Stock splits can be confusing.

On the surface, it appears that an investor is increasing their stake in a company when in reality their position hasn’t changed at all.

But, what about if you own stock options instead?

Does your strike price change then?

How about the duration of your contract?

In this article, we explain what stock options are, what is the difference between a stock split and a reverse split, and whether it affects options differently.

If you have ever wondered how stock splits affect your investments then continue reading below.

What Happens When A Stock Splits?

A forward stock split happens when a company chooses to increase the number of shares outstanding trading on the public markets.

Contrary to popular belief, stock splits do not affect or increase the overall value of the underlying stock and company.

Rather, they are primarily used by a business to increase accessibility for investors who may not have the capital to purchase meaningful shares.

For example, let’s say that a stock, Company A, conducts a two-for-one stock split where each existing share is divided into two shares.

If you were an investor in Company A and owned 1,000 shares before the split, you would now own 2,000 shares of the business.

However, this does not mean your investment’s value has increased.

Instead, if each share was worth $5 before the split, then it would be worth $2.50 per share afterward.

Essentially, a stock split increases the number of slices in a pie, but it does increase the size of the pie itself.

To increase the size of the pie or company, the business needs to create more value for its customers thus increasing its intrinsic value, and subsequently, its market capitalization as well.

Why Do Companies Use Stock Splits?

Companies use stock splits for a variety of reasons, however, the main reason is to make their stock more accessible to a broader range of investors.

When a company’s stock becomes too expensive, it sometimes discourages people from investing if they are unable to afford the shares.

So, by splitting the stock and reducing the share price, more investors gain access to the business’s shares making it a more favorable asset to invest in.

Another reason that companies find stock splits useful is that they increase the liquidity of the asset.

With more shares outstanding trading on the market, the volume of shares traded likely increases as well.

This greater liquidity makes it easier for investors to buy and sell shares which may end up increasing the overall demand for the company’s stock as well.

Lastly, some companies choose to split their stock as a way to indicate to the market that they are confident in their prospects.

By announcing a stock split to the public market, a company is essentially implying that it anticipates its share price to rise in the future.

However, as we mentioned earlier, for the share prices to increase in value, the business itself needs to create additional value in the market.

Otherwise, the stock price may end up falling if and when the business fails to achieve this goal.

What Happens to Options When Stocks Split?

By now you may be wondering what happens to options when a company chooses to perform a stock split.

Well, if you own options and this occurs, the first thing you can expect is for the strike price to be adjusted accordingly.

During a stock split, the number of shares will increase, but the value of each share will decrease proportionally.

To account for this change, the strike price of the option will be adjusted downward in a similar fashion as the stock price.

For example, in a four-for-one stock split, the new strike price would be divided by four.

Building off of that, the contract multiplier, which is used to calculate the value of the option contract, will also be adjusted to reflect the stock split.

In this case, if the multiplier was 50 before the split, it would be changed to 200 afterward.

Lastly, you can expect that the option contract size will change as well.

Just like the contract multiplier, the number of contracts size will adjust accordingly to reflect the new number of shares.

So, if the number of contracts previously represented 100 shares, it would represent 400 after the four-for-one split.

In regards to the expiration date, it will remain the same regardless of whether a stock split occurs or not.

Overall, the changes will not make a huge difference, but you should expect that the strike price and the contract multiplier will change to reflect the underlying stock value.

Hopefully, now you won’t be surprised when this happens out of nowhere and you think that you purchased more than you bargained for.

What is a Reverse Stock Split?

Opposite to a stock split, reverse splits reduce the number of shares outstanding by consolidating existing shares into a smaller number of shares.

Typically, a company uses a reverse stock split when they experience a decline in their stock price and are attempting to boost the value to make their shares appear more attractive to investors or to meet a minimum price requirement for listing on an exchange.

For example, in a one-for-four reverse stock split, a shareholder who previously owned 1,000 shares before the split would end up with 250 shares afterward.

Again, this does not increase the value of the investor’s position even though the stock price has increased.

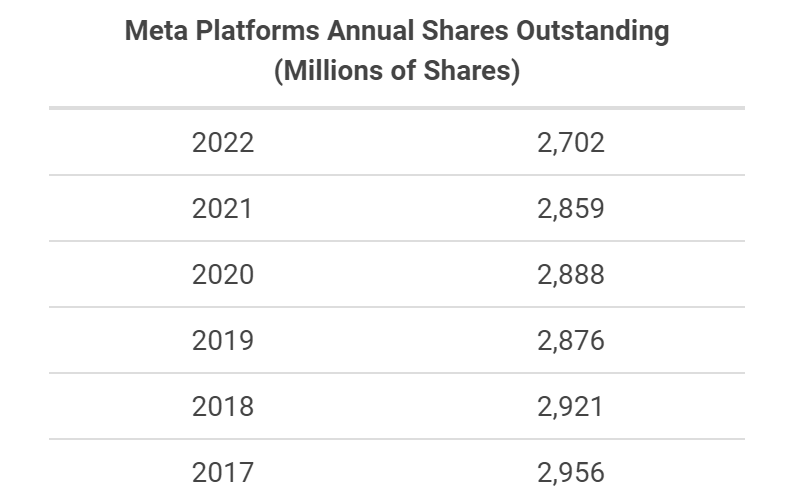

What is a Share Buy Back?

To help clarify another common misconception, reverse stock splits are not the same as share buybacks.

Instead, share buybacks happen when a company decides to buy back its shares from the market.

This buyback aims to reduce the number of shares outstanding, thus increasing the company’s earnings per share.

When purchased below a company’s intrinsic value, share buybacks are highly advantageous for existing shareholders as it increases their ownership stake in the business without them needing to take any action.

On the other hand, it can be detrimental to shareholders when a company overpays for its shares since the return on investment will be dismal compared to other projects and investments they could pursue.

In other words, rather than putting that money toward creating more value for customers, they are making a poor investment that generates marginal returns.

So, with that being said, reverse stock splits and share buybacks both reduce the number of shares outstanding, but they do so in different ways.

As such, it is valuable to understand the difference between the two so that you can make a more informed decision when they happen to your investments.

What Happens to Dividends when a Stock Splits?

Unfortunately for you dividend investors, a stock split does not increase the number of cash dividends paid.

Like many of the effects mentioned so far, a stock split will result in the dividend per share being adjusted to account for the change.

This means that if you were receiving $2 per share before the split, you would receive $1 per share following a two-for-one stock split.

Moreover, the total stock dividend payment that you receive will stay the same.

As for the dividend yield, which is the annual dividend payment as a percentage of the stock price, this will stay the same as long as the dividend policy and payout ratio remain unchanged; this is slightly different for a special cash dividend which will typically experience a decrease in the yield after the split because the stock price has decreased proportionately to the increase in shares.

So, to summarize all of this, you can be assured that nothing will happen to your prized stock dividends as the total amount of money will remain the same.

Ever wondered what the differences between growth and value investing are, check out this article.

Examples of Stock Splits in the Market

Following the recent bull market that reached record highs in 2021, multiple notable companies performed massive stock splits.

Here are three of the most talked about stock splits to happen in recent years:

- Amazon (AMZN)

In March 2022, Amazon declared its first stock split since 1999, whereby it implemented a twenty-for-one stock split. At its peak, shares were worth $2,785, a gain of 176,981% since May 1997. Today, they trade around $100.85 as of March 22, 2023, post-split.

- Google (GOOGL)

In July 2022, Google declared a twenty-for-one stock split. At its peak, Google shares were worth $3,030, a gain of 5,796% since September 2004. Today, they trade around $106.25 as of March 22, 2023, post-split.

- Tesla (TSLA)

In August 2022, Tesla declared a three-for-one stock split. At its peak, Tesla shares were worth $1145, a gain of 23,854% since July 2010. Today, they trade around $195.20 as of March 22, 2023, post-split.

Want to know how to value growth stocks like these, check out this article.

Frequently Asked Questions About When a Stock Splits

Are stock splits good or bad?

Stock splits are neither good nor bad, however, there are periods when it makes the most sense to use them.

For example, forward stock splits are most useful when a stock is trading at or near an all-time high because there is ample liquidity, and investments in the stock are expected to be at their highest levels.

On the other hand, a reverse split would be most useful when a stock is trading below its pricing requirements.

That being said, the actual effect of a stock split is neither good nor bad.

Ultimately it depends on the productivity of the business in relation to its current valuation that ends up determining whether it was worth it or not.

Does a stock split signal anything about the company’s future performance?

No, it does not.

Stock splits are primarily used to create greater accessibility for the asset.

They are not an indication of a business’s performance, or its future performance.

When a stock split occurs, it does not change the market cap valuation or the intrinsic value.

Therefore, the only thing that is indicated by a stock split is that the company is taking corporate action to make the stock more accessible to a wider array of shareholders; though it does not guarantee that new shareholders will join.

Should I buy options before or after the Stock Split?

Buying options before or after a stock split will have no adverse effect on the options themselves.

However, there may be an unanticipated reaction due to the stock split either causing the stock to increase or decrease in price.

For that reason, one could argue that there is an additional risk when buying options before a stock split compared to afterward when the split has already been taken into account by the market.

That being said, the options contract itself will not be positively or negatively affected by the stock split since they are adjusted to reflect the change.

Overall, it is important to do your research and understand the risks involved when trading options.

Not sure about options investing? Try investing in penny stocks instead. Check out this video to learn more.

Final Thoughts

Stock splits are a way for companies to create greater accessibility for investors, however, they do not increase the value of the business.

That is why it is advantageous for investors to understand them so that they do not fall victim to the common misconceptions of the market.

If you own a company that announces a stock split, take some time to understand why the business might be doing so.

Who knows, if the price per share falls following the announcement, you may be in a position to buy the dip at an exceptional price.

That being said, always keep in mind that even though the number of shares you own increases, it does not mean you own more of the company.

Overall, you should be able to use this information, to be better prepared, for when a stock split occurs.