Investing in the stock market is one of the most effective ways to build long-term wealth. Few other strategies are as accessible, pain free, and powerful as investing in stocks.

That said, building a stock portfolio from scratch can be daunting, overwhelming, and downright frustrating, especially if you’re new to the game.

Fortunately, with the right approach and a solid investment plan, anyone can create a successful stock portfolio.

In this article, we’ll take you through a step-by-step guide to building a stock portfolio from the ground up. We’ll start by defining your investment goals and risk tolerance, then move on to performing proper research on an investment, and we’ll end with some key considerations everyone should know about managing a portfolio on a consistent basis.

We’ll also touch on important topics such as asset allocation, diversification, and rebalancing, to ensure your portfolio is optimized for long-term growth.

Whether you’re looking to start investing or want to refine your current portfolio, this guide will provide you with the tools and knowledge you’ll need to make better financial decisions on a consistent basis.

Why Should You Invest in the First Place?

Proper investment portfolio building can be a powerful tool to help you achieve your financial goals. But for those who are just starting out, it might be unclear as to why exactly investing is such an important part of managing your finances.

Here are four of the most important reasons why you should consider investing:

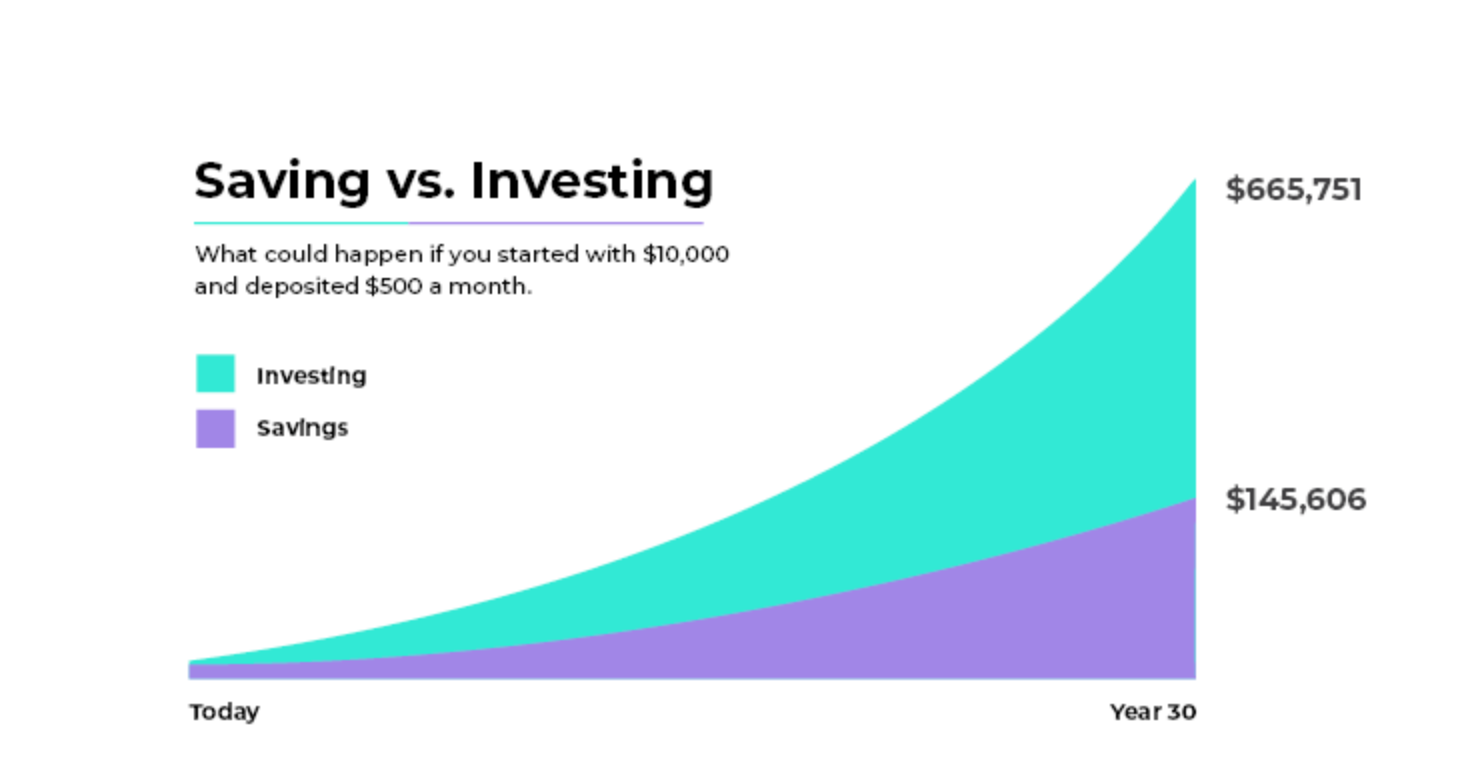

Grow your wealth: Investing allows you to earn returns on your money and grow your wealth over time. Regardless of your investment strategy, you should be able to earn higher returns through investing than you would with a savings account or keeping your hard earned money in cash.

The chart below shows the outperformance of choosing to invest in the S&P 5oo versus choosing to simply just save your money. In the long run, investing will lead to more wealth and better quality of life when compared to saving alone.

Image Source: Hatch invest

Beat inflation: Inflation can erode the value of your money over time. By investing in assets that outpace inflation, such as stocks or real estate, you can help protect your purchasing power and maintain the value of your savings.

Diversify your income streams: Investing can provide you with additional income streams beyond your primary job or business. This can help you achieve financial independence and create a more secure financial future.

Achieve your financial goals: Whether you’re saving for retirement, a down payment on a house, or a child’s education, investing will help you achieve your financial goals faster and more efficiently.

In other words, investing is a key component of building long-term wealth and achieving financial security. By starting early and sticking to a sound investment plan, you can create a brighter financial future for yourself and your loved ones.

What is an Investment Portfolio?

Image Source: Corporate Finance Institute

An investment portfolio is a compilation of diverse assets, including but not limited to stocks, bonds, mutual funds, real estate, and other alternative investments, which is owned by individuals or organizations. The objective of constructing an investment portfolio is to establish a diversified blend of investments that can effectively manage risk and maximize potential returns in the long term.

When creating a portfolio, it’s important to first determine your investment goals, risk tolerance, and time horizon. This information will provide guidance in the selection of appropriate investments that align with your financial objectives. Additionally, you should also consider liquidity requirements, tax implications, and other important factors that may influence what and how you choose to invest.

Understanding the balance between growth and income investments in your portfolio is also an important consideration. While growth investments, such as stocks, may present the potential for higher returns, they also carry a higher risk. Conversely, income investments, such as bonds or real estate investment trusts (REITs), offer the potential for stable, recurring income but may have lower returns on an annualized basis.

Ultimately, the composition of an investment portfolio is unique to each individual’s financial circumstances and objectives. By creating a well-diversified portfolio that aligns with your financial goals, investors can increase their potential for long-term success and avoid many of the common mistakes newer investors make when beginning their journey in the stock market.

Things to Consider Before Investing

Before investing, there are several things that you should understand and consider to ensure that you’re making educated decisions that will align with your financial goals and personal values.

The following are 5 key factors investors should thoroughly understand before buying their first stock:

Risk Tolerance

Your risk tolerance is an important consideration when investing (perhaps the most important). More specifically, risk tolerance refers to the level of investment risk that you’re willing and able to take.

It’s important to assess your risk tolerance to help determine the types of investments that are suitable for you. For example, if you have a lower tolerance, you will probably prefer to invest in more conservative, lower volatility investments, such as bonds or mega cap companies, while a high-risk investor may wish to allocate a larger percent of their portfolio to more aggressive investments, such as small caps or crypto.

Passive or Active?

Another thing to consider is whether you prefer passive or active investing. Passive investing involves investing in a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) that track the performance of a market index. Active investing, on the other hand, involves selecting individual stocks or actively managed funds with the goal of outperforming the market.

Personal Values

Investing can also be an opportunity to align your investments with your personal values.

Many investors focus on companies that prioritize social responsibility or environmental sustainability over firms who are associated with harming the environment or having poor working conditions for their employees.

Consider researching companies that align with your own personal values to ensure that your investments are consistent with your beliefs.

Time Horizon

Your time horizon refers to the length of time you plan to hold your investments. This is an essential factor to consider when determining your investment strategy.

If you have a long-term investment horizon, you may be comfortable taking on more risk as you have more time to ride out market fluctuations. On the other hand, if you have a shorter investment horizon, you may prefer to invest in less volatile, more stable assets.

DIY or Hire a Professional

New investors must also consider the choice between pursuing a do-it-yourself (DIY) strategy or working with a financial advisor. A DIY strategy allows investors to have complete control over their investment portfolios, choose their own investments, and save on fees. However, this approach requires a certain level of knowledge, expertise, and discipline.

Conversely, working with a financial advisor or other certified financial planner provides access to professional guidance, expertise, and support. Advisors can help investors develop a comprehensive investment strategy, monitor their portfolio, and make adjustments as needed. However, this approach comes with fees and requires finding the right advisor who is aligned with your investment goals and values. Ultimately, the decision to pursue a DIY strategy or work with financial advisors depends on individual circumstances and preferences, as both approaches have their own benefits and drawbacks.

In summary, before investing, it’s essential to assess your risk tolerance, consider whether you prefer passive or active investing, align your investments with your personal values, determine your time horizon, and decide how active you want to be in monitoring your investments.

By taking these factors into account and understanding the drawbacks and advantages to different strategies, you can be sure your investment plan and investment portfolio will align with your goals and specific financial situation.

Step-by-Step Guide to Building an Investment Portfolio From Scratch

Building an investment portfolio may seem overwhelming, but with a step-by-step approach, it can be a straightforward process. Here’s a guide to help you build your very own investment portfolio from scratch:

Set up an Investment Account

When setting up investment accounts, you’ll need to choose between various types, such as taxable brokerage accounts, retirement accounts or a tax free savings account. Each type has different tax implications and rules, so it’s important to choose the right one based on your financial goals and circumstances.

Let’s take a quick look at 3 of the most common accounts for investors:

TFSA

A Tax-Free Savings Account (TFSA) is a Canadian government program that allows individuals to save and invest money tax-free. The contributions to TFSA are not tax-deductible, but the investment income, capital gains, and withdrawals are all tax-free. The advantage of the TFSA is the flexibility to withdraw funds at any time without penalty, making it a great option for short-term savings goals.

IRA

An Individual Retirement Account (IRA) is a similar savings program in the United States that helps Americans save for retirement. Contributions to a traditional IRA are typically tax-deductible, which means they can reduce your taxable income for the year, while investment earnings grow tax-free until you withdraw the funds, usually in retirement. At that point, withdrawals are taxed at your ordinary income tax rate.

Taxable Account

A taxable brokerage account is an investment account that allows individuals to buy and sell stocks, bonds, and other securities. Unlike TFSAs and IRA’s, investment gains in taxable accounts are subject to taxes in the year they are realized. The advantage of a taxable brokerage account is the flexibility to invest in a wider range of assets without contribution limits or withdrawal restrictions. However, taxes can eat into your investment returns, making it a less tax-efficient option for long-term savings goals.

Fund Account

Funding your investment account can be done in various ways, such as electronic transfers, direct deposit, or check. Some investment firms may require a minimum deposit to open an account or have a minimum balance to avoid fees. It’s important to ensure that you have enough funds to invest in the securities you’re interested in.

Pick Your Investments

Image Source: Droptechy

When selecting investments, it’s crucial to consider factors such as risk tolerance, investment goals, time horizon, and diversification (sound familiar?).

And while it’s hard to give specific advice on what an investor should focus on when first starting out, we’ve provided a brief list of the most common assets (as well as what they are) investors can begin to build their portfolio with.

Stocks

Stocks represent ownership in a company and offer the potential for significant growth and dividends. More specifically, stock investments are one of the most popular ways to invest in an investment account and offer a wide range of different choices, including growth stocks, value stocks, small caps, mid caps, and mega caps.

ETFs

Exchange-traded funds (ETFs) are a type of investment fund that trade on stock exchanges like individual stocks, however they’re made up of a large basket of different companies. Investing in ETFs offers a diversified mix of investments and are a popular choice for more passive investors.

Crypto

Cryptocurrencies like Bitcoin and Ethereum have become popular investment options in recent years. However, these digital currencies are highly volatile and should be approached with caution for the newer investor.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified mix of investments. The greatest benefit to investing in mutual funds, is that this investment vehicle is managed by professional fund managers who will oversee and manage the holdings in the fund for you. However, this also means mutual funds come with higher expense ratios that can eat into an investor’s return.

Bonds

Bonds are debt securities that represent a loan made by an investor to a borrower. They can offer a stable source of income and are generally less volatile than stocks, though also present less opportunity for above average returns.

Manage Your Investment Portfolio

Portfolio investment management involves monitoring and adjusting your asset allocation and diversification based on changes in the market and your financial goals.

To help you understand the nuances involved in successfully managing a portfolio, let’s take a closer look at two of the most important things to consider when managing your portfolio.

Asset Allocation

Asset allocation is the process of dividing your portfolio into different asset classes, such as stocks, bonds, and cash, based on your investment goals, risk tolerance, and time horizon. A well-diversified portfolio should have a mix of different asset classes to balance risk and return.

A common approach is to use the “age-based” rule of thumb, which suggests that the percentage of stocks in your portfolio should be roughly equal to 100 minus your age. For example, if you’re 30 years old, your portfolio may be composed of 70% stocks and 30% bonds. This is done to help younger investors maximize their returns when their investing time horizon is longer and slowly scale back their risk exposure as they get closer to retirement.

Diversification

Diversification is a strategic investment approach that entails distributing funds across various asset classes, sectors, and geographic locations to mitigate risk. Its primary aim is to avoid concentrating an entire portfolio in one asset class, industry, country, or individual stock, which can leave investors exposed to market fluctuations or other unforeseen risks.

For instance, investing in a well-rounded mix of stocks, bonds, and real estate across different regions worldwide can offer robust diversification to an investment portfolio. Similarly, investing in firms across various industries can provide an added layer of diversification within a stock portfolio.

It is crucial to note that while there are numerous ways to achieve proper diversification, consistently reviewing your investment portfolio and making slight adjustments as necessary is essential. This practice can help ensure that your portfolio stays in line with your risk tolerance level, investment goals, and changing market conditions.

Wash, Rinse, Repeat

Once you have your investment portfolio up and running, it’s important to remember that investing is a long-term game and constant review of your portfolio is needed. Market fluctuations and economic conditions can create short-term volatility, but sticking to your investment strategy and avoiding emotional reactions to market movements is essential for success.

The steps we’ve covered today are universal truths in the world of investing and can (and should) act as a framework for investors both new and experienced to base their investment decisions on. Consistently reviewing the investment accounts you have, the asset classes currently in your portfolio, and your overall investment goals will ensure you can pivot and adjust your portfolio on the fly with success.

Finally, remember to be patient and consistent in your investment approach. Over time, your portfolio will likely experience ups and downs, but sticking to your strategy and having conviction in the assets that make up your portfolio can help you weather market volatility and ensure you achieve your long-term investment goals.

Investing is For Everyone

Image Source: Linkedin

Without question, investing is one of the most effective ways to grow your wealth on a consistent basis.

Instead of just earning income from your job, investing allows you to put your money to work for you, earning returns and generating additional income over time. This can be particularly important for achieving financial goals such as saving for retirement, buying a home, or paying for your children’s education.

And while setting up your stock portfolio can seem overwhelming at first, it’s important to remember that investing is for everyone, regardless of your income level, experience, or background. By taking the time to learn about investing and building a diversified portfolio, you can minimize risk and maximize returns.

Building a portfolio from scratch inevitably comes with risks, but it’s essential to understand what your comfort level is and choose investments that align with your goals and values. Working with a financial advisor can be an excellent option for those who are new to investing or want professional guidance in managing or starting their portfolio.

Finally, it’s worth emphasizing the importance of staying positive and focused on the long-term. While there may be bumps along the way, with the right approach and mindset, anyone can start investing on their own and achieve lasting financial success.