When you think of stock investing, which businesses usually come to mind?

For most of us, we would respond to this question with Apple, Microsoft, Coca-Cola, Google, or perhaps Tesla

While it may be no surprise that these established companies were mentioned, it may shock you that in their early days, many of them did not anticipate that their success would take them from being tiny insignificant start-ups to the largest corporations in the world.

But, as their market share grew and more investors became wary of their potential, these businesses exploded in size and reputation, reaching market cap valuations that trumped 99% of the companies on Earth.

Many of these businesses dominate their industry outright, eliminating competitors with ease and dictating the way consumers perceive value.

But with great power comes great responsibility, and if they aren’t careful, it may all come tumbling down.

So, as individual investors, how do we know if a large-cap stock is a good investment, and where can we find these dominating businesses?

In this article, we will outline these questions and more as we help guide you to becoming a knowledgeable large-cap investor.

If you have ever wanted to invest in the best businesses in the stock market, most effectively, you will want to read what we have to say.

What is a Large-Cap Stock?

Large-cap stocks are publicly traded companies with a market capitalization that exceeds $10 billion.

Large caps are generally well-established, mature companies with a long track record of stable earnings and revenue growth.

These mature businesses tend to have the largest economies of scale, allowing them to adapt to new competition by purchasing more productive assets than anyone else.

For this reason, many of these large corporations have a strong competitive edge within their industry and may offer a broad range of products and services.

Investors who are typically attracted to large-cap stocks prefer them over smaller companies, like small-cap stocks or penny stocks, because they are more predictable and less risky than their tiny counterparts.

However, with greater stability, there is often less growth potential since many of these stocks’ best days are behind them.

Are Large-Cap Stocks the Same as Blue-Chip Stocks?

Yes, large-cap stocks and blue-chip stocks are synonymous, but the term “blue-chip” is reserved only for the most high-quality businesses.

Therefore, if a large cap is to achieve the rank of blue-chip stock, it must first demonstrate to investors that its business is a top-tier investment through stability, financial strength, and reputation within its industry.

Not only are they excellent businesses, but blue-chip stocks tend to be market leaders with an almost indestructible moat or competitive advantage.

But just because a large-cap stock reaches the status of blue-chip, it doesn’t mean that it’s a good investment.

For a blue-chip company to be a worthwhile investment, it must also be purchased at a reasonable price at or below its intrinsic value.

The same rule applies to any investment you make, but it is especially important with large caps because you oftentimes are sacrificing better returns for security.

Reasons to Invest in Large-Cap Stocks

Large-cap stocks offer many advantages and should be considered a valuable investment by all investors.

Here are a few of the best reasons to invest in large-cap stocks:

More Stability & Predictability

Most large-cap companies have been publicly traded for quite some time.

As such, many of them have proven to be a worthy investment through an extensive track record that demonstrates strong and consistent earnings growth over many years.

It is through this extensive history that investors can formulate a clearer picture of how a company performs during the good times and the bad.

Moreover, it makes its stock a lot easier to value since the intrinsic value won’t fluctuate as often as compared to smaller companies like mid and small-cap stocks.

While nothing is guaranteed in the stock market, and there may be times when a large-cap stock plummets, investors can express greater confidence in these companies because of the firm position in the market and their historical ability to overcome poor market conditions.

Greater Liquidity

As large-cap stocks tend to be the most commonly traded businesses, this produces greater liquidity amongst their shares, which means that the stock price is less likely to fluctuate as dramatically.

In other words, with more buyers and sellers available, an investor looking to trade this stock can be reassured that there will always be someone on the other side of the transaction.

This is in contrast to penny stocks and small-caps which sometimes face a shortage of buyers or sellers.

For example, if a company has a surplus of buyers, and only a few sellers, this may result in the stock price rocketing, making it more difficult to buy a stock at a reasonable price; The opposite is true if the adverse event occurs.

Therefore, due to the higher liquidity of large caps, investors prefer them over other assets because they can easily move their capital in and out of the asset without much volatility.

Lower Risk

With a more established business, there is less risk overall.

However, risk ultimately comes down to the business itself, its financial standing, its management team, the economic conditions, and the price you end up paying for the asset.

Since most large caps have achieved these quality attributes already, it means that one can expect their money to be safe and productive as long as they decide to buy at or below the intrinsic value of the company.

But, if you end up overpaying for a stock, it’s almost inevitable that you will lose money or, at the least, underperform the broad market.

So, if you want to lower risk as an investor, then buy high-quality stocks and a discount on what they are worth.

Otherwise, it may cost you dearly.

Disadvantages of Large-Cap Stocks

Large-cap stocks are a sturdy and valuable investment vehicle that every equity investor should consider.

However, in certain circumstances, they may not be your best option as an investor.

To highlight this, here are a couple of the biggest disadvantages of investing in large-cap stocks.

Limited Growth Potential

For the most part, large-cap companies are established businesses that have existed in their respective markets for quite some time.

This has enabled them to create massive footholds in their industries, ensuring their prosperity for many years to come.

But due to their size and position, it also means that for most large caps, their best years are already behind them.

As sad as this sounds, if you are a retail investor looking to maximize your return on investment, then your best bet is to go with a company with a much smaller market cap, like a small cap or even a mid-cap stock.

Don’t get me wrong, it’s likely that these large-cap behemoths continue to grow into the future, but that growth potential is quite limited given that there is only so much capital circulating in the market, and one business can only create so much value.

Therefore, it makes more sense to invest in a stock that is just hitting its stride rather than one that is slowly maturing and has no more room for growth.

If you’re still not convinced, I offer you this thought as an explanation…

Ask yourself, how easy would it be for a company with a market capitalization of $1 trillion to double?

How about a business with a market cap of $10 billion? $1 billion? $500 million? $20 million?

As you go further down the list, it becomes easier to double the market cap and, therefore, your investment.

Not only will you double your investment by buying smaller stocks, but you may also end up tripling, quadrupling, or even 10Xing your ownership with relative ease.

Of course, it all depends on the businesses you buy, but if you focus your efforts and build a disciplined investment strategy, you may end up increasing your success quite substantially.

To learn more about how we approach small-cap investing, check out this article.

Limited Buying Opportunities

Another reason investing in large-cap stocks can be disadvantageous is due to the limited opportunities to invest at a reasonable price.

With millions of investors flocking to these assets, including institutional investors, like mutual funds and hedge funds, the stock price of large-cap companies tends to hold at higher valuations for longer than they do with smaller businesses.

That is because large-cap stocks receive the most coverage and attention of all assets, therefore demand for these companies tends to stay quite high regardless of the market conditions.

As a retail investor, this can become quite frustrating if you are forced to wait for an extended time, even years, before it is justifiable to invest in a large-cap at its current price.

Whereas due to the lack of exposure smaller businesses receive, there tend to be more opportunities to buy small-cap stocks and penny stocks at a reasonable price than there are with large-cap corporations.

So, even though large-cap stocks are generally higher quality businesses, that is only one part of the equation, given that an investor must also be cautious of the price they pay.

To make the most bang for your buck, you must not only buy great companies at a discount but do so often enough that you can consistently deploy your capital effectively.

In general, there will be fewer opportunities to accomplish this if you solely focus on large-cap stocks.

Investing in Large-Cap Stocks

As large-cap stock investors, our goal is to find easy-to-understand businesses with a trustworthy management team and a durable competitive advantage.

To do so, we must be disciplined in our evaluation process and remain patient when it is finally time to buy.

If you have read our other beginners’ guides, you will notice that there is a common investment process for any stock we invest in, and that is because it works.

But, when it comes to investing in large-cap stocks, the degree to which you apply these rules increases as the business becomes more established in its industry.

Fortunately, it is a lot easier to find these excellent assets due to their extensive track records and proven reputation.

All you have to do now is determine the best ones based on the quality of the businesses and the price for which you’ll pay.

To demonstrate this, here is a step-by-step process comparing two of the top large-cap companies.

You can use this example to help guide you for all individual stocks, no matter their market civilization value.

Please keep in mind that this is not investment advice and is meant solely for educational purposes.

How to Evaluate Top Large-Cap Stocks

To begin the evaluation process, we must decide on two large-cap companies to assess.

For this example, we will use Nvidia (NVDA), a designer and developer of graphics processing units, used in a variety of applications, including gaming, artificial intelligence, etc., and Meta (META), the parent company of social media platforms Facebook, Instagram, and WhatsApp.

Keep in mind that this is only a brief overview of the process and that one should conduct more research before making an investment decision.

Step 1: Do I Understand the Large-Cap Stock?

The first step in the assessment process is to figure out the company’s business model and determine whether we understand it well enough to invest in.

If not, that is more than alright.

As you begin your investment journey, you will notice that you say “NO” to 90% of the stocks you come across, and for a good reason.

Only invest in those stocks that you have the highest conviction behind because when the going gets tough and the stock crashes, you want to be sure that you will make a smart and rational decision.

What is Nvidia?

Nvidia is an American technology company specializing in the designing and manufacturing of advanced graphics processing units (GPUs) and system-on-a-chip units (SoCs), as well as other related software.

According to Wccftech, Nvidia holds the second highest market share in the overall GPU market with a 17% stake; this is second to Intel which owns 71%.

But, when it comes to desktop GPUs, Nvidia is the clear-cut market leader with a massive 82% share of the market.

In 2022, the company’s Compute & Networking segment made up 55.9% of its total revenues at $15.09 billion, while its Graphics segment made up the other 44.1% at $11.90 billion.

One of Nvidia’s key competitive advantages is its leading graphics technology, which offers the most advanced, high-performance GPUs on the market today.

What is Meta Platforms?

Meta is a technology company that owns and operates three of the biggest social networking platforms in the world.

Through these platforms, Meta works with businesses to provide curated advertisements to users.

This system is designed to match companies with their ideal consumer to create a more personal and effective advertising experience.

Recently, Meta has also been working on providing a next-generation mixed reality platform through its Oculus Quest virtual reality headsets.

Meta is the outright leader in both the global social media market and the VR platform market, with a 79.06% and 66% stake, respectively.

In 2022, 98.1%, or $114.5 billion, of Meta’s revenues came from its Family of Apps segment, while the other 1.9%, or $2.2 billion, was due to its Reality Labs segment.

Step 2: Is the Large Cap Growing?

After learning more about the business and deciding whether you understand it well or not, the next step is to analyze the business’s fundamentals a determine whether its moat is growing or sinking.

Hint: we want the large-cap company’s fundamentals to be growing and fast.

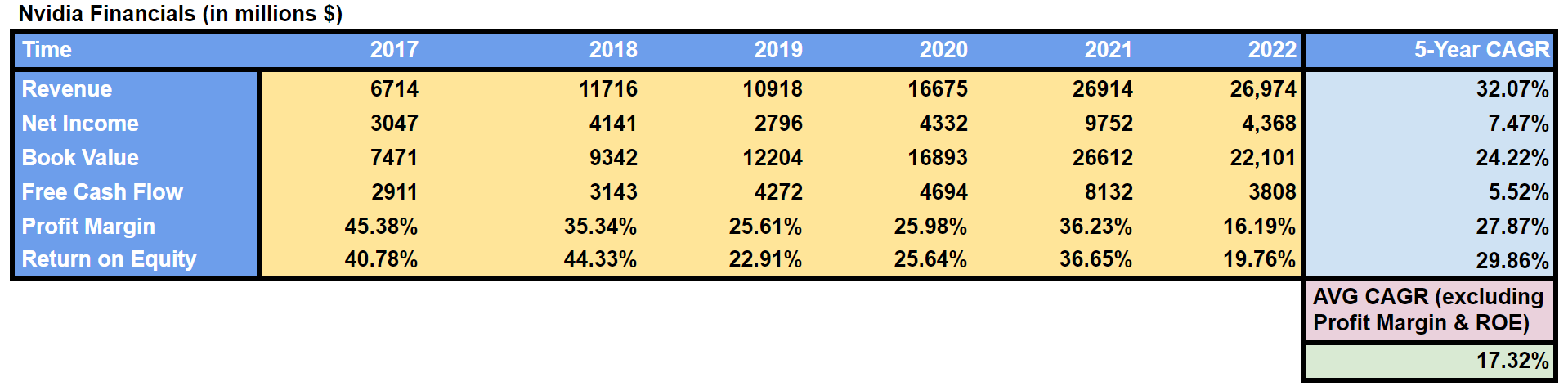

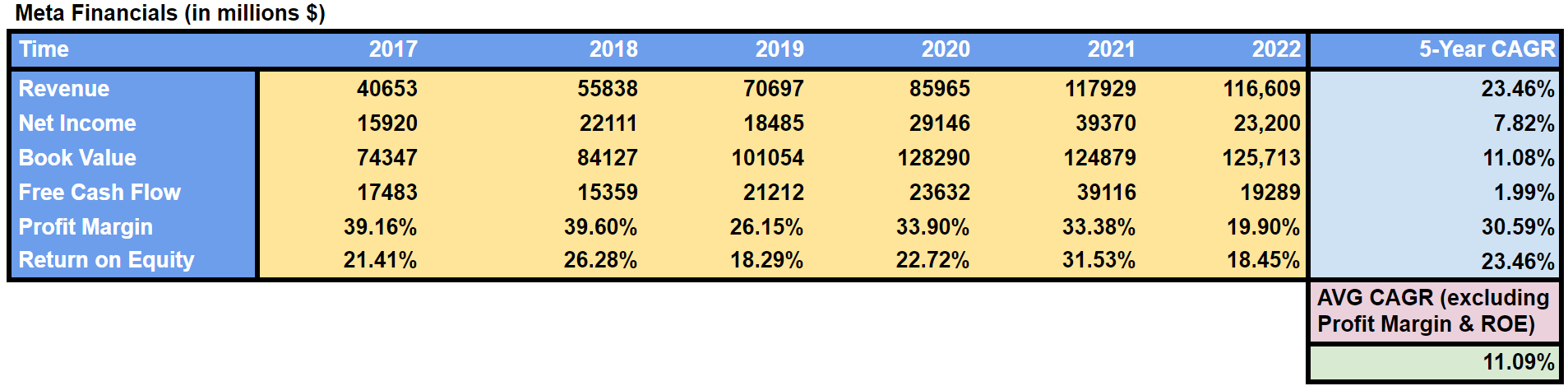

For simplicity’s sake, we will measure the growth of revenue, net income, book value (shareholder equity), free cash flow, profit margin, and return on equity over the last five years.

Nvidia’s Financials

Meta’s Financials

Step 3: Who is the Management Team?

Another key consideration when evaluating large-cap companies is to understand who the management team is and what their relationship is like with shareholders.

We will want to find a business that has leaders who are decisive, competent, and accountable because we need to trust that they will use our money wisely.

To determine the character of a management team and the CEO, review the company’s earnings call and annual letters, and decide if their approach and values align with your own.

As a bonus, we give brownie points to those large-cap stocks whose CEOs are both founders and large shareholders of the company.

Here is a brief overview of both large caps’ CEOs.

Nvidia CEO: Jensen Huang

Jensen Huang co-founded Nvidia in 1993 and has been serving as its CEO and President ever since.

In total, Mr. Huang has served as CEO of Nvidia for over 29 years and currently owns around 3.5% (approx. $19.6 billion) of the company.

He is being paid $23,737,661 annually in compensation for his role as CEO.

Meta CEO: Mark Zuckerberg

Mark Zuckerberg founded Meta Platforms (formerly known as Facebook) in 2004 and has been serving as its CEO since then.

In total, Mr. Zuckerberg has served as CEO of Meta for over 18 years and currently owns around 13.42% (approx. $60.3 billion) of the company.

He is being paid $26,823,061 in compensation for his role as CEO.

Step 4: What is it Worth?

The final step in the evaluation process is determining what the business is worth.

By knowing the intrinsic value of a large-cap company, you can then use it to compare it against the market capitalization and decide whether the business is undervalued or not.

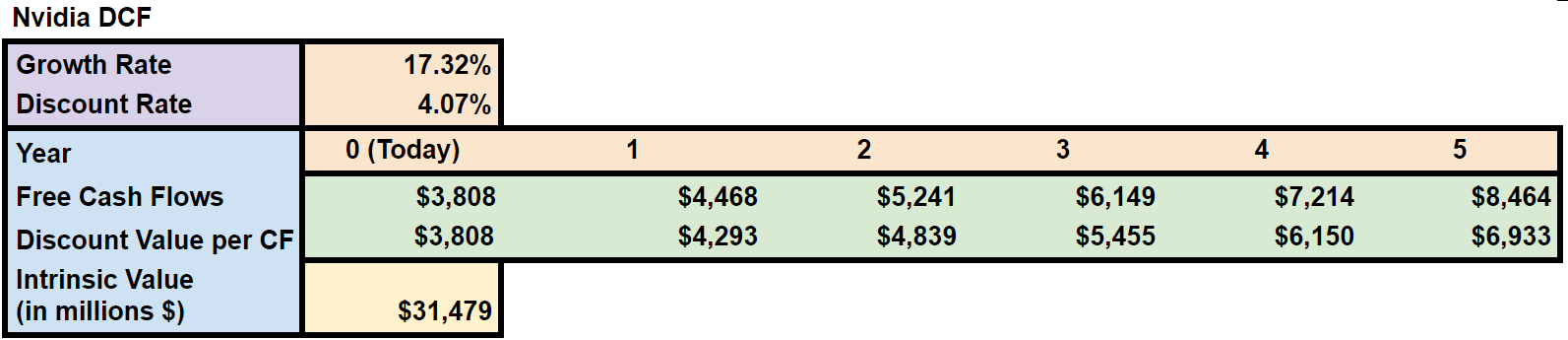

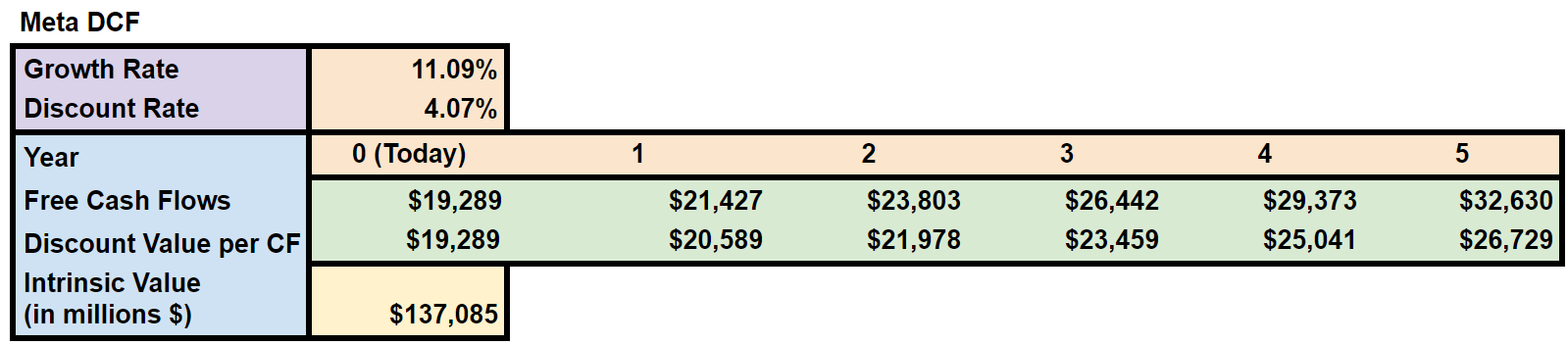

For this example, we used a simple DCF model, assuming an average growth rate based on the CAGRs found in Step 2, and a risk-free rate of 4.07% (US 10-Year Treasury Yield).

To learn more about valuing growth companies, check out this article.

Nvidia’s Intrinsic Value

Meta’s Intrinsic Value

The Final Step: Deciding to Invest or Not

Last but not least, it is time to decide whether you should invest in individual large-cap stocks or not.

After taking into consideration your understanding of the business, its financial health, and the management team, and comparing its intrinsic value to the market cap, you have all of the tools needed to make a sound investment decision.

As this example is not investment advice, you should note that your decision to invest is your choice alone and that the information we provided is only a small glimpse into the entire evaluation process.

To acquire all of the information needed to make a proper investment decision, it will take considerable time to understand a business and its market; the more time, the merrier.

With that being said, this evaluation process should help guide you to becoming a more knowledgeable and decisive investor capable of finding a few great large-cap stocks of your own.

Remember, always conduct your own research and only invest what you are comfortable with losing.

Happy investing large-cap stocks investors.

Ever considered investing in Venture Capital? Check out this video explaining how you can get started with only $100.