In the dynamic world of finance, pre-IPO investing is a unique and noteworthy strategy, especially for individuals keen on delving into the complexities of the market.

Unlike the traditional investment approach that directs attention to companies’ post-public debut, pre-IPO investing offers a select group of investors the intriguing opportunity to immerse themselves in companies’ financial dynamics before they debut.

This distinctive phase is characterized by heightened potential risks and rewards, making it a fascinating arena for those seeking a more nuanced understanding of investment strategies.

Pre IPO | WallStreetMojo

Initial Public Offering

An Initial Public Offering (IPO) is when a private company becomes a public company by offering its shares to the general public on a stock exchange for the first time. In simpler terms, an IPO marks a company’s transition from private ownership to public ownership.

IPO | Investopedia

There is a multitude of reasons as to why a company might decide to “go public.”

Both startup and longstanding companies issue an IPO to raise funds, put their company on the map, create liquidity for existing shareholders, diversify ownership, create employee stock option incentives, or even position themselves competitively.

What is a Pre-IPO Company?

A pre-IPO company refers to a business getting ready to become publicly traded. This entails preparing to offer its shares to the public for the first time through an Initial Public Offering (IPO).

Before this transition, the company operated as a private entity, usually owned by a limited group of investors, founders, and employees.

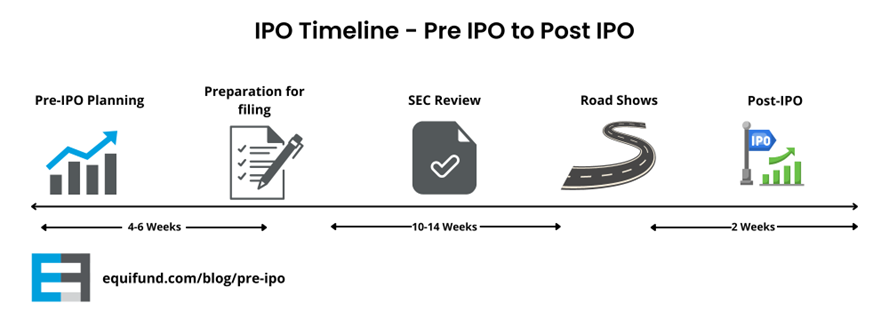

When a company decides to go public, it signifies a pivotal moment in its journey, involving various essential steps.

IPO Timeline | Equifund

In the pre-IPO phase, companies often undergo financial audits, ensure compliance with regulations, and engage in discussions with underwriters (financial institutions facilitating the IPO process).

Understanding pre-IPO companies is crucial for beginner investors because they represent opportunities to invest before a company hits the public stock market.

As investors, it is essential to note that pre-IPO stocks have an evident risk due to their limited public financial information and uncertainties associated with a given company’s transition from private to public.

What is Pre-IPO Investing?

Picture pre-IPO investing as a proactive and strategic method that allows investors to get in early. It is not unlike other investment procedures, such as value or growth strategies.

The process involves making informed decisions before a company’s public debut, offering investors a backstage pass to the company’s financial dynamics.

By taking this approach, investors aim to position themselves advantageously, leveraging insights and patterns in the pre-public domain to potentially yield significant returns.

Investing | Forbes

In essence, pre-IPO investing becomes a narrative of deliberate choices and strategic insights. It challenges traditional investment narratives, encouraging a nuanced understanding of market dynamics and emphasizing the importance of making intentional decisions in the pre-public phase.

For those venturing into this domain, it represents an opportunity to grasp the subtle art of financial improvement and gain valuable insights before the broader market notices.

Who Usually Buys Pre-IPO Stock?

A select group of investors typically purchases pre-IPO shares, and the eligibility criteria for participation often depend on regulatory requirements and the company’s policies. Some categories of investors who commonly buy pre-IPO shares include:

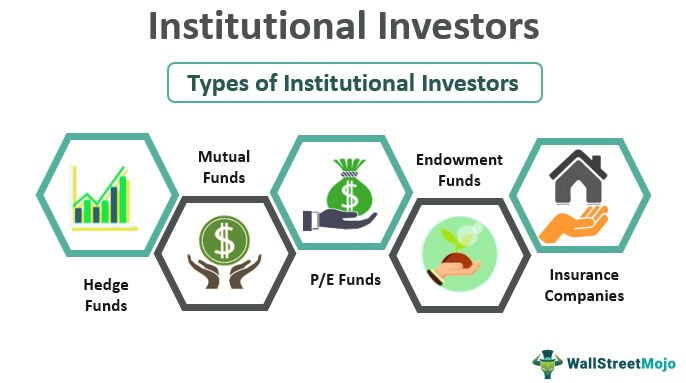

Institutional Investors

Large institutional investors such as mutual, pension, and hedge funds often participate in pre-IPO investments. These entities have the financial capacity and expertise to make substantial investments before a company goes public.

Institutional Investors | WallStreetMojo

Venture Capital Firms

Venture capital investment firms can play a significant role in financing startups and early-stage companies. They invest in these companies expecting significant returns, often gaining access to pre-IPO shares as part of their investment agreements. If you’d like to learn how to become a venture capital investor, check out our Beginners Guide.

Private Equity Firms

Like venture capital firms, private equity funds invest in private companies but may focus on more mature businesses. Private equity investors may secure pre-IPO shares in anticipation of the company’s future public offering.

Accredited Investors

Accredited investors are individuals or entities that meet specific financial criteria set by securities regulators. These investors may access pre-IPO shares through private placements, secondary market transactions, or specialized investment funds.

Employees

Employees of a company undergoing an IPO may have the opportunity to purchase pre-IPO shares through employee stock option programs. This allows them to buy shares at a predetermined price before the company goes public.

Employees | ComBox

Founders and Early Investors

Founders of a company and early investors who took part in its initial funding rounds may hold pre-IPO shares. They may sell these shares in secondary market transactions or retain them through a public offering.

High-Net-Worth Individuals

High-net-worth individuals who meet specific financial criteria may have the chance to invest in pre-IPO shares directly or through specialized investment vehicles.

It’s important to note that participation in pre-IPO investments often requires a level of sophistication and financial capability, as these investments come with inherent risks and may lack the same level of regulatory scrutiny and transparency as publicly traded securities.

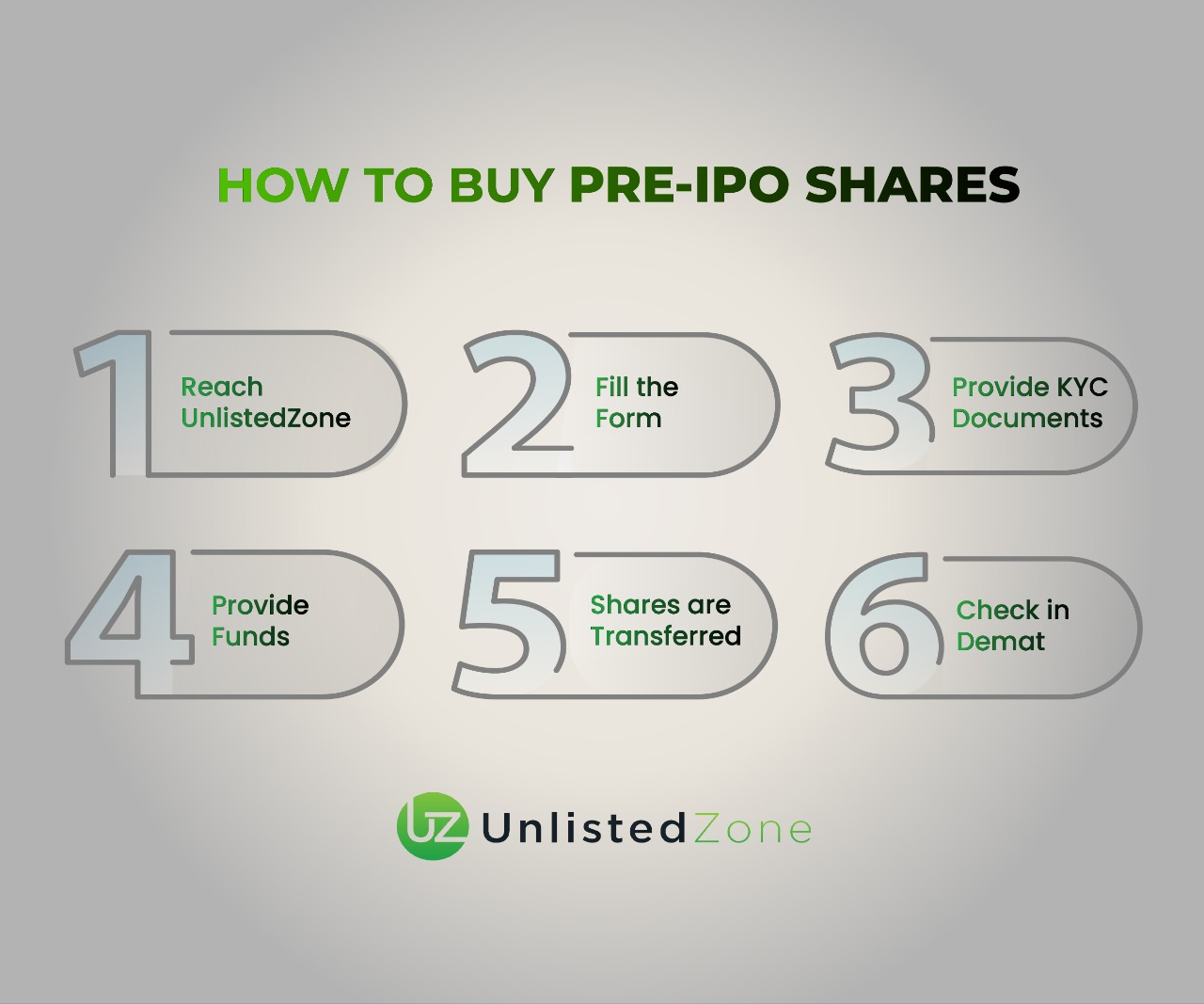

How Buy Pre-IPO Stock | UnlistedZone

Additionally, regulations surrounding pre-IPO investments vary by jurisdiction, so it is essential to be aware of the legal and regulatory landscape applicable to their situation.

Can Retail Investors Buy Pre-IPO Stocks?

In some cases, retail investors may have opportunities to buy pre-IPO stock, but it’s important to note that direct access to these shares is often limited.

How to Buy Pre-IPO Shares

Due to the risks and complexities involved, pre-IPO investing is typically associated with institutional investors, accredited investors, and individuals with a significant net worth.

However, there are a few potential avenues through which retail investors may indirectly gain exposure to pre-IPO shares:

Specialized Investment Funds: Some investment funds, including certain mutual funds or exchange-traded funds (ETFs), focus on investing in pre-IPO companies. Retail investors can invest in these funds, gaining exposure to a diversified portfolio of pre-IPO stocks managed by professional fund managers.

Secondary Market Platforms: Some secondary market platforms facilitate the buying and selling of shares in private companies, including pre-IPO shares. These platforms may allow retail investors to participate in secondary market transactions, purchasing shares from existing shareholders.

Secondary Market | Investopedia

Exceptional Purpose Acquisition Companies (SPACs): SPACs are companies formed to raise capital through an IPO to acquire an existing company. Retail investors can invest in SPACs before identifying and merging with a target company, effectively participating in a pre-IPO stage.

Crowdfunding Platforms: Certain crowdfunding platforms offer retail investors the opportunity to invest in early-stage companies before they go public. While this doesn’t involve traditional pre-IPO shares, it provides a means for retail investors to support and potentially profit from companies in their early stages.

Crowd Funding | Canon

Employee Stock Purchase Plans (ESPPs): Some companies offer their employees the opportunity to buy discounted shares through Employee Stock Purchase Plans. While not technically pre-IPO, these plans can provide retail investors an entry point before the company goes public.

For retail investors, exercising caution and conducting thorough research is paramount when considering pre-IPO-related investments.

These endeavors typically entail heightened risks, lower liquidity, and a scarcity of publicly available information compared to more conventional securities.

Retail Investors | WallStreetMojo

Moreover, it’s crucial to recognize that regulatory requirements and opportunities for retail investors vary across jurisdictions.

To navigate this terrain prudently, seeking guidance from a financial advisor and maintaining awareness of any investment opportunity’s specific terms and conditions becomes indispensable. Investing in pre-IPO stocks carries inherent risks, with these companies often lacking a proven financial track record, and pertinent information may be limited to the public.

The illiquid nature of these investments adds a layer of complexity, making it advisable for beginners to thoroughly assess the associated risks and seek counsel from experienced financial advisors before delving into this domain.

What Are The Benefits of Buying Pre-IPO Shares?

Pre-IPO investing, while carrying its own set of risks, can offer several potential advantages for investors. Here are some pros of pre-IPO investing:

Access to High-Growth Companies: Pre-IPO investors can invest in companies during their early stages of growth. These companies may be innovative and have the potential for significant expansion, allowing investors to align themselves with high-growth prospects.

Potential for Significant Returns: One of the primary attractions of pre-IPO investing is the potential for substantial returns. If a company performs well after going public, early investors who entered during the pre-IPO stage may benefit from the appreciation in the stock’s value.

Diversification: For investors looking to diversify their portfolios, pre-IPO investments can provide exposure to a different asset class. Investors may diversify their risk by including private, pre-IPO companies in a portfolio and potentially enhance overall returns.

Diversification | Investopedia

Early Access to Innovation: Pre-IPO companies are often at the forefront of innovation in their respective industries. Investing in these companies allows investors to support and potentially profit from groundbreaking technologies, products, or services.

Innovation | INC

Long-Term Investment Horizon: Pre-IPO investing often requires a longer-term perspective. Investors willing to hold their positions for an extended period may benefit from the company’s growth trajectory.

Potential for Limited Competition: In some instances, pre-IPO opportunities may have less competition than publicly traded stock investments. This can allow investors to access promising opportunities before they become widely known.

Strategic Influence: Depending on the terms of the investment, pre-IPO investors may have the opportunity to exert some level of strategic influence or input in the company’s direction. This involvement can provide a unique level of engagement for individual investors themselves.

Pros and Cons | CityTech

What Are The Disadvantages of Investing in Pre-IPO?

While pre-IPO investing can offer enticing opportunities, investors must be aware of the potential downsides or cons associated with this type of investment:

High Risk: Investing in pre-IPO companies carries a higher risk than established, publicly traded companies. These ventures are often in their early stages, with unproven business models and limited financial histories. Check out our post here to learn more about the risks of purchasing stocks!

Limited Liquidity: Pre-IPO investments are typically illiquid, meaning selling or exiting the investment before the company goes public can be challenging. Investors may have to wait for an IPO or other exit events to realize returns on their investment.

Uncertain Valuation: Determining the actual value of a pre-IPO company can be challenging. Valuations are often based on assumptions and future projections, making it difficult to assess the accuracy of the company’s worth.

Uncertainty | HelpGuide

Information Asymmetry: Pre-IPO companies are not subject to the same level of regulatory disclosure requirements as publicly traded companies. This lack of transparency can lead to information asymmetry, where insiders have more information than outside investors, potentially disadvantaging the latter.

Lack of Market Feedback: Public markets provide valuable company performance feedback through stock prices and analyst coverage. In the pre-IPO stage, investors may lack this market feedback, making it harder to gauge the broader market’s sentiment.

Feedback | SJ Hemley Marketing

Dependency on Company Performance: The success of pre-IPO investments is heavily dependent on the company’s subsequent performance after going public. If the company faces challenges or fails to meet expectations, investors may not realize the anticipated returns.

No Dividend Payments: Pre-IPO companies typically reinvest earnings back into the business rather than paying dividends to investors. This means that investors may not receive any income from their investment until the company generates profits and decides to distribute dividends.

Limited Exit Options: Until a pre-IPO company goes public or experiences another exit event (such as acquisition), investors may have few options for selling their shares. This lack of exit options can contribute to the illiquid nature of these investments.

Market Volatility: The stock prices of pre-IPO companies can be more volatile than those of established companies, making it challenging to predict short-term share price movements and exposing investors to higher market risk.

Dilution: As a company raises additional funding rounds before going public, it may issue more shares, diluting existing shareholders’ ownership. This can impact the value of the shares held by early investors.

Importance of Investing in Pre-IPO Companies

While the journey through pre-IPO investing may come with its own set of challenges and uncertainties, the potential for substantial returns, access to high-growth companies, and the thrill of being part of a company’s early narrative make it an enticing venture for those who appreciate the intricacies of the financial world. In today’s market, keeping an eye on pre-IPO AI stocks like OpenAI may benefit investors; check out our video on the AI revolution to learn more!

Here are some private companies looking to issue an IPO in the year 2024:

Reddit | Reddit

Reddit is a social media platform and online community where registered users can participate in discussions, share content, and engage with others. It is organized into various communities, known as “subreddits,” each dedicated to a specific topic, interest, or theme. Users can submit posts, links, images, or text, and other users can then upvote or downvote these contributions, influencing their visibility within the community.

Shein

Shein | Shein

Shein is an international online fast-fashion retailer that originated in China. The company, officially known as Shein Group Ltd., was founded in 2008 by Chris Xu. Shein has gained significant popularity for its wide range of trendy and affordable fashion items, catering to a global customer base.

Skims

Skims | Skims

SKIMS is a shapewear and loungewear brand founded by American media personality, socialite, and businesswoman Kim Kardashian. The brand was launched in September 2019 to provide inclusive and diverse solutions for various body shapes and skin tones. SKIMS quickly gained attention for its focus on comfort, inclusivity, and a broad range of sizes.

Benefits of Buying Pre-IPO Stock

For those venturing into this domain, pre-IPO investing represents an opportunity to grasp the subtle art of financial improvement and gain valuable insights before the broader market notices.

While participation is often associated with institutional and accredited investors, retail investors may explore avenues like specialized investment funds, secondary market platforms, SPACs, crowdfunding, and employee stock purchase plans for indirect exposure.

As we weigh the pros and cons, the potential for significant returns, access to high-growth companies, and the thrill of early involvement make pre-IPO investing enticing. Yet, the cons, such as high risk, limited liquidity, and uncertain valuations, necessitate careful consideration.

The journey through pre-IPO investing presents challenges and uncertainties. Still, the allure of substantial returns and the opportunity to shape a company’s early narrative make it a captivating venture for those navigating the financial world.

Whether eyeing potential IPOs in 2024 or exploring dynamic sectors like AI, pre-IPO investing remains a dynamic and evolving chapter in the ever-changing realm of finance.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.