Artificial Intelligence (AI) is at the forefront of the investment world today. In the spirit of exploring uncharted territories, AI emerges as the maestro of market dynamics, decoding the soul of financial landscapes.

It’s not about replacing human intelligence. Instead, it’s about utilizing the tools available to us in the modern world. AI has become the trusted advisor, navigating vast datasets with unparalleled precision to uncover hidden patterns and foresee emerging trends.

AI | Geeks For Geeks

The future of investing is now woven into the fabric of AI as we work with the algorithms of possibility in the quest for financial knowledge.

What is Artificial Intelligence

Investopedia defines artificial intelligence as ” The simulation of human intelligence by software-coded heuristics.”

AI, or Artificial Intelligence, is a tool created by humans that has transcended the realm of computation to spread throughout every facet of our modern existence.

This intelligence tool encompasses applications like OpenAI’s Chat GPT, which converses with users, or Verses’ KOSM, a network operating system that integrates AI into real-world applications.

Artificial Intelligence | Investopedia

In the intricate weave of silicon and algorithms, AI serves as a manifestation of the outliers—those groundbreaking technologies that disrupt conventional paradigms.

It has reached a tipping point where its impact, once gradual and incremental, now cascades into our daily lives. This culmination of incremental advancements transforms how we perceive and interact with the world.

How Does Using AI for Investing Work?

Utilizing AI for investment decisions involves leveraging its analytical capabilities to process vast amounts of financial data, identify patterns, and make informed predictions.

AI can assist by automating routine tasks, conducting sentiment analysis on news and social media, and executing trades based on predefined strategies.

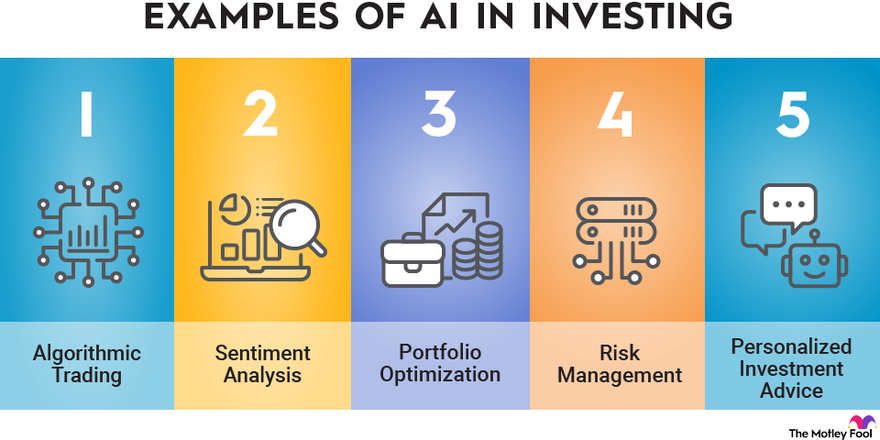

Examples of AI Investing | The Motley Fool

Strategies involving artificial intelligence use machine algorithms to learn from historical market data and recognize trends and anomalies, helping investors make more informed decisions. Additionally, AI-driven predictive modeling can assess risk and return, providing valuable insights for portfolio optimization.

However, it’s essential to approach AI tools with a balanced perspective, combining the strengths of new technology with human judgment to navigate the complexities of financial markets. Here are some ways that AI can be used to enhance one’s investment strategies:

Data Analysis and Pattern Recognition

AI excels at processing vast amounts of financial data quickly. It can identify patterns, trends, and correlations that might be challenging for humans to discern, providing valuable insights for investment decisions.

Stock Picking

Retail investors use AI to efficiently sort through the many data points of companies trading on the stock market, which can help identify stocks that meet the criteria of a given investment strategy. Applications or tools like stock screeners allow investors to filter and select stocks based on specific criteria. This criterion can include fundamental metrics, technical indicators, and other variables that help investors identify stocks that meet their particular investment objectives, preferences, or strategies.

Risk Management

Investing involves risk, and AI revolutionizes investing risk management by swiftly analyzing vast datasets, predicting market trends, and automating decisions. Its capabilities extend to sentiment analysis, fraud detection, portfolio optimization, credit risk assessment, and algorithmic trading. AI-driven tools enable stress testing, regulatory compliance monitoring, and dynamic asset allocation, empowering investors with adaptive decision-making in the face of evolving market conditions.

Risk Management | Investopedia

Portfolio Optimization

AI transforms investment portfolios by diversifying efficiently through data analysis and advanced algorithms. It identifies optimal structures that balance returns and risk, employing efficient frontier analysis and optimization algorithms. With scenario analysis and real-time monitoring, AI adapts portfolios to changing market conditions, enhancing traditional optimization for effective risk management.

Algorithmic Trading

AI in algorithmic trading utilizes advanced algorithms and machine learning to analyze data, identify patterns, and execute trades autonomously. These algorithms incorporate predictive analytics and risk management strategies, making rapid, data-driven decisions.

With direct market connectivity, trades are executed efficiently and devoid of emotional biases. AI algorithms navigate dynamic market conditions by adapting and continuously learning from new data.

Some systems extend to high-frequency trading, capitalizing on price differentials.

Market Research

AI revolutionizes market research through automated data collection and processing from diverse sources like social media. With sentiment analysis, AI provides insights into customer satisfaction and trends, while predictive analytics forecasts future market dynamics. Image and video analysis, chatbots, and virtual assistants improve customer interactions, while automated survey analysis streamlines data extraction, making market research more efficient and data-driven.

AI’s contributions span demand forecasting, dynamic pricing, and trend analysis, empowering businesses to stay competitive in a dynamic market landscape.

Personalized Investment Advice

AI generates personalized investment advice by utilizing machine learning algorithms to analyze individual financial data, preferences, and financial goals. The process involves collecting relevant data, assessing risk tolerance, analyzing market conditions, constructing a personalized investment portfolio, implementing diversification strategies, and dynamically rebalancing the portfolio as needed.

Behavioral analysis helps fine-tune advice based on an investor’s reactions to market conditions, and continuous learning allows the AI to adapt and improve recommendations over time. The communication of advice is facilitated through user-friendly interfaces, mobile apps, or other channels. This comprehensive approach aims to provide investors with relevant, effective, and tailored guidance for an enhanced investment experience.

Just For You | Medium

Various investing strategies utilize AI tools like ChatGPT; check out our post on the best ChatGPT trading and investing strategy here.

AI Tools for Investing

With all of the applications of artificial intelligence at our fingertips, here are some notable investing tools you can use to aid your investment portfolio:

Magnifi

Magnifi is an AI-powered investment app that connects users with financial experts for personalized advice through one-on-one video consultations. The platform aims to make financial expertise more accessible by facilitating direct interactions between users and professionals.

Magnifi | Cision

Trade Ideas

Trade Ideas is a financial technology company that provides AI-driven stock scanning and market analysis tools for traders and investors. The platform offers real-time scanning, alerting, and strategy development features to help users identify potential trading opportunities in the stock market. Trade Ideas uses artificial intelligence and machine learning to analyze market data, recognize patterns, and generate actionable insights. Traders can customize and implement their trading strategies based on the information provided by the platform.

Trade Ideas | Tradewise

Capatalise.ai

Capitalise.ai is a financial technology company that provides a platform for algorithmic trading automation. The platform allows users to create and implement automated trading strategies using natural language processing (NLP). Capitalise.ai aims to simplify the process of developing and executing algorithmic trading strategies by enabling users to express their trading ideas in plain English sentences.

Capitalise | Interactive Brokers

Many investors also use ChatGPT as a tool to improve their investment process; click here to learn more.

Pros of Using AI to Invest

Using AI in investment comes with several advantages that appeal to investors and financial professionals:

Data Analysis Efficiency

Artificial intelligence processes vast amounts of financial data at high speeds, uncovering patterns and trends that may be challenging for humans to identify. This efficiency allows for more informed investment decisions.

Quantitative Analysis

AI excels in quantitative analysis, providing a systematic and data-driven decision-making and investment management approach. This can lead to more objective and consistent investment strategies.

Real-Time Decision Making

Generative AI tools enable real-time analysis of market conditions, allowing for swift decision-making and execution. This is particularly advantageous in fast-paced stock markets, where timing is crucial.

Real-Time Decision | Actian

Risk Management

Risk management models driven by AI can assess and mitigate risks more effectively by analyzing historical data and identifying potential vulnerabilities in a portfolio without the adverse effects of human biases.

Diversification and Optimization

AI algorithms can optimize portfolios by considering various factors such as risk tolerance, return objectives, and market conditions. This aids in creating well-balanced and diversified portfolios.

24/7 Monitoring

Generative artificial intelligence systems can monitor financial markets 24/7, providing continuous surveillance and timely responses to market changes, news events, or emerging trends.

Scalability

GenerativeAI can scale effortlessly to handle large datasets and complex analyses, making it suitable for managing portfolios of various sizes.

Adaptability to Market Changes

In dynamic financial environments, the adaptability of AI systems is essential, enabling them to modify strategies in response to shifting market conditions. If you’d like to read more about changes in the market involving artificial intelligence, click here!

Adaptability | Edge2Learn

Pattern Recognition

Leveraging its proficiency, AI identifies intricate patterns and correlations within historical data, proving invaluable for predicting market movements and discerning investment opportunities.

Enhanced Research and Insights

Utilizing AI tools enables thorough research, processing vast amounts of information to offer nuanced insights into market trends, global economic growth indicators, and potential investment opportunities.

These advantages highlight AI’s potential in investing, emphasizing the need for a nuanced approach that blends technological strengths with human judgment.

Cons of Using AI to Invest

Despite the numerous advantages, the use of AI in investment also comes with its share of challenges and potential drawbacks:

Over-reliance on Historical Data

AI models often rely on historical data for training. If market conditions change significantly, historical patterns may not accurately predict future events, leading to suboptimal decision-making.

Complexity and Lack of Transparency

Many AI models, especially deep learning algorithms, are complex and operate as “black boxes.” This lack of transparency can make understanding how decisions are reached more challenging, potentially eroding trust among investors.

Data Quality and Bias

The quality of AI-driven insights heavily depends on the quality of the data used for training. If the data is biased or incomplete, the AI model’s predictions may be inaccurate or reflect existing biases.

Algorithmic Risks

Algorithms are not foolproof. There’s a risk that AI algorithms may misinterpret data, make incorrect predictions, or fail to adapt to unforeseen market events, potentially leading to financial losses.

Lack of Human Intuition

AI lacks human intuition and may struggle to interpret contextual information or unexpected events that do not align with historical patterns. Human judgment is often needed to navigate unique or unprecedented situations.

Market Manipulation Risks

In high-frequency trading scenarios, there’s a risk that AI algorithms, if not properly regulated, could contribute to market manipulation or exacerbate market volatility.

Security Concerns

The reliance on AI introduces new cybersecurity risks. Malicious actors could exploit vulnerabilities in AI systems, leading to data breaches or manipulation of financial models.

Regulatory Challenges

The rapid evolution of AI in finance poses regulatory challenges. Policymakers may struggle to keep up with technological advancements, potentially leading to regulatory frameworks lagging.

Ethical Considerations

AI systems may inadvertently perpetuate or amplify existing biases present in historical data. This raises ethical concerns, especially if AI-driven decisions have discriminatory impacts on particular groups.

Ethics | Santa Clara University

High Implementation Costs

Implementing and maintaining sophisticated AI systems can be expensive. Smaller investors or firms may struggle to afford the necessary infrastructure and expertise.

Market Impact

The widespread use of similar AI strategies by various market participants could lead to crowded trades or herding behavior, potentially amplifying market movements.

Investors and financial institutions should meticulously assess these risk factors and adopt risk management practices to tackle potential challenges linked to AI usage in investment. Furthermore, a well-balanced approach, integrating AI insights with human expertise, is frequently advised to navigate the intricacies of financial markets successfully.

Ride The AI Wave

As artificial Intelligence (AI) takes the lead in the new technological wave, it acts as a trusted advisor, shaping the future of investing. From conversational AI like Chat GPT to network operating systems like KOSM, AI disrupts paradigms. If you’d like to learn more about Verses AI, check out our interview on YouTube.

Leveraging AI involves harnessing its analytical prowess for data processing, pattern recognition, stock picking, risk management, and more. Notable tools like Magnifi, Trade Ideas, and Capatalise offer personalized advice and algorithmic trading applications. The pros include efficiency, real-time decision-making, and enhanced research, but challenges like data reliance, complexity, and ethical considerations highlight the need for a balanced approach.

In conclusion, riding the AI wave in investing offers unparalleled opportunities but requires careful consideration of its limitations and risks. As investors like you and I continue to watch the exponential growth of artificial intelligence, be sure to use it to your advantage!

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.