If you are an investor or are interested in finance, you make have heard of the term “efficiency frontier.” But was exactly is it?

An efficiency frontier is an effective tool that can help you create the optimal portfolio by maximizing returns while minimizing risk. However, it also has its flaws.

In this article, we will discuss both the advantages and disadvantages of using efficient frontier and explain how you can use it in your investing practice.

If you are someone looking to expand your investment strategy horizon and find new ways to make the most of your investments, continue reading.

What is an Efficient Frontier?

The efficient frontier theory is an extension of Modern Portfolio Theory which was first introduced by Nobel Prize laureate Harry Markowitz, in 1952.

Essentially, it’s an investment tool often taught in universities and investment funds that creates a graphical representation of the trade-off between risk and return.

Then, an investor uses the information to make a more informed decision about what to invest in and how they should manage their investment portfolios.

When using the efficient frontier, the main goal is that you find the optimal investment combinations based on what is available, allowing you to maximize returns for a given level of risk.

How does the Efficient Frontier Work?

To understand how the efficient frontier works, imagine that you and your family are risk-seeking investors trying to make the most efficient investment portfolio possible.

In other words, your goal is to achieve the highest investment returns possible without jeopardizing your risk.

To create an efficient frontier, you first need to identify a set of investment combinations (or portfolios) that you are interested in.

Are the combinations made up of individual stocks? Bonds? Index Funds? Cryptocurrency, perhaps?

Whatever they are, you will need to calculate the expected return and risk for your investment portfolio by combining different assets of different proportions or weights.

To calculate the expected return of an asset, you will need the risk-free rate (rf), the beta of an asset (Ba), and the market risk premium (rm – rf).

Furthermore, you will need to determine the riskiness of an asset as well, which can be calculated by figuring out the standard deviation of the asset.

Then, once you can combine both the expected returns of an asset and its risk, you can use it to determine where the asset fits within the efficient frontier.

This can be expanded on even further as it can be used to figure out the expected return and riskiness of a portfolio as well.

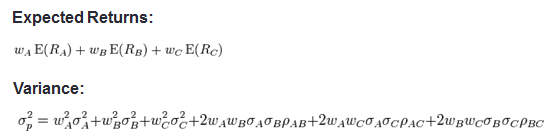

To calculate the portfolio risk and expected return, refer to the formula below, where “w” is the weight of each asset in the portfolio.

After everything is calculated, plot the different portfolios or assets on a graph to figure out the efficient portfolio frontier and optimal investment mix, generating the highest return for a given portfolio risk.

You may also want to add the tangency portfolio, which is simply where the risk-free interest rate intersects with the efficient frontier line.

When analyzing the graph, any portfolio that sits on the efficient frontier line is considered to be the most efficient, given that it will maximize returns at a specific level of investment risk.

Once you decide on a risk-to-reward relationship that you are comfortable with, you can then select the portfolio that best meets your needs.

What is Modern Portfolio Theory?

Modern Portfolio Theory (MPT) is based on the idea that an investor can optimize their returns by building a diversified portfolio that balances risk and returns.

It assumes that all investors are risk-averse, meaning that they are aiming to minimize risk while maximizing returns.

According to MPT, this is best achieved when an investor builds a diversified portfolio across multiple asset classes because the risk associated with each asset is reduced while the overall return of the portfolio is maximized.

However, one of the biggest disputes against MPT is that it assumes that the market is always efficient and that the value of an asset is equal to its market price, given that investors have access to all of its available information.

This implies that an investor can’t beat the market and that they are better off investing in the market as a whole rather than selecting individual assets.

But, as Warren Buffett, Mohnish Pabrai, Bill Miller, Peter Lynch, Li Lu, and other Super Investors of Graham-and-Doddsville would argue, that isn’t necessarily true.

Though to be fair, nearly 90% of investors fail to beat the market in the long run (>15 years).

Want to know if growth stocks are efficient, check out this video.

How Can Investors Use the Efficient Frontier?

If you want to incorporate the efficient frontier into your investment strategy, then here is how to make it happen.

To use the efficient frontier, the first thing you need to do is identify your risk tolerance and investment goals.

Then, plot the various portfolios on the efficient frontier to determine which portfolio provides you with the optimal balance between risk and return for a particular situation.

Remember, this decision is subjective to your personal needs so there is no perfect answer.

For example, if an investor has a higher risk tolerance, meaning that they are seeking higher investment returns, then they may choose a portfolio that is located towards the top of the efficient frontier.

This portfolio would likely include a higher allocation of riskier assets, such as stocks or cryptocurrencies.

On the other hand, an investor with a lower risk tolerance may choose an investment portfolio located toward the bottom of the efficient frontier.

This portfolio would likely include more bonds, real estate, and cash, given that they are less risky and also offer smaller returns.

Whatever you decide, choose something that is going to meet your investment goals without jeopardizing your health and well-being.

What are the Benefits of the Efficient frontier?

There are multiple benefits to using the efficient frontier in your investment process.

Here are a couple of reasons why you should consider using it.

Asset Allocation & Diversification

The efficient frontier emphasizes the importance of diversification as a means of minimizing risks in an investment portfolio.

By using this tool, you will learn how to diversify your portfolio more effectively by determining the optimal allocation of each asset.

This in turn will help you capture returns more accurately without putting your capital and financial independence on the line.

An Optimized Portfolio for You

An efficient frontier is a valuable tool in that it provides investors with a visual representation of the various risks and possible returns of different portfolios.

Investors can use this to construct a portfolio that better fits their risk tolerance and investment goals.

Not only that, but you can also use it to measure the performance of your current portfolio to the efficient frontier.

If it sits below the frontier, you may not be maximizing your returns, given the risk you are taking.

What are the Criticisms of the Efficient Frontier?

Just as there are many supporters of using an efficient frontier, there are also an equal amount of investors against it.

Here are two of the biggest criticism against it.

Assumes that Markets are Always Efficient

One of the biggest assumptions that the efficient frontier makes is that financial markets are always efficient and that investors are rational at all times.

But if you explore the numerous bubbles and busts throughout history, you may argue otherwise.

Though financial markets may be rational most of the time, the reality is that humans are emotional creatures, and they tend to act irrationally from time to time.

As such, assets tend to swing from being overvalued to undervalued and back again.

If you were to rely solely on MPT and the efficient frontier, you might run into situations where you end up overpaying for an asset, given that you assume that assets are always priced accurately.

To help explain this market phenomenon, Benjamin Graham introduced the analogy of Mr. Market, an emotional salesman who comes by your house trying to sell and buy assets at a new price every day.

Just like the stock market!

Want to learn how to spot overvalued stocks? Check out this article.

Overreliance on Historical Data

Another thing to watch out for when using the efficient frontier is its overreliance on historical data.

To estimate the future risk and expected return of an asset, you require statistics and data to conduct your calculations.

However, since the most accurate information comes from an asset’s past performance, you may end up overlooking the impact of future risks.

Another way of putting it is that past performance is not an indication of future performance.

Therefore, if you do plan on using the efficient frontier, it is better to underestimate returns and overestimate risk.

That way you’ll be better prepared for anything unexpected.

Final Thoughts: Is It Worth Using an Efficient Frontier?

An efficient frontier is a useful tool for those looking to optimize a well-diversified portfolio.

However, as we would argue ourselves, stocks tend to be overpriced and underpriced in certain market conditions. Thus, it’s better to focus on finding undervalued assets rather than assuming that it’s reasonable to buy at all times.

To do so may require more time and effort, but if you are willing to commit to the process, then you may end up generating better returns in the long run.

Not to mention that it will help minimize your risks as well.

Even though the efficient frontier may be a tool that provides some value, it is best used as a supplement to your investment strategy rather than the sole determinant of how you manage your portfolio.

If you’d like to learn more about periods when markets aren’t efficient, check out this article.