Image Source: Cybersecurity Investment To Grow By 13% In 2023 | Cyber Risk Leaders

In our digital age, the need for strong cybersecurity frameworks is more important than ever.

The amount of data breaches, cyber threats, and cyber attacks have increased almost exponentially within the last decade as businesses continue to transition their operations online and hackers find new ways to access sensitive information.

Given this new reality of cyber threats leading to financial losses and loss of customer trust, investors owe it to themselves to take the time to understand why investing in cybersecurity today is worth their time and

To help, today we’re going over the top reasons why cybersecurity will be a defining investment trend in the next decade and more.

Cybersecurity Explained (And The Different Types of Cybersecurity Being Used Right Now)

Understanding exactly how cybersecurity threats are actually stopped can seem overwhelming to investors who don’t have direct experience in the industry.

And while some parts of cybersecurity are quite technical, the underlying premise of what cybersecurity is and how it works is relatively simple.

To help understand why investors should consider investing in cybersecurity, we’ve broken down (in simple terms) what cybersecurity is, as well as the main cybersecurity areas being used today.

What is Cybersecurity?

Cybersecurity refers to the practice and methodologies involved in protecting computer systems, networks, and data from digital attacks, unauthorized access, or damage. At its core, cybersecurity aims to ensure the confidentiality, integrity, and availability of information for a company or individual.

Below are the most important niches within cybersecurity that are gaining the most attention and investment from companies as they work to secure their systems and data.

Network and Data Security

Network security is the practice of safeguarding computer networks from a data breach, regardless of whether it is an opportunistic malware attack or something more targeted.

It includes measures to secure both hardware and software mechanisms. By managing access to the network, implementing security policies, and deploying firewalls, network security aims to protect the usability and integrity of a network and data.

Information Security

Information security, or InfoSec, focuses on protecting sensitive data from unauthorized access and alterations during storage and transmission. This type of cybersecurity ensures that both physical and electronic data are protected from data breaches and cyberattacks. Encryption and identity and access management (IAM) systems are commonly used tools in information security.

Application Security

With a focus on keeping software and devices free of threats, application security is very important in today’s world. It involves the use of various defenses within all software and services to protect against a wide range of threats. Application security can include hardware, software, and procedural methods to protect applications from various external attacks.

Operational Security

Operational security involves the strategies and methods used to manage and safeguard information assets. It includes the user’s access rights within a network and the guidelines that dictate the storage and distribution of data. Furthermore, operational security includes the mechanisms for overseeing and securing data assets, along with the regulations regarding the storage and distribution of information.

Top 5 Reasons to Invest in Cybersecurity

Image Source: Google and Microsoft will invest in cybersecurity | Techiexpert.com

Now that we have a better understanding of what cybersecurity is and how it is being used, here is a list of the top 5 reasons why investing in cybersecurity is worth it right now.

1.) Expanding Market in a Digital Economy

In November of 2023 alone, there were 470 publicly disclosed cyber incidents. Before the year is over, there will be an estimated 1,404 cyber incidents/attacks, compromising over 6 billion files. And the largest cyber attack in history took place this year, with estimated damages being almost $4 billion.

Clearly, the number of cybersecurity incidents is showing no signs of slowing down as businesses and individuals increasingly rely on digital solutions in their everyday lives.

And while the number of security risks is alarming, it presents opportunities for investors who are willing to take the time to research where in the industry they should invest their capital. Trends such as cloud security and antivirus software are becoming critical investment areas as cyberattacks become increasingly sophisticated.

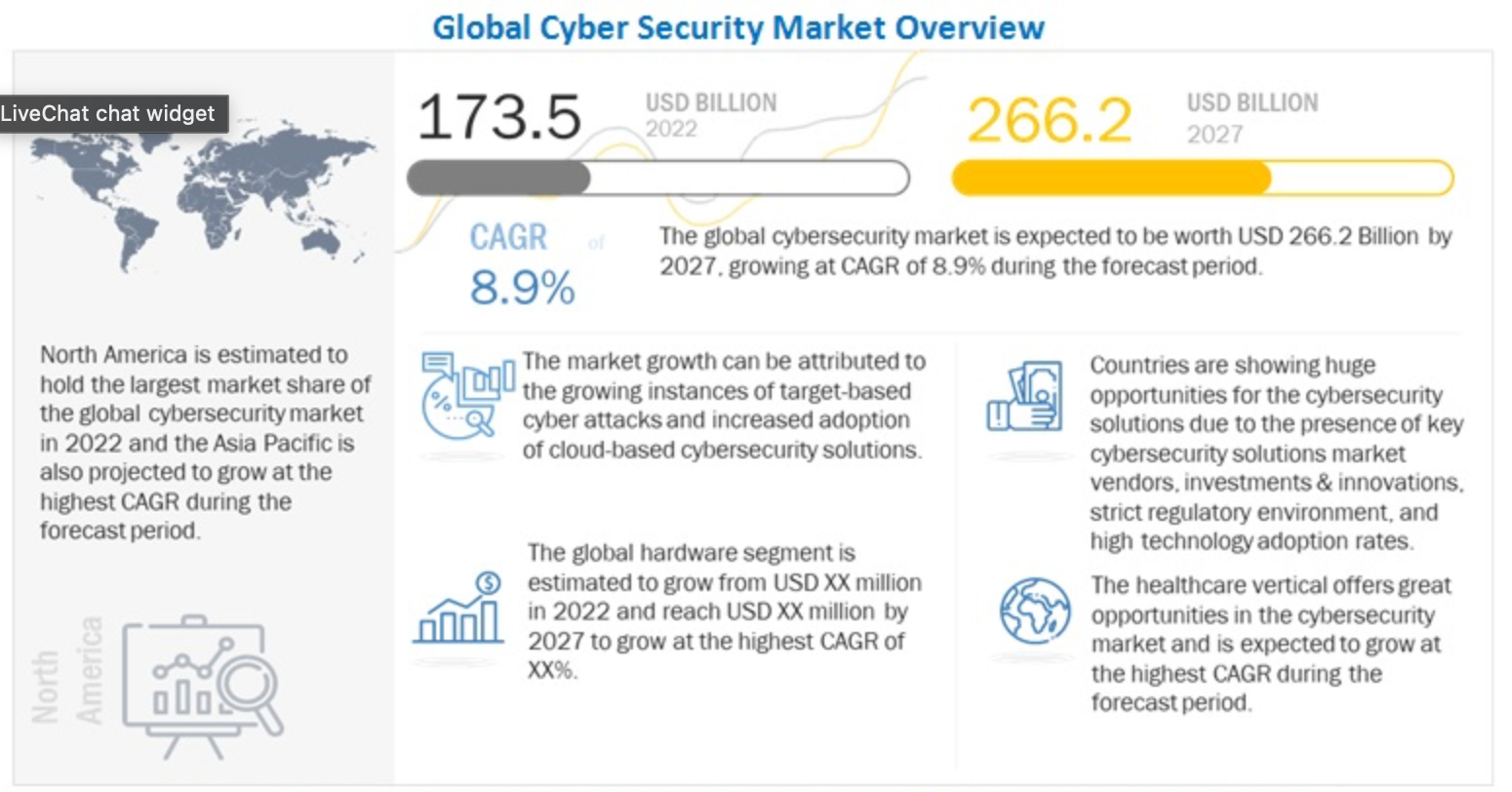

As highlighted in the graphic below, Market Research forecasts suggest that the global cybersecurity market, valued at approximately $173 billion in 2022, is expected to grow to close to $270 billion by 2027. This clearly shows that a company’s financial resources are being aggressively pushed into cybersecurity spending, meaning regardless of where the economy goes, the cybersecurity industry should see sustained growth as companies prioritize protecting their business operations from malicious attacks.

Image Source: Cybersecurity Market Overview | Market Research

2.) Strategic Advantage in Mergers and Acquisitions

In the world of mergers and acquisitions, cybersecurity now plays a pivotal role.

For investors and companies engaged in M&A activities, robust cybersecurity measures can significantly enhance the value and attractiveness of a business.

In today’s market, companies with strong cybersecurity frameworks are often valued higher due to the reduced risk they present. This aspect is increasingly scrutinized during due diligence processes, as the cost of data breaches and cyber threats can substantially impact the financials and reputation of the acquired firm. By investing in cybersecurity, businesses not only shield themselves from cyber threats but also position themselves as more secure and stable partners or acquisition targets.

This reality should make cybersecurity a key consideration for investors looking to maximize returns and minimize risks in both private and public markets.

3.) Profitable Business Models with Strong Cash Flows

Cybersecurity companies often boast business models with respectable margins, strong free cash flow, and great scalability. These companies also typically have lower physical asset requirements and can scale rapidly due to the digital nature of their services.

This scalability, combined with recurring revenue models such as subscription-based services, results in robust financial performance, making them great investments for nearly any type of investor.

4.) Regulatory Compliance Driving Demand

Increasing regulatory requirements around data protection and privacy, such as GDPR and CCPA, are driving businesses to invest more in cybersecurity.

This regulatory landscape is creating a baseline demand for cybersecurity services, as businesses of all sizes must comply with these regulations to avoid hefty fines and reputational damage.

5.) Innovation and Technological Advancements

The cybersecurity industry is at the forefront of technological innovation. With advancements in areas like artificial intelligence, machine learning, and blockchain, cybersecurity firms are continuously evolving.

This innovation not only helps in staying ahead of cyber threats but also opens new market opportunities and applications, further improving the growth prospects and attractiveness of the industry to investors.

Conclusion

Image Source: Cybersecurity frameworks explained | CPA Canada

Point blank, cybersecurity is more important now than ever before.

It’s not just about stopping hackers; it’s a key part of doing business in a world that relies on technology. Companies need cybersecurity to protect their information, follow laws, and keep their customers’ trust.

For investors, putting

Looking ahead, cybersecurity will only become more important. Investing in it now is a step towards a safer, more secure future for everyone in the digital world. This isn’t just about technology or investment returns; it’s about building a future where businesses and customers can thrive online without the fear of cyber attacks and stolen information.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.