“We’re blind to our blindness. We have very little idea of how little we know.” – Daniel Kahneman

Investing is an emotional game. One day you are living the millionaire dream, and the next, barely getting by.

While people tend to believe that we are rational creatures acting logically in our best interests, the reality is that we are highly flawed, often unable to make rational decisions and behave in ways that are detrimental to our overall well-being.

As such, we go through life, in this case investing, blind to our weakness, and always falling just short of reaching our full potential.

But there is a solution. In this article, we will explore the psychology that goes into investing, its history, truths, and traps.

Moreover, we will offer suggestions on how you may overcome the pitfalls that punish most investors (retail investors and portfolio management teams alike).

If you wish to overcome your weaknesses, master the markets, and achieve investing success, then understanding the emotional side of investing is an important first step.

Let’s dive in.

What is Behavioral Finance?

Humans are not always rational. We are biased and emotional beings that resort to cognitive shortcuts that can limit our decision-making abilities.

These weaknesses make us susceptible to psychological traps like overconfidence, herd mentality, anchoring, and more.

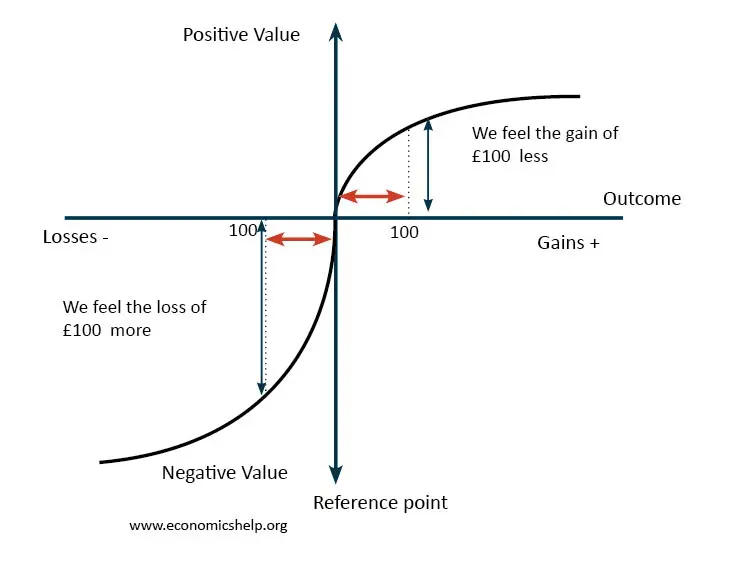

To understand how behavioral finance may affect investors, psychologists Amos Tversky and Daniel Kahneman introduced the Prospect Theory in 1979, a groundbreaking research on human judgment and decision-making grounded in behavioral finance.

Prospect Theory challenged the traditional rational economic model by showing that people’s decisions are influenced by their attitudes toward risk and their perception of potential gains and losses.

It touches on key concepts like loss aversion, which describes how investors will react more negatively to a loss than to a gain of equal value.

For example, the next time you experience a capital gain of $1,000 and subsequently a capital loss of $1,000, consider how you feel after that event happens—it is likely that you feel worse off despite your net gain being $0.

This is contrary to modern financial thought, which argues that humans act rationally at all times, thus causing the stock market to perform efficiently regardless of the conditions.

But as you can see, there are many instances where human nature causes us to behave in ways that are not in our best interest (i.e., refer to any stock market bubble or crash).

That is why it is important to understand behavioral finance and learn how to mitigate its effects using financial theory.

Otherwise, it may end up costing you dearly.

What are Psychological Traps in Investing?

Many psychological traps in investing can lead to investors making irrational and suboptimal decisions.

These traps can cloud judgment and hinder investors from achieving their financial goals.

Here are some key psychological traps to be aware of:

-

Loss Aversion

Losing money on investment is tough, but it is part of an investor’s journey to achieving success.

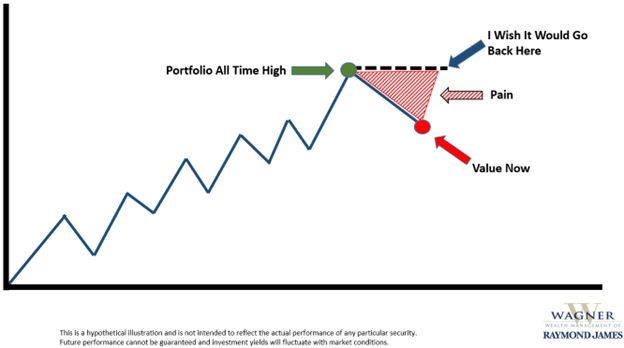

However, sometimes, we may feel so overwhelmed by a previous mistake that we try to avoid losing at all costs rather than taking advantage of worthwhile investment opportunities in the future. This is loss aversion.

Loss aversion is the psychological response that causes an investor to react to losses more strongly than the pleasure of receiving gains. It may also occur during active trading, when we choose to sell a winning stock early to avoid the risk of losing our hard-earned gains.

While it can be difficult to comprehend, it is essential to know that investment mistakes are inevitable, and it is better to learn from those mistakes than to try and avoid making them altogether.

Nobody is perfect, not even Warren Buffett. Don’t beat yourself up over a few bad investments. There are many more worthwhile opportunities ahead.

-

Overconfidence

Winning feels great, but be careful.

Overconfident investors tend to believe that they have more knowledge and skill than they actually do, which can lead to excessive trading, over-concentrated positions, and taking on higher risks without adequately assessing potential downsides.

It is a good idea to stay humble, review your portfolio, and never stray from your investment portfolio’s management principles.

As Jeff Bezos once said, “When [a] stock is up 30% in a month, don’t feel 30% smarter, because when it’s down 30% in a month, then you’re gonna have to feel 30% dumber, and it’s not gonna feel as good.”

-

Anchoring

The world is constantly changing, and one must learn how to adapt to these new circumstances.

Anchoring is the tendency to rely too heavily on the first piece of information encountered when making decisions.

Investors may anchor on the purchase price of an investment and hold on to it, failing to adjust their decision based on new information or changing market conditions.

That is why it is essential always to challenge your original thesis and measure it against those with differing opinions, especially if you engage in active trading.

In other words, never assume that because a stock is performing well now that it will continue to do so in the future.

-

Confirmation Bias

We, humans, love to believe that we are always right. However, this is often not the case.

Confirmation bias is the product of seeking out information that confirms our existing beliefs and ignoring or downplaying information that contradicts us.

This can lead to a lack of awareness and an unwillingness to consider alternative viewpoints. Though it may feel uncomfortable, learning to embrace different opinions is one of the most valuable tools an investor can have.

Who knows, maybe you will learn a thing or two about a company that you never considered before.

-

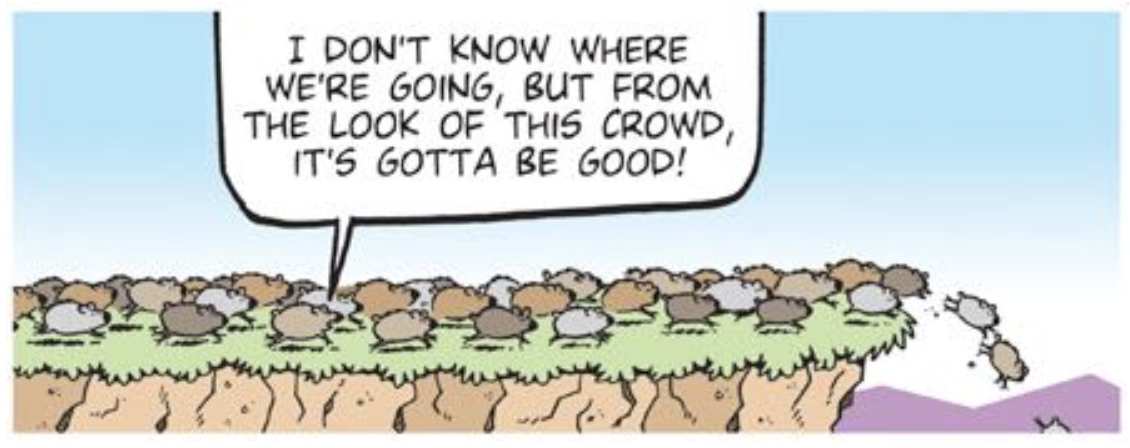

Herding

It pays to be a contrarian when investing.

Herding occurs when many investors tend to follow the crowd and make investments based on what others are doing rather than conducting independent research and analysis.

Sometimes, it is difficult to separate yourself from other retail investors though, especially when a stock is performing well in the short run.

However, if you are comfortable going against the grain, this often leads to the most rational and advantageous decisions one will ever make.

As Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.”

-

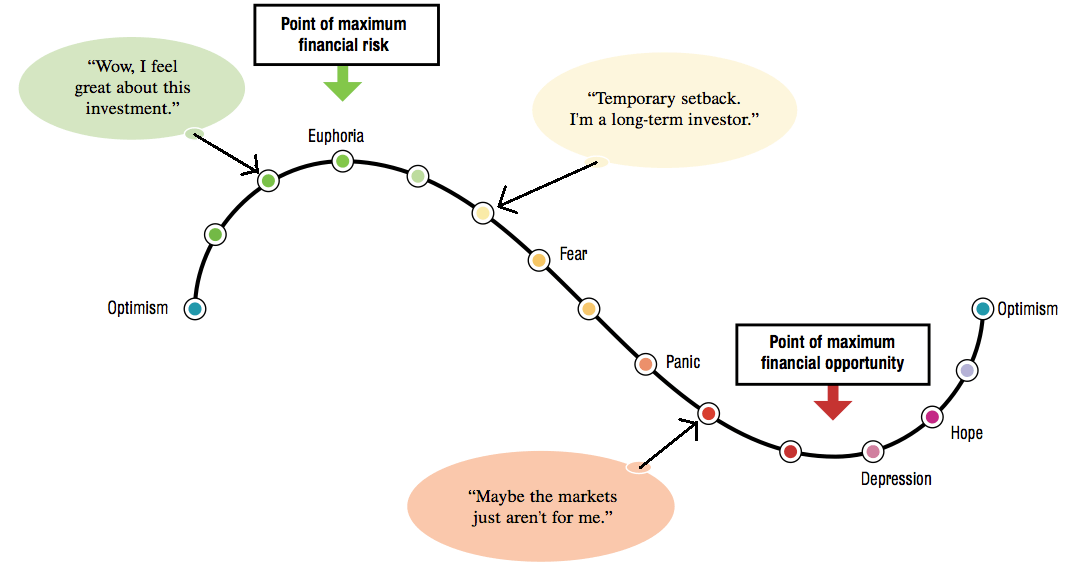

Emotional Decision-making

Emotions such as fear and greed can drive impulsive decisions.

Fear of missing out (FOMO) may lead to chasing high-flying investments, while fear of losses can cause panic selling during market downturns.

Since we are all emotional creatures, it is best to avoid making investment decisions when you are feeling euphoric or overwhelmed.

Instead, take some time to ground yourself, review the facts, and seriously consider your decision. This mental accounting practice will help you prevent making costly mistakes that you otherwise would never make.

-

Gambler’s Fallacy

The gambler’s fallacy is the belief that past events influence future outcomes in random events.

For example, if a coin has come up heads several times in a row, the gambler’s fallacy would cause you to believe that tails are now “due,” leading to decisions based on flawed reasoning.

Instead, understand the stock market is very unpredictable. Even when you believe that your thesis is correct and it is likely to play out just as you expect, there may be moments when the complete opposite occurs.

To protect yourself from the gambler’s fallacy, apply a margin of safety to your stock evaluations to limit the effects of unpredictable and sometimes disastrous events.

What to Consider When Thinking of the Psychology of Investing?

Being aware of one’s weaknesses pays exponentially as an investor.

Therefore, when thinking about the psychology that goes into investing, it is worthwhile considering the various psychological factors that can influence your decisions.

With that being said, here are a few psychological factors to consider when investing in as an investor:

-

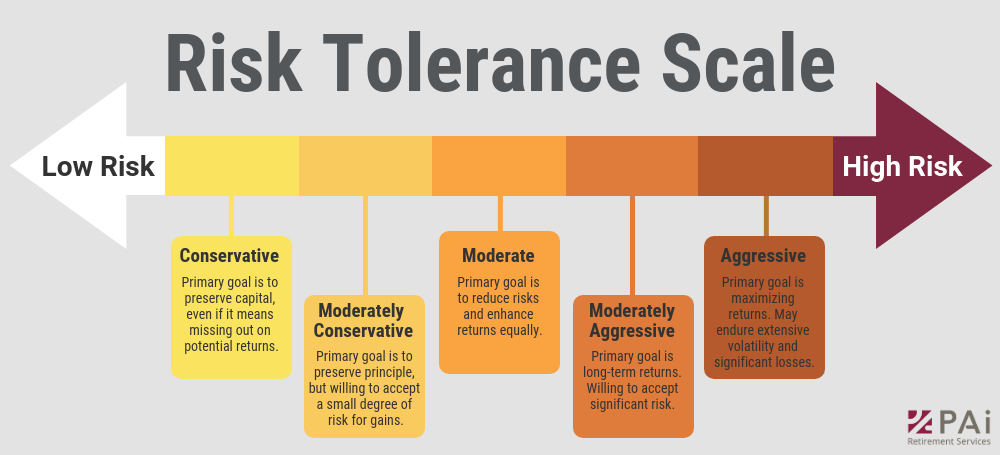

What is Your Risk Tolerance?

Every investor has a different level of risk tolerance, which is influenced by their psychological makeup, financial goals, and life circumstances.

As such, it is important to understand your risk tolerance and align your investments accordingly. For example, some people are comfortable with taking more significant risks for potentially higher returns, while others prefer safer, more conservative investments.

One of the most effective ways to mitigate risk as an investor is by conducting thorough research on a company and purchasing shares with a margin of safety.

When you understand a business well, you are less likely to react irrationally when a stock continues to climb (i.e. FOMO) or crashes out of nowhere.

On the flip side, it doesn’t hurt to avoid stocks that seem complicated and are difficult to understand—there will always be better investment opportunities in the future.

Moreover, by purchasing stocks with a margin of safety (i.e. a discount to a business’s intrinsic value), you protect yourself from any uncertainty you fail to foresee.

As a general rule of thumb, it is a good idea to add a larger margin of safety (i.e. 50% vs. 25%) to those stocks you feel less confident about.

-

Pay Attention to Behavioral Biases

As this article highlights, many behavioral biases affect our judgment and decision-making as investors.

If you can recognize these common behavioral biases before they take effect, you will protect yourself from succumbing to them, thus improving your chances of achieving success.

One effective way to overcome this obstacle is to record your decision-making through a journal or something similar.

The practice of recording your decisions and reflecting on them is an incredible tool that will increase your self-awareness and help you avoid making similar mistakes in the future.

While it is unlikely that you will master your behavioral biases immediately, over time, your awareness and ability to counteract them will improve, thus strengthening your skills over time.

-

Practice Emotional Discipline

Emotions, such as fear and greed, can have a powerful impact on investment decisions. To avoid making impulsive decisions based on short-term emotions, it is worthwhile to develop safeguards that strengthen your emotional discipline.

One way to accomplish this is by creating an investment checklist. An investment checklist is a set of criteria that must first be met before you make an investment decision.

This may include a certain growth rate, return on investment capital, debt level, margin of safety, or management team, among others.

Not only will this improve your emotional disciple, but it will also help you better understand a business and, thus, your investment success.

-

Diversify, Diversify, Diversify!

While diversification is not always necessary, it can help reduce investment risk, especially for those just beginning their investment journey or seeking to preserve wealth.

This largely has to do with over concentration, whereby a single stock or a couple of stocks make up a large portion of one’s portfolio.

If you find yourself overwhelmed by the fluctuations that these stocks bring, it is probably best to increase the number of your holdings to limit such volatility.

However, it is important to be aware that diversification can limit your growth potential as well, given that your top-performing stocks will be weighed down by slower growers.

Therefore, if you are seeking to maximize your growth potential, there may be more effective ways to mitigate risk than through diversification.

In other words, it doesn’t always make sense to diversify if you own high-quality companies whose chance of failure is quite low as is.

-

Avoid Information Overload

In the age of information, investors can be overwhelmed with financial news, market updates, and investment advice.

It’s essential to filter out and focus on reliable and relevant information to avoid analysis paralysis and emotional decision-making.

To overcome information overload, prioritize reading sources that come directly from the company and avoid relying on media outlets such as CNBC, YouTube, or Reddit.

Some of the best resources include a company’s annual reports, financial statements, earnings reports, earning calls, etc.

These sources provide in-depth information about a company and enable an investor to make reasonable conclusions about a business and its management team.

On the other hand, media platforms are largely opinion based and attempt to increase engagement through polarizing topics rather than offering sound investment advice.

That being said, media channels may help you discover new opportunities and perspectives.

As such, treat every source with skepticism, and form your own conclusions when making investing.

-

Past Performance vs. Future Prospects

Investing is a combination of analyzing historical data and considering future outcomes.

Though analyzing a stock’s past results helps one understand the business, its market, and its management team, it is not indicative of what will happen moving forward. Therefore, an investor should also attempt to understand the current economic conditions, as well as any future headwinds or tailwinds that may affect the performance of the business.

Combined, these assumptions paint a clearer picture of where a business is headed. However, there will always be situations where uncertainty is present and difficult to account for.

This is where a margin of safety is quite useful since it protects you from those uncertainties and any misjudgments you may have.

In all, it is better to be conservative in your assumptions to ensure that good outcomes in your investments lead to good outcomes.

-

Find an Investment Friend or Seek Professional Advice

One of the best ways to keep your investment assumptions in check is to involve friends or an advisor in your decision-making process.

These investment partners are a valuable asset since they offer different perspectives and open your mind up to outcomes that you may not have yet considered.

When debating with an investment partner, encourage them to be skeptical about your analysis and allow them to play devil’s advocate.

By challenging your thesis, your understanding of a potential investment will grow stronger and possibly help protect you against many of the emotional biases that plague our judgment.

-

Review and Rebalance Your Portfolio Regularly

Though you may have invested in a business and are pleased with your decision, your job isn’t finished, as you must continue to evaluate the investment to ensure that your thesis holds; if not, it is best to rebalance.

Reviewing your portfolio regularly is a great way to improve your investment skills over time, as it helps you take into account new information that you may otherwise miss.

Moreover, it doesn’t hurt to play devil’s advocate yourself since it will only strengthen your understanding of a business and protect you from holding a bad stock.

Investing is a game of constant learning. Those investors who stay hungry, humble, and rational throughout are often the ones who come out on top in the long run.

Conclusion

Investing can be quite emotional.

While we like to think that we have it under control all of the time, the reality is that many of our most important decisions are driven by emotions, not logic.

As such, we must be diligent throughout our investment process to ensure that we master our emotions and limit the effects of these behavioral biases.

If we do, then we will be lightyears ahead of those who allow human nature to get the best of them.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Braxia stock and are compensated by Braxia for Investor Relations Services. Edge Investments and its owners reserve the right to buy and sell shares in Braxia without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright ©️ 2023 Edge Investments, All rights reserved.