Few threads in life are as important as financial independence and security.

The journey towards a comfortable and worry-free retirement is one that requires careful planning and strategic decision-making. And amidst the hustle and bustle of daily routines, it’s all too easy to postpone thinking about retirement until it’s too late.

The good news is the path to financial well-being in our golden years is paved with a single, invaluable principle: investing early.

Today, we’re going to dive into the intricate layers of retirement planning and explore the substantial advantages that investing for retirement earlier rather than later brings.

3 Reasons to Invest Early

What Is The Average Savings Of A Canadian By Age | My Rate Compass

If you’re looking for motivation to start saving your hard-earned money for retirement, then look no further.

While spending your money when you’re young can lead to great experiences and fancy things, everyone (and I mean everyone) should try to prioritize putting at least a small portion of their income into their savings in a retirement account.

To help you understand why investing early can be so powerful, we’ve outlined 3 of the most important reasons why investing early should be the priority of everyone who is beginning to build their nest egg.

Flexibility

Imagine a retirement defined not by rigid schedules and financial constraints but by the ability to dance through life’s chapters on your own terms.

The ability to truly enjoy your retirement lies in time – the more of it you have, the more rewarding your retirement becomes.

From deciding when to retire to pursuing new passions or even reimagining your career, investing early will give you the power and flexibility needed to craft a retirement that caters to you the life you want.

Ability to Take on More Risk

At the heart of investment lies the delicate art of risk management – a skill honed through experience and wisdom.

Early investors are again given the precious gift of time, a valuable asset that allows them to ride out the turbulence of market fluctuations and seek out ventures with higher growth potential. While all investing involves risk, early investment transforms it from a source of apprehension to a tool of empowerment, as financial markets will inevitably reach new highs and work through any economic turbulence when given enough time.

Investing early allows you to weather through market drops and even add to your portfolio at discounted prices.

Inflation

Inflation, often referred to as the “silent thief,” gradually diminishes the purchasing power of money over the years. Those who invest early possess a potent weapon in this battle against the ever-rising tide of prices: compound interest.

By starting the investment journey early, you will be able to harness the exponential growth potential that comes from reinvesting gains, effectively fortifying your portfolio against the corrosive effects of inflation.

What is The Best Age to Building Your Retirement Savings?

As the hands of time tick steadily forward, the question of when to begin building your retirement savings becomes increasingly important. It’s a question that echoes in the minds of individuals across generations, each seeking to understand at what age should I seriously begin to think about retirement.

In this section, we’ll dive into the nuances of what you should be thinking about in terms of retirement planning based on how old you are.

Navigating the Age Spectrum:

The ideal age to begin building your retirement savings isn’t cast in stone; rather, it’s a person-specific decision shaped by a myriad of factors unique to each individual. From the exuberance of youth to the seasoned wisdom of middle age, every life stage presents distinct opportunities and challenges.

Let’s examine some key age brackets and the considerations that come into play:

Early Career Enthusiasm (20s – Early-30s)

Seizing the Advantage of Time:

Starting your retirement savings journey in your 20s or early 30s gives you an extraordinary asset: time. The power of compounding interest, where your money generates earnings that, in turn, generate their own earnings, can work its magic over several decades. Even modest contributions during this period can turn into substantial sums by the time you reach retirement age.

Capitalizing on Risk Appetite:

Youth often accompanies a willingness to take on more risk in investments, as you have a longer horizon to recover from potential losses. This age period is prime for thinking about putting your capital into higher-growth investments.

Mid-Career Focus (Mid-30s – 40s)

Balancing Responsibilities:

For many, the mid-career phase is characterized by increasing financial responsibilities, such as mortgages, education expenses, and family needs. Balancing these demands with retirement savings requires careful planning and awareness.

Maximizing Earnings:

By your mid-30s to 40s, you’ve likely established a more stable income. Capitalizing on this increased earning potential can allow you to make more substantial contributions to your retirement funds, ensuring your nest egg grows at a respectable pace.

Nearing the Summit (Late 40s – 50s)

Intensifying the Focus:

As you approach your 50s, preparing for retirement will become your main priority. The need to intensify your retirement savings efforts becomes paramount, as there are fewer years left to accumulate savings (and less time for investments to grow).

Balancing Catch-Up Contributions:

In your 50s, you become eligible for catch-up contributions to retirement accounts, allowing you to make larger contributions than younger individuals. This window provides an opportunity to make up for any earlier gaps in savings.

The Countdown Begins (Late 50s and Beyond)

Fine-Tuning Retirement Plans:

The late 50s and beyond mark a period of fine-tuning your retirement strategy. As retirement draws near, it’s essential to reassess your investment portfolio, risk tolerance, and retirement goals.

Considering Post-Retirement Income:

Exploring options like part-time work, consulting, or other sources of post-retirement income can help supplement your retirement savings and provide added financial security.

Ultimately, the best age to build your retirement savings is not a one-size-fits-all answer but a never-ending interplay of factors that must align with your personal path to a secure and fulfilling retirement.

How Much Money Do You Need to Retire?

How Much do you Need to Retire in Canada | HomeEquity Bank

One of the most critical questions that individuals face as they plan for retirement is: Do they have enough money to comfortably sustain their lifestyle during their golden years?

While there is no one-size-fits-all answer to this question, several factors come into play when estimating your retirement savings goal. By carefully considering these factors and making strategic financial decisions, you can create a retirement plan that aligns with your aspirations and needs.

1. Current Lifestyle and Expenses

Your current lifestyle and spending habits serve as a starting point for estimating your retirement expenses. Take some time to evaluate your monthly and yearly expenditures. This includes housing costs, utilities, groceries, transportation, healthcare, entertainment, and any other regular expenses. Keep in mind that some expenses, like mortgage payments, might decrease or be eliminated in retirement, while others, such as healthcare costs, could increase.

2. Inflation

Inflation is the gradual increase in the cost of goods and services over time. Factoring inflation into your retirement calculations is crucial, as it can erode the purchasing power of your savings. A retirement that lasts 20 to 30 years or more will likely experience significant changes in the cost of living due to inflation. Therefore, it’s essential to account for inflation when estimating your future expenses.

3. Healthcare Costs

Healthcare expenses tend to rise as we age, and they can be a significant financial burden during retirement. Insurance of universal healthcare may cover some of these costs, but it’s important to budget for premiums, deductibles, and potential out-of-pocket expenses. Long-term care costs should also be considered, as they can impact your retirement savings if the need arises.

4. Retirement Lifestyle Goals

Retirement isn’t solely about covering basic expenses; it’s also an opportunity to pursue your passions and enjoy new experiences. Consider what you envision for your retirement lifestyle. Do you plan to travel extensively, try new hobbies, or live in a different location?

These goals will influence your financial needs and help you determine a realistic retirement savings target.

5. Investment Strategy and Withdrawal Rate

Your investment strategy and withdrawal rate play a crucial role in how long your retirement savings will last. Financial experts often recommend the “4% rule,” which suggests withdrawing 4% of your initial retirement portfolio balance annually, adjusted for inflation. A well-thought-out investment approach can help balance risk and potential returns throughout your retirement years.

In conclusion, estimating how much money you need to retire involves careful consideration of various factors, including your current expenses, inflation, healthcare costs, retirement goals, and income sources. By taking a holistic approach to retirement planning and seeking professional advice ( if needed), you can enter your retirement journey with confidence and financial security.

Your Biggest Advantage to Investing Early: Compounding Interest

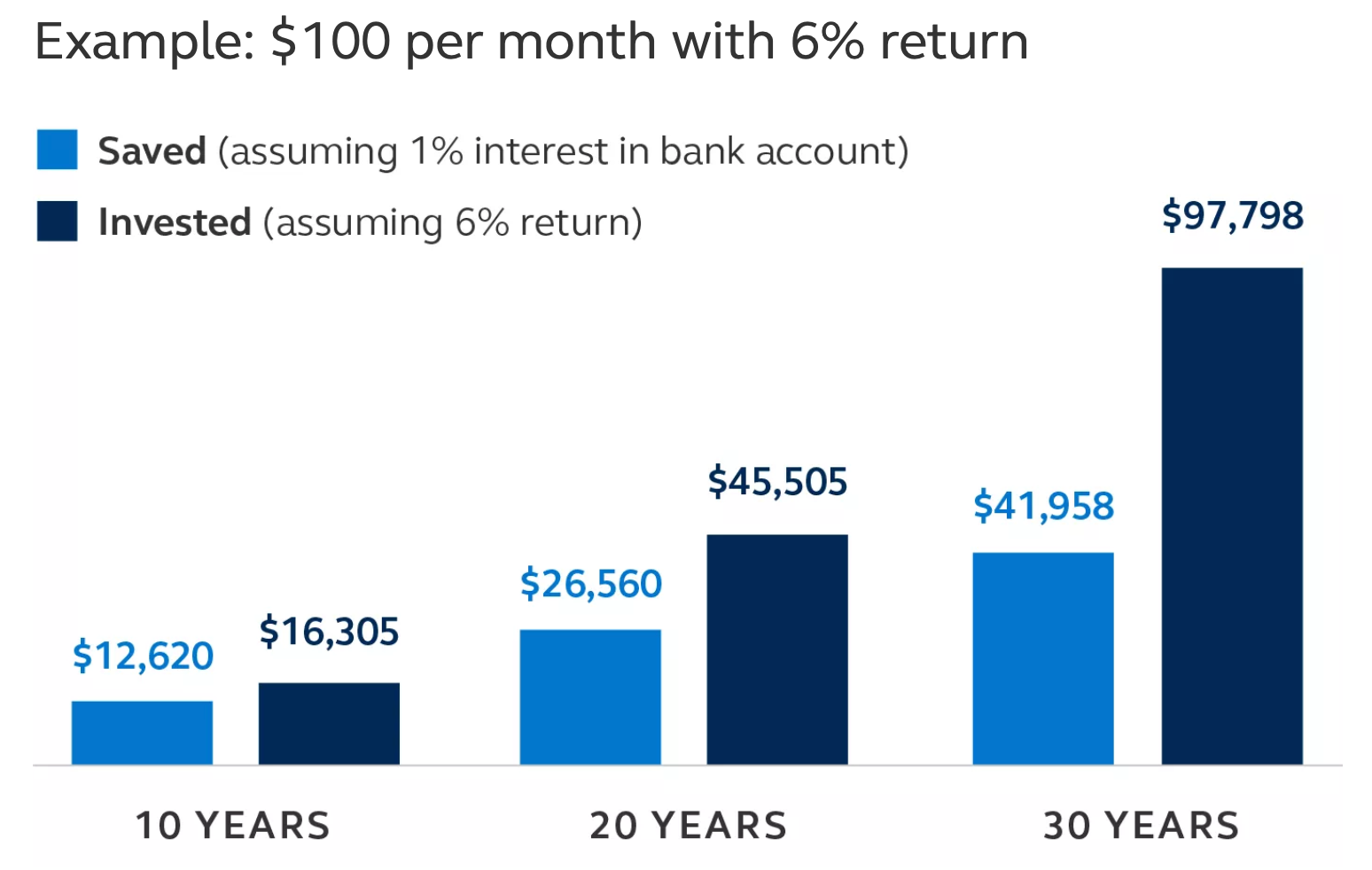

When looking at all the advantages of investing early for retirement, one of the most powerful tools at your disposal is the concept of compounding interest.

Often referred to as the “eighth wonder of the world” by Albert Einstein, compounding interest has the potential to significantly boost your savings over time. Understanding how it works and harnessing its potential can make a substantial difference in achieving your retirement goals.

Compounding interest is the process by which your money earns interest not only on the initial amount you invest but also on the accumulated interest over time. In simple terms, it’s interest on top of interest. This compounding effect can lead to exponential growth of your savings, especially when investing for the long term.

The true magic of compounding interest lies in the concept of time. The longer your money is allowed to compound, the more substantial the growth becomes. Even relatively small contributions can accumulate into a significant sum when given enough time. This is why starting to save and invest for retirement early is so important.

Example of Compounding in Action:

Let’s consider an example to illustrate the power of compounding interest.

Suppose you invest $10,000 in a retirement account that earns an average annual return of 7%. In the first year, you earn $700 in interest. However, in the second year, you earn interest not only on your initial $10,000 but also on the $700 from the previous year. This means you earn $749 in the second year. Over time, this compounding effect snowballs, and your savings grow significantly without requiring additional contributions.

To show the full effects of what compounding interest will do for your money, the picture below shows the difference between 3 different individuals who started putting money into their retirement accounts at different times:

Compounding Interest Example | Principal.com

Clearly, the person who decided to start saving for retirement the earliest was able to make significantly more money over time, as their investment portfolio had more time to compound.

This goes to show just how powerful it is to build a diversified portfolio earlier in life and why saving for retirement as early as possible is such a big advantage.

Maximizing Compounding for Retirement:

To make the most of compounding interest for your retirement savings, keep the following tips in mind:

- Start Early: The earlier you begin saving for retirement, the longer your money has to compound. Even if you can only afford to contribute a small amount initially, the time factor will always work in your favor.

- Consistent Contributions: Regular contributions to your retirement accounts, such as 401(k)s, TFSAs, or IRAs, allow you to take full advantage of compounding. Set up automatic contributions to ensure a consistent investment pattern.

- Reinvest Dividends and Interest: When your investments generate dividends or interest, reinvesting these earnings can lead to additional compounding. This is often an option in retirement accounts and various investment assets.

- Stay Invested: Avoid withdrawing from your retirement accounts prematurely, as doing so can disrupt the compounding process. Aim to keep your funds invested for the long term.

Compounding interest is indeed your secret weapon in the journey toward a comfortable retirement. By understanding its mechanics and incorporating it into your financial strategy, you can harness the remarkable growth potential it offers. When coupled with disciplined saving and prudent investment choices, compounding interest becomes a formidable ally that can help you achieve the retirement you’ve always dreamed of.

Conclusion

As you begin to think about your retirement, remember that careful planning is the key to securing a fulfilling and financially stable future. Estimating your retirement savings goal, understanding the power of compounding interest, and making smart investment choices are all integral parts of this process. While the road to retirement may seem long, each step you take today brings you closer to the retirement you desire.

By assessing your current lifestyle, factoring in inflation and healthcare costs, and setting achievable retirement goals, you can lay a solid foundation for your financial security. Moreover, harnessing the potential of compounding interest by starting early, contributing consistently, and staying invested can amplify the growth of your retirement savings even more.

Remember that seeking professional financial advice and regularly reassessing your plan can help you navigate potential challenges and make necessary adjustments. Your retirement is a chapter you have the power to shape, and with thoughtful planning and diligence, you can look forward to your golden years with confidence and excitement.

Here’s to a rewarding and well-prepared retirement!

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Braxia stock and are compensated by Braxia for Investor Relations Services. Edge Investments and its owners reserve the right to buy and sell shares in Braxia without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.