In the ever-evolving landscape of startup funding, Series F funding stands as a pivotal milestone, representing a significant stage in a company’s growth trajectory.

It is the point where your business is on the verge of becoming profitable, and you require one last boost of capital to take you to the promised land.

For those unfamiliar with the nuances of venture capital financing, Series F might seem like a complex term.

However, by reading this article, you’ll uncover its significance in fueling innovation, expansion, and market dominance for emerging enterprises.

Get ready to learn how early-stage companies can raise money for the funds they need to take their company to the next level.

What is series funding?

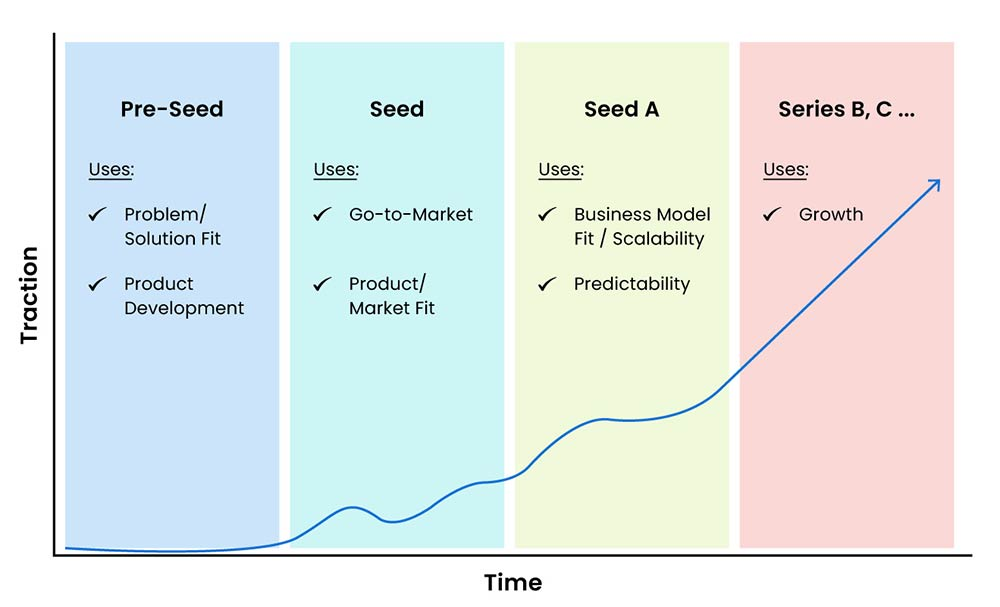

Series funding is the captivating storyline in the life of a startup presented as a sequence of seed funding rounds marked from Series A to F (and beyond).

At its core, series funding involves startups raising capital from venture capitalists, private equity firms, investment banks, and angel investors, among others, in exchange for equity in the business. Each round propels growth, advances product development, and validates the startup’s viability.

Image By: DealRoom

But reaching Series F isn’t easy. It demands tangible results including revenue growth, loyal customers, and a clear path to profitability.

Moreover, it requires a management team to effectively present and persuade investors to buy a full equity stake in the company. At every stage of funding, these executives must prove that the business is improving and nearing its full potential. Otherwise, the cash won’t come and the business will flounder.

But it’s not just about amassing capital; it’s about securing the endorsement of seasoned investors who believe in the startup’s potential to revolutionize industries, redefine norms, and leave an indelible mark on the world.

For example, if you have someone like Peter Thiel or Bill Gates investing in your business, it is a clear indication that you are doing something exceptional.

With these esteemed investors involved, your company can reach new markets, discover key partners, and master your business model.

So, as you can see, series funding is not simply about the money you raise, but more so the network and relationships you create along the way.

By building a great product, partnering with brilliant investors, and raising enough funds to survive, nothing is stopping you from making your business idea a reality and achieving your entrepreneurial dreams.

What is pre-seed funding?

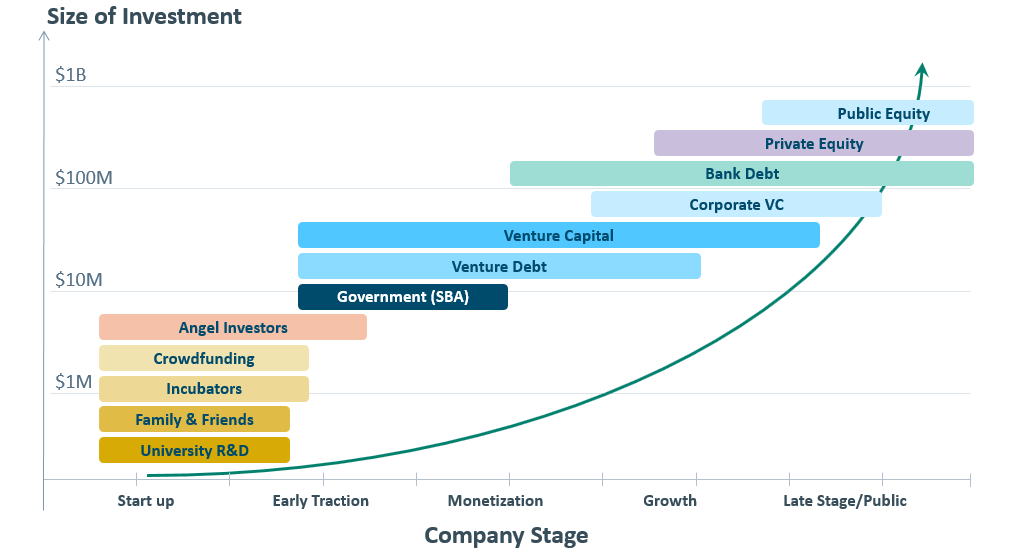

Series funding is often reserved for more established startups that have already achieved some form of operational productivity.

But if you require capital earlier on, pre-seed funding can serve as the critical initial injection of capital that sets the wheels in motion for an aspiring entrepreneur.

You can think of it as a financial fuel that kickstarts the journey of transforming a visionary concept into a tangible business.

Whether it comes from angel investors, friends, family, or early-stage venture capital firms, these early backers play a pivotal role, not only by providing financial support but also by expressing belief in your potential.

With them by your side, you now have everything you need to bring your idea to life.

How do series funds work?

From Series A funding to Series F funding to an initial public offering, and beyond, all funding rounds serve an important purpose for a new venture: to raise more capital and establish new relationships.

But this is by no means an improvisation. Startups work hard to ensure they maximize the amount of funding they raise. After all, it is their legacy and livelihood on the line.

To help you understand the process a little better, here is a step-by-step guide on what it takes for startup companies to raise cash.

Step 1: Preparation and Planning

To begin, start by determining the precise amount of funding needed for your startup’s objectives—whether it’s for scaling operations, product development, market expansion, or other strategic initiatives. Potential investors will expect that you know exactly how much capital you need, why you need it, and what you plan to do with it.

Next, craft a meticulous business plan that outlines your startup’s mission, target market, revenue projections, growth strategy, and potential challenges. Complement this with a captivating pitch deck—a concise visual aid that narrates your startup’s story, highlighting its unique value proposition, market opportunity, and the team’s capabilities.

Step 2: Identifying Potential Investors

Once step one is complete, move on to investor research and begin identifying potential investors who share an interest in your industry, startup stage, and investment criteria. You should attend industry events, conferences, and networking sessions to establish connections with new investors and engage with prospective venture capitalists. These targeted meetups will ensure that you bring on people who deeply care about your mission as opposed to those who are seeking to make a quick buck.

Step 3: Pitching and Due Diligence

Deliver a compelling pitch that conveys your startup’s vision, showcasing its potential for growth and success. Engage with interested investors, addressing their queries and concerns while offering a clear understanding of your business model and market strategy. As investors express interest, they embark on due diligence—an investigation into your startup’s financials, market viability, team competence, and legal compliance. Be prepared to provide detailed information and answer inquiries during this phase.

Step 4: Negotiation and Term Sheets

Upon capturing investor interest, receive term sheets outlining proposed investment terms and conditions. Review these sheets meticulously, negotiate terms that align with your startup’s objectives, and seek legal guidance to ensure fairness and clarity in the agreement. Craft a balanced agreement that satisfies both your startup’s needs and the investor’s expectations, encompassing aspects such as investment amount, valuation, governance rights, and exit strategies.

Step 5: Closing the Deal

Once a deal is agreed upon, engage with legal advisors to draft and review the legal documentation (ie. investment agreements, shareholder contracts, etc.). However, before finalizing the deal, you will want to ensure that all parties involved understand and consent to the terms. After that, everything is set for you to receive those funds and begin executing your mission.

Step 6: Post-Funding Relationship

Though the funding round is now complete, realize that your work has only just begun. To maximize your relationship with shareholders, establish an ongoing communication channel with investors, sharing regular updates on milestones achieved, challenges faced, and the progress of your startup. Maintain transparency and seek guidance when necessary. Deploy the raised capital strategically, adhering to the planned objectives and focusing on achieving key milestones outlined in your business plan. Remember, these investors are your partners. Embrace this opportunity and create a fruitful relationship that lasts a lifetime.

Why do startups participate in series funding?

Startups engage in series funding for multifaceted reasons that extend beyond financial gain. Series funding represents a pivotal juncture in their growth journey including an opportunity to propel their aspirations toward fruition and to scale their ventures to unprecedented heights.

Here are three reasons why an early-stage venture will participate in series funding:

1. Fueling Growth and Expansion:

Image By: Flavia Richardson

First and foremost, series funding serves as the rocket fuel for startups, providing the substantial capital needed to scale operations, expand market reach, and accelerate growth. With these significant investment rounds, startups unlock the resources required to capture larger market shares and dominate industries.

2. Harnessing Strategic Partnerships

Series funding often involves collaborations and partnerships with experienced investors who bring more than just capital to the table. These investors offer strategic guidance, mentorship, industry expertise, and invaluable networks that open doors to new opportunities, markets, and business alliances.

3. Attracting Top Talent

With substantial funding rounds, startups can attract top-tier talent by offering competitive salaries, equity incentives, and the allure of working for innovative, high-growth companies. Access to talented individuals strengthens the team and drives the company toward achieving ambitious milestones.

How does a startup become series funding eligible?

Becoming eligible for seed round or venture capital funding is a strategic milestone and a pivotal point in a startup’s journey. Reaching this feat requires meticulous preparation, showcasing potential, and proving readiness for the next phase of growth.

So, if you plan on receiving that initial investment from those wealthy venture capitalists, here’s what you need to do:

1. Strong Value Proposition

Start by crafting a compelling value proposition—a clear outline of the problem your startup solves and the unique value it offers. It’s about presenting a solution that addresses a significant pain point in the market and stands out among competitors.

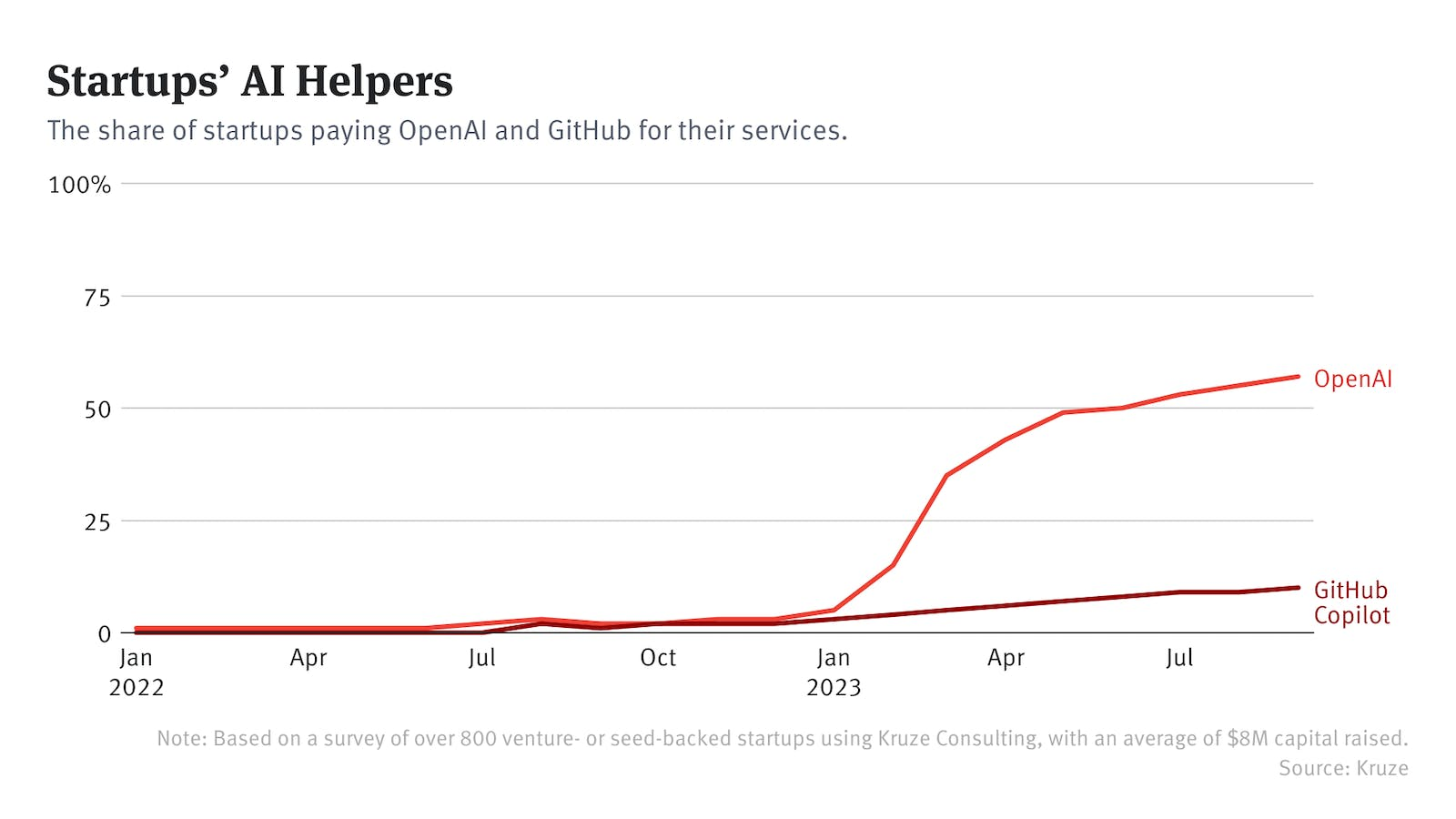

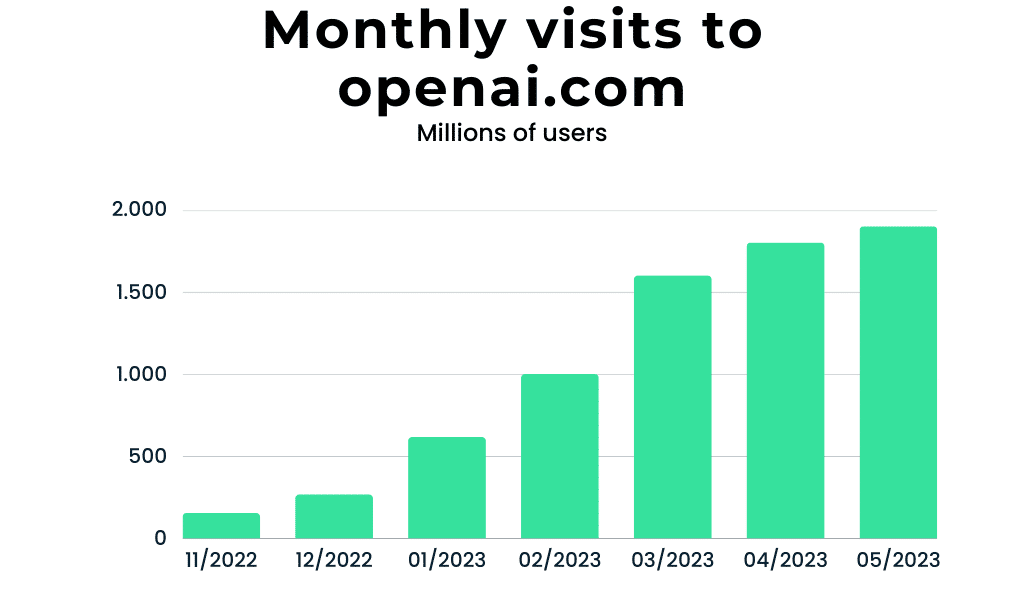

2. Market Validation

Image By: The Information

Validate your market hypothesis by demonstrating traction. Showcase initial market validation through customer feedback, pilot programs, early adopters, or initial sales. Providing evidence of market demand and a scalable customer base significantly enhances your eligibility for series funding.

3. Scalable Business Model

Develop and showcase a scalable and sustainable business model. Investors seek startups that can scale efficiently and achieve substantial growth. Showcase a well-defined revenue model, clear customer acquisition strategy, and a path to profitability.

4. Demonstrated Growth Potential

Image By: The Tech Report

Highlight your growth trajectory and potential. Showcase milestones achieved, growth in user base or revenue, and a clear plan for scaling operations. Investors are interested in early-stage startups with a demonstrated ability to grow rapidly and capture market share.

5. Solid Team and Execution

Investors place immense value on the startup team. Build a capable, committed, and diverse team equipped to execute the business plan effectively. Highlight the expertise, experience, and synergy within the team that positions your startup company for success.

6. Clear Roadmap and Vision

Present a clear roadmap for future growth. Outline the milestones, expansion plans, and strategies for utilizing the funding effectively. Paint a compelling vision of how your startup will disrupt industries and drive innovation.

With these achievements reached, you will have everything you need to begin pitching your business to sophisticated investors. Don’t worry about rejection and embrace every failure throughout your startup journey. The road to success isn’t a straight line; it’s a rollercoaster of triumphs and defeats that tests anyone willing to take the leap. In the end, it is the resilient who survive.

The Bottom Line

Series funding is an excellent way to raise capital, establish partnerships, and make your dreams a reality.

Though raising money for your venture is just one stepping stone in a long journey, it is a tremendous feat that should be celebrated.

From pre-seed rounds to initial public offerings, every dollar counts when you are seeking to disrupt an industry and transform lives.

So, if you are itching to create something and reach your full potential, there is no better time than now to start your entrepreneurial journey.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.