Image Source: Calculate Compound Interest: Formula with examples and practice problems. How the Formula Works | Math Warehouse

The phrase ‘time is

Today’s article will dive into the intricacies and magic of compound interest. More specifically, we’ll talk about why compounding interest is so important, what investments and accounts can help achieve compounding interest, tax considerations investors should be aware of, and some strategies investors can use to maximize their returns.

Fundamentals of Compound Interest

Image Source: Compound Interest Questions & Formulas | Leverage Edu

Compound interest can be incredibly powerful when given enough time to work. In fact, the ability for compounding interest to turn small amounts of

And what’s even better, is the fact that anyone can understand and implement compounding interest into their financial plans.

So, before we dive any deeper into the different kinds of compound interest accounts, investments, and strategies one can use, let’s quickly go over what exactly compounding interest is and how it works.

Compounding Interest Explained Simply

Compound interest is often referred to as “interest on interest.”

It’s a method that will help you grow your

The key takeaway about compound interest is that it can turn small, regular investments into a substantial sum over time. The earlier you start saving and investing, the more you can benefit from compound interest. It’s not just about the amount you save, but also about giving your

The Magic Formula

The formula for compound interest is:

A = P(1 + r/n)^nt

Where:

A: is the future value of the investment/loan, including interest.

P: is the principal investment amount.

r: is the annual interest rate.

n: is the number of times that interest is compounded per year.

t: is the time the

The biggest takeaway from understanding this formula is that, the largest determining factor for how much

The more frequently the interest is compounded, the greater the interest will be and the more

A Real-World Example

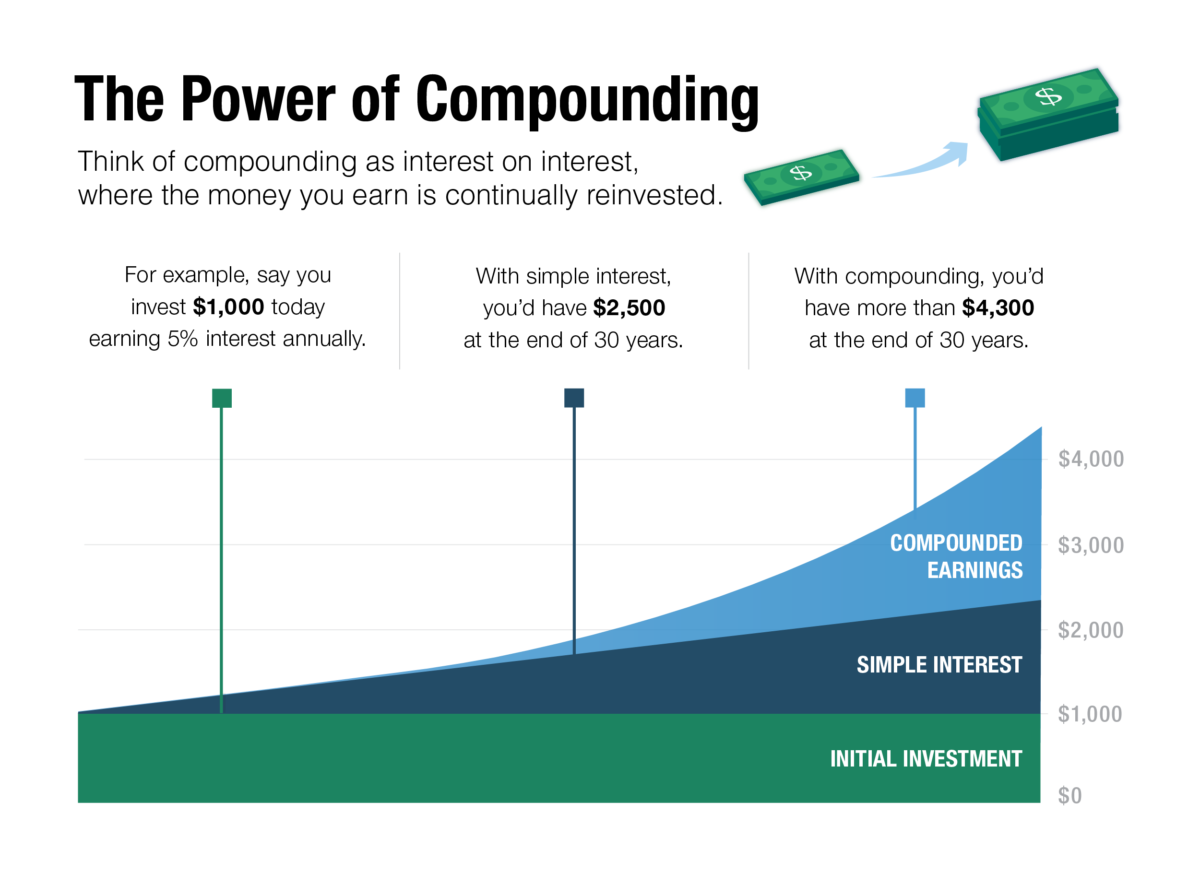

To give an example of how compounding interest can significantly increase the total amount of your investment over time, the chart below displays the effectiveness of compound interest when compared to your principal investment amount and simple interest.

Image Source: Compounding: A Great Way for Your

This chart shows what compounding interest would do for an initial investment of $1,000 that is compounded at 5% a year, for 30 years. At the end of the 30 years, you would have over $4,000! Compare this to simple interest, where after the same period of time, you would only have $2,500.

Clearly, utilizing accounts or investments that allow for compound interest is without a doubt the most efficient, simple, and powerful way to grow your

Investments & Accounts Utilizing Compound Interest

Image Source: A Quick Guide To Accounting For Dividends | Deskera

Compound interest is a powerful tool in both investment strategies and various types of saving accounts.

To help investors understand how exactly they can take advantage of compound interest, here we’ll go over the most common and accessible investments/accounts that utilize compounding interest principles.

Investments Using Compound Interest

Stocks and Dividends: Investing in stocks, especially those that pay dividends, can be great compounding interest assets – as long as the dividends are reinvested. This reinvestment buys more shares, which may then generate more dividends, creating a very strong compounding effect.

Bonds: Bonds, particularly zero-coupon bonds, utilize the concept of compounding interest by being issued at a discount and not paying periodic interest. Instead, they accumulate interest over their entire term, with the interest effectively compounding until the bond matures. This makes zero-coupon bonds a unique investment option, as they grow in value over time and pay out the face value at maturity, representing the initial investment plus compounded interest.

Mutual Funds and ETFs: These funds often reinvest dividends and interest payments, leading to compounded growth. The effect is more pronounced in funds that focus on reinvestment over distributions.

Real Estate Investment Trusts (REITs): REITs pay out most of their profits as dividends. If these dividends are reinvested, investors can then reinvest back into the REIT, or, invest that capital into other compounding interest investments.

Accounts with Compound Interest

Saving Accounts: Interest earned in saving accounts is added to the principal amount, enabling it to earn further interest. The frequency of compounding in these accounts can vary widely, though typical compounding periods are annual or monthly.

Money Market Accounts: A

Retirement Accounts (401(k)s and IRAs): These accounts usually contain investments like stocks and mutual funds. The earnings are reinvested, allowing the account to grow through compound interest. Additionally, the tax-deferred nature of these accounts can enhance the compounding effect even further.

High-Yield Online Savings Accounts: High-Yield Online Savings Accounts provided by online banks typically offer higher interest rates than traditional banks and also feature better compounding periods when compared to other accounts.

Considerations When Selecting Compounding Interest Investments

Image Source: 7 Ways to Compare Stock Market Investments | Wisebread

As we’ve seen in the section above, there are multiple different asset classes and accounts one can you use when relying on compounding interest to build wealth.

Though with so many different options, means investors should make sure to understand the most important differences and considerations between each investment/account.

Below, we’ll touch on the different levels of risk of various investments, how your time horizon will impact which account is best for you, and talk about some other important considerations investors should be aware of.

1. Risk vs. Reward

High-Risk Investments (Stocks, REITs): Investments like stocks or REITs can offer higher overall returns, but will almost always come with increased volatility and risk. Investors who aren’t willing to take on greater risk, should put a smaller amount of their total portfolio into stocks.

Moderate-Risk Investments (Mutual Funds, ETFs): Mutual funds and ETFs can provide a great balance, through offering (potentially) lower returns than individual stocks but with reduced risk and volatility.

Low-Risk Investments (Savings Accounts, CDs): Savings accounts and/or CDs are the safest options, offering a very stable but lower return. These investments will have set returns, meaning investors will know exactly how much they will make each year.

2. Time Horizon and Liquidity

When looking at investments that utilize compounding interest, it’s important to factor in your time horizon and liquidity needs.

For short-term financial goals, high-yield savings accounts and CDs are always preferable. These options offer greater liquidity, allowing you easier access to your funds when needed, and they present lower risk, making them suitable for goals that are just a few years away.

On the other hand, for long-term objectives, such as retirement or growth investing, stocks, mutual funds, and retirement accounts are more appropriate. These investments require a longer time horizon to realize their full potential, as compound interest has more time to work its magic. This longer duration helps to mitigate the impact of short-term market fluctuations, giving you a more substantial return of your investment over time.

3. Accessibility and Ease of Management

In terms of accessibility and ease of management, investments can generally be categorized into self-managed and managed options.

Self-managed investments, such as individual stocks and ETFs, demand a more hands-on approach from the investor. This requires a deeper understanding of the market and a commitment to actively managing the portfolio.

On the flip side, managed investments like mutual funds and REITs provide a more passive investment experience. These are typically managed by professionals, reducing the need for the investor to closely monitor market changes.

Every investment option that utilizes compound interest has its unique set of characteristics. Understanding these differences is important when building a portfolio that will align with your financial goals and investing timeline.

Hopefully, this comparison serves as a starting point to help you decide which type of investment/account will work best within your individual plan and risk tolerance.

Strategies for Maximizing Compound Interest

Knowing what investments and accounts will let you earn compound interest is a good place to start, however there are equally important other things investors can (and should) do to maximize the effectiveness of compounding interest.

Below are some of the simplest, yet most effective ideas investors should know to ensure they get the most out of their portfolio.

Starting Early: The Impact of Time

The principle of starting early in investing can’t be emphasized enough. The longer your investment period, the more time compound interest has to work in your favour. This early start allows even small investments to grow exponentially over the years.

Regular Contributions: Boosting Compound Growth

Consistently adding to your investments will significantly enhance the power of compound interest. By making regular contributions, you’re not only increasing the principal but also the compounded returns over time. This strategy is particularly effective when combined with the discipline of automatic investing and dollar cost averaging, which helps in maintaining a steady investment pace regardless of market fluctuations.

Reinvesting Dividends and Interest

Reinvesting dividends and interest back into your investment is the backbone of the compounding effect. Instead of taking out this capital and spending it, allowing your

Choosing Investments with Higher Compounding Frequencies

Investments that compound interest at higher frequencies, such as monthly or daily, offer more rapid accumulation compared to those compounding annually. When selecting investments, understanding and comparing their compounding frequencies can make a significant difference in the growth of your investments.

Utilizing Tax-Advantaged Accounts

Investing in tax-advantaged accounts like 401(k)s, IRAs, TFSAs, or 529 education plans allows your earnings to compound without immediate tax implications. These accounts not only let you maximize the amount of

Compound Interest and Tax Implications

Image Source: Tax Implications of Separated Couples Under the Same Roof | TaxPage.com

So far, we’ve talked about the best compound interest investments, as well as the various accounts available. We’ve also looked at some other important strategies (like regular contributions and the importance of time) investors can use to maximize their investment portfolio.

And now, we have one more very important aspect of building a successful compounding interest investment account…taxes.

Taxes can weigh heavily on investment returns when you inevitably have to sell or move your

Tax-Deferred vs. Taxable Investment Accounts

The distinction between tax-deferred and taxable investment accounts significantly impacts the accumulation of compound interest. In tax-deferred accounts, like 401(k)s and IRAs, taxes on interest, dividends, and capital gains are postponed until withdrawal, allowing the investment to grow unhindered.

Conversely, in taxable accounts, taxes could be due on the interest and dividends earned annually, which can slow down the compounding process. Choosing the right type of account based on what’s available to you and your financial situation is essential for optimizing the benefits of compound interest.

Understanding Capital Gains and Interest Income Taxation

Capital gains and interest income are taxed differently, and understanding these differences is key. Long-term capital gains, usually from the sale of investments held for more than a year, are taxed at lower rates compared to short-term gains.

Interest income, like that from savings accounts and CDs, is typically taxed at your ordinary income tax rate. Balancing your portfolio with a mix of investment types can help in managing the tax impact on your compound interest earnings.

Tax-Efficient Investment Strategies

Implementing tax-efficient investment strategies can (and will) maximize your returns. This involves maxing out your tax-deferred bank accounts first, and only after this, adding investments to your taxable accounts. Additionally, strategies like tax-loss harvesting, where you sell investments at a loss to offset gains, can be effective in managing taxes and enhancing the overall return of your bank account.

Conclusion

Compounding interest is deceptively simple, yet incredibly powerful. Unlike other forms of strategies that require a large amount of time,

Even better, is there are many different options for investors to choose form depending on their risk tolerance, time frame, and investment goals. From a savings account offering interest, to

When looking to begin taking advantage of compounding interest, be sure to look at other considerations like tax sheltered accounts, the amount you will contribute each month, and what timeline you will be investing for. Remember, the longer you remain invested, the more your

Above all else, remain patient, trust the process, and allow the magic of compounding interest to grow your wealth slowly but steadily over the coming months, years, and decades.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.