To be a successful investor, it takes guts, temperament, and a lot of luck.

But one of the most overlooked keys to successful investing is a well-thought-out portfolio rebalancing strategy.

We all know that it is smart to have a well-diversified portfolio, but for most of us, it isn’t clear what that actually means or how to allocate one effectively.

That is where portfolio rebalancing comes in.

By periodically adjusting the composition of your portfolio, you can ensure that your investments align with your goals and risk tolerance.

Not only that, but it will set you up to properly adapt to changing market conditions, opportunities, and more.

But keep in mind that there are multiple ways to go about it, and it can be difficult to know which one is right for you.

In this article, we will explain a few of the most popular stock allocation strategies and how they can be applied to your specific needs.

Whether you are a seasoned investor or just starting out, it is always valuable to know about the various strategies out there so that you can fulfill your investment goals to the fullest.

What is Portfolio Rebalancing?

Essentially, portfolio rebalancing is the process of managing your asset classes by buying and selling investments to create an optimal investment process that effectively meets your financial goals and risk tolerance.

Most investors use these kinds of strategies to reach a desired asset allocation within a portfolio over time.

This means that you may end up weighing your investment holdings differently depending on what you are looking to accomplish and how the market conditions appear.

The weight of an asset or asset class is simply the percentage of the asset within your portfolio.

For example, you may have 50% in a broad index fund, 20% in bonds, 20% in individual stocks, 5% in cryptocurrencies, and 5% in gold.

However, you may want to consider rebalancing your portfolio if you believe that the market is going to perform differently, such as in a recession.

In that case, you may change the weight of each asset to better suit a slowing economy where you are more likely to experience high market volatility.

Using our previous example, your portfolio risk management strategy may look like this instead: 50% in a broad index fund, 15% in bonds, 15% in individual stocks, 10% in gold, 1% in cryptocurrencies, and 9% in cash.

This is what a chief investment officer does for a living and why they are paid so much if they are successful.

Wondering how we rebalance our portfolio during a down market? Check out this video.

Types of Portfolio Rebalancing Strategies

There are many different types of portfolio rebalancing strategies, including a simple buy-and-hold approach where rebalancing matters less.

However, it is always good to consider what strategies are out there and what investment plan makes the most sense to you.

With that being said, here are six of the most common rebalancing strategies used by investors:

Time-Based Rebalancing

This method of management involves a strategic rebalancing of your investment portfolio at regular intervals, regardless of the market conditions or the performance of the asset class.

The time-based strategy typically means that an investor will select a specific time frame, such as every six months or once a year, to review and rebalance a portfolio.

The goal of this is to maintain a desired portfolio mix and risk exposure regardless of the market conditions.

For example, if we had a classic 60-40 investment portfolio, with an allocation of 60% stocks and 40% bonds, and the stock market experienced a bull run in that year, this would mean that our portfolio became unbalanced as our exposure to stocks increased.

Since we are aiming to maintain a portfolio that has 60% stocks and 40% bonds every year, this would mean that we would sell some of the realized gains on our stocks, at our pre-determined interval (ex. 1 year), to restore our original balance.

As you can see, the time-based strategy is relatively simple to implement and can help you to control risk and your emotions.

However, it may result in missed opportunities or poorer performance, depending on what type of market we are in.

Therefore, this strategy is best suited for passive investors wanting little to do with the management of their portfolio.

If you want to learn more about realized and unrealized gains and when it makes sense to sell assets, check out this article.

Percentage-Based Rebalancing

Removing time from the equation, the percentage-based strategy prioritizes a desired percentage allocated to every asset.

This is achieved by periodically adjusting the weights of assets depending on your predetermined allocation strategy or based on the specific market conditions of that period.

The frequency of rebalancing will vary based on your investment goals, so it is important to figure out what makes sense to you.

In some instances, it may even be reasonable to avoid rebalancing the weighting of assets altogether, even if a single stock or asset exceeds its predetermined weight.

Legendary investor Peter Lynch refers to this as. “watering the weeds and Cutting the flowers.”

In other words, ask yourself, “why would it make sense to trim the weight of my best-performing assets if they have the potential to keep over performing?”

Of course, there is also the possibility that the stock has reached its peak and may come tumbling down.

In that instance, the percentage-based strategy is a great hedge because it helps avoid overexposure to an asset and reduces the decision-making down to a single target number.

That way, you will avoid the temptation of chasing overhyped stocks or sectors and, instead, focus on a sound long-term investment strategy.

All-in-all, this strategy is best suited for those investors who prefer to be a little more active because it requires them to monitor their asset allocation more frequently.

Threshold-Based Rebalancing

The threshold-based strategy is a method similar to the percentage-based strategy, though it differs in one particular way.

Instead of simply rebalancing your portfolio when it goes beyond the predetermined weight of an asset, this portfolio management strategy uses a certain threshold, say, plus or minus 5% of your desired weight.

So, in the event that one of your stocks is underperforming, thus dragging down its percentage of the portfolio, the right plan of action would be to hold off from increasing your stake, or reducing your exposure to other assets, unless it exceeded the threshold of 5%.

The advantage of using a strategy like this is that it allows for more flexibility in the management of the portfolio.

Also, it avoids the need to frequently rebalance your stocks, thus helping you avoid unnecessary trading costs or taxation.

That being said, it is still smart to actively monitor your portfolio when using this strategy because you may end up facing larger deviations from the target allocation if you set the threshold too high or fail to react.

Overall, this strategy is most useful to those active investors who prefer greater flexibility in their investment approach.

Hybrid Rebalancing

In most situations, there isn’t one particular strategy that works best for investors.

Therefore, many prefer to use a combination of portfolio management strategies to effectively meet their investment objectives.

The hybrid strategy achieves just that as it is a combination of percentage-based and threshold-based capital allocation strategies.

With this strategy, an investor will determine a target allocation for each asset class in the portfolio, as well as a deviation threshold.

Then, an investor will rebalance the portfolio if the asset deviates from the specified threshold.

The advantage of the hybrid strategy is that you get the best of both worlds as an investor because not only will you have greater flexibility over your portfolio, but you will also maintain a disciplined investment approach.

If you are an investor who is still figuring out what is the best strategy for you, the hybrid method will work perfectly for you as you learn to tweak your investments.

Constant-Mix Rebalancing

For those investors seeking to be even more active with their investment portfolios, the constant-mix rebalancing strategy may be perfect for you.

Essentially, this portfolio management method is the percentage-based strategy on steroids, as you will be continuously adjusting the weights of assets in a portfolio so that they align with your desired percentage allocation.

Under this approach, you will set up a fixed target allocation, typically expressed as a percentage of the portfolio, then constantly monitor your positions to ensure that they never deviate from your target.

Though this is certainly a disciplined investment strategy, you should be cautious when using it because it may end up costing you more than a more passive approach if you begin to trade frequently.

However, with stock brokerages trending to cheaper and even free-commission trading, this approach is more feasible to the common investor than it once was.

Regardless, it is always wise to keep taxes and transaction fees in mind because they may end up hurting your returns if you don’t.

At its most basic level, the more trades you make, the more it will cost you.

Therefore, a less active approach is often recommended.

To learn more about why investing long-term is worth your while, check out this article.

Opportunistic Rebalancing

Saving the best for last, or at least my favorite, is the opportunistic portfolio rebalancing strategy.

This method of maintaining a target asset allocation is solely based on the opportunities that exist in the market.

Since the stock market, or any market for that matter, is only somewhat efficient, this means that from time to time, there are moments when an asset can be undervalued or overvalued, and it is best to act accordingly.

For example, you may determine that a stock is trading significantly below its intrinsic value; thus, you are planning to invest a certain portion of your portfolio.

If you were to use one of the portfolio management strategies mentioned earlier, you may end up limiting your ability to capitalize on this investment opportunity because you have put a cap or threshold on the amount you can invest.

Sure, this approach may protect you from overexposing yourself too much to one particular asset, but it may end up hurting your returns as well if you prevent yourself from capitalizing on it.

On the other hand, why not keep buying until the story changes from undervalued to overvalued?

That way, you can take full advantage of the opportunity without increasing your risk.

Of course, there is one obvious caveat to this method.

It requires you to know how to value companies and spot undervalued opportunities.

Therefore, if you are unaware of how to do this effectively, it is probably best that you stick with one of the more disciplined approaches.

To learn how to spot overvalued and undervalued companies, check out this article.

How Often Should You Rebalance Your Portfolio?

There is no perfect answer to this question.

Instead, you should determine a rebalancing process that works best for you.

Generally speaking, it is recommended that you monitor or rebalance your portfolio at least once every six months or annually to ensure that it remains aligned with your investment objectives.

In doing so, you will help mitigate your risk and reduce the impact of underperforming or overexposed stocks.

Additionally, you may want to increase the frequency with which you rebalance your portfolio if you plan on being more aggressive and have a higher tolerance for risk.

This is in contrast to a more passive investor with a lower-risk tolerance, who may choose to rebalance their portfolio less often to maintain a more stable and predictable portfolio.

Regardless, always keep in mind that the more you trade, the more likely you are to pay taxes.

Therefore, if your goal is to avoid costs and make the most of your investment returns, it is probably best that you steer clear of any unnecessary trades or rebalancing you may be thinking of doing.

All-in-all, it really comes down to your goals as an investor and what you are hoping to accomplish.

As you gain experience, this will become clearer over time.

How to Rebalance Your Portfolio in 2023

So far, 2023 has been filled with uncertainty and you may be wondering how to rebalance your portfolio.

In one corner, you have the bears arguing that a recession and a stock market crash are coming.

And on the other hand, you have the bulls screaming that you should buy up everything you can get your paws on.

Since it is quite unclear what will happen, your best bet is to try and build a portfolio that addresses both sides.

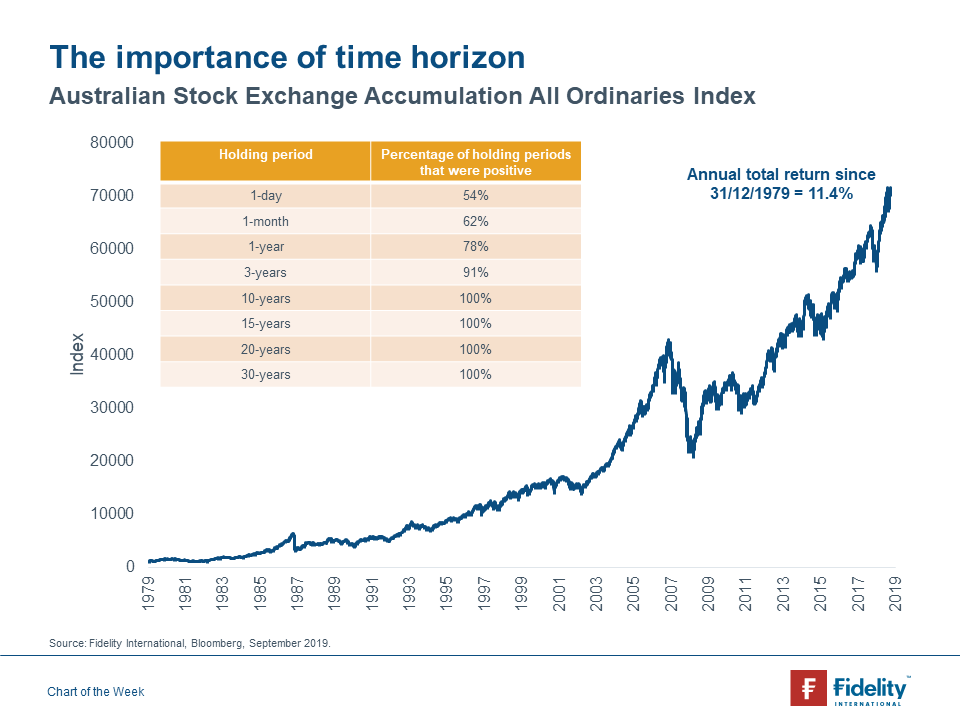

There is a common saying amongst investors that “time in the market is better than timing the market,” and this is true.

You never want to be in a situation where you are completely out of the market, even if you are expecting the market to crash, because in the event that the market rallies, you will completely miss your opportunity.

That being said, it is also smart to allocate a small portion of your portfolio in cash or another liquid asset like short-term treasury bonds.

That way, you can scoop up any undervalued stocks you might find without sacrificing your existing investments.

In general, you never want to try and time the market because it is nearly impossible to do so.

Therefore, it is always smart to consider every possible outcome and to try and plan accordingly.

To learn about how we invest in growth stocks during a recession, check out this article.

Final Thoughts

Determining a portfolio rebalancing strategy is a good idea for any investor planning to manage their own assets.

In doing so, you will create a more disciplined approach that helps guide your investment philosophy and manages your emotions.

Since there is no perfect portfolio management strategy out there, you should test out multiple methods to figure out which one works best for you.

If you are a more conservative investor, you may want to consider something like the time-based strategy.

Alternatively, if you are a more aggressive investor, the constant-mix rebalancing strategy could be best.

No matter what you decide, do something that feels comfortable and easily attainable.

The last thing you want is to be overwhelmed because you are unsure of whether you are doing it properly or not, especially when it comes to your money.

Overall, a sound portfolio strategy may be the difference between you succeeding or failing your investment goals, so choose wisely.