Did you know that you can vote with your money when you buy shares in a business?

Social impact investing is a powerful tool that enables you to make a difference in the world by purchasing assets that align with your values.

Oftentimes, regular citizens, particularly those who may not be affluent, have limited influence on society due to the lack of money and power they possess.

However, when they invest in social-focused businesses, it is an effective way to shape the future of their lives and the world around them.

Therefore, if you care about more than just money and power, social impact investing may be the perfect strategy for you.

In this article, we will break all of this down and more as you discover the impact that socially conscious investing can have on your portfolio.

What is Social Impact Investing?

Image By: The Bridgespan Group

At its core, social impact investing is a strategy that seeks to generate both a financial return and a positive societal outcome.

Unlike traditional investing, where the primary goal is maximizing profits, it places a strong emphasis on creating tangible, positive changes in the world, either through social or environmental impact investment.

This often produces a win-win scenario for all stakeholders involved, as everyone benefits from the sustainability and productivity of the business.

However, it is important to remember that the social and environmental impact should not take precedence over a business’s economics.

The key is to find something that is making a positive impact while also being economically viable.

Otherwise, if you invest solely based on the idea that something will end up changing the world, it can end up costing you dearly when the project fails to come to fruition.

That being said, when you can find a business that is improving society and making money, there is no better combination in the stock market today.

Benefits of Social Impact Investing

Image By: Venture Crowd

Social impact investing isn’t just a trend; it is a paradigm shift that offers a multitude of undeniable benefits, both for you as an impact investor and for the greater good.

Here are the top reasons why you and impact investors should consider social impact investing.

1. Alignment with Values: Social Impact Investing lets you put your money where your heart is. It empowers you to support the causes that resonate deeply with your beliefs, whether it’s environmental conservation, social justice, or poverty alleviation.

2. Positive Societal Impact: Beyond profits, your investments become a force for positive social change. By directing capital towards socially responsible endeavors, you play a role in addressing critical global issues and making the world a better place.

3. Long-Term Perspective: Secure your financial future with a long-term commitment. Social impact investments align seamlessly with your financial goals for the future, ensuring stability and growth.

4. Attracting Talent and Customers: Be part of companies that attract the best and the brightest. Businesses with strong social impact initiatives not only thrive but create opportunities for your investments to flourish.

5. Innovation and Opportunity: Social Impact Investing drives innovation. Companies addressing societal issues often discover lucrative opportunities that translate into competitive returns on your investments.

6. Financial Returns: Forget the misconception that social impact comes at the expense of your financial returns. Ethical and sustainable investing practices often lead to long-term outperformance, offering you financial rewards without compromise.

7. Regulatory and Tax Incentives: Governments worldwide are recognizing the importance of social impact investments. Benefit from regulatory incentives and tax breaks that amplify the financial appeal.

Examples of Social Impact Investing

There are many ways you can participate in socially responsible investing.

Here are a few of our favorite markets to explore:

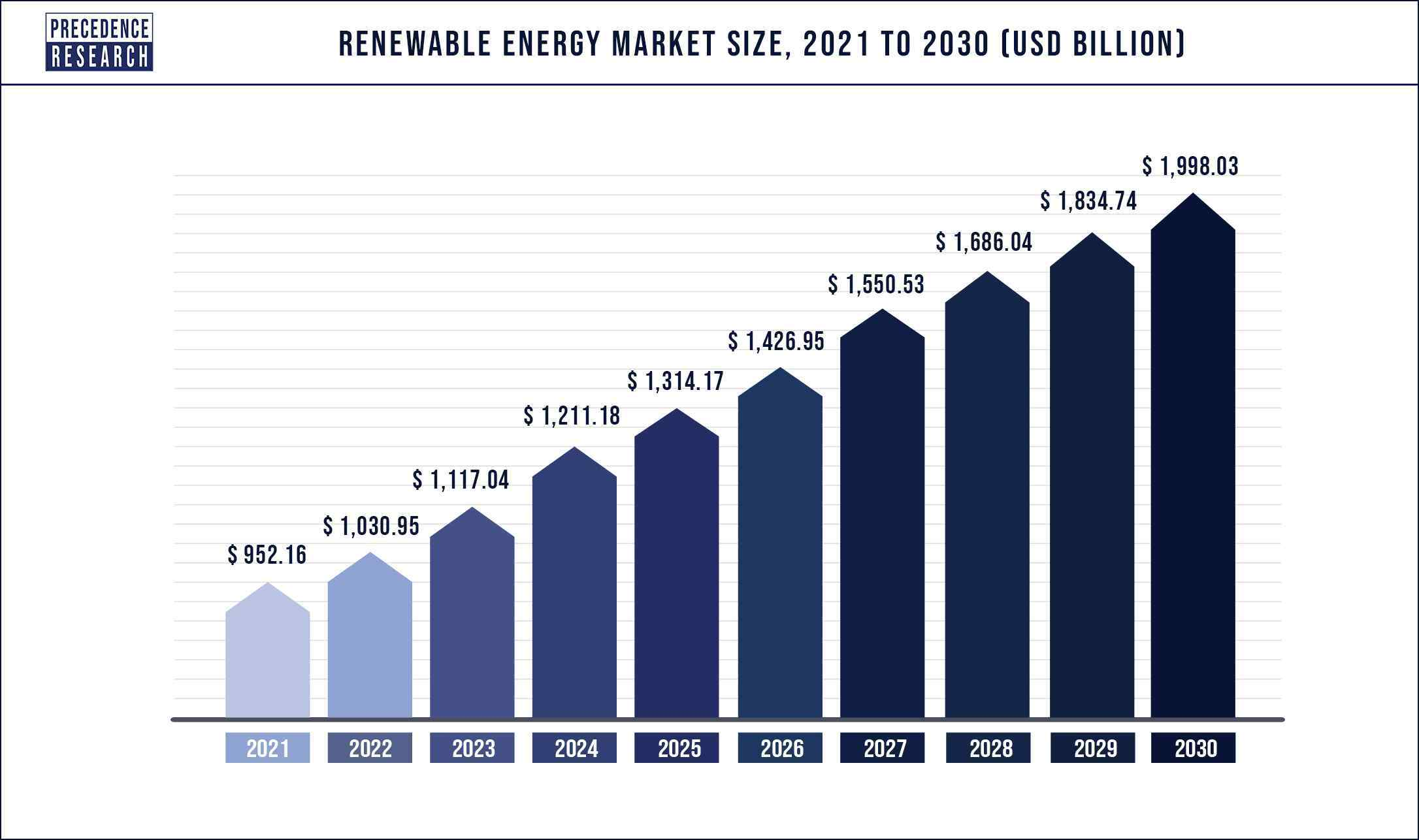

1. Renewable Energy Initiatives

Image By: Precedence Research

Investing in renewable energy projects such as solar and wind farms is a quintessential example of social impact investing.

By supporting clean energy, you not only stand to gain financially but also contribute to reducing greenhouse gas emissions and combating climate change.

These investments are at the forefront of the global transition to sustainable energy sources, playing a pivotal role in securing a cleaner, more sustainable future for our planet.

2. Microfinance Institutions

Microfinance institutions provide small loans to entrepreneurs in underserved communities worldwide.

When you invest in these institutions, you empower individuals in impoverished regions to start or expand their businesses, thereby lifting themselves and their communities out of poverty.

Microfinance is a powerful tool for economic empowerment and social progress, making it a compelling choice for Social Impact Investing.

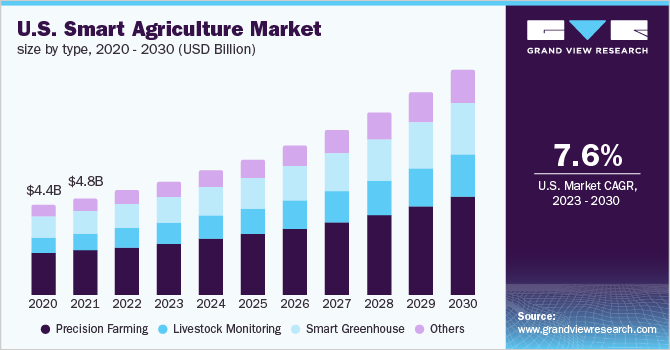

3. Sustainable Agriculture

Image By: Grand View Research

Investing in sustainable agriculture ventures supports environmentally friendly farming practices.

These investments promote responsible land use, reduce chemical pesticide usage, and enhance food security.

By backing sustainable agriculture, you’re not just investing in a more environmentally resilient world; you’re also contributing to the availability of healthier and more sustainably produced food for future generations.

4. Impactful Education Technologies

Investing in educational technology companies that provide innovative solutions to enhance access to quality education is a prime example of social impact investing.

These investments bridge educational gaps, empower individuals, and promote lifelong learning.

By supporting educational technology, you become a catalyst for positive societal change, improving educational outcomes and fostering a more educated global population.

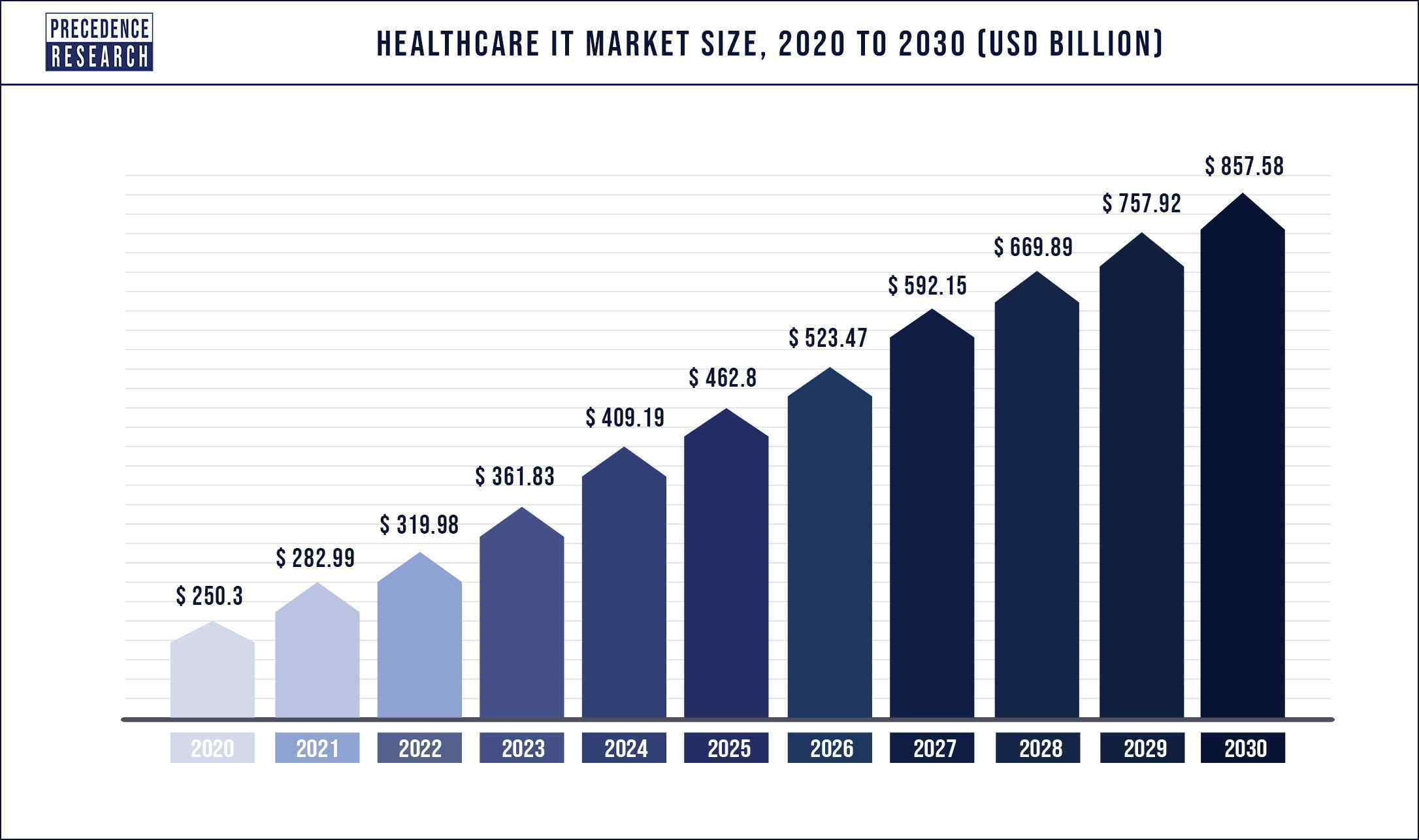

5. Healthcare Initiatives

Image By: Precedence Research

Investments in pharmaceutical companies dedicated to finding cures for diseases or in healthcare providers expanding access to medical services in underserved areas represent a vital dimension of social impact investing.

These investments have the potential to save lives, improve healthcare outcomes, and contribute to overall societal well-being.

As a socially conscious investor, you play a crucial role in advancing medical research and equitable healthcare access.

How to Analyze the Risk of a Social Impact Investing Opportunity

Investing in socially responsible businesses is an admirable pursuit. However, it does not come without risks.

Therefore, if you plan on pursuing this investment strategy, make sure that you keep these factors in mind.

1. Mission & Objectives

It’s one thing to have a revolutionary idea; it is another to put it into action.

When a business pitches its business model, make sure that the company has clear sustainable development goals in place that define exactly what the company intends to achieve.

More importantly, make sure that they have accomplished objectives in the past and are doing so in an economically feasible way.

There should be tangible proof of the impact that it is creating. Otherwise, you should probably seek out other businesses.

2. Impact Metrics

On that note, a business should have clearly defined impact metrics that demonstrate its performance thus far and whether they are meeting the predefined objectives.

Triple Pundit outlined several social impact metrics that can help you measure the effectiveness of a company’s social efforts.

These include:

- Volunteer Hours: Volunteer hours signify more than just an investment of time; they reflect a company’s commitment to hands-on social engagement. The number of hours employees volunteer can reveal the depth of their dedication to social causes. It also illustrates a company’s culture of giving back.

- Business Impact Metrics: These metrics quantify the tangible effects of a company’s social responsibility efforts on its core business. This includes the financial impact, market share, customer loyalty, and overall reputation improvement as a direct result of social initiatives. Business impact metrics provide a clear, bottom-line-oriented view of effectiveness.

- Net Promoter Score: NPS measures customer satisfaction and loyalty. Companies committed to social responsibility often experience improved NPS, demonstrating that customers appreciate and endorse their ethical practices. A higher NPS is a testament to the effectiveness of a company’s social efforts in building trust and loyalty.

- Social Media Activities: Social media is a powerful platform for spreading awareness and mobilizing support for social causes. The level of engagement, the reach of social campaigns, and the resonance of a company’s social messages can all be measured. High engagement and a growing social presence indicate the effectiveness of a company’s efforts in raising awareness and driving action.

- Employee Turnover Rates: High employee turnover can be a red flag for corporate social responsibility. A company genuinely invested in social responsibility often enjoys lower turnover rates, as employees are more likely to stay with an organization that aligns with their values. Low turnover rates reflect the effectiveness of a company’s efforts in fostering a positive workplace culture.

- Feedback: Soliciting feedback from stakeholders, including employees, customers, and community partners, is invaluable. Positive feedback, coupled with constructive suggestions for improvement, helps gauge the perceived impact and effectiveness of social initiatives. It also provides insights for fine-tuning strategies.

- Donations: Donations, both in terms of monetary contributions and in-kind support, quantify a company’s commitment to social causes. The effectiveness of these contributions can be assessed by examining the scale of donations, the impact they’ve had on recipient organizations, and the alignment with the company’s values and goals.

- Environmental Impact: An effective way to assess a company’s environmental commitment is by evaluating its sustainability practices. This includes energy efficiency measures, waste reduction initiatives, water conservation efforts, emission reduction targets, and the use of renewable resources. Companies demonstrating these sustainable practices are more likely to reduce their environmental impact.

3. Financial Health

A business without strong financial performance is one that is going to struggle to sustain success or achievement of its objectives.

It must be evident that the company’s efforts are improving its bottom line and the fundamental characteristics of the organization.

As we often talk about here at Edge, the goal of an investor is to find high-quality businesses with attractive prospects.

This encompasses a company’s competitive advantages, management team, and economic characteristics.

If a business is considered to be high-quality, then this should be accurately reflected in its financial statements through metrics such as revenue, net profits, book value, free cash flow, and cash on hand.

Ultimately, a business will fail to survive, no matter the nobility of its mission, if it does not bring more money in than it spends.

Therefore, only buy stocks whose environmental, social, and governance impact is benefiting its bottom line as well.

4. Valuation

Everything comes at a price.

If you overpay for a company, despite its prospects looking quite attractive, you will struggle to realize a return if the business is worth less than what you paid for.

Sometimes, it can be difficult to tell what a business is worth and to know when it is overvalued or not.

However, this is one of the most important skills an investor can have, and thus, it is necessary to learn how to determine the value of a company.

But, as a general rule of thumb, it should be painfully obvious that the company is trading for less than what it is worth before you invest.

If you buy during these periods, your chances of success are significantly higher.

Final Thoughts: What is the Future of Social Impact Investing?

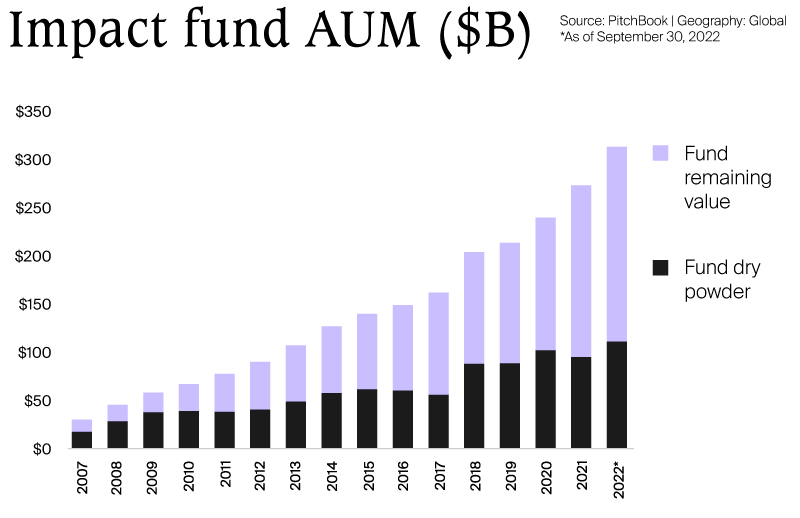

In the past couple of years, institutional investors like fund managers (i.e., pension funds, mutual funds, private equity, venture capital, etc.) have been preaching the importance of investing in socially impactful businesses.

However, some of this has been undermined due to the greenwashing of sustainability efforts like ESG investing.

This has caused many to doubt the benefits of social impact investing and its influence on the world.

But make no mistake, investing with your beliefs and values in mind is more important than ever.

When you prioritize a social impact investing strategy, you can propel the world forward in ways that once were unimaginable.

This not only benefits you but also everyone who is connected to those businesses.

So, to whatever extent you believe socially responsible and ethical investing is valuable, remember that every share you buy is a vote of confidence through your capital.

In that case, you might as well use it for good.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.