Venture capitalist Aileen Lee, founder of Cowboy Ventures, said in 2013 that the term unicorn startup has quickly swept the venture capital industry and become a rite of passage for entrepreneurs around the globe.

What is a unicorn startup, and more importantly, what are the defining characteristics of the companies that successfully achieve unicorn status?

Before the pandemic, venture capital investment soared on the back of broad innovation and rock-bottom interest rates. However, it now paints a different picture, and entrepreneurs may find it more difficult to find the success and funding that is required to turn a private company into a full-fledged unicorn. While it may be harder, it is definitely not impossible.

To help entrepreneurs on their road to building a billion-dollar company, we’re breaking down everything you’ll need to know about unicorn startups. In this article, we’ll cover:

- What is a Unicorn startup?

- Examples of Successful Unicorn Startups

- The Common Characteristics of Unicorn Startups

- Creating Your Own Unicorn Startup

- Chances of Achieving Unicorn Status

- Conclusion

What is a Unicorn Startup?

In the venture capital world, a unicorn refers to a privately-owned startup that has achieved a valuation of at least $1 billion.

The term unicorn was first used as it was (and still is) considered a rare accomplishment for an entrepreneur to grow a business to the point of being worth a billion or more.

A startup’s value is determined through a combination of the amount of capital raised through venture capital funding, as well as the perceived value of a company’s technology, ability to grow revenue, and any other assets the firm may own. However, in order to achieve unicorn status, a company’s management team must successfully (and regularly) convince venture capitalists their business is worth investing in.

10 Examples of Successful Unicorn Startups

To help show that unicorns come in all shapes and sizes, here is a list of some of the most well-known, as well as some of the most recent unicorn companies in the world today.

Airbnb (ABNB)

The now publicly traded company provides a travel marketplace for individuals to host guests at their properties or for travelers to find unique accommodations outside of traditional hotels. Founded in 2008, Airbnb actually became a unicorn before the term had ever been used and successfully reached a valuation of $1 billion off a $100 million VC capital raise in 2011.

The company is one of the most famous examples of a startup reaching (and surpassing) unicorn status, with Airbnb currently worth approximately $75 billion in public markets.

Byte Dance

Byte Dance, the parent company of the popular video app TikTok, is a unicorn company currently valued at $353 billion, according to research from Statista.

Byte Dance is a shining example of how a strong network effect and large market size (two characteristics we will touch on later) are common features amongst unicorn companies.

Space X

Elon Musks’ rocket company Space X raised over $1 billion in a two-month period back in 2021, making it one of the fastest-growing unicorns in the world. Today the company has a valuation of around $75 billion, with estimated revenue of $1.6 billion, and has received the backing of some of the biggest private market investors in the world today.

Whether Musk intends to take his space company public remains to be seen. However, a valuation of close to $100 billion would make it the biggest initial public offering in history.

Stripe

Founded over a decade ago in 2010, payment processing company Stripe joined the unicorn club back in 2014 with a valuation of $1.8 billion and has since grown that to $95 billion today. Stripe has become a well-established company within the fintech space and is used by other successful companies such as Amazon and Alibaba.

Coupang (CPNG)

South Korea-based e-commerce firm Coupang is another example of a unicorn that bridged the gap between private unicorn to public entity. More specifically, Coupang is an e-commerce/technology company that raised over $3 billion in 11 rounds of VC funding, eventually listing on the New York Stock Exchange, raising an additional $4.6 billion.

Databricks

When thinking about billion-dollar startups, Databricks is most likely a company investors have never heard of. The software company found value in a specific niche of building automated cluster notebooks and iPython-style notebooks, which quickly caught the eye of other software firms like Microsoft, who were looking for internal process efficiencies.

Databricks is one of the newest unicorns, only achieving this status in 2022. The company now has an estimated $1 billion in revenue with over 4,000 employees worldwide.

Phantom

A closed-source crypto wallet, Phantom achieved its unicorn startup credentials extremely quickly, as the crypto firm was founded only two years ago. Phantom is focused on reimagining the traditional crypto wallet with an easy-to-use interface and guided onboarding process, as well as supporting new experiences like the capability to see NFTs directly in the extension.

Their first VC capital raise amounted to $9 million from popular venture capitalists Andreessen Horowitz, Variant Fund, and Jump Capital, among others. Phantom only became a unicorn as of January 2022.

Veev

Veev’s business model is designed to revolutionize the real estate industry by giving the power of home design back to the individuals buying instead of the development companies building. Their latest round of funding brought in almost $600 million, pushing the company into unicorn territory in late 2022.

Axelar

Canadian company Axelar is another crypto-focused firm that is determined to help blockchain technology and cryptocurrencies operate across platforms in a seamless and trustworthy way.

The company has only just touched unicorn status after raising $35 million in a series B funding round from various venture capitalists, including an executive from another former unicorn company Door Dash (DASH). In 2023, Axelar has an estimated valuation of $1 billion.

Scandit

Scandit is a very rare Swiss-based unicorn startup in the supply chain and logistics space. The company’s innovative solution includes augmented reality (AR) and mobile computer vision to provide scanning capabilities with any application on smart camera-equipped devices.

Although Scandit was founded in 2009, its journey to achieving unicorn status took longer than some other companies. It was not until early 2023 that Scandit reached a valuation of $1.3 billion and officially became a unicorn.

Common Characteristics of Unicorn Startups

As the above list makes clear, companies valued over $1 billion come from a variety of different industries like crypto, logistics, real estate, or travel and successfully achieve these higher valuations over varying periods of time.

However, there are some lasting characteristics that almost every unicorn mentioned above shares in common with each other.

Here’s a list of the most defining elements unicorn companies consistently hold in common with one another:

Large market size

Successful unicorn startups tend to target a large and growing market with significant potential for future growth. Even companies who target niche markets must still ensure they’re operating within an industry that is expecting lasting growth, with a large target market to penetrate year after year.

Strong management team

These startups often have a highly talented and experienced management team with a strong track record of success in their respective industries. The management team is responsible for making important strategic decisions, overseeing daily operations, and steering the company toward growth and profitability. Their experience and expertise are critical in navigating the complexities of a rapidly growing company and achieving unicorn-like success.

Strong network effects

Successful unicorn startups often benefit from strong network effects, where the value of the product or service increases as more users or customers join the platform. This creates a virtuous cycle where more users attract more users, making it difficult for competitors to replicate the same level of value. Examples of companies with strong network effects include social media platforms like Facebook and LinkedIn and ride-sharing platforms like Uber and Lyft.

Disruptive innovation

Successful unicorn startups tend to introduce disruptive innovation that fundamentally changes the way people live, work, or interact with each other. This means they are not simply improving upon existing products or services but are instead creating something entirely new and innovative. Disruptive innovation has the power to create new markets and disrupt existing industries, both of which will inevitably lead to significant growth.

Scalability

Unicorn startups often have a highly scalable business model that allows them to expand and grow their business rapidly. As the company grows, it can add new customers or users at a relatively low cost without sacrificing quality or efficiency. Scalability is often achieved through technology, automation, and streamlined processes and is an instrumental element in reaching a valuation of $1 billion or more.

Product-market fit

Unicorns have a deep understanding of their target market and customer needs and have developed a product or service that surpasses those needs on a regular basis. More specifically, successful startups focus on performing extensive market research, identifying customer pain points, and creating a solution that addresses those pain points in a unique and effective way. This creates a strong connection with their customer base, which is critical in achieving sustained growth.

Agility

Successful unicorn startups are highly agile and can quickly adapt to changes in market conditions and customer needs. They achieve this by pivoting their business strategy, changing their product offering, or adjusting their marketing approach based on new information or feedback. Agility is crucial in a fast-changing business environment, where being ahead of the curve can make all the difference between success and failure.

Culture of innovation

Successful startups tend to foster innovative ideas more efficiently than their competitors, creating a workplace where new ideas are encouraged and failures are viewed as learning opportunities. As a result, employees are empowered to think creatively, take risks, and experiment with new approaches without fear of failure. A culture of innovation can drive continuous improvement, spark new ideas, and ultimately help the company grow its valuation.

Strong brand identity

Successful startups often have a strong brand identity and a passionate user or customer base that drives their growth and success. Companies should ensure their customers feel a strong connection to their brand and are willing to promote it through their own networks. A strong brand identity creates a competitive advantage, increases customer loyalty, and ultimately drives growth and profitability.

Creating Your Own Unicorn Startup

Achieving unicorn status is a challenging and rare feat, but it’s not impossible. With hard work, dedication, and the right approach, you can increase your chances of building a successful business that attracts the eyes of venture capitalists.

While there certainly isn’t a hard and fast formula to creating a unicorn, there are some important variables entrepreneurs can focus on to help increase their chances of success.

Below are the six most important parts of a business that entrepreneurs should turn their attention to when working towards creating a unicorn:

- Identify a gap in the market: One of the key factors that can set your business apart from the competition is identifying a gap in the market. Look for areas where existing solutions are not meeting the needs of customers or where there is room for improvement. Focus on solving a problem or providing a service that no one else is offering.

- Build a strong team: Building a strong and dedicated team is critical to the success of any business. Look for individuals who share your vision and bring complementary skills to the table. Foster a culture of collaboration, communication, and innovation to help your team stay motivated and focused on achieving your goals.

- Create a unique value proposition: A unique value proposition is what sets your business apart from the competition and helps to attract customers. Focus on developing a clear and compelling value proposition that articulates the benefits of your product or service in a way that resonates with your target market.

- Focus on customer experience: Customer experience is critical to building a loyal customer base and driving growth. Make sure that your product or service is easy to use, reliable, and delivers on its promises. Focus on building relationships with your customers and responding quickly to their feedback and concerns.

- Leverage technology: Technology can be a powerful tool in building a successful business. Look for ways to leverage technology to streamline your operations, automate repetitive tasks, and provide customers with a seamless experience. Consider partnering with technology providers or hiring developers to help you build a custom solution that meets your specific needs.

- Stay nimble and adaptable: The business landscape is constantly changing, and it’s important to stay nimble and adaptable in the face of new challenges and opportunities. Keep an eye on emerging trends, be willing to pivot your business strategy if necessary, and always be open to new ideas and perspectives.

By focusing on the list above (and with a little bit of luck), you can increase your chances of building a successful and sustainable business that has the potential to achieve the rapid growth and lasting success required to reach unicorn status.

Chances of Achieving Unicorn Status

A common belief is that achieving unicorn status is an almost impossible feat that only a few entrepreneurs will ever accomplish. This belief is reinforced by research reports like the one from CB Insights, which found that out of the tens of thousands of venture-backed startups that have been founded since 2003, only a tiny fraction – around 0.1% – have gone on to reach unicorn status.

While it’s certainly difficult to build a unicorn, the years leading up to covid-19 showed an explosion of unicorn companies entering the VC scene, with over 1,000 startups reaching unicorn valuations in 2022. This is a stark contrast to the year prior, which only supported 360 unicorns.

What created this exponential increase in billion-dollar companies?

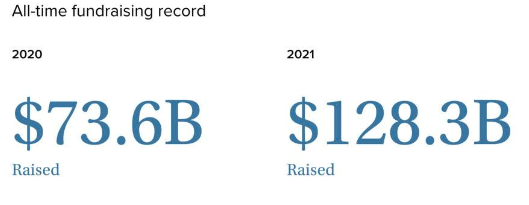

An explosion in venture capital funding is the biggest contributing factor. Throughout the pandemic (and leading up to it), venture capitalists set record-breaking amounts of funding year after year. Low-interest rates and incredible innovation taking place as companies were forced to adapt to operating within a global pandemic led to the rise of innovative tech startups in the VC space.

The point of this analysis is to show reaching unicorn status has become more attainable throughout the years as many investors realize the great potential and ability to generate returns innovative startups possess.

The odds of reaching unicorn-level valuations are still slim. However, catching the eye of various VC investors has never been more accessible and realistic than in today’s technology-centered world.

Achieving unicorn status is not the only measure of success for a business. Many businesses can achieve sustainable growth, profitability, and long-term success without ever reaching unicorn valuations.

Conclusion

Unicorn startups are companies that have achieved a rare and prestigious status in the world of entrepreneurship by reaching a valuation of $1 billion or more. These companies are typically characterized by a large market size, a strong management team, and a scalable business model, among other key features.

While becoming a unicorn is certainly an aspirational goal for many entrepreneurs, it’s important to remember that it is a rare and difficult feat to achieve. The vast majority of startups will never become unicorns, and success in the startup world depends on a variety of factors beyond just valuation.

Nevertheless, the examples of successful unicorn startups such as Airbnb, Stripe, and SpaceX serve as inspiration and proof that it is possible to achieve rapid growth and success through innovation, perseverance, and a strong business strategy.

By focusing on creating value for customers, building a strong team, and leveraging technology and emerging trends, entrepreneurs can increase their chances of building a successful and sustainable business that has the potential to achieve unicorn status (among other measures of success).