Investing is one the most powerful tools for creating wealth and securing your financial future.

However, it can also be quite confusing and overwhelming when you’re starting, making it difficult to know which strategy is best for you.

One of the best ways to overcome this is by finding and building a business relationship with an investing mentor, who can help guide you through your journey by sharing knowledge and experience, thus saving you valuable time and money.

In doing so, you can avoid costly mistakes that most young investors make while also discovering new ideas you may otherwise have never found.

In this article, we will explore what a mentor for investing is, their role, the benefits of having one, the characteristics of a good mentor, and how to find a someone for mentoring yourself.

So, with that being said, let’s dive in and help you find an investing mentor of your own.

What is a Mentor for Investing?

We all have mentors, but what exactly is an investing mentor?

An investing mentor is a trusted and experienced individual who can guide you through the process of investing and help you achieve your financial goals.

Many mentors provide you with valuable insights, advice, and resources that can help you make informed investment decisions and navigate the ups and downs of the market.

Through their many years of dealing with uncertainty in the financial markets, mentoring is a valuable resource that will teach you what to avoid and whether your current investments are a good choice.

Investing mentors can cover a broad range of specialties, including stock investors, real estate investors, alternative investment managers, and more.

Before choosing an investing mentor, decide what type of investment strategy best suits your needs.

That way, you can make the most of your opportunities, though, to be fair, it doesn’t hurt to have multiple mentors at once.

What is the Role of an Investing Mentor?

You can think of an investing mentor as a coach or teacher who supports and guides you on your investing journey.

Their primary role is to provide one on one mentorship to help you navigate the complex world of investing.

This means offering insights into investment strategies and opportunities, helping you develop a personalized investment plan, and ensuring that you stay disciplined and focused no matter the circumstances.

One of the best ways to take advantage of an investing mentor is by asking them to evaluate your current investment portfolio and assets.

Not only will this be hugely beneficial since you’ll learn whether you’re on the right track, but it will also provide your mentor with insights into your philosophy and current mindset.

The more transparent you are, the better off your experience will be since they’ll be able to figure out a strategy that works for you.

Ultimately, when it comes to investing mentors, don’t hesitate to ask as many questions as possible. Their role is to help teach and guide you, and the best way to do that is by embracing and questioning everything that they share.

Benefits of Having an Investing Mentor

Having an investing mentor can provide a multitude of benefits.

Some of the most significant benefits include:

1. Learning from Experience

For most of us, the main reason why we might seek out an investing mentor is because they have spent an entire career in the financial markets with many important lessons learned.

Experience is one of the most valuable assets an investor can have since it teaches you things about yourself, your assets, and insights on investing that you may not have otherwise.

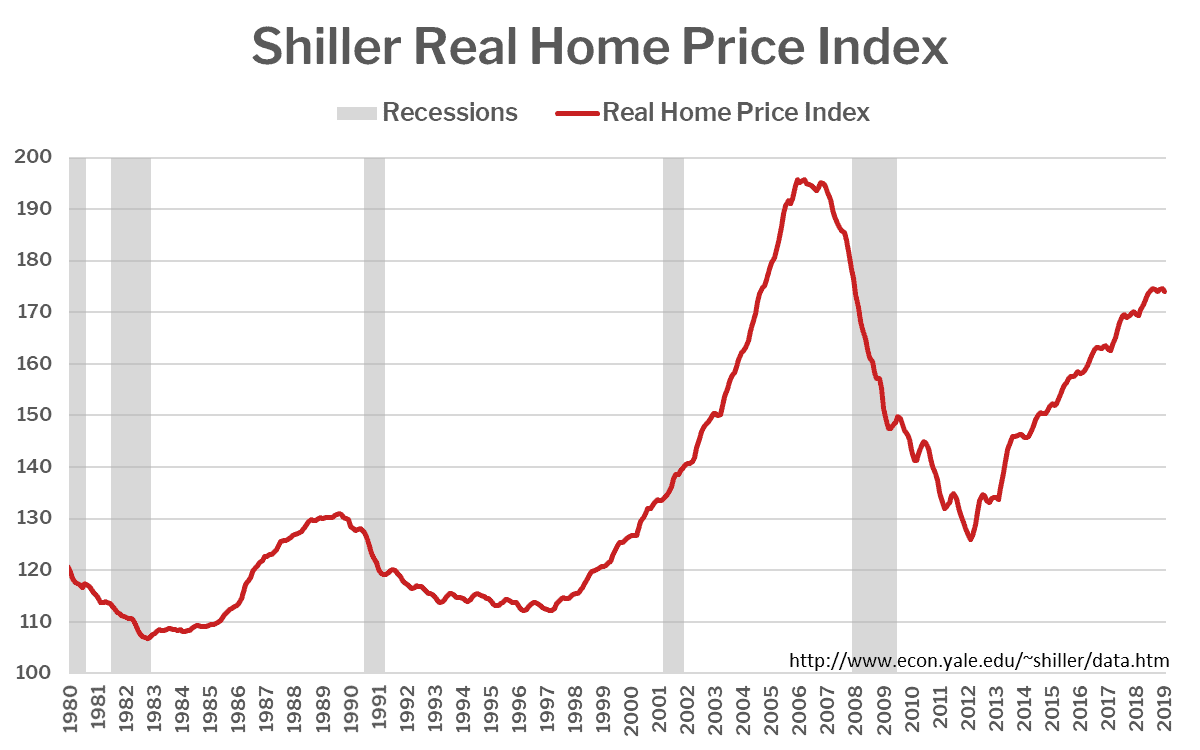

For example, a real estate investor who experienced investing in the real estate industry during the 2007-2008 financial crisis would have some of the best insights into the market.

Regardless of whether their real estate business thrived or failed during that period, both perspectives are immensely valuable since you can learn what works and what to avoid during turbulent times.

If you were seeking real estate investing mentors who achieved success during the Great Recession, you might ask them what opportunities offered them the most value or, perhaps, what they would have done differently if they could go back.

On the other hand, if you were speaking with real estate mentors that struggled, you might ask, what led you to make your investments, or how did you react after making a mistake?

In both instances, you gain invaluable insight that will help you better prepare for the next market crash.

What’s more, the best real estate mentor will show you how to take advantage when that opportunity arrives.

Overall, when looking for a potential mentor, seek out those with experience investing in both difficult and prosperous environments. The more chaos they’ve navigated, the better.

2. Access to Insights and Strategies

Another benefit to having a mentor is that you gain access to their insights and strategies.

Since they have been playing the investing game for some time, they have likely built their own models of due diligence and principles for success.

If they are willing to share these insights with you, you’ll be at a significant advantage over other investors with similar experiences.

Some of the key insights you’ll learn from a mentor are what assets to buy, when to buy them, and how long you should own them. Not only that, but they may be able to provide you with unique data, information, or connections that will help elevate your understanding of investing even further.

In general, the more information and insights you have, the greater advantage you’ll possess.

Personalized Advice

Since a mentor typically underwent the same experience you are currently going through, at some point in their life, they may be able to offer you personalized advice that helps cater to your needs and aspirations.

As mentioned earlier, the more information you are willing to share, the better understanding a mentor will have about what you are dealing with.

In return, they’ll provide advice that best suits your investment objectives, risk tolerance, and financial situation.

Ultimately, if you create an investment strategy you believe in, it will be easier to stay committed and see it through until the end.

Remember, investing is for the long run. If you want to make the most of it, you need to build something that will benefit you forever, not just for the next couple of years.

Characteristics of a Good Investing Mentor

Not all mentors are created equal.

To find a good investing mentor, look for the following characteristics:

Experienced Investor

As we mentioned, experience is everything when it comes to investing.

It’s one thing to read about stock market crashes and another thing to experience it yourself.

Investing is filled with emotion; if you haven’t overcome some of the most challenging circumstances yet, it’s difficult to know how you will react when all hell breaks loose.

Therefore, seeking out a mentor who has managed to conquer their emotions during the toughest of times is someone worth speaking to and learning from.

A Good Listener

While hearing advice is invaluable, finding someone willing to listen to your struggles and experiences is also beneficial.

That is because it can sometimes be difficult to resonate with another person’s experiences unless you have experienced them yourself.

Having a mentor willing to listen and ask questions not only demonstrates mutual respect and interest in your success, it also shows that they are making an effort to try and understand your situation better.

In doing so, your experience will benefit greatly since your mentor relationship will be more catered to you, rather than being entirely based on someone else’s experiences alone.

Are They a Good Communicators?

Just as it is valuable for your mentor to be a good listener, it is also important that they can communicate well.

Find someone who can explain complex investing topics in simple terms that you can easily understand.

Ultimately your objective with a mentor is to soak as much information as you can.

If you have a teacher who speaks financial jargon without explaining what it means, you may end up feeling discouraged and overwhelmed.

Therefore, it’s often best that you learn from someone who is patient and willing to teach things slowly and with precision so that you can make the most of it.

Are They the Right Fit?

Lastly, your mentor should be someone who you feel comfortable working with and enjoy being around.

They should share your values and goals and be willing to work with you on a personal level, even if that means pushing you beyond your comfort zone.

At the same time, you should be in a good state of mind and willing to put in the effort.

Investing is grueling and sometimes tedious, yet if you are willing to make the sacrifice, your growth can be astronomical.

How to Find a Mentor for Investing

Now that we’ve uncovered the benefits and characteristics of a good investing mentor, let’s determine a few methods for finding a mentor for investing.

Networking Events

Networking events are an excellent way to meet new investors and possibly a mentor.

With so many like-minded people in the same place, there is no better opportunity to pick the brains of highly successful people.

Some of the most popular investor networking events include Deal Night, Berkshire Hathaway’s Annual Shareholder Meeting, and the Startup Grind Global Conference; it is also worthwhile checking out any local networking events near you.

When attending one of these events, don’t hesitate to introduce yourself to as many investors as possible.

At the end of the day, your goal is to find people who will help guide you toward financial independence and investment success.

Mentorship Programs

Another great strategy is to attend various mentorship programs catered towards investors.

Whether free or paid mentorship programs, these programs are beneficial in two ways given that you’ll have a chance to meet fellow investors, who are likely at the same stage as you, as well as being taught many of the insights directly from the people running the program.

While they often come at a cost, the investment is more than worth it since you’ll gain valuable guidance, experience, and connections while attending the program.

If you’re looking for an investing mentorship program to attend, check out Phil Town’s Rule #1 Virtual Investing Workshop, which provides you with everything you need to begin your investing journey.

As for a real estate mentorship program, check out FortuneBuilders Mastery Program, though it doesn’t hurt to attend local real estate investing mentorship programs.

Social Media Platforms

If you prefer a more indirect setting, social media is another effective method for meeting mentors.

Whether it’s LinkedIn, Reddit, Twitter, CEO.CA, or Blossom Social, all of these platforms host business or investing-specific content, meaning that all you need to do is sign up and start networking.

By engaging in conversation on these social media sites, you’ll gain a plethora of knowledge from a variety of people.

In some ways, this can be more beneficial than seeking a mentor elsewhere since you can do so in a comfortable setting where you’re less likely to be overwhelmed by everyone who is a part of the community.

What’s more, social media is also one of the most cost-effective strategies, given that most platforms are free to join.

Books, Podcasts, and YouTube

Though you may not be communicating with anyone directly while using these resources, books, podcasts, and YouTube are one of the best to learn about investing.

By tapping into these assets, you’ll access some of the brightest minds in the field, who put their thoughts to paper and guide you through their journey to financial freedom.

A few of our favorite books are Gautam Baid’s “The Joys of Compounding”, Mohnish Pabrai’s “The Dhando Investor”, and Robert Hagstrom’s “The Warren Buffett Way”.

As for podcasts, we provided a list of the best investment podcasts to listen to.

Similarly, we’ve also compiled a list of the best investing YouTube channels to subscribe to.

And while you’re at it, don’t hesitate to check out Our YouTube Channel as well!

Final Word

Finding an investing mentor is an excellent way to overcome the confusion and overwhelm that may arise when starting your investing journey.

Investing mentors are experienced and trusted individuals who can guide you through the process, providing valuable insights, advice, and resources that can help you make informed investment decisions and navigate the ups and downs of the market.

Having an investing mentor can provide a multitude of benefits, including learning from experience, access to insights and strategies, and personalized advice.

To find the right mentor for you, you should determine what type of investment strategy best suits your needs, seek out potential mentors with experience investing in difficult environments, and be transparent about your philosophy and current mindset.

Ultimately, with the help of an investment mentor, you can avoid costly mistakes and discover new opportunities that you may otherwise have never found, leading to a better chance of achieving your financial goals.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Verses AI stock and are compensated by Verses for Investor Relations Services, amounting to eighty-nine thousand seven hundred sixty dollars. Edge Investments and its owners reserve the right to buy and sell shares in Verses AI without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright ©️ 2023 Edge Investments, All rights reserved.