, personalized investment advice and solutions for all types of investors, whether you’re just starting your investment journey or have years of experience under your belt.

These intelligent platforms leverage cutting-edge technology to remove complexity and streamline the investment management process.

By harnessing the power of data-driven algorithms, robo-advisors can swiftly analyze vast amounts of financial information, identify suitable investment opportunities, and optimize your portfolio for maximum growth potential, making your financial journey a whole lot more enjoyable.

How Do Robo-Advisors Work?

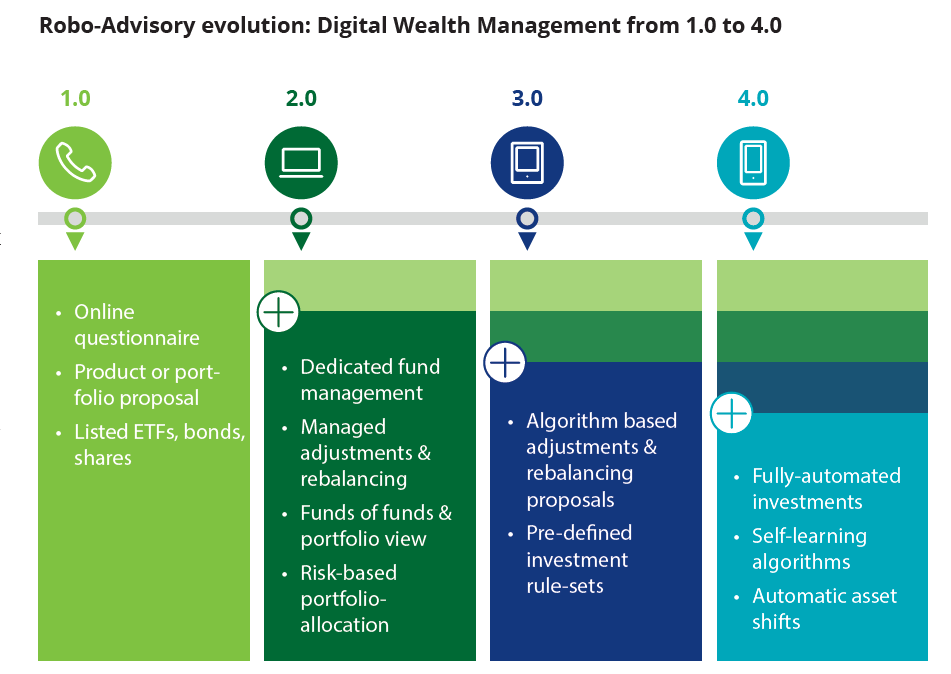

Image By: Digital Data Design Institute at Harvard

Robo-advisors represent a cutting-edge evolution in the world of financial advisory services, combining the benefits of a traditional financial advisor with unmatched efficiency and scalability.

Let’s dive into a comprehensive breakdown of the capabilities that define the typical robo-advisor:

-

Risk assessment

As you embark on your journey with a robo-advisor, you’ll undergo a seamless onboarding process that involves a series of thoughtful questions.

These queries aim to understand your unique financial goals, risk tolerance, and investment horizon.

Armed with your responses, the robo-advisor intelligently assigns a suitable risk profile to match your individual preferences and objectives.

-

Portfolio creation

Drawing from the information acquired through the risk assessment, the robo-advisor unleashes its powerful algorithms to craft a meticulously tailored and diversified investment portfolio.

Your personalized portfolio may encompass a strategic mix of asset classes, ranging from stocks and bonds to exchange-traded funds (ETFs) and other compelling investments.

This careful curation of investment securities ensures that your portfolio remains poised to achieve your financial aspirations.

-

Automated management

Once your expertly curated portfolio is in place, the robo-advisor springs into action as your vigilant and dedicated investment manager.

Employing cutting-edge technology, the robo-advisor diligently monitors your investments, keeping a watchful eye on market trends and dynamics.

With the utmost precision, it automatically rebalances your portfolio as needed to maintain your desired asset allocation over time.

This unwavering commitment ensures that your investments consistently align with your personal circumstances, risk preferences, and financial goals.

-

Low fees

The beauty of robo-advisors lies in their efficiency and technology-driven approach.

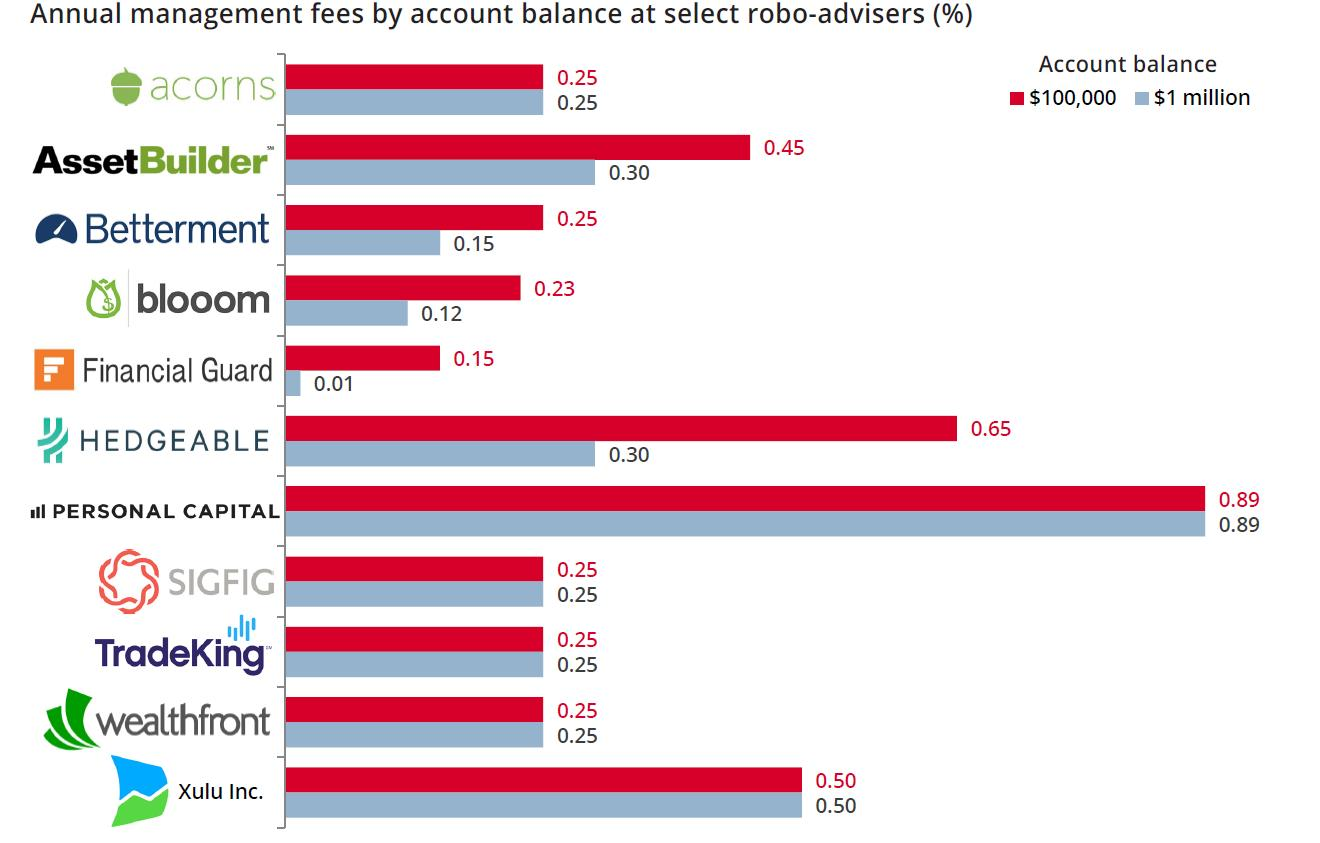

By leveraging automation instead of relying on human financial experts, robo-advisors typically offer lower fees compared to traditional financial advisory services.

This cost-effectiveness ensures that more of your hard-earned money is channeled into your investment growth.

-

Accessibility

Embracing the era of digital convenience, robo-advisors offer a user-friendly and easily accessible experience.

Through intuitive web-based platforms or user-friendly mobile apps, you can effortlessly access your investment accounts, track your portfolio’s progress, and make adjustments at your convenience.

The power to manage your financial future is right at your fingertips.

-

Scalability

One of the most impressive attributes of robo-advisors is their ability to gracefully handle a vast number of clients simultaneously.

This scalability is a testament to their efficiency and adaptability.

Whether you’re an individual investor or a business entity, the robo-advisor confidently and seamlessly meets your needs, regardless of scale.

What Are the Advantages and Disadvantages of Robo-Advisors?

Image By: Digital Data Design Institute at Harvard

Robo-advisors offer investors a unique and effective way to invest without the hassle of actively managing their funds.

However, it pays to evaluate them from a balanced lens.

Here is a quick overview of the various advantages and disadvantages of using robo-advisors.

What Are the Advantages of Using a Robo Advisor?

- Low Costs: Say goodbye to hefty fees! Robo-advisors shine when it comes to affordability, offering lower charges compared to traditional human financial advisors. For investors with smaller portfolios, this translates into substantial cost savings over time.

- Accessibility: Robo-advisors empower you to access your accounts and make smart investment choices whenever you please. Busy schedules and different time zones? No problem! Stay in control effortlessly.

- Diversification: Robo-advisors craft portfolios tailored to your risk tolerance, financial dreams, and investment timeline. The result? Reduced risk that comes with a variety of investments, minimizing the impact of market ups and downs.

- Automation: Imagine a personal assistant for your investments. Robo-advisors automate tasks like portfolio rebalancing, tax optimization, and goal tracking. You get to escape the daily grind of monitoring and adjusting, giving you more time to enjoy life.

- Consistency: No emotions, no impulsiveness. Robo-advisors base investment decisions on solid data and algorithms, ensuring a steady hand in the face of market twists. Goodbye to emotional biases, hello to rational choices!

- Lower Minimum Investments: Many robo-advisors have lowered the barriers with more accessible minimum investment requirements, inviting a diverse range of investors to join the journey.

- Education and Transparency: Learn as you go! Robo-advisors are your educational partners, offering insights and explanations about investment strategies. Understand your investments better and embark on your financial journey with confidence.

What Are the Disadvantages of Using a Robo Advisor?

- Limited Human Interaction: While robo-advisors excel at efficiency, they may lack that personalized human touch some investors crave. If you’re a fan of direct interactions and tailor-made advice, this might be a point to ponder.

- Complex Financial Situations: Complexity meets nuance. Robo-advisors might face challenges when navigating intricate financial situations like estate planning, tax optimization, or unconventional investment strategies. For these scenarios, a human touch might be the key.

- Market Volatility: Robo-advisors automate decisions, but they can’t predict the future. Sudden market twists might catch them off guard compared to human advisors who can respond more effectively to extreme events.

- Lack of Flexibility: One size doesn’t fit all. Some robo-advisors offer limited customization, potentially clashing with your unique investment preferences or ethical considerations.

- Overreliance on Algorithms: A word of caution: putting all your eggs in the algorithmic basket can carry risks. Unexpected market shifts or algorithmic quirks could lead to less-than-ideal investment choices.

- Data Security and Privacy: Your financial safety matters. Trusting the robo-advisor’s security measures to safeguard your sensitive data from cyber threats and breaches is a crucial consideration.

- Uncertain Regulation: The landscape is evolving. Keep in mind that the world of robo-advisors is subject to changing regulations that could impact their functioning and the protection they offer to investors.

What to Consider When Choosing Between Robo Advisors vs Financial Advisors

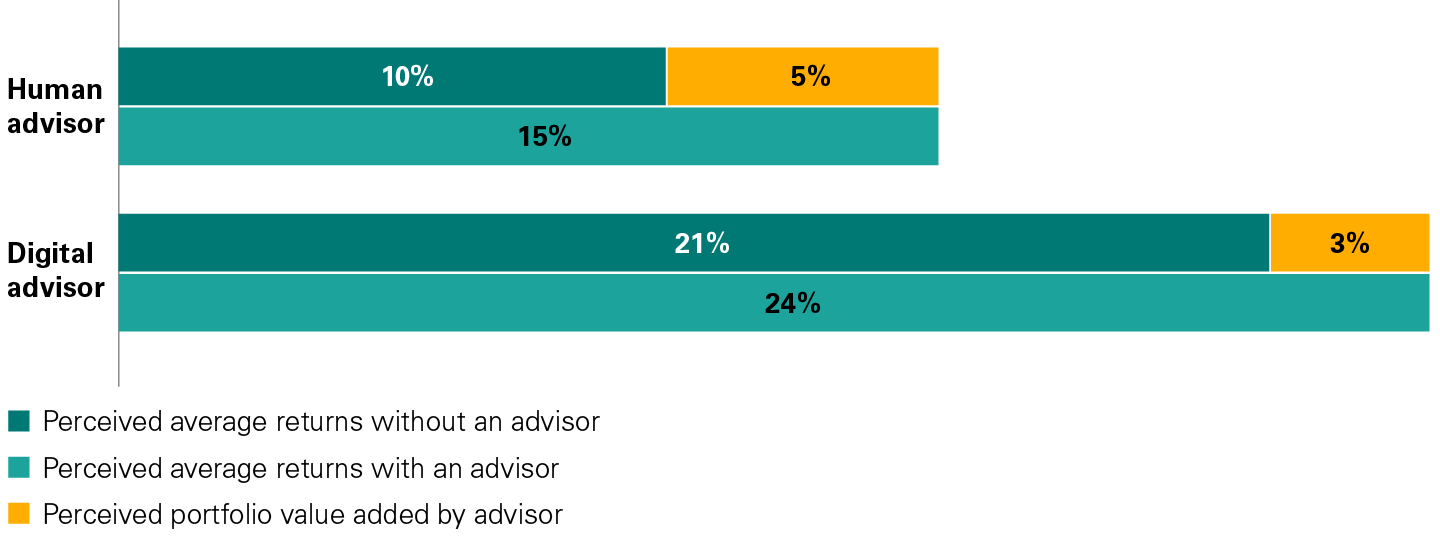

Image By: Vanguard Advisors

Choosing between robo-advisors and human financial advisors can be an important step in your investment process.

Both options offer distinct advantages, and the choice largely depends on your individual preferences and needs.

That being said, here are some key factors to consider when making your decision:

1. Financial Goals and Complexity

Robo Advisors: Think of robo-advisors as your trusty navigators for straightforward financial goals. Want to plan for retirement or simply see your investments grow? Robo-advisors, with their automated wizardry, have got your back.

Financial Advisors: If your financial planning journey involves intricate landscapes—multiple goals, estate planning, or tax strategies—human financial advisors bring personalized expertise to guide you through every twist and turn.

2. Personalization and Human Interaction

Robo Advisors: Imagine the convenience of automation. Robo-advisors offer a streamlined approach if you’re all about the efficiency game. No direct, human advisor interaction? No problem!

Financial Advisors: If you thrive on personalized discussions, tailored investment advice, and having an expert guide your choices, human financial advisors are your go-to companions.

3. Costs

Robo Advisors: Robo-advisors are known for their budget-friendly nature, often charging lower fees (between 0.25% to 0.50%). This sweet deal is especially inviting for those with smaller portfolios.

Financial Advisors: Personal touch comes at a premium. Financial advisors typically charge around 1% of assets per year, and sometimes an hourly fee, but the investment in tailored guidance and expert insights could yield substantial returns.

4. Convenience and Accessibility

Robo Advisors: Robo-advisors grant you 24/7 access to manage your investments. Perfect for those juggling busy schedules or who prefer making decisions on their terms.

Financial Advisors: While scheduling appointments might be the norm, human advisors provide in-person interactions and on-demand consultations. It’s like having a third financial advisor or confidant always ready to assist

5. Investment Knowledge

Robo Advisors: Worried about investing jargon? Fear not! Robo-advisors simplify the process to provide investment advice, often with handy educational resources. No Ph.D. in finance is required.

Financial Advisors: For those who appreciate a guiding hand through the financial labyrinth, human advisors offer a wealth of knowledge to help you confidently navigate financial life together.

6. Emotional Factors

Robo Advisors: Say goodbye to emotional roller coasters. Robo-advisors take the emotion out of investing, ensuring a steady course even during market storms.

Financial Advisors: If you’re seeking a reassuring presence, human advisors provide emotional support, helping you stay focused on your long-term objectives, no matter the market’s ups and downs.

7. Technology and Security

Robo Advisors: Picture technology as your travel companion. Robo-advisors leverage cutting-edge tech for seamless transactions and portfolio management. Just make sure you address any data security concerns.

Financial Advisors: With the human wealth management experience comes robust security. Established human advisors might have stringent cybersecurity measures in place, though technological advancements can vary.

What Should You Choose?: Robo-advisors or Financial Advisors

In the end, the path you choose, robo-advisors or human financial advisors, should harmonize with your aspirations, lifestyle, and the level of personalized guidance you desire.

Remember, your financial journey is unique, and whichever route you take, know that you’re making strides toward a brighter financial future.

The key is to start investing.

After that, very little matters other than choosing an investment strategy that fits well with your financial goals and aspirations.

Once you do, you can let the power of compounding work its magic bringing you unmeasured wealth and freedom for generations to come.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.