The world of investing can often be complex and overwhelming, given the abundance of data and terminology used in the industry.

This can lead investors to overlook certain aspects of it that may otherwise be beneficial to them.

One such term—or role—is that of a transfer agent.

Registered transfer agents may not be the sexiest position in financial services, but make no mistake, these employees play an important role in the communication between companies and their shareholders.

In this article, we’ll delve into the crucial role of transfer agents, their differences from brokers, their responsibilities, the benefits they offer, and who might need one in their investment journey.

Prepare to explore one of the most underrated positions in the financial services industry today.

What is a Transfer Agent?

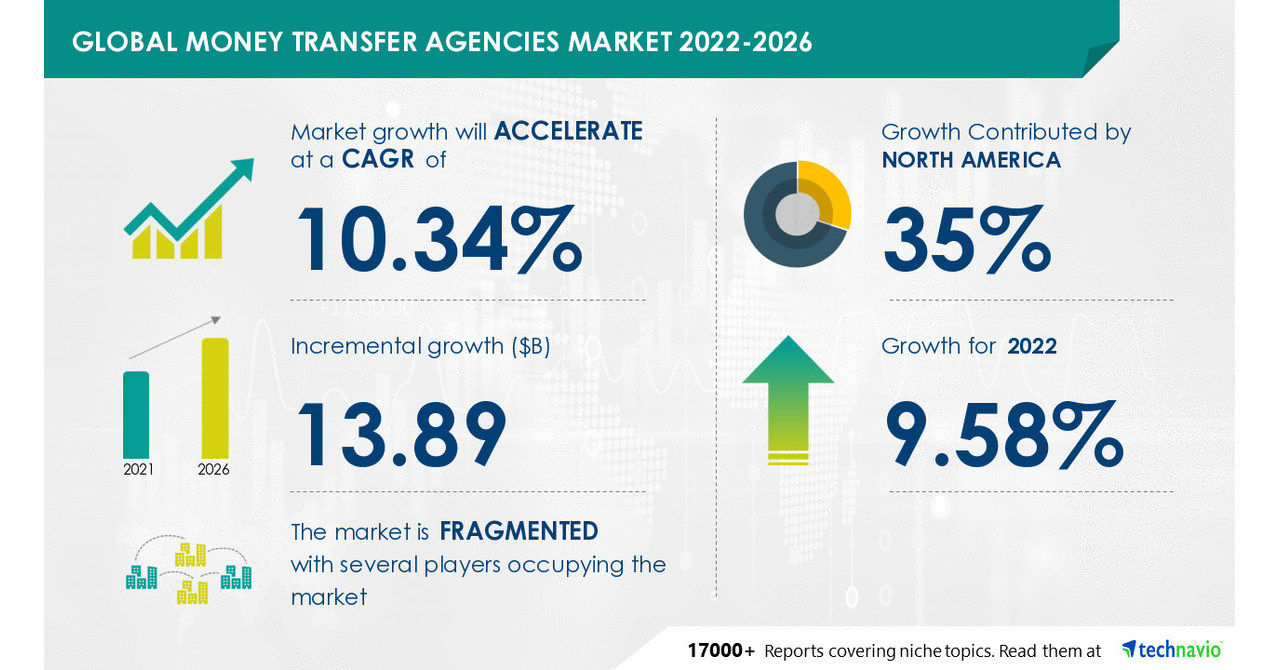

Image By: Technavio

A transfer agent is a pivotal but often overlooked entity in the realm of investments.

Their primary role revolves around maintaining records of a company or investment fund’s shareholders (i.e., mutual funds), tracking the issuance and transfer of securities, replacing a lost stock or bond certificate, and ensuring that shareholders receive the benefits and entitlements associated with their holdings.

As such, transfer agents are like financial administrators, keeping meticulous records of who owns a company’s stocks or bonds, the history of those holdings, and the transactions related to them.

But, on top of that, they also act as intermediaries between the company and its shareholders, facilitating the smooth transfer of securities, payment of dividends or interest, and the distribution of annual reports and other critical documentation.

In essence, this makes them unofficially the accountants of the investor relations section of a company.

What is the Difference Between a Broker and a Transfer Agent?

You may be wondering, how does this differ from an investment broker?

Well, it is important to distinguish between these two positions, given that their roles differ significantly:

Investment Brokers

- Execution of Trades: An investor’s brokerage firm primarily hires stock brokers for buying and selling orders on behalf of investors. They act as intermediaries in the process of buying or selling securities in the open market, ensuring that transactions are carried out efficiently.

- Market Expertise: Brokers typically have an in-depth understanding of the financial markets, providing investment advice, trading recommendations, and research to help investors make informed decisions.

- Client Relationships: Brokers often maintain direct relationships with their clients, providing personalized investment guidance and portfolio management services.

Transfer Agents

- Record Keeping: Transfer agents are responsible for maintaining accurate records of a company’s shareholders. They keep track of the ownership of securities, the transfer of ownership, and the distribution of dividends or interest payments.

- Regulatory Compliance: Transfer agents play a vital role in ensuring that the company adheres to various regulations and reporting requirements, such as the SEC’s rules and the Securities Exchange Act of 1934.

- Shareholder Services: Transfer agents are the primary point of contact for shareholders, handling tasks like distributing annual reports, processing dividend payments, facilitating stock transfers, and addressing shareholder inquiries.

Responsibilities of a Transfer Agent

Image By: Securitize

With that determination out of the way, let’s discuss the specific roles and responsibilities a transfer agent has.

These include:

1. Record Keeping

At the heart of a transfer agent’s role lies the meticulous task of record-keeping. These financial custodians maintain comprehensive records of a company’s shareholders, leaving no detail unaccounted for. Contact information, the number of shares held by each shareholder, and the intricate history of their ownership are all meticulously logged.

2. Transfer of Securities

When shareholders engage in the buying or selling of securities, stock transfer agents take center stage to ensure the smooth transition of these assets from one party to another. Whether it’s the sale of stocks or the exchange of bonds, the transfer agent acts as the bridge that allows these transactions to take place seamlessly.

3. Dividend and Interest Payments:

A transfer agent plays a pivotal role in the distribution of financial rewards to shareholders. When it comes to companies, this means facilitating the timely and accurate distribution of stock dividends. In the realm of bonds, they ensure that interest payments reach bondholders as scheduled.

4. Shareholder Communications

Efficient and effective communication between a company and its shareholders is a cornerstone of good governance. Transfer agents serve as the catalysts for this communication, ensuring that shareholders receive important documents, reports, and notifications.

5. Regulatory Compliance

Regulatory compliance is a weighty responsibility shouldered by transfer agents. Companies must adhere to a multitude of regulations and reporting requirements, ranging from the rules of the Securities and Exchange Commission (SEC) to the mandates of other regulatory bodies. An exchange agent ensures that all of these rules and requirements are upheld.

Benefits of Transfer Agents

Image By: SuperStaff

If you are a business owner looking to improve your relationship with shareholders, it may be time to get your own transfer agent.

However, with the world becoming more digitized and software becoming more capable of replacing transfer agents, you might be thinking, what’s the point of hiring one if technology can do it for you?

Well, here are a few of the main benefits of hiring a transfer agent:

1. Accuracy and Reliability

In an age where software solutions promise automation and efficiency, it’s crucial to remember the value of human expertise.

While automation can expedite processes, it can’t replicate the discernment and judgment of a skilled transfer agent.

These professionals bring their experience and understanding of complex regulations to the table, ensuring that records are not just meticulously recorded but also scrutinized for accuracy.

Errors in shareholder records can have significant ramifications. Therefore, a transfer agent, with their human touch, acts as a safeguard against these potential pitfalls.

2. Shareholder Support

The investment journey is not always a straightforward path.

Shareholders may encounter diverse challenges, from the need to transfer stocks to the unfortunate loss of certificate documents.

In such instances, the transfer agent serves as a point of contact, offering invaluable support to shareholders.

While software solutions can provide automated responses, they lack the human element of empathy, adaptability, and nuanced understanding that a skilled transfer agent possesses.

This human interaction aspect is not just about problem-solving but about providing shareholders with the assurance that their concerns are heard and addressed by a real person who understands the intricacies of their investments.

3. Enhanced Trust

In the world of investments, trust is the currency that underpins success.

A reputable transfer agent can be the cornerstone of this trust, enhancing the credibility of a company and instilling confidence in its investors.

This human presence reinforces the company’s commitment to its shareholders, signaling that their interests are not just a matter of data entry but a priority that merits personal attention.

As a result, investors can feel confident knowing that they are operating in a trustworthy, stable, and prosperous investment environment.

Who Needs a Transfer Agent?

A transfer agent isn’t just another role to be filled in a company; it’s a strategic necessity for anyone who values precise control, regulatory adherence, and efficient shareholder interactions.

Let’s explore who, in particular, stands to benefit from the expertise of a registered transfer agent services.

1. Larger Publicly-Traded Companies

Large, publicly traded companies, with their intricate securities structures and substantial shareholder base, often find the services of a transfer agent indispensable. These entities can have a myriad of complex financial instruments in circulation, such as multiple classes of common stock, preferred shares, or convertible bonds. Managing the issuance and transfer of these securities while ensuring accurate record-keeping is a monumental task, best entrusted to the capable hands of a transfer agent.

2. Startups and Emerging Companies

Even in the early stages of growth, startups and emerging companies can benefit from the services of a transfer agent. By implementing these services early on, they can establish robust record-keeping practices, ensure regulatory compliance from the outset, and instill confidence in the minds of investors. It’s a proactive step that paves the way for smooth growth and development.

3. Private Companies with Shareholders

Private companies with a limited number of shareholders may also choose to engage a transfer agent. While their responsibilities may be less extensive, these professionals can assist in maintaining accurate ownership records and facilitating transactions, reducing the potential for disputes or errors.

4. Mutual Fund Transfer Agent

Mutual fund transfer agents are responsible for maintaining records of investor accounts in mutual funds. They process subscription and redemption requests, manage investor account information, and ensure that dividends or capital gains are distributed to fund shareholders.

5. Bank Transfer Agents

Some banks offer transfer agent services to manage stockholder accounts for companies. However, these transfer agents must register with the Federal Deposit Insurance Corporation (FDIC), Comptroller of the Currency, Board of Governors of the Federal Reserve System, or another bank regulatory agency, as opposed to the Securities Exchange Commission (SEC), which is the case for most registered transfer agents. They do so because their primary role involves managing shareholder accounts related to securities issued by banks and financial institutions rather than publicly traded companies. As such, they must follow a different set of rules and requirements that are more appropriate for their position.

The Bottom Line

Transfer agents remain an essential part of a company’s investor relations services.

As record keepers, overseers of transactions, and their close attention to regulatory compliance, among other responsibilities, these employees act as valued administrators, ensuring that businesses cooperate well with their shareholders.

While software tools are certainly making their jobs easier, it is important that these businesses maintain that human element when working with investors.

Fortunately, these transfer agents are ready to answer the call.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.