Are you seeking to expand your horizon by leveraging multiple investment platforms?

Perhaps you are wondering which websites offer the best information on investing.

To get started, Seeking Alpha and Motley Fool are two of the best and most commonly used investing platforms out there.

But which one is better?

In this article, we will explore both platforms in detail, weighing their pros and cons, and offer our recommendations for which investment platform is best for you.

If you want to improve your investment knowledge by opening yourself up to new ideas and resources, then understanding how to maximize these platforms is an important tool for every serious investor.

Seeking Alpha vs Motley Fool Overview

To evaluate these platforms and compare them against one another, we considered a variety of factors, including their usefulness, accessibility, and their ability to generate meaningful insights.

When it comes to investing influencers, no matter the platform, many of them cover stocks in a way that fails to provide meaningful information on a business.

Sure, it may be valuable to learn about what a company does and how it makes money, but this business overview isn’t enough to make an informed decision about whether it is worth investing in or not.

What you really need as an investor is writers and analysts who provide in-depth evaluations and unconventional arguments about a stock or the stock market.

This not only expands your knowledge of stocks, but it may also challenge your biases towards it as well. But there’s a catch.

In many instances, you will come across platforms that require you to pay (aka The Paywall) if you want the really juicy insights.

Therefore, you will need to determine whether you can generate meaningful investment insights on your own, thus reducing costs, or if it is worth exploring additional insight at a cost.

To help make this decision a little easier, our commentary on Seeking Alpha and Motley Fool should provide a more balanced assessment of what these platforms have to offer.

Have you ever wondered how to invest in penny stocks? Check out this video.

What is Seeking Alpha?

Seeking Alpha is a financial news and investment analysis platform that offers investors a wide range of articles, blogs, and financial information from industry experts.

The platform provides both free and paid content covering most securities, including stocks, bonds, ETFs, options, commodities, and currencies.

What makes Seeking Alpha particularly special is that its content is mostly produced by independent writers, meaning that the analysis is generally more authentic as the analysts are not working for the company.

Instead, these professional investors put their beliefs on the line by offering candid theses on whether they believe a stock is a worthwhile investment or not.

For this reason, Seeking Alpha has built a massive community of contributors, readers, and commenters who engage in thoughtful discussions about investing strategies, stock market trends, and economic views.

Seeking Alpha is the #9 ranked financial website, according to similarweb, boasting 24.1 million visits on its platform.

Seeking Alpha Key Features

Seeking Alpha offers investors a wide range of features spanning from portfolio tracking to stock ideas.

Here are a few of its most popular if you subscribe to its Alpha Premium account:

-

Professional Stock Analysis

One of the primary reasons that investors are attracted to Seeking Alpha is its in-depth professional stock analysis.

When you search for a stock, for example, Apple (AAPL), you gain access to every article written by credible investors, including their buy, hold, or sell recommendations.

This can be quite valuable as it sheds light on the good, the bad, and the ugly about a company.

Furthermore, you will discover information on a stock/ business that you may never have been aware of before.

-

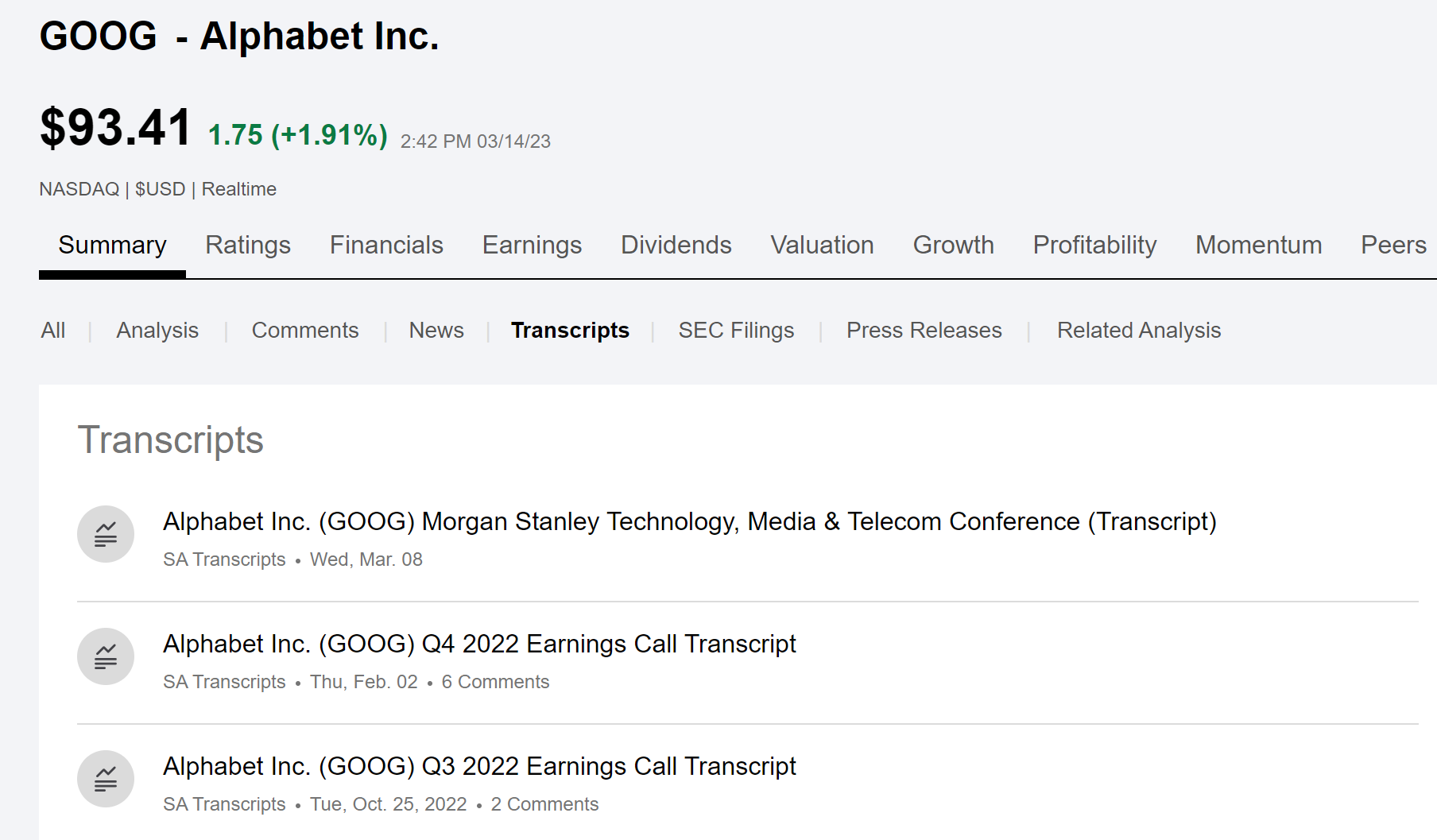

Earnings Call Transcripts

One of the best ways to learn about a stock and its management team is through the company’s earnings calls.

If you were to search for an earnings call or its transcript from, say, Q3 2021, you will notice that it is nearly impossible to find the full transcript anywhere else.

But, when you subscribe to Seeking Alpha, you gain access to many years worth of earnings call transcripts, dating all the way back to 2005.

-

My Portfolio

Want to track your stock investment performance?

Seeking Alpha offers investors a free and easy way to track their stocks through its My Portfolio Feature.

Through it, you can view basic stock information, such as price, performance, and weight, while also being informed of any new information about a stock via email alerts and push notifications.

Seeking Alpha Cost

To make the most out of Seeking Alpha, here are its various subscription plans:

- Seeking Alpha Basic: Free

Offers Stock analysis email alerts; Real-time news updates; Access to stock prices & charts; and Wall Street Ratings for every stock.

- Seeking Alpha Premium: $239 per year

Offers Unlimited access to Seeking Alpha Premium content; Seeking Alpha Author Ratings; Seeking Alpha Author Performance; Stock Quant Ratings; Stock Dividend Grades; and all Basic features.

- Seeking Alpha Pro: $499 per year

Offers Top Ideas; PRO content & newsletters; Short ideas portal; Idea screener/filter; VIP Service; and all Premium features.

Seeking Alpha Pros and Cons

- Pro #1: In-Depth Financial Information

Seeking Alpha offers extensive financial information about a company, including 10 years worth of income statements, balance sheets, and cash flow statements.

Beyond that, it also provides earnings coverage and estimates, as well as dividend tracking, stock valuations, growth forecasts, and competitor analysis.

All of this information is extremely useful when attempting to analyze individual stocks, making this process more efficient given that it is all in one place.

That being said, all of this info comes at a cost, and other websites out there offer most of the same information for free.

- Pro #2: Balanced Stock Analysis

There are few platforms out there that offer such a balanced investment perspective, like Seeking Alpha.

Since bulls, bears, and everything in between, provide insight, opinions, and coverage on stock recommendations, investors reading these articles benefit from this broad exposure, leading to more informed investment decisions.

If you want to be a successful investor, one of the best ways to do it is by stress-testing your investments so that you are more equipped to handle uncertainty and volatility.

In my experience, there is no alternative platform out there that does this as effectively as Seeking Alpha.

- Con #1: Limited International Stock Coverage

If you are looking to explore stocks outside of the United States, you may run into problems where there is limited coverage of a company.

This issue extends to smaller companies as well given that there may be only a few investors in the stock.

As you continue to use the platform, you will notice that there is a large imbalance of articles between the most and least popular stocks in the stock market.

When reading articles about a less popular stock, be wary that the opinions shared may be limited and that it’s worthwhile to check other resources as well.

- Con #2: Limited Features on its Basic Plan

Probably the biggest critique of Seeking Alpha is the limited information and articles available to free users.

If you are planning to not pay for its premium features, keep in mind that you will have access to only a few articles each month and that almost all of the information is blocked behind a paywall.

To make the most of this platform, you will be required to cough up some cash.

What is Motley Fool?

Motley Fool is a financial media company and one of the most well-known brands in the financial industry.

The platform provides investment research, analysis, and financial advice to retail investors looking to broaden their understanding of investing and financial assets.

Motley Fool offers a wide range of free and paid products and services, including online subscriptions to investing newsletters, stock-picking services, podcasts, blog articles, videos, and more.

Its investment philosophy leans towards buying and holding high-quality businesses for the long term, with a focus on stocks that possess a strong competitive advantage, healthy financials, and an attractive valuation.

If you are an investor searching for new investing ideas in a variety of different industries, then Motley Fool is one of the best platforms to get you started, as they cover any and all topics.

With a friendly, sometimes humorous, approach to investing, readers are often to attracted to their content when they are progressing from beginners to more advanced investors.

Motley Fool is the #2,002 ranked financial website, according to similarweb, boasting 46 thousand visits on its platform in the last month.

The Motley Fool’s Key Features

Motley Fool offers a plethora of products and services.

Here are a few of its most commonly purchased premium subscriptions:

-

The Motley Fool Stock Advisor

If you are an investor seeking advice and guidance on your investment portfolio, The Motley Fool Stock Advisor stock picking service is an effective tool to use when learning about investing and the stock market.

By signing up, you will receive monthly stock picks, top 10 stock rankings, educational materials, and more.

This can be valuable for those who don’t have the time to conduct their investment research, though we recommend that you at least be cautious when receiving individual stock recommendations from anyone.

That being said, you can have some degree of confidence that their stock picks are successful given that The Motley Fool claims its stock recommendations have achieved returns of 366%, versus 111% for the S&P 500.

-

Rule Breakers

Similar to its Stock Advisor feature, the Rule Breakers subscription is a stock picking service suited for investors that prefer investing in high-growth stocks, “poised to tomorrow’s market leaders.”

Once again, subscribers will receive monthly stock picks, top 10 rankings, and more, though these are catered more toward the growth stock asset class rather than stocks in general.

On its website, Motley claims that its Rule Breakers’ stocks have returned 192%, versus the S&P 500.

-

Personal Finance

Beyond its stock investing features, The Motley Fool also offers valuable personal finance guides that will help you become a master of your assets.

Under the “Personal Finance” tab, you will find guides like Credit Cards 101; Bank Accounts 101. Home Loans 101; Pay Off Debt; and more.

If you are someone unfamiliar with personal finance nuances or just beginning to take responsibility for your finances, these features are easily digestible and an excellent way to build a solid financial foundation.

Motley Fool Cost

Wanting more from the Motley Fool? Here are five of its commonly purchased subscription plans:

- Stock Advisor: $199 per year

“Market beating stocks from our award-winning service.”

- Real Estate Winners: $249 per year

“A service designed to capture the benefits of real estate investing through publicly traded entities.”

- Rule Breakers: $299 per year

“High-growth businesses we think are poised to be tomorrow’s market leaders.”

- Epic Bundle: $499 per year

“The Epic Bundle grants members immediate access to our four foundational stock-recommendation services: Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners.”

- Motley Fool Options: $999 per year

“Get a world-class options education in easy-to-swallow pieces with our exclusive Options University!”

Motley Fool Pros and Cons

Pro #1: New Investment Ideas

If you are on the hunt for new stock ideas, The Motley Fool has got you covered.

The platform has written hundreds of articles covering the hottest industries and individual stocks, including top “Top 10 Stock” articles as well.

This is useful if you are trying to learn more about a market or trying to figure out your next big investment idea.

Not only will you be introduced to new stocks, but you will also learn what businesses compete against each other and how certain stocks reach the top versus others.

Simply type in your search bar a stock or industry that you would like to explore, and you will most likely notice that The Fool’s articles are near or at the top of your list.

Pro #2: Sound Investment Philosophy

The Motley Fool’s investment closely aligns with our own in that they strive to invest in high-quality stocks for the long run (minimum of 5 years).

Moreover, Motley focuses on businesses with sound long-term fundamentals rather than short-term fluctuations in a stock’s price.

This is a great philosophy to have because it eliminates speculation and emphasizes being an owner of a business rather than a stock picker.

Ultimately our goal as investors are to create more wealth than we started with.

The best way to achieve this is by investing in and holding assets that are productive over extended periods.

The Motley Fool supports this ideology well, so you can be confident that their recommendations are at least worth your consideration.

To learn more about Edge Investments’ investment philosophy, check out this article.

Con #1: Surface-Level Analysis

If you come across any of The Motley Fool’s articles online, you will notice that they provide a relatively brief overview when discussing a stock.

While this will certainly help introduce you to new ideas, the information should be taken with a grain of salt because there is a lot more information required if you wish to be a successful investor.

So, rather than using The Fool’s analysis as your reason for investing, it’s better to consider it as a gateway instead, given the limited information available.

Ultimately the goal with any investment decision is to understand the business as if you were the sole owner of the business.

Therefore, it’s always a good idea to do your own research before investing.

Con #2: Quality of Stocks Varies

The Motley Fool stock pick articles tend to cover the hottest stocks in the market but not always the best ones.

From the information available, it may seem that all of the stocks they recommend have the potential to perform well.

However, when you analyze the businesses further, including their financial statements, you often realize that you are dealing with an underwhelming asset.

As a general rule of thumb, it is smart to be skeptical about a stock before investing.

In the end, you should only invest in those stocks that you believe offer the greatest potential, while also limiting your risk.

Motley Fool vs Seeking Alpha: Which is Better?

If you are a beginning or early-stage investor, your best bet is to go with The Motley Fool, given its detailed yet easily digestible content.

Whether it is Motley Fool’s Stock Advisor service or Personal Finance guides, you will gain confidence as an investor and be better informed than you otherwise would.

However, if you want a platform that will be useful and accessible no matter what level of experience you have with investing, then Seeking Alpha is the way to go.

Personally, Seeking Alpha is one of the most valuable resources I use in my investment practice and a platform that I recommend to everyone.

With an endless array of articles and a multitude of perspectives, Seeking Alpha offers investors a wealth of knowledge that is fundamental to successful stock picking.

Not only will your ideas be tested, but you will gain new insights as well.

Therefore, if you are someone who wants to participate in the individual stock-picking game, Seeking Alpha is one of the best resources you can find.

Regardless, it is always valuable to keep expanding your horizon and opening yourself up to new and brilliant investment strategies.

Want to learn more about other investing resources? Check out this article.