It is well-known that engaging in high-risk activities can bring prosperous rewards, especially within the stock market. In the exciting world of trading, a mysterious force lies at the heart of financial triumphs and tribulations.

Leveraging, the intricate thread that amplifies gains and multiplies risks, deceives casual traders and seasoned analysts. According to a 2020 Yahoo survey, 43% of retail traders are using leverage in their strategy.

Understanding margin trading can be a powerful weapon to add to your investing arsenal. However, it is essential to beware of its double edge. In this post, we embark on a journey to unveil the true essence of leveraging in trading.

Join us as we delve into leveraged trades, where risk and reward are entangled within loss and gain.

What is leverage?

Leveraged trading is a way to amplify the buying power of your money when you make investments. It’s like using a magnifying glass to make things appear more prominent.

Let’s say you have $100 and want to buy company shares. Typically, you could only buy $100 worth of shares. But with leverage, you can borrow extra money from a broker to buy more shares.

How does it work?

Leverage can be helpful because it allows you to control more shares and potentially make more money if the share prices go up, especially if you do not carry sufficient funds in your account.

Trading with leverage is like having more tools and a more significant opportunity to earn profits. You can use it to trade all types of assets, including a variety of financial markets and derivatives like Exchange-Traded-Funds (ETFs) and even Foreign Exchange.

However, it’s important to remember that high leverage also comes with more risk.

If the share prices go down, you can lose more money than your initial capital investment. So, it’s crucial to use leverage wisely and to keep an eye on your trading account and cash balance.

Example

Imagine you have $1,000 in your trading account, believing that a particular stock’s price will increase soon. Without leverage, you would be limited to purchasing $1,000 in shares. However, with the option of leverage, you could potentially control a more prominent position you wouldn’t usually have sufficient funds for.

Let’s say you decide to utilize the leverage ratio formula of 1:5, which means you can control $5 in trading power for every dollar you have. In this scenario, your $1,000 can be leveraged to control a position size of $5,000 ($1,000 x 5).

If the stock price rises as anticipated, let’s assume it increases by 10%. Without leverage, your $1,000 investment would generate a profit of $100 (10% of $1,000).

However, with high leverage ratios, the impact is enhanced. Since you control a position of $5,000, a 10% increase would result in a profit of $500 (10% of $5,000). Thus, leverage has the potential to amplify your gains significantly.

It’s essential to recognize that leverage acts as a double-edged blade. In the event that the underlying market price moves against your position, losses are also magnified.

Suppose the stock price decreases by 10%. Without leverage, your $1,000 investment would result in a loss of $100. Yet, with leverage, the impact would be more substantial. As you control a position of $5,000, a 10% decrease current market price would lead to a loss of $500.

This example highlights the potential benefits and risks associated with leverage trading. While leverage can enhance profitability when trades move in your favor, it exposes you to increased losses or even a margin call.

Careful risk management, setting appropriate stop-loss orders, and utilizing leverage responsibly are crucial to effectively navigating the intricacies of leverage trading.

The risks involved

When it comes to leveraged trading, there are several risks that traders should be aware of:

Increased Losses

While leveraged stock trading can bring magnified profits, it also amplifies losses. If the financial market moves against your position, your leveraged position may cause you to lose more capital than you initially invested.

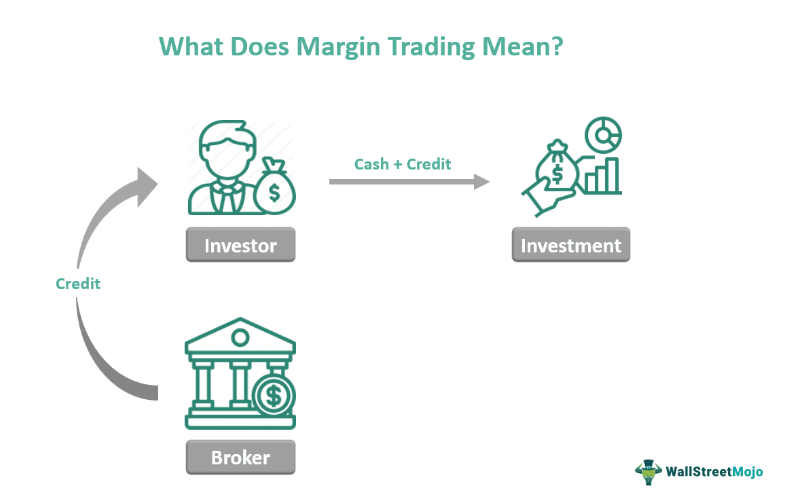

Margin Trading

According to TD Bank, when you trade with leverage, you’re typically required to maintain a certain level of collateral known as margin. If your trades incur significant losses and your account balance falls below the level of margin needed, you may receive a margin call. You’ll need to deposit more funds into your trading account to meet the margin requirements, or the broker may automatically close your positions.

Impulsiveness in Financial Markets

The availability of leverage can tempt traders to overtrade or make impulsive decisions. It’s essential to have a well-defined trading protocol and stick to it. The proper practice involves avoiding excessive trading activity driven by emotions or short-term market fluctuations.

Understanding how to use and incorporate leverage in your own toolbox is the best way to mitigate risk exposure and a possible margin call. Utilizing management tools such as stop-loss orders is essential to limit potential losses.

Pros and cons of leveraged trading

Let’s take some time to weigh out the pros and cons of leverage in the stock market; some pros would be:

Increased Trading Power

The ability to make significant profits and control larger positions with a smaller amount of capital entices investors to utilize leverage. It allows traders to access more significant opportunities and potentially generate higher profits.

Magnified Returns

By amplifying your trading position, leverage has the potential to multiply your gains if the market moves in your favor. It enables you to benefit from even small price fluctuations and capitalize on market opportunities more effectively.

Diversification

Leverage in trading can provide the opportunity to diversify your portfolio by enabling you to trade multiple positions simultaneously. This diversification can help spread risk. If you want to learn how to build a diversified stock portfolio, click here.

Flexibility

Leverage trading allows traders to enter positions that would otherwise be unattainable with their available capital. It offers flexibility in taking advantage of market movements and exploring various trading strategies.

Now let’s take a look at some of the cons of leveraged trades:

Increased Risk

While leverage amplifies potential profits, it also significantly increases the risk of losses. If the market moves against your position, losses, like profits, are magnified, and you could end up losing more than your initial investment. This quote from Wealth Within explains it best “The higher the risk, the greater the level of knowledge and experience required to manage the risk.”

Margin Calls and Liquidation

When trading with leverage, maintaining a sufficient margin is essential. If your account balance falls below the required margin level, you may receive a margin call and be required to deposit additional funds. Failure to meet margin requirements could result in the broker liquidating your positions, potentially incurring further losses.

Higher Costs

Leverage trading often involves additional costs, such as interest charges on borrowed funds or fees for maintaining leveraged trade positions over a specific period. These costs can eat into your overall returns and affect profitability.

Limited Timeframes

Leverage is often provided for a specific duration, such as a day or a few weeks. If your trades extend beyond the given timeframe, you may need to roll over positions and incur additional fees.

It’s crucial to approach leverage trading with caution and have a solid understanding of the associated risks. Proper risk management, disciplined trading protocols, and a thorough market comprehension are vital to successfully navigating the complexities of leverage trading.

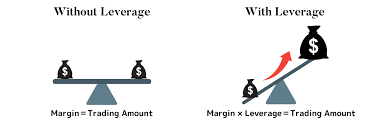

Understanding Margin vs. Leverage

While often used interchangeably, understanding the distinctions between these concepts is crucial for navigating the financial landscape with confidence and clarity.

Let’s start with margin—a fundamental component of trading. Margin refers to the collateral brokers require from traders to engage in transactions exceeding their available funds.

It acts as a safety net, providing access to a larger pool of capital than an investor possesses. Think of it as a bridge between your current resources and your desired trading potential.

By utilizing margin, traders can open positions and participate in transactions that surpass their initial investment.

On the other hand, trading leverage is the financial tool that enables traders to multiply their exposure to an asset class or investment without additional funds.

It is a mechanism that allows investors to control a more prominent position with a smaller amount of capital.

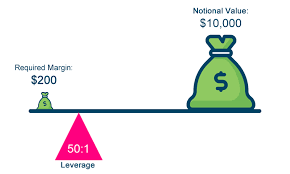

Leverage is expressed as a ratio, such as 1:10, indicating that traders can access ten times the market value for every unit of capital invested.

Here’s where margin and leverage converge: Margin is the collateral required to access leverage. It is the amount of funds a trader must provide to utilize borrowed money for trading purposes. The margin requirement is typically a percentage of the total value of the position or transaction.

Tips for risk management

Effective risk management is crucial when engaging in leverage trading to protect your capital and navigate the potential pitfalls. Here are some tips to help you manage the risks associated with leverage trading:

- Determine your risk tolerance level before entering any trades. Assess how much of your capital you are willing to put at risk and establish clear guidelines for when to exit a trade if it moves against you. Avoid making emotional decision-making during volatile market conditions.

- Stay informed about market trends, economic indicators, and news events that may impact your trades. Continuously educate yourself about trading strategies, risk management techniques, and market dynamics to enhance your decision-making capabilities.

- Implement stop-loss orders as a fundamental risk management tool. A stop-loss order specifies a price at which your position will automatically be sold, limiting potential losses of an underlying asset. Set your stop-loss orders at a level that aligns with your risk tolerance and the volatility of the underlying asset that you’re trading.

- Carefully consider the size of your trading positions relative to your account balance. Avoid overexposing yourself to a single trade by spreading your capital throughout different positions. This helps mitigate the impact of potential losses and diversifies your risk across multiple trades.

- Start with lower leverage ratios. As you gain experience and confidence, you can gradually increase your own leverage ratio. This approach allows you to familiarize yourself with the risks involved and develop sound risk analysis practices without exposing yourself to excessive risk.

- Take the time to study and understand the historical price movements and volatility of the underlying assets that you plan to trade. Adjust your position sizes and risk assessment strategies accordingly.

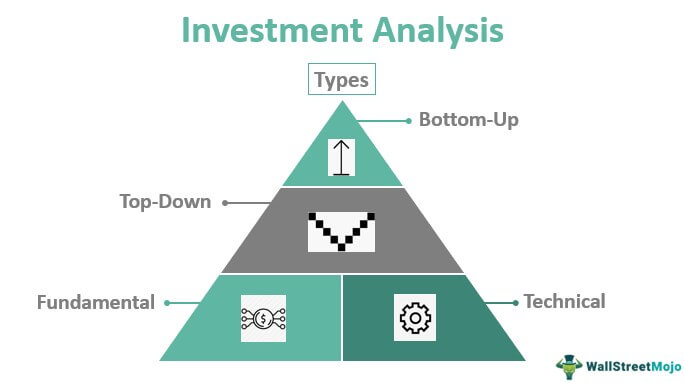

- Perform comprehensive technical and fundamental analysis before entering any trades. Develop a well-defined trading protocol based on thorough analysis and stick to it. Avoid impulsive trading decisions driven by short-term market fluctuations.

- Keep a close eye on your open positions. Regularly monitor the market conditions and any relevant news that could impact your trades. Adjust your stop-loss levels or take profit targets to manage your risk effectively.

Remember, risk management is a vital aspect of leverage trading. Implementing these tips will protect your capital, minimize losses, and increase your chances of long-term success in the exciting realm of leverage trading.

Finding the Right Broker

When searching for the right broker for leverage trading, consider the following factors to ensure a reliable and suitable trading experience.

Regulation and Compliance

Choose a regulated broker. Regulatory oversight provides an added layer of protection for your funds and helps ensure fair trading practices. Research the broker’s regulatory status and verify their compliance with relevant authorities.

Fee Structure

Review the broker’s fee structure, including commissions, spreads, overnight financing charges, and other applicable fees. Compare fee structures across brokers to find competitive rates aligning with your investment strategy and expected trading volume.

Leverage Offered

Assess the maximum leverage and options provided by the broker. Different brokers offer varying leverage ratios for calculating margin, so consider your risk tolerance and trading strategy when selecting a broker. Ensure they offer leverage levels that work with your trading preferences.

Customer Support

Consider the quality and availability of customer support. A reputable broker should offer responsive customer service to address any concerns or issues that may arise during your trading journey. Look for multiple channels of communication, such as phone, email, and live chat.

Asset Variety

Consider the range of assets offered by the broker. Ensure they provide access to the financial markets and other financial instruments you intend to trade. A diverse selection of assets allows for more trading opportunities and flexibility.

Trading Platform

Evaluate the broker’s trading platform, as it is the interface through which you will execute your trades. The platform should be user-friendly, stable, and equipped with essential tools and features for technical analysis. If available, test the platform’s demo account to get a feel for its functionality.

Educational Resources

Assess the broker’s educational resources and research materials. Comprehensive educational content, webinars, tutorials, and market analysis can be valuable resources for enhancing your trading knowledge and skills.

Security Measures

Ensure the broker employs robust security measures to safeguard your personal and financial information. Look for brokers that utilize encryption protocols, two-factor authentication, and segregated client accounts.

Reputation and Reviews

Conduct thorough research and read reviews from other traders to gauge the broker’s reputation. Check independent review sites, forums, and social media platforms for insights into the experiences of other traders. Consider both positive and negative feedback to make an informed decision.

Remember to take your time when selecting a broker for leverage trading. Consider your specific trading needs and preferences to find a reputable broker with the right features, leverage ratios, security, and support to enhance your gains and trading journey.

Is leverage trading right for you?

Determining whether leverage trading is right for you requires careful consideration of your financial situation, risk tolerance, trading objectives and emotional control. Here are some factors to help you make an informed decision:

Risk Tolerance

Leverage trading involves significantly higher risks compared to traditional trading. Assess your risk tolerance level and evaluate how comfortable you are with the potential for larger losses. If you have a low tolerance for risk or find it difficult to manage emotions during market volatility, leverage trading may not be suitable for you.

Financial Stability

Evaluate your financial situation and determine if you have sufficient capital to engage in leverage trading comfortably. Consider the amount of money you are willing to put at risk and ensure you have enough disposable income to withstand potential losses without affecting your overall financial stability.

Knowledge and Experience

Leverage trading requires a solid understanding of the markets, trading protocols, and risk assessment principles. Assess your knowledge and experience in trading and determine if you have the necessary skills to navigate the complexities of leverage trading effectively. It may be beneficial to start trading with traditional methods and gradually transition to leverage trading as you gain experience and confidence. If you are a beginner learning how to analyze stocks, check out this post.

Time Commitment

Leverage trading often demands more time and attention due to the increased risks and potential for rapid market movements. Assess if you have the availability and dedication to closely monitor the markets, manage your positions, and stay informed about relevant market events.

Trading Goals

Clarify your trading goals and objectives. Are you seeking short-term gains or long-term wealth accumulation? Leverage trading is often associated with most traders with short-term trading strategies and quick profits. If your goals align with a more conservative, long-term investment approach, leverage trading may not be ideal.

Education and Learning Curve

Trading capital with leverage requires continuous learning and staying updated with market trends. Assess your willingness to invest time in educating yourself about leverage trading protocols, risk assessment techniques, and market analysis of financial assets. Leverage trading may be more suitable for those who enjoy learning and have a genuine interest in the financial markets. If you want to expand on your ever-evolving investing knowledge, check out our video on venture capital.

Emotional Control

While this may align with risk tolerance, emotional trading can ruin many traders, even professional traders. Understanding oneself and how one responds to stressful situations is an important character trait for any successful trader. Utilize self-awareness to make informed, logical decisions about new investment opportunities.

Leverage in Trading

Leveraging in trading is a powerful tool that amplifies gains and multiplies risks. It allows traders to control more prominent positions with a smaller amount of capital, potentially leading to increased profits. However, leveraging also comes with increased risk, as losses can be magnified as well.

Ultimately, the decision to engage in leverage trading should be based on a thorough evaluation of your personal circumstances and objectives. Remember that it is essential to approach it with a disciplined mindset, proper risk analysis, and a commitment to ongoing education.

As you enter this new realm of trading, be diligent with your financial education, balanced in your decision making, and ready for the exploration of new economic opportunities.