Image Source: Equity Crowdfunding | Inventors Digest

In 2022 alone, the equity crowdfunding sector helped raise over $394 million for fast-growing companies. The average investment check size was $1,256, making it clear that this is not just some short-term fad. Rather, equity crowdfunding is a lasting trend that is here to stay (and is giving everyday investors a chance to enter the venture capital arena regardless of the size of their portfolio.)

However, despite the great opportunity and excitement surrounding equity crowdfunding, many still ask themselves, “Exactly what is equity crowdfunding?” They wonder how it differs from traditional investment opportunities or how they can get involved in this promising new industry.

In this article, we’re going to explain how equity crowdfunding is changing the game for investors, the advantages equity crowdfunding presents, the associated risks, and how you can start using this investment opportunity to grow your own portfolio.

The Concept of Equity Crowdfunding

Image Source: The Purpose of Developing a Business Pitch | CEOWORLD magazine

Equity crowdfunding represents a significant shift in how companies can raise capital and how individuals can now invest in early-stage startups.

It allows entrepreneurs to reach beyond the traditional avenues of venture capitalists and angel investors to a broader audience, leveraging the power of the internet to showcase their business ideas to potential investors worldwide.

How Equity Crowdfunding Works

Image Source: Equity Crowdfunding – Definition, Pros, Cons, Regulations | Corporate Finance Institute

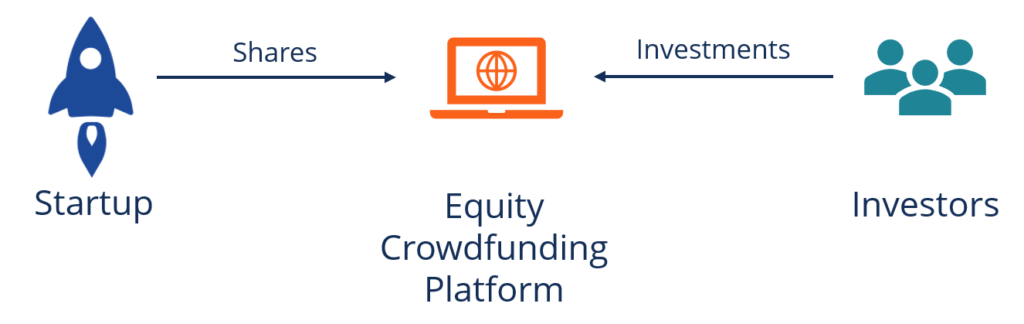

Equity crowdfunding platforms serve as modern marketplaces where entrepreneurs showcase their businesses, complete with comprehensive insights into their business models, market potential, and financial needs.

Prospective investors can explore these opportunities, perform their due diligence, and directly invest in companies that resonate with them.

And where traditionally, investing in startup businesses was reserved for venture capital firms or high-net-worth individuals, equity crowdfunding sites now let investors (regardless of their net worth) invest smaller sums in these fast-growing startups.

Essentially, instead of relying on one financial institution to provide the capital an entrepreneur needs to grow their company, business owners can now accept smaller sums of money from a larger amount of investors to raise significant amounts of capital quickly.

Investors then gain access to the high potential returns from investing in startups, while entrepreneurs can raise capital much more efficiently than traditional financing models.

Regulatory Framework

An important part of equity crowdfunding is the regulatory framework that helps protect both investors and the businesses involved.

In the United States, the Securities and Exchange Commission (SEC) oversees all equity crowdfunding activities, enforcing rules that both companies and platforms must follow:

- Companies must provide financial statements and business plans.

- Platforms are required to ensure that all information provided to potential investors is fair, clear, and not misleading.

Platforms like SeedInvest, Crowdcube, and others have become the gateways through which this exchange of capital for equity occurs. These platforms perform crucial roles in the equity crowdfunding ecosystem, including:

- Vetting: They conduct due diligence on the companies seeking to raise funds to ensure they meet high standards of business operation and transparency.

- Facilitation: They provide a streamlined process for transactions, making it easy for investors to purchase shares and for companies to receive funds.

- Education: They offer educational resources to help investors understand the risks and rewards associated with equity crowdfunding.

By utilizing these platforms, investors gain access to a portfolio of startups that were once out of reach, and entrepreneurs receive the necessary business funding needed to grow.

This is a significant evolution (and exciting improvement) from the exclusive, often opaque process of traditional venture capital investments.

Advantages of Equity Crowdfunding

Before we get into the different types of crowdfunding options for investors, we’ll first touch on some of the most important advantages investors should understand when looking to participate in equity crowdfunding opportunities.

Access to Early-Stage Ventures

- Individuals can invest in startups at an early stage, which was previously challenging without significant capital or the right connections.

- Investors have the opportunity to be part of a company’s growth journey from the ground up, potentially leading to substantial returns if the company is successful.

This shift not only empowers investors with smaller portfolio sizes but also stimulates innovation by channeling capital to where it is most needed. By funding startups, investors help to drive progress and innovation in various sectors.

Portfolio Diversification

- Equity crowdfunding enables investors to spread their risk across different industries and business models.

- It allows for investment in alternative assets, which can reduce overall portfolio risk when done properly.

One of the most significant advantages of equity crowdfunding is its ability to offer unique diversification from the stock market. These companies are not publicly traded and can be a great compliment to an already built out portfolio of stocks and bonds.

Potential for High Returns

- Startup investments can result in a great ROI if the business succeeds, significantly outperforming traditional equity and bond investments.

- The success of a crowdfunded company not only benefits the investors financially but also contributes to economic growth and job creation.

Furthermore, the satisfaction of contributing to a startup’s success story is a unique intangible benefit. Investors often feel a sense of pride and accomplishment in knowing that their capital is helping to fuel the next generation of companies.

Supporting Innovation and Growth

- By investing in startups, individuals directly support innovation and can drive industry change.

- There is an emotional reward in helping entrepreneurs achieve their dreams and bringing new products and services to the market.

In essence, equity crowdfunding is not just about potential financial returns; it’s about being part of the entrepreneurial ecosystem.

It’s about the joy of discovering new businesses and the gratification of knowing you’ve played a role in their success stories. As such, equity crowdfunding is not just an investment; it’s an adventure into the future of business and innovation.

3 Biggest Risks and Disadvantages of Equity Crowdfunding

Although investing in startups through equity crowdfunding is undeniably exciting, it is not without its fair share of risks.

It’s crucial for investors to approach these opportunities with a full understanding of the possible downsides.

High Failure Rate

Startups are inherently risky, with a significant percentage failing within the first few years. Investment in a single startup should be weighed against the backdrop of this statistical reality.

Liquidity Concerns

Equity in private companies is not as liquid as traditional stocks; selling shares can be difficult without a public market. This can lead to capital being tied up for longer than anticipated, sometimes several years.

Risk of Dilution

Additional funding rounds can dilute the equity of earlier investors if not properly structured. Understanding the terms of your investment is essential to mitigate unexpected dilution.

How to Get Involved in Equity Crowdfunding

Getting involved in equity crowdfunding is relatively easy. However, those interested should make sure they understand the process from start to finish and take their time when looking for the right platform and investment.

To help you get started, we’ve highlighted the three main steps you’ll need to consider.

Select a Platform

Your choice of crowdfunding platform is foundational. Opt for one that boasts rigorous vetting processes, a history of successful campaigns, and a commitment to investor education. It should feel like a natural extension of your investment style.

Below, we’ve highlighted 3 crowdfunding platforms for you to check out:

Assess Potential Investments

Assess the potential of startups by examining the strength of their business model, the experience of their team, and the uniqueness of their product or service. (for a more detailed look at how to perform due diligence and analyze a company, check out our other post here!)

Embrace Diversification

A diversified investment approach is your safeguard. By spreading your investments across different startups, you can buffer against the volatility typical of the startup ecosystem.

Additionally, be prepared for some of your investments to fail.

Not all startups are going to be successful, so inherently, some of the equity crowdfunding investments you make will go to zero, while others will provide significant gains.

Alternatives to Equity Crowdfunding

Image Source: Global asset managers pour more into alternative investments in 2022 | Pensions & Investments

While equity crowdfunding offers unique opportunities for investors, it’s not the only avenue for investing in early-stage companies or innovative projects.

Savvy investors can look at a spectrum of options to find the right fit for their portfolio. Here’s a look at some alternatives that provide different risk profiles and investment dynamics.

Venture Capital Firms

Venture capital remains a powerhouse in startup funding, offering seasoned investors a chance to pool their money in funds that have the resources and expertise to vet and support high-potential companies. Investments here are typically larger and more long-term, with the potential for VC firms to hold significant influence over company decisions.

Angel Investing

Angel investing allows individuals to make personal investments in startups at an early stage. Unlike equity crowdfunding, where the investment is often passive, angel investors may take a more hands-on approach, offering mentorship and leveraging their networks to guide the company’s growth.

Debt Crowdfunding

Debt crowdfunding is another option, where instead of equity, investors lend money to companies and receive interest payments in return. This option is similar to small business loans because it provides a fixed return and is considered less risky when compared to equity investments since lenders are paid out before equity holders in the event of liquidation.

Traditional Stocks and Bonds

Investors looking for a more traditional route can consider stocks and bonds, which offer liquidity and a level of predictability. While the returns might not be as high as those potentially gained from successful startups, they provide a stable addition to an investment portfolio.

Different Types of Equity Crowdfunding

Any guide answering the question, “What is equity crowdfunding?” wouldn’t be complete without showcasing the different types of crowdfunding available.

No specific type is better than another. Rather, different styles of crowdfunding will appeal to different investors based on their interests, portfolio size, and investment goals.

Here’s a look at the different forms available:

Regulation Crowdfunding (Reg CF): This type allows startups to raise up to $5 million from both accredited and non-accredited investors through registered crowdfunding portals, subject to regulatory caps on investment amounts based on an investor’s income and net worth.

Regulation A (Reg A): Often referred to as a “mini-IPO,” this type enables companies to raise up to $75 million from the public with fewer regulatory hurdles than a traditional IPO, allowing for a broader investor base.

Regulation D (Reg D): Typically reserved for accredited investors, Reg D allows companies to raise an unlimited amount of money without registering securities with the SEC, usually through private placements.

Intrastate Crowdfunding: Specific to residents within a state, intrastate crowdfunding permits companies to raise funds from non-accredited investors in their own state under state securities regulations, often with less stringent rules than federal regulations.

Each type of equity crowdfunding has its strategic benefits and regulatory considerations, offering different avenues for companies to secure funding and for investors to find potential investment opportunities.

Conclusion

Image Source: What mindset gives you the best edge in the startup world? | Quora

Equity crowdfunding has revolutionized how we think about investing, bringing the thrill of venture capital to the broader public. By leveling the financial playing field, it empowers individuals to support and grow with the startups they believe in.

That being said, it’s not without its complexities and demands a strategic approach to be successful.

Investors must balance their enthusiasm for innovation with a measured understanding of the inherent risks.

And as this sector evolves, intelligent investors who are well-prepared and willing to do their research stand to gain immense value (and money) from the opportunities equity crowdfunding presents.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.