Investors operate more like careful archaeologists than frenzied treasure hunters in the intriguing world of Wall Street, where the clamor for quick gains often drowns out reason.

These are the value investors, practitioners of a philosophy akin to searching for hidden gems in a marketplace, often too shortsighted to recognize their true worth. The core idea of value based investing is to look for companies whose stock prices are undervalued by the market.

But how do you know if a stock is undervalued? It’s not just a wild guess; investors use detailed analysis of a company’s financials—such as how much money it makes, how much debt it has, and its overall financial health—to determine its value.

This intrinsic value is like a secret number telling you what the company is worth.

Values-Based Investing

Picture a bustling market, where most are dazzled by the latest, shiniest objects. Yet, in the crowd, someone like Benjamin Graham, often dubbed the ‘father’ of value investing, is calmly sifting through the less glamorous, overlooked pieces.

How To Align Your Money Principles | FinanceBuzz

His protégé, the legendary Warren Buffett (the best-known value investor), likens it to buying a dollar for fifty cents. It’s not just a matter of finding a bargain but understanding deeply and patiently why something is undervalued.

This approach requires a blend of humility and audacity — humility to acknowledge that the market often gets things wrong and audacity to bet against the prevailing wisdom. It’s a philosophy grounded not in the frantic trading of the moment but in the slow, systematic analysis of a company’s fundamentals: its earnings, debts, and management.

It’s a commitment to the long view, to the belief that actual value is not consistently recognized at first glance but emerges over time.

Value investing isn’t just a strategy; it’s a mindset. In a world that often prizes the quick and the new, values-based investing is a testament to the enduring power of patience and insight.

Define: Intrinsic Value

Intrinsic value is like a secret story hidden within the pages of a company’s financial reports, waiting to be deciphered. It’s not the flashy headline price you see on the stock ticker but something more profound, more fundamental.

Imagine walking into an antique shop and spotting a dusty, overlooked painting. To the untrained eye, it’s just another piece of old art, but to an expert, it’s a rare masterpiece worth far more than its price tag.

That’s true value – the actual, inherent worth of something, often unrecognized at first glance.

Investors like Warren Buffett see intrinsic value as the North Star guiding investment decisions. It’s not about the price the market is willing to pay today but about uncovering the actual value of a company based on its assets, earnings, growth potential, and more.

Intrinsic value is elusive; it’s not a fixed number but a carefully calculated estimate. It requires looking beyond the surface, beyond market sentiment and short-term fluctuations, to understand what a company is truly worth.

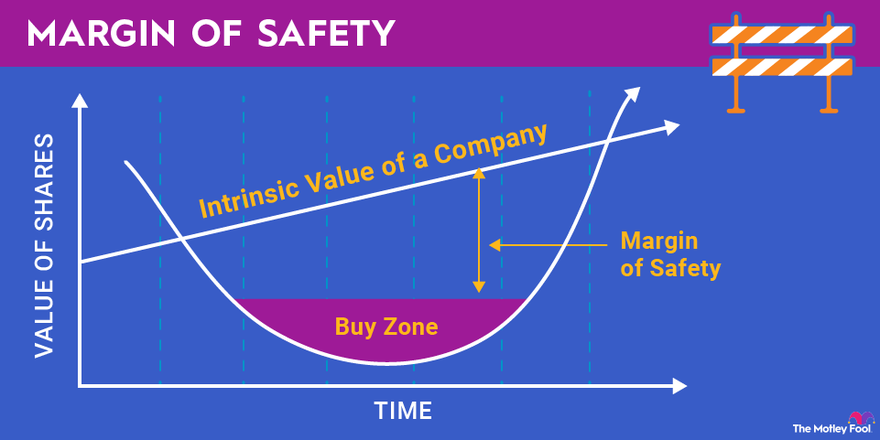

The Margin of Safety

Now, enter the concept of margin of safety, which acts as a protective buffer in this scenario. It differs between a company’s principal value and its current market price. Think of it as a safety net for investors.

When you buy a stock at a price significantly lower than its value, you’re giving yourself a cushion. This cushion is your margin of safety. It’s like buying that hidden treasure at a price far less than its worth, giving you room for error in estimating its value.

The margin of Safety Definition and How to Use it | The Motley Fool

A margin of safety is crucial because even the most thorough analysis can’t predict the future perfectly. By investing only when this margin is substantial, you protect yourself against errors in calculation, unforeseen market fluctuations, and the inherent uncertainty of investing.

This is a concept deeply rooted in risk aversion; you’re not just looking for suitable investments but for excellent and cheap assets. Even if the market doesn’t recognize the company’s value as soon as you’d hoped or if your analysis was slightly off, you’re still more likely to avoid a significant loss.

In summary, intrinsic value is about finding the actual, often hidden, worth of a company, while the margin of safety is about protecting yourself against the risks of the market and errors in your analysis by ensuring you buy at a price well below this estimated value. Together, they form the bedrock of a conservative, risk-aware investment strategy. Check out our podcast here to discover the true intrinsic value of Bowlero.

Is The Market Efficient?

According to Investopedia, the Efficient Market Hypothesis “states that share prices reflect all information and consistent alpha generation is impossible.” This means that all stock market prices at any time incorporate and reflect all information, making it impossible to “beat” the market.

Benjamin Graham, often referred to as the “father of value investing,” had views that fundamentally contrasted with the Efficient Market Hypothesis (EMH). It’s important to note that Graham’s key works, such as “The Intelligent Investor,” were published by Eugene Fama before the formal development of the EMH in the 1960s. However, Graham’s investment philosophy provides a clear counterpoint to the core tenets of the EMH.

The Intelligent Investor | Medium

On the other hand, Graham believed that the market often misprices stocks, which can lead to significant undervaluation or overvaluation of companies.

His investment approach was centered on identifying and investing in undervalued stocks – those trading for less than their value – and holding them until the market corrected the pricing inefficiency.

This belief in market inefficiencies is a direct challenge to the EMH, which posits that such mispricings are either non-existent or too fleeting to be profitably exploited.

:max_bytes(150000):strip_icc():format(webp)/effientmarkethypothesis-Final-cf7dc9dd753847619cf023ca29248f78.jpg)

Efficient Market Hypothesis | Investopedia

Why Stocks Become Undervalued

In the framework of values-based investing strategies, stocks become undervalued for various reasons, often tied to market inefficiencies and investor behavior. Here are some key factors that can lead to stocks being undervalued:

Market Sentiment and Overreaction

Investor emotions and psychology play a significant role. Markets can overreact to positive or negative news, leading to stock price fluctuations that don’t necessarily align with a company’s value. Negative news can cause investors to irrationally sell off a stock, driving its price down below its true worth.

Short-Term Focus of the Market

Many investment managers and traders focus on short-term performance and gains, overlooking long-term value and potential. This short-termism can lead to the undervaluation of stocks that may face temporary issues but have solid fundamentals and good long-term prospects.

Misunderstanding or Ignorance of Fundamentals

Stocks can become undervalued if the market misunderstands or overlooks critical aspects of a company’s financial health or business model. This can happen with complex businesses or industries or more minor, less-covered companies that don’t receive much attention from analysts and media.

Macroeconomic and Industry-Specific Factors

Broader economic downturns or industry-specific challenges can lead to the undervaluation of stocks across a sector, regardless of individual companies’ strengths. Investors often react to these broader trends by selling off stocks, sometimes indiscriminately.

Changes in Management or Strategy

Uncertainty or skepticism about changes in a company’s management or strategic direction can lead to undervaluation, as investors may be cautious until new strategies prove successful.

Market Inefficiencies

Value-based investing operates on the premise that the market is not always efficient and can take time for a stock’s price to reflect its value accurately. These inefficiencies create opportunities for value investors to buy stocks at prices lower than their estimated true worth.

Check out our post here to learn more about how to find deeply discounted stocks.

Diving Into Financial Statements

Values-based investors, who focus on identifying stocks that are undervalued relative to their actual value, pay close attention to financial statements, as these documents provide crucial insights into a company’s financial health and performance. Here’s how they typically analyze vital metrics such as Revenue Per Share, Operating Income, and Net Income Per Share and Debt:

Net Income Per Share

Also known as Earnings Per Share (EPS), Net Income Per Share is calculated by dividing the net Income by the number of outstanding shares. This is a crucial metric for value investors as it directly measures profitability per share. A high and growing EPS indicates a profitable company managing its share count effectively. Value investors compare the EPS with the stock price to evaluate metrics like the Price/Earnings (P/E) ratio, which helps determine whether the stock is undervalued.

Operating Cash Flow

Operating Income is essential as it reflects the profits a company makes from its core business operations, excluding expenses and incomes unrelated to the primary business activities. Value investors scrutinize this number to understand the company’s operational efficiency and profitability. A consistently growing operating income suggests a company that is efficiently managed and potentially undervalued by the market.

Revenue Per Share

Revenue Per Share is calculated by dividing total revenue by the number of outstanding shares. This metric helps investors understand a company’s top-line financial performance on a per-share basis, providing a sense of how effectively it generates revenue relative to its share count. While high revenue per share is often seen positively, value investors also assess the sustainability of the revenue and the profit margins to ensure the company is not just increasing sales but doing so profitably.

Debt

Value investors scrutinize a company’s debt levels to understand its financial leverage and risk profile. They often look at metrics such as the Debt-to-Equity Ratio and Interest Coverage Ratio. A high Debt-to-Equity Ratio might indicate that a company is aggressively funded by debt, which can increase risk, especially in uncertain economic times. The Interest Coverage Ratio, which shows how easily a company can pay interest on outstanding debt, is also crucial. Value investors prefer companies with manageable debt levels that do not compromise their financial stability.

Overall, investors utilizing a value-based approach look for low amounts of debt and consistent growth of at least 15% in their financials throughout 10+ years of financial statements of a given company. It is essential to recognize that investors executing this approach look not only at financials but also at every aspect of a given company, including factors that impact investing, such as management, news, and personal values.

Benefits of a Value-Based Investment Strategy

Here are some of the benefits associated with a value-based strategy for investing:

Potential for High Financial Return: By purchasing undervalued stocks, investors can realize significant gains when the market corrects the stock’s price to reflect its actual value.

Margin of Safety: This principle, central to many value investing strategies, involves buying stocks at a price lower than their estimated value. This buffer can protect against losses if the market valuation doesn’t increase as expected or if the investor’s analysis is incorrect.

Reduced Volatility: Value stocks are often less volatile compared to high-growth stocks. This is because value stocks are typically established companies with stable earnings, which can lead to less dramatic price swings.

Focus on Fundamentals: Value investing requires a thorough analysis of a company’s financials, which encourages a deep understanding of the company’s business, financial goals, and industry. This can lead to more informed investment decisions.

Long-Term Perspective: Values-based investing is inherently a long-term strategy, which can lead to more disciplined investing and potentially lower transaction costs compared to frequent trading.

Risks of Value Investing

Here are some risks associated with values-based investing:

Risk of Value Traps: Some stocks are undervalued not because of market overreaction but due to fundamental issues within the company. These ‘value traps’ can lead to sustained low performance, resulting in investor losses.

Underperformance in Bull Markets: During bull markets, when high-growth stocks may surge, value stocks can underperform. Investors might miss out on significant market gains during these periods.

Time Horizon and Opportunity Cost: Value investing often requires a long time horizon to realize gains. There can be an opportunity cost, as funds are tied up in investments that may take years to appreciate.

Market Recognition: There is a risk that the market may never recognize the stock’s value within the desired timeframe or that intrinsic value was miscalculated.

Lack of Diversification: If an investor’s value-oriented investment portfolio is concentrated in certain sectors or stocks, it may lack a diversified portfolio, increasing risk.

Sustainable Investing With Mutual Funds

Warren Buffet himself has been known to follow the punch card rule; here is how he explains it:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments.”

While actual value investors seek to invest in individual companies, those who do not wish to risk the lack of diversification from this strategy can invest in funds. By applying the same rules of value investing to a mutual fund, investors seek information regarding factors like investment philosophy, fund managers’ track records, holdings, expense ratios, diversification, consistency of performance, dividend yield, and fund size.

Don’t Follow The Herd

Value-based investing is a distinct and thoughtful approach in finance, prioritizing long-term stability and true worth over short-term market trends. It involves a meticulous analysis to identify undervalued stocks, guided by the principles of intrinsic value and margin of safety.

Herd Mentality | Medium

This strategy, exemplified by legendary investors like Benjamin Graham and Warren Buffett, advocates for patience, discipline, and independence, often going against prevailing market sentiments. For those cautious about individual stock selections, value-based mutual funds offer a balanced way to apply these principles while achieving diversification. If you’d like to learn more about other long-term investment strategies, check out our post on growth investing.

In essence, value investing is a mindset that encourages standing apart from the herd, focusing your investment dollars on long-term value rather than immediate market reactions. As you explore this path, you’ll find that value investing is not just a strategy but a journey into the financial world’s deeper, often overlooked aspects, opening doors to a unique understanding of market dynamics and investment wisdom.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.