CNBC Investing Club with Jim Cramer | CNBC

Few names carry as much weight as Jim Cramer. A renowned stock market expert, best-selling author, and the host of CNBC’s Mad Money, Cramer has amassed a massive following of investors seeking his guidance in navigating the complexities of the stock market. Among the many ventures associated with this financial guru is the Jim Cramer Investing Club, a private membership platform that promises exclusive insights and personalized investment strategies.

For those eager to unlock the potential of their portfolios, the thought of joining Cramer’s Investing Club can be tantalizing. However, with countless investment platforms vying for attention, it’s important to evaluate the credibility and effectiveness of such ventures before committing your hard-earned money. In this comprehensive review, we aim to reach the heart of the Jim Cramer Investing Club, shedding light on its features, performance, and overall value proposition.

Introduction to the Jim Cramer Investing Club

The Jim Cramer Investing Club is the brainchild of Jim Cramer, a prominent figure in the world of finance and investing. Widely recognized as the host of CNBC’s Mad Money and a former hedge fund manager, Cramer’s expertise and passionate approach to financial analysis have garnered him a massive following of investors seeking his guidance.

The club was founded with the aim of democratizing investing and providing individual investors with exclusive access to Cramer’s proven investment strategies and market insights. Through a variety of membership tiers, the club caters to investors of all levels, offering a range of benefits, educational resources, and a supportive community.

At its core, the Jim Cramer Investing Club is dedicated to empowering its members with the knowledge and tools needed to navigate the complexities of the stock market successfully. By tapping into Cramer’s extensive experience and analysis, investors gain valuable insights to make quick decisions with the intent of enhancing their investment portfolios.

Who is Jim Cramer? A Brief Background

Jim Cramer’s guide to investing: Never buy all at once | CNBC

Jim Cramer, a prominent figure in the financial world, boasts an impressive background that has made him a household name in the realm of investing. Born on February 10, 1955, in Wyndmoor, Pennsylvania, Cramer’s journey to becoming a renowned financial expert began with his early passion for the stock market.

Cramer attended Harvard University, where he honed his analytical skills and nurtured his interest in the financial markets. After graduating in 1977 with a Bachelor’s degree in government, he swiftly dove into the world of finance, securing a position at Goldman Sachs as a stockbroker.

It was during this tenure at Goldman Sachs that Cramer’s passion for stock trading truly ignited. He eventually transitioned to the hedge fund world and co-founded Cramer & Co., later renamed Cramer, Berkowitz & Co., where he managed money for high-net-worth clients.

Cramer’s reputation as a savvy investor continued to grow, leading to his successful career on Wall Street. He became known for his bold and outspoken style, always ready to offer his candid opinions on various growth stocks and market trends. His approach to financial analysis blended fundamental research with an understanding of market psychology and trends, setting him apart from more conventional investors.

In 2005, Cramer achieved mainstream fame with the debut of his popular TV show, Mad Money, on CNBC. The show’s format allowed Cramer to engage directly with viewers, offering investment advice, market insights, analysis of individual stocks, and tips on managing a stock portfolio in his characteristic energetic manner. Mad Money’s blend of financial education and entertainment resonated with audiences and catapulted Cramer to widespread recognition.

Beyond his TV presence, Jim Cramer is also a prolific author, having written several best-selling books on investing and personal finance. His publications include “Confessions of a Street Addict,” “Jim Cramer’s Real Money: Sane Investing in an Insane World,” and “Get Rich Carefully,” among others. These books further solidified his role as a prominent financial educator.

In addition to his work on Mad Money, Cramer remains actively engaged in the financial media landscape. He contributes regularly to various financial publications, including TheStreet, which he co-founded. His insights and market commentaries reach a wide audience, making him one of the most influential voices in the financial media.

Through his decades-long career, Jim Cramer has earned respect for his dedication to educating individual investors and democratizing access to financial knowledge. The Jim Cramer Investing Club stands as a testament to his commitment to empowering others with the tools and insights necessary to navigate the complexities of the stock market confidently.

The Philosophy Behind the Jim Cramer Investing Club

At the core of the Jim Cramer Investing Club lies a well-defined investment philosophy shaped by Jim Cramer’s extensive experience and unique approach to the stock market. Cramer’s philosophy embodies a combination of fundamental analysis, technical expertise, and an understanding of investor psychology, making it distinct from traditional investment approaches.

Fundamentals and Growth Potential

Central to Cramer’s investment philosophy is a focus on fundamental analysis. He believes that understanding a company’s financial health, business model, competitive advantage, and growth prospects are essential when evaluating potential investment opportunities. By scrutinizing a company’s balance sheet, income statement, and cash flow, Cramer aims to identify fundamentally sound businesses with strong growth potential.

A Long-Term Outlook

Cramer emphasizes the significance of taking a long-term view when investing. Rather than succumbing to short-term market fluctuations, he advocates for patience and discipline, encouraging investors to stay committed to their chosen investments. By adopting a long-term perspective, Cramer seeks to avoid knee-jerk reactions to market volatility and instead focuses on the underlying strength of the companies in which he invests.

Technical Analysis and Market Timing

While fundamental analysis serves as the foundation of Cramer’s approach, he also incorporates technical analysis into his decision-making process. Technical analysis involves studying past market data and price movements to identify patterns and trends that may influence future price movements. By combining technical indicators with fundamental insights, Cramer aims to make well-timed entry and exit points for his investment positions.

Risk Management and Diversification

Cramer places a strong emphasis on risk management. He advises investors to diversify their portfolios across different industries and asset classes, reducing exposure to the risks associated with individual stocks or sectors.

Staying Informed and Adapting

In the fast-paced world of finance, Cramer’s philosophy acknowledges the need to stay informed and adapt to changing market conditions. His continuous research and monitoring of market trends enable him to adjust his investment strategies as needed to capitalize on emerging opportunities or navigate potential risks.

Education and Investor Empowerment

Central to Cramer’s overarching philosophy is the belief that financial education empowers investors to make better decisions. Through the Jim Cramer Investing Club, he aims to educate and equip members with the knowledge and tools necessary to make better investment choices independently.

By understanding and internalizing the philosophy behind the Jim Cramer Investing Club, members can align their investment strategies with Cramer’s guiding principles. As we move forward with this review, we’ll explore how these philosophies are translated into actionable insights and personalized strategies for club members seeking to navigate the stock market with confidence.

Membership Benefits and Features

Joining the Jim Cramer Investing Club opens the door to an array of exclusive benefits and features designed to provide members with valuable insights, personalized strategies, and a supportive community of like-minded investors. Whether you are a seasoned trader or just starting your investment journey, the club offers a range of membership tiers, each tailored to meet the unique needs and aspirations of its members.

Access to Jim Cramer’s Expert Insights

One of the primary draws of the club is the opportunity to gain direct access to Jim Cramer’s expert insights and market analysis. As a club member, you’ll receive regular, real time alerts and updates on Cramer’s stock picks, investment strategies, and his views on the current market conditions. This real-time information allows you to stay up-to-date on market movements and align your investment decisions with Cramer’s experienced perspective.

Exclusive Stock Picks and Portfolio Updates

Club members gain access to Cramer’s exclusive stock picks, which are backed by his fundamental and technical analysis. These carefully selected stock recommendations aim to identify potential growth opportunities and undervalued assets. Additionally, Cramer provides regular portfolio updates (through the action alerts plus feature), allowing members to track the performance of his recommended stocks.

Educational Resources and Webinars

The Jim Cramer Investing Club places significant emphasis on financial education and empowerment. As a member, you’ll have access to a wealth of educational resources, tutorials, and guides that cover a wide range of investment topics. These materials are designed to enhance your understanding of investing fundamentals, risk management, and the various strategies employed by Cramer.

The club also hosts exclusive webinars and Q&A sessions, providing opportunities to learn directly from Cramer and engage with other experts in the financial industry. These interactive sessions offer invaluable insights and help members stay up-to-date with the latest market trends and investment strategies.

Community Interaction and Support

Being a part of the Jim Cramer Investing Club means becoming a member of a vibrant and supportive community. Through forums and networking opportunities, you can interact with other investors, share ideas, and discuss investment strategies. This sense of community fosters a collaborative learning environment, where members can draw from each other’s experiences and knowledge.

Transparency and Performance Tracking

Transparency is a core principle of the club, and members can access historical performance data of Cramer’s stock picks. The club maintains accountability by regularly tracking and reporting the performance of the recommended stocks.

Personalized Investment Strategies (Higher Tiers)

For members seeking more personalized guidance, higher-tier memberships offer the opportunity for one-on-one interactions with Cramer’s team. This personalized support helps tailor investment strategies to individual goals and risk tolerance

The Jim Cramer CNBC Investing Club offers a comprehensive suite of benefits and features aimed at empowering its members with expert insights, educational resources, and a supportive community.

Whether you’re seeking to expand your financial knowledge, access exclusive stock picks, or connect with fellow investors, the club provides a platform where you can refine your investment approach and potentially enhance your portfolio’s performance. The annual subscription to the stock picking service is expensive at $399/year, however, the connections, guidance, and investment education will help any investor manage their investment portfolio.

Performance Analysis: Examining the Club’s Track Record

The past performance of Jim Cramer’s charitable trust portfolio over the years raises a key question: Did it consistently outperform the market?

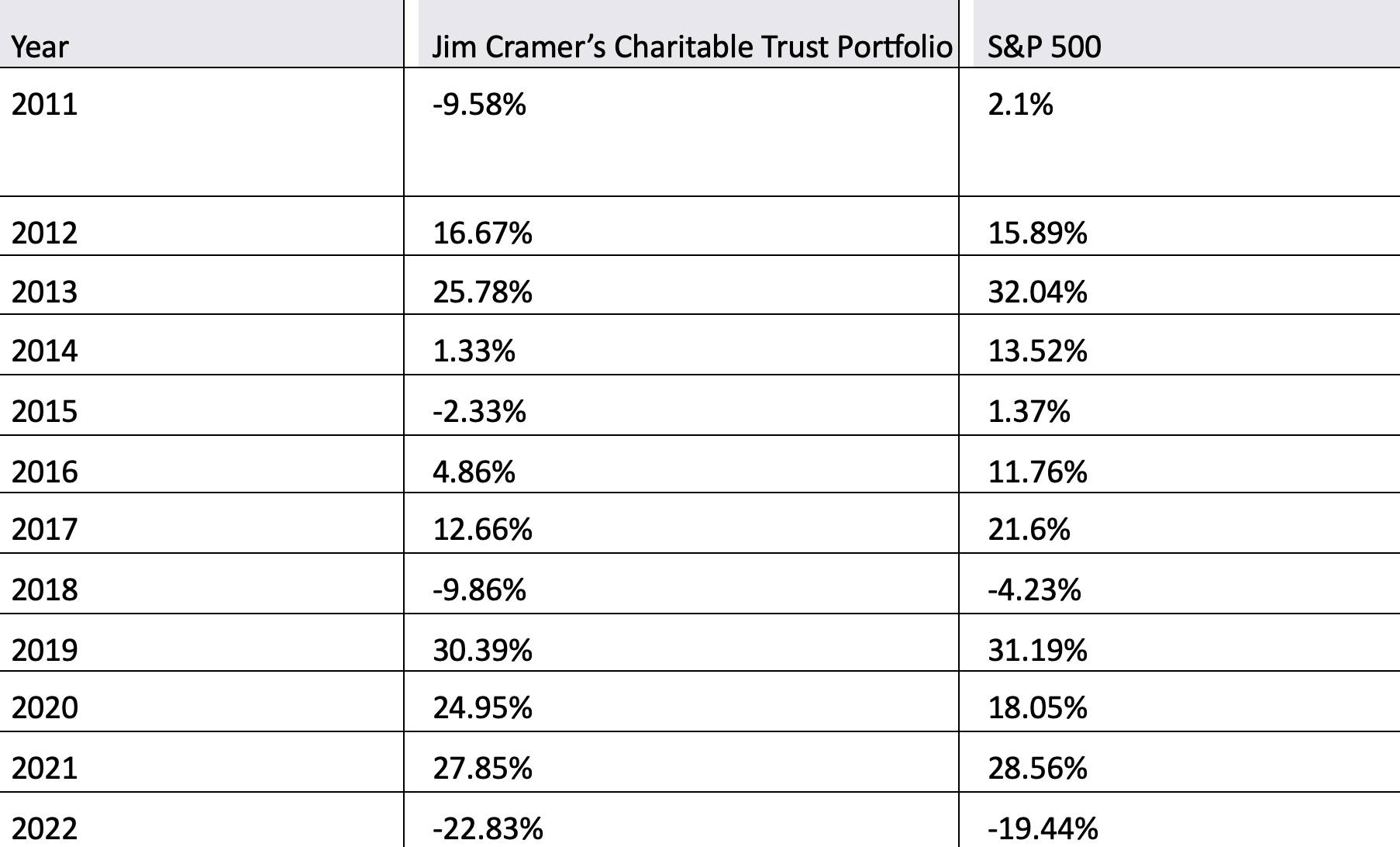

Here is a snapshot of the performance comparison between Jim Cramer’s charitable trust portfolio and the S&P 500 for each year since 2011:

From the table, it’s evident that Jim Cramer’s charitable trust portfolio narrowly outperformed the market in only 2 out of the 12 years from 2011 to 2022. While the portfolio delivered substantial gains in certain years, it also experienced periods of underperformance.

Investors should carefully consider this performance data when evaluating the suitability of Jim Cramer’s investment strategies and the potential risks involved. It is essential to bear in mind that past performance is not indicative of future results, and prudent due diligence is necessary before making any investment decisions.

Potential Drawbacks and Criticisms

While the Jim Cramer Investing Club offers an enticing range of benefits and insights, like any investment platform, it is not without its potential drawbacks and criticisms. It is essential for potential members to consider these factors before deciding to join the club.

Here are some of the key potential drawbacks and criticisms associated with the Jim Cramer Investing Club:

- Market Dependency: The club’s performance heavily relies on market conditions, and economic downturns or volatility can impact its results.

- Short-Term Focus: Cramer’s investment approach can often get caught up in short-term trading and momentum plays, which may not align with all members’ long-term investment goals.

- Risk and Volatility: The club’s strategies may involve higher levels of risk and volatility, potentially leading to substantial losses during market downturns.

- Membership Costs: Membership in the club comes with significantly higher fees than other services, and potential members should consider the cost versus the perceived value of the benefits.

- Contrarian Viewpoints: Critics argue that Cramer’s investment recommendations on Mad Money may sometimes be contradictory or subject to frequent changes.

- Individual Suitability: The club’s strategies may be more suitable for certain risk profiles and investment preferences, requiring potential members to assess their own goals and objectives.

It is important for investors to carefully weigh these potential drawbacks and criticisms alongside the benefits offered by the Jim Cramer Investing Club before they make their decision about joining.

Is the Jim Cramer Investing Club Worth Joining?

The decision to join the Jim Cramer Investing Club is a significant one, and it requires careful consideration of the club’s benefits, drawbacks, and how well it aligns with your investment goals. One of the primary advantages of joining the club is gaining access to Jim Cramer’s expert insights and market analysis. If you value Cramer’s investment philosophy and appreciate his candid approach to financial analysis, being part of the club may provide valuable guidance for your investment decisions. Additionally, the club offers exclusive access to Cramer’s stock picks and historical performance data, allowing you to evaluate the club’s track record and assess the consistency of its performance compared to market benchmarks.

For investors seeking to expand their financial knowledge and engage with a supportive community, the club’s educational resources and networking opportunities may prove beneficial. If you value continuous learning and appreciate a collaborative environment, the club can offer a valuable learning experience. However, considering your risk tolerance and investment preferences is crucial when evaluating the club’s suitability. The club’s investment strategies may involve higher levels of risk and short-term focus, which may not align with the preferences of more conservative, long-term investors.

The cost of membership is also an important consideration. Assess whether the benefits offered by the club justify the associated fees, and compare them with alternative investment platforms or advisory services to gauge the overall value proposition (to see our comparison review of other investing services including Motley Fool Stock Advisor and Seeking Alpha click here). Ultimately, the decision to join the Jim Cramer Investing Club should align with your personal investment goals and aspirations. Reflect on whether the club’s strategies and resources are in line with what you aim to achieve in the financial markets.

Conclusion: Is the Jim Cramer Investing Club Right for You?

The decision to join the Jim Cramer Investing Club hinges on several key factors. The club offers valuable benefits, such as access to Jim Cramer’s expert insights, exclusive stock picks, and educational resources, making it an attractive option for investors seeking personalized guidance and real-time market analysis. Additionally, being part of a supportive community may appeal to those who value collaborative learning and networking opportunities.

However, potential members should also consider the club’s potential drawbacks, such as its market dependency, short-term focus, and exposure to higher levels of risk and volatility. Investors with more conservative risk profiles or those seeking long-term investment strategies may find the club’s approach less suitable for their preferences.

Ultimately, the decision to join the Jim Cramer Investing Club should align with your individual investment goals, risk tolerance, and investment preferences. Assessing the club’s performance track record, evaluating the value proposition relative to the membership costs, and reflecting on how well its strategies align with your financial objectives are essential steps in making an informed decision.

If you resonate with Jim Cramer’s investment philosophy, appreciate his market insights, and find value in the club’s educational resources and community interaction, the Jim Cramer Investing Club may be a great opportunity for you to better manage your finances. However, for those who prefer different investment styles or risk profiles, exploring other investment platforms that better align with your needs may be a more suitable approach.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.