Warren Buffett is undoubtedly the greatest investor of all time.

Since fully acquiring Berkshire Hathaway (BRK-B), a struggling textile company, the Oracle of Omaha has achieved a compound annual return of 19.8% or a total return of 3,787,464% (since 1965).

This compares to the measly 9.9% annual return and 24,708% total return of the S&P 500 in the same period.

In other words, if you had invested $10,000 into Berkshire when Buffett took over, your investment would now be worth a staggering $378,746,400!

To achieve such unprecedented returns, Buffett developed an investment strategy that prioritizes finding wonderful businesses, buying them at a discount, and owning them for a long time.

This simple approach makes it nearly impossible to lose, yet most investors fail to understand it.

In this article, we’ll explain how you can invest like Warren Buffett so that you, too, can achieve abnormal investment returns of your own.

If you aim to amass a billion-dollar fortune, there may be no more effective investment strategy out there.

Who is Warren Buffett?

For those who may have heard his name but not his story, Warren Buffett is a multi-billionaire investor who obtained the bulk of his wealth owning and operating Berkshire Hathaway, a large multinational corporation.

Buffett’s life as an entrepreneur began early on as he pursued multiple endeavors, including selling bottles of Coke, delivering papers, and setting up pinball machines, among others.

By the time he was 14, he had amassed a net worth of $5,000 or about $53,000 today.

While Buffett’s early feats are impressive, what truly transcended him was his time spent as an understudy of Benjamin Graham, the father of value investing.

After graduating from the University of Nebraska in 1949, Buffett studied economics at Columbia Business School, where Graham and fellow finance professor David Dodd taught.

During that time, Buffett refined his skills as a value investor, learning how to effectively evaluate businesses and spot undervalued opportunities using Graham and Dodd’s investment strategy.

Not long after graduating, Buffett convinced Graham to hire him as an analyst at Graham-Newman Corporation, Benjamin Graham’s investment partnership.

There, Buffett applied his newfound skills directly, evaluating businesses and computing their liquidation values to help Graham make investment decisions.

Then, in 1956, Buffett ventured out and began his own investment partnership that would lay the foundation for his legacy and future success.

In those early years, Buffett applied a Graham-like investment strategy, buying up struggling businesses that were selling below their liquidation value–the value of the business after all its liabilities are paid for.

This cigar butt investment approach worked well for quite some time. However, things began to change when Buffett fully acquired the fledgling textile company Berkshire Hathaway.

While Berkshire was cheap based on Graham’s investment principles, the business was struggling to turn a profit, and its long-term outlook was bleak.

But, rather than selling the crumbling company, CEO Warren Buffett opted to hold on and squeeze out whatever cash he could muster in order to acquire more promising businesses.

It was from this decision that Berkshire Hathaway, under Buffett, was reborn.

From 1965 onward, Buffett and his long-time business partner Charlie Munger built Berkshire Hathaway’s portfolio into an impenetrable compounding machine.

To this day, Berkshire continues to generate superior returns, despite trading at a remarkable $742 billion market cap.

And all it took was a few investments into wonderful companies with durable competitive advantages at a fair price.

With that being said, let’s explore how Warren Buffett invests so that you may achieve investing success of your own.

What is Warren Buffett’s Investment Strategy?

Warren Buffett’s investing style is distinct yet simple, focused solely on buying great businesses for a reasonable price and holding them for the long term.

This investment strategy has enabled him and Berkshire Hathaway to achieve a compound annual return of 19.8% for nearly six decades.

Here is a complete breakdown of Warren Buffett’s investment principles:

1. All Investing is Value Investing

“Price is what you pay. Value is what you get.” – Warren Buffett

As a student of Ben Graham, Warren Buffett is naturally a believer in value investing, which involves seeking out undervalued businesses and investing in them until their long-term intrinsic value is realized.

For a stock to be considered undervalued, there must be a discrepancy between what a business is worth and what the market is willing to pay.

This often occurs when a business runs into short-term trouble or investor sentiment changes for the worse.

When this happens, a company’s stock tends to sink as investors panic on the way out.

However, if the business is fundamentally healthy and growing organically, then it is a worthwhile investment, regardless of how the stock behaves in the short run.

This stance is the essence of Warren Buffett’s investment philosophy.

2. Focus on the Fundamentals

“I don’t look to jump over 7-foot bars; I look around for 1-foot bars that I can step over.” – Warren Buffett

To determine whether a business is undervalued or not, one must know what it is worth.

This is achieved by performing a Discounted Cash Flow Analysis which projects a company’s future cash flows and discounts them back to present value.

But don’t get too hasty.

Before one can value a stock, one must understand how the business makes money, plans to grow it, and what differentiates it from the competition.

Buffett considers these fundamental questions and more whenever he evaluates a potential investment.

In doing so, he gains a clearer picture of how the business will perform and what it takes to bring it down.

Ultimately, as investors, the more we know about a company, the less risks we face since we understand its strengths and weaknesses.

On the flip side, if it is too difficult to understand, don’t hesitate to move on and find a better company.

Heck, even Buffett says “no” to approximately 99% of the companies he comes across.

3. Avoid Speculation at All Costs

“The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator’s primary interest lies in anticipating and profiting from market fluctuations. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices.” – Benjamin Graham

Building on the last point, Buffett is an investor, not a speculator.

This means that he could care less about a stock’s price, its technicals, market cap, etc.

Instead, he focuses on finding fundamentally strong businesses and acts as if he owns the company entirely.

With this mindset, he never takes unnecessary risks and only makes investments when the upside potential is painfully obvious.

Why gamble your money when you can be nearly 100% certain an investment will pan out?

As Buffett once said, “Rule No. 1 Never lose money. Rule No. 2: Never forget rule No. 1.” The most effective way to achieve this is by purchasing great businesses at a discounted price.

4. Find Managers Who Put Shareholders First

Managers play a critical role in the long-term success of a company.

However, it is quite difficult to tell a CEO’s intentions, especially when you don’t have access to them directly.

To overcome this, Warren Buffett seeks out managers who treat the business as if it was the only asset their family could own for 100 years.

These types of CEOs are motivated by more than just money as they hope to build a business that sustains itself for generations to come.

Moreover, if a CEO treats their shareholders like family, they are more likely to be transparent and conscientious of their decisions because they have lasting effects on everyone.

While it is quite difficult to know when a business has a CEO like this, there are a few signs to watch out for.

For one, look for CEOs who are realistic, accountable, and overdeliver on their promises (listen to quarterly calls and read annual reports).

Two, seek out those whose compensation is based on the success of the business, not the stock price.

Three, invest in those who consistently generate a high ROIC (>10% per year) because it demonstrates an ability to make smart capital allocation decisions.

If you find CEOs with these three characteristics, you have likely found your leader.

5. Buy With a Margin of Safety

“If you buy stock with a sufficient margin of safety, the probability is with you.” – Li Lu

While it is possible to determine what a business is intrinsically worth, the reality is that the market is unpredictable and humans are imperfect, making it difficult to be 100% certain.

To protect himself from this uncertainty, Warren Buffett applies a margin of safety when valuing a business. The MOS is a discount (i.e. 20%, 30%, 50%, etc.) on a business’s intrinsic value that helps mitigate human misjudgment and unforeseen risks.

For example, if you believe a business’s intrinsic value is worth $1 billion, you may apply a 50% MOS to “prevent” you from buying shares unless the company falls below a $500 million market cap.

Not only will protect you from uncertainty, but it also improves your return potential given the massive discount on your purchase price.

In the end, it doesn’t hurt to have some extra cushions in case things go awry. Plus, if Warren Buffett needs a MOS, you probably do too.

6. Long-Term Perspective

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” – Warren Buffett

Financial markets can stay irrational much longer than one thinks.

Therefore, rather than trying to predict how a stock will perform in the next year, focus on owning businesses for the long term.

Most often the case, a business will realize its true potential eventually, as long as its fundamentals remain intact and management continues to put shareholders first.

Warren Buffett applies this principle better than anyone as he has owned stocks like Coca-Cola for more than 30 years.

His rationale is that Coke continues to provide value for stakeholders and is unlikely to be disrupted by the competition due to its strong brand, economies of scale, pricing power, and loyal consumer base.

All these factors provide him the confidence that Coca-Cola will keep compounding in the future, and thus he isn’t worried about selling or trying to time the market.

Instead, he continues to buy shares in great businesses like this when they are trading at a discount, and otherwise holds, as long as the company’s story holds true.

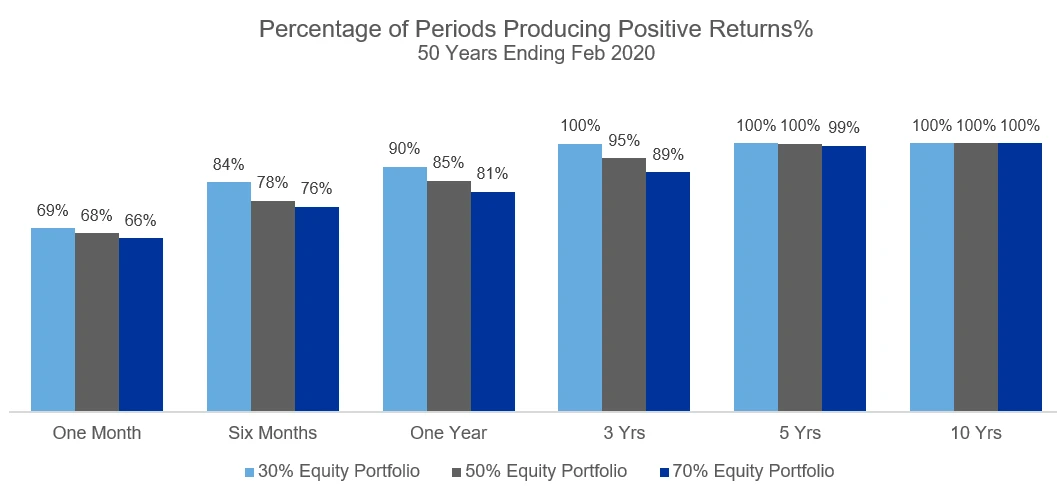

While some achieve success buying and selling frequently, most are better off buying and holding like the most successful investor of all time.

7. Concentration is Key

“The whole secret of investment is to find places where it’s safe and wise to non-diversify. It’s just that simple. Diversification is for the know-nothing investor; it’s not for the professional.” – Charlie Munger

It is often argued that diversification is key to successful investing given that it limits volatility and prevents any one particular business from sinking the whole ship.

However, diversification also has its disadvantages.

For one, by diversifying your portfolio, you inevitably end up investing in poorer businesses (either through indexes or individual stocks), as opposed to just sticking with your strongest bets.

In doing so, you limit your upside potential as these under-performers drag down the rest of your portfolio.

Though some investors are comfortable with this sacrifice as it prevents overexposure, it really doesn’t make much sense logically given that the risks associated with your strongest bets are lower than these secondary picks.

In other words, why would you not buy more of the company with 10x potential and a 10% chance of failure, than spreading your bets in companies with 2x potential and a greater chance of failure?

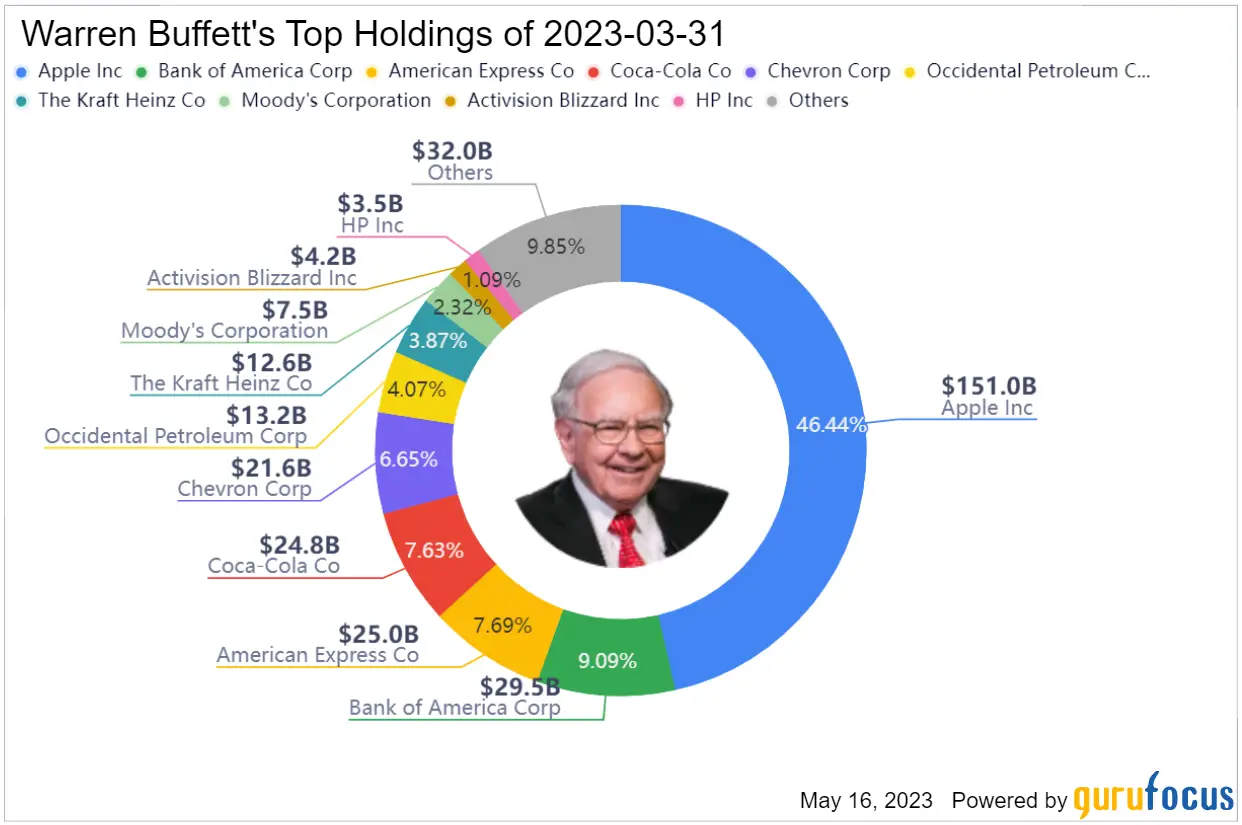

To demonstrate this, Berkshire Hathaway’s holdings provide a glimpse into how concentration can work wonders for your investment portfolio.

While the company owns shares in more than 50 businesses, its top seven holdings make up 80.3% of the portfolio, with Apple comprising 46.6% alone.

Based on this, it is clear that Buffett is comfortable doubling and tripling down on his strongest bets despite running a $742 billion corporation with millions of stakeholders depending on him.

Don’t get me wrong, diversification is a valuable tool for most investors who don’t have the time research individual stocks.

However, if you want to consistently beat the market and invest like Buffett, the best way to do it is by investing in the best businesses, and nothing else.

What are the Benefits of Learning from Warren Buffett’s Investing?

There is a reason why Warren Buffett’s investment strategy works so well, and no, it was not by luck.

But in case you don’t believe me or Berkshire’s annual returns, you may be surprised to learn that many of the best investors follow the same simple strategy.

That is because investing in fundamentally sound and financially healthy businesses at a discount works.

Not only do you minimize your downside risks when you buy cheap, but you also maximize your upside potential since you benefit from the undervaluation of an amazing, fast-growing company.

As long as humans continue investing, there will be opportunities to generate superior returns like Buffett.

You just have to be willing to go against the grain and put in the work. If you do, it is likely you find abnormal investment success of your own.

Final Thoughts: How to Invest Like Warren Buffett

By applying the seven investing principles mentioned above, an investor will increase their chances of beating the market.

While Buffett is the prime example, there have been countless investors who have used these principles to achieve the same.

However, be careful.

It is one thing to study and another to apply it.

If your goal is to invest like Warren Buffett, then you must be willing to put in the work.

That means figuring out what makes a business great, how to value it, and having the guts to “be greedy when others are fearful.”

It is not meant to be easy, but the rewards are endless.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.