Image Source: Types of Crowdfunding: Donation, Rewards, Equity-Based | Startups.com

Equity crowdfunding has emerged as a game-changer in the world of startups and investments, offering a unique twist on the private equity space.

Where traditionally, investing in private companies were reserved for venture capital firms or angel investors, now anyone with access to the internet can partake in the industry.

Though as exciting as crowdfunding is, many don’t realize there are many different types of crowdfunding options, all with their own unique twists, funding models, and advantages.

This article will define what exactly equity crowdfunding is, compare it to other forms of crowdfunding options, provide some equity crowdfunding sites, and finally, help our readers determine (whether your an entrepreneur looking to raise capital or an investor wanting to diversify their portfolio) what form of crowdfunding is best for you.

What is Equity Crowdfunding?

Equity crowdfunding is more than just an innovative approach to raising capital; it represents a shift towards a more open and accessible form of investing, allowing everyday individuals the opportunity to have equity ownership in promising companies they believe in.

The roots of equity crowdfunding can be traced back to the aftermath of the 2008 financial crisis, a time when the tightening of bank lending criteria made it difficult for small businesses to secure funding.

This financial drought paved the way for legislative changes, such as the pivotal U.S. JOBS Act of 2012, specifically Title III—Regulation Crowdfunding, which was an equity crowdfunding regulation allowing startups to attract investors through an approved equity crowdfunding platform.

To understand equity crowdfunding even better, here are some defining traits within the equity crowdfunding industry:

Broadened Investor Access:

- Equity crowdfunding democratizes investment, allowing everyday investors the opportunity to purchase shares of startups and small businesses.

- It lowers the entry barriers, enabling people with smaller amounts of capital to participate in investment opportunities that were traditionally available only to wealthy individuals or institutional investors.

Diverse Investment Opportunities:

- Equity crowdfunding platforms host a wide range of industries, from technology and healthcare to real estate and renewable energy.

- This variety attracts a diverse group of investors with different interests and investment goals.

Community and Marketing Benefits:

- Startups not only gain capital but also build a community of investors who are motivated to see their business succeed.

- Equity crowdfunding campaigns serve as a marketing tool, increasing visibility and validating the concept in the marketplace.

Potential for High Returns:

- While high-risk, equity crowdfunding can potentially offer high returns if the businesses invested in become successful.

- Investors have the opportunity to get in on the ground floor of disruptive startups that could potentially redefine entire industries.

Investor Engagement:

- Equity crowdfunding creates a platform for investors to engage directly with the entrepreneurs in whom they invest, often providing feedback and sharing expertise.

- This engagement fosters a deeper connection between the business and its shareholders, which can be beneficial for long-term growth.

Alignment of Interests:

- Investors’ returns are directly tied to the company’s success, aligning the interests of the business owners and their investor community, which can drive the business to perform better.

Equity crowdfunding’s uniqueness lies in its open invitation to a wide audience of potential investors, allowing for a more inclusive approach to raising capital. This mode of funding is not just about financial transactions; it’s about fostering a community around a shared vision, where each investor’s stake is a testament to their belief in the company’s potential.

For entrepreneurs, it offers a dual advantage: access to a diverse base of investors and the creation of a dedicated customer base that is financially and emotionally invested in the company’s success.

For investors, it represents an avenue to diversify their portfolios beyond traditional stocks and bonds, tapping into a segment of early-stage ventures with the possibility for substantial growth.

Different Types of Crowdfunding Models

Image Source: An Introduction to the Different Types of Crowdfunding | Arora Project

Equity crowdfunding is one piece of a larger mosaic of crowdfunding models, each with unique characteristics catering to various goals and preferences of both project creators and backers.

Here’s a brief overview of some of the other most popular crowdfunding models:

Rewards Based Crowdfunding

Rewards-based crowdfunding is one of the most recognized forms within the crowdfunding landscape. Platforms like Kickstarter and Indiegogo have become synonymous with this model, where backers pledge money in anticipation of receiving tiered rewards. These rewards are often directly related to the project itself, such as pre-orders of the product being developed, personalized experiences, or credits. This model thrives on the direct relationship between backers and the creative process they are funding.

Donation Based Crowdfunding

Donation-based crowdfunding is driven by altruism, supporting causes without the expectation of financial return. Used extensively for charitable ventures, personal emergencies, and non-profit initiatives, platforms such as GoFundMe allow individuals to solicit funds directly from donors who wish to assist or contribute to a cause they care about. This model underscores the philanthropic spirit inherent in the concept of crowdfunding.

Debt Crowdfunding

Also known as peer-to-peer lending, debt crowdfunding pivots on the concept of borrowing and lending outside of traditional banking systems. Through platforms like Prosper and LendingClub, individuals lend money to others and expect repayment with interest over time. This model appeals to those who prefer a fixed-income investment and are comfortable with the credit risk associated with lending to individuals or unproven small businesses.

Real Estate Crowdfunding

Real Estate Crowdfunding has opened the gates to investment in property markets, which were once reserved for those with large amounts of capital. Through platforms like Fundrise and RealtyMogul, investors can now take either an equity stake in property investments or participate as lenders in property-related debt, enjoying potential returns from rental income, property appreciation, or interest on lent funds. This has added a new dimension to crowdfunding, enabling diversified investment portfolios and offering access to a traditionally high-barrier market.

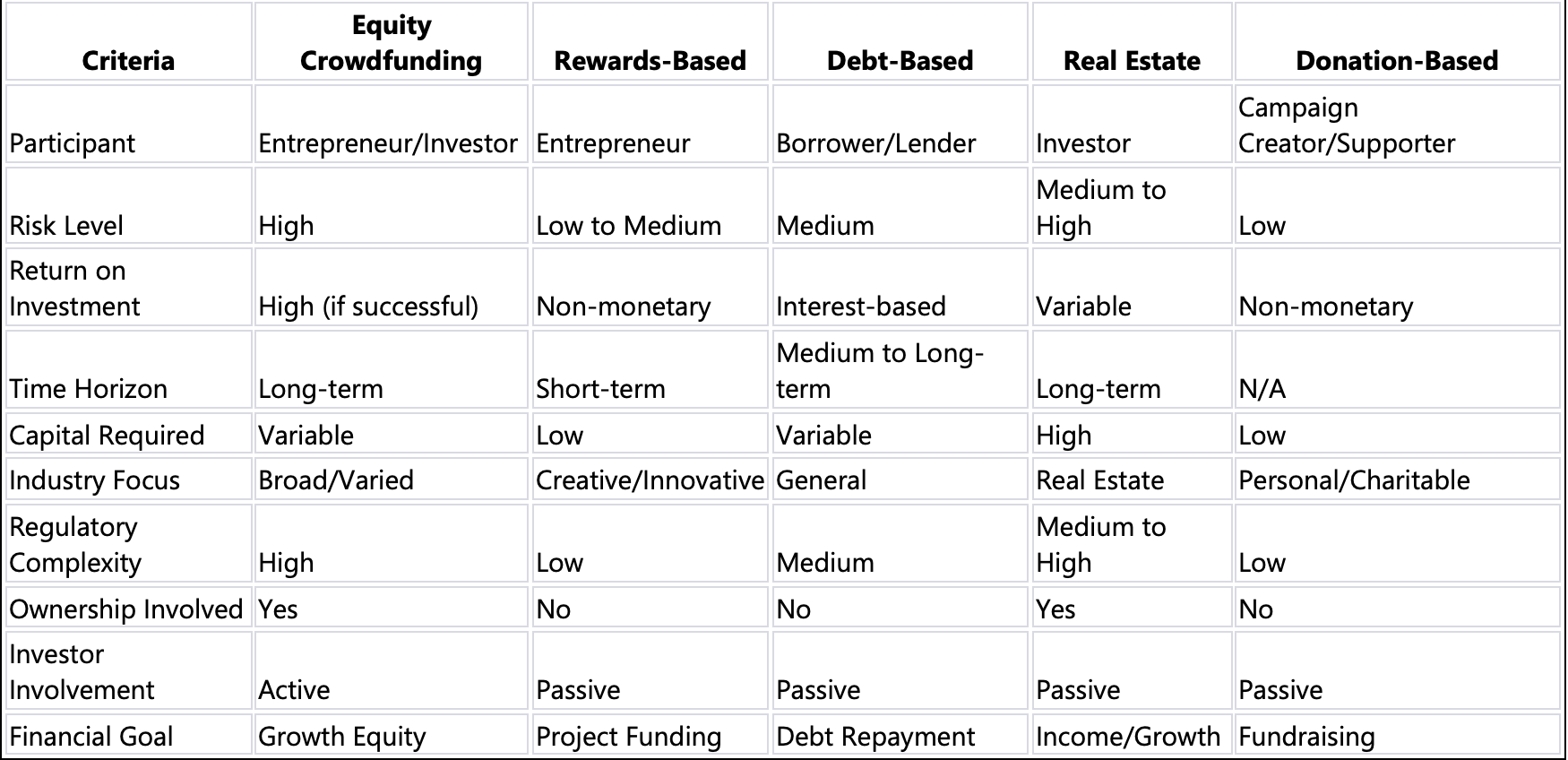

Main Differences Of Equity Crowdfunding

To truly understand how equity crowdfunding is unique, here we’ll compare the different types of crowdfunding directly with equity crowdfunding to highlight each models unique characteristics, advantages, and disadvantages.

Rewards-Based vs. Equity Crowdfunding

Major Differences:

Rewards-based crowdfunding revolves around backers contributing funds in exchange for a product, service, or experience, whereas equity crowdfunding involves investors receiving a stake in the company. In rewards-based crowdfunding, the backer’s return is tangible and immediate, while in equity crowdfunding, the return is financial, long-term, and dependent on the company’s success.

Advantages:

Rewards-based crowdfunding allows creators to validate their product in the market without giving up equity. It’s also less regulated, making it more straightforward for project creators. Equity crowdfunding, on the other hand, offers investors the opportunity for financial growth and a deeper involvement in the company’s trajectory.

Disadvantages:

Rewards-based crowdfunding doesn’t offer backers any financial return or ownership in the company. The risk is generally lower, but so is the potential reward. In equity crowdfunding, investors face the potential loss of their investment if the company fails and must navigate more complex regulatory requirements.

Donation-Based vs. Equity Crowdfunding

Major Differences:

Donation-based crowdfunding is driven by philanthropy, with backers contributing funds without expecting any return, while equity crowdfunding is an investment, with backers expecting a financial return in the form of company equity.

Advantages:

Donation-based crowdfunding is simple and direct, ideal for personal or charitable causes. It’s an expression of support without financial motivation. Equity crowdfunding, conversely, enables investors to potentially profit from their investment and be part of a business’s growth story.

Disadvantages:

Donation-based crowdfunding offers no financial return or material reward, relying purely on the altruistic motivation of backers. Equity crowdfunding involves financial risk, and the return on investment is uncertain and almost always long-term.

Debt-Based vs. Equity Crowdfunding

Major Differences:

Debt-based crowdfunding involves lending money with the expectation of repayment with interest, while equity crowdfunding involves buying a stake in a company for future investment returns.

Advantages:

Debt-based crowdfunding offers lenders a fixed return over a specified period, making it a more predictable form of investment. Equity crowdfunding, however, provides the potential for higher returns if the company grows significantly in value.

Disadvantages:

The return in debt-based crowdfunding is capped at the interest rate, and there’s the risk of borrower default. In equity crowdfunding, while the potential gains can be substantial, investors risk losing their entire investment if the company fails.

Real Estate Crowdfunding vs. Equity Crowdfunding

Major Differences:

Real estate crowdfunding involves investing in property and is usually more sector-specific, whereas equity crowdfunding spans various industries. In real estate crowdfunding, returns may come from rental income or property sales, while equity crowdfunding yields are based solely on the company’s overall performance.

Advantages:

Real estate crowdfunding allows investors to access property markets with smaller capital, and returns can be more stable since they’re tied to tangible assets.

Conversely, equity crowdfunding offers the potential for significant capital gains and diversification beyond real estate.

Disadvantages:

Real estate crowdfunding can involve complex management issues and is sensitive to property market fluctuations. Equity crowdfunding can be more volatile, with higher risks associated with startup investments.

In summary, each crowdfunding model serves different investor needs and preferences. While rewards-based, donation-based, and debt-based crowdfunding offer varying levels of risk and return, they typically don’t offer ownership or a share in the profits, which is a defining feature of equity crowdfunding. Real estate crowdfunding is more sector-specific but provides an alternative asset class for portfolio diversification, much like equity crowdfunding.

Understanding these differences is crucial for both creators and investors to align their strategies with their goals and risk tolerance.

Best Crowdfunding Platforms

Image Source: Top 15 Crowdfunding Platforms in Europe | Crowdsourcing Week

When selecting a crowdfunding platform, it’s important for both entrepreneurs and investors to choose one that aligns with their goals, industry, and type of crowdfunding they are interested in.

Below are some of the best crowdfunding platforms, categorized by the type of crowdfunding they facilitate.

For Equity Crowdfunding:

- SeedInvest: SeedInvest has gained a reputation for its highly selective process, accepting only a small percentage of applicants to ensure that investors have access to high-quality startup investment opportunities. It’s user-friendly and offers a range of tools for both investors and entrepreneurs.

- StartEngine: This platform allows a wide range of businesses to raise capital and a diverse pool of investors to participate. StartEngine supports entrepreneurs throughout their campaign with a host of educational resources and promotional tools.

- Crowdcube: Based in the UK, Crowdcube is one of the leading platforms in Europe. It allows investors of all sizes to invest in businesses they believe in and offers a straightforward process for companies looking to raise funds.

For Rewards-Based Crowdfunding:

- Kickstarter: Kickstarter is the leading platform for creative projects across fields such as art, music, film, technology, and design. It is known for its all-or-nothing funding model, where projects must reach their funding goals to receive any money.

- Indiegogo: Offering more flexibility than Kickstarter, Indiegogo allows for a range of projects, including charitable causes. Entrepreneurs can choose between fixed and flexible funding models depending on their needs.

For Debt-Based Crowdfunding:

- LendingClub: LendingClub is a peer-to-peer lending platform that connects borrowers with investors. It’s primarily focused on personal loans but also offers opportunities for investors to fund these loans in exchange for returns in the form of interest payments.

- Prosper: Similar to LendingClub, Prosper offers peer-to-peer lending for personal loans. Investors can fund loans in increments and receive monthly returns, making it accessible for those not looking to make a large initial investment.

For Real Estate Crowdfunding:

- Fundrise: Specializing in real estate, Fundrise makes it possible for non-accredited investors to buy shares in real estate investment trusts (REITs), which invest in portfolios of real estate.

- RealtyMogul: This platform offers investments in individual properties or in REITs, catering to both accredited and non-accredited investors. It provides options for investing in commercial and residential real estate.

For Donation-Based Crowdfunding:

- GoFundMe: Renowned for personal fundraising, GoFundMe is the go-to platform for individuals facing challenging circumstances who need to raise money quickly and without specific project requirements.

Each of these platforms has their own unique features, fee structures, and focus areas. For entrepreneurs, it’s crucial to consider the type of project, the desired funding model, and the specific audience they want to reach.

Investors should look at the types of opportunities available, the due diligence process each platform employs, and the platform’s track record for successful investments.

As the crowdfunding space evolves, these platforms will continue to refine their offerings and provide valuable services to both sides of their users.

Conclusion: What Type of Crowdfunding is Best?

Image Source: Top 5 Crowdfunding Platforms | Opportunities To Launch Any Project 2022 | Finextra

Determining the best form of crowdfunding depends upon individual objectives and your specific goal.

To help our readers determine which crowdfunding model would best suit their needs, we’ve provided a summary of each below:

While there are many different options, equity crowdfunding is particularly best suited for businesses with scalable models and for investors who are interested in long-term growth potential and are also willing to accept the associated risks.

The choice between equity, rewards-based, debt-based, real estate, or donation-based crowdfunding pivots on a strategic assessment of your needs. Are you an entrepreneur willing to share your company’s success with investors in exchange for their financial backing? Or, are you looking to test out a new product on a wide range of potential customers? How you answer questions like these will greatly influence what type of crowdfunding is best for you.

Equity crowdfunding will open the door to not just funds, but also a base of supporters. If retaining full control and offering backers a sample of your innovation is more your speed, then rewards-based crowdfunding is your avenue.

For those with a clear repayment strategy or investors seeking regular, fixed returns, debt-based crowdfunding offers a straightforward, loan-like funding mechanism. Real estate crowdfunding is suitable for those looking to invest in tangible assets, while donation-based crowdfunding is the go-to for cause-oriented initiatives seeking support.

Whatever your decision, ensure it aligns with your financial goals, risk tolerance, and the level of involvement you desire.

Each model has its unique set of benefits and challenges, and the “best” choice is the one that most closely matches with your individual or organizational objectives.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.