There are many types of assets out there in the financial markets today. For example, we have access to stocks, bonds, commodities, crypto, art, real estate, derivatives, and more!

But one particular asset that you may not have heard of but may be invested in is mid-cap stocks.

Medium-sized companies tend to be considered the forgotten stock class because of their position in the market.

On the one hand, you have the mighty large caps that dominate the stock market with hundreds of billions, even trillions, of dollars invested in these companies. On the other, you have penny stocks and small caps, which are fledgling startups hoping to change the world.

But what about the stocks in the middle?

Though they are not often talked about, mid-caps are an excellent asset class because, in many instances, they possess the best of both large caps and small caps without adding on any risk.

In this article, we will provide you with a full breakdown of mid-cap stocks, their risks, and their advantages, plus an explanation of how to invest in mid-caps effectively.

If you’re looking to take advantage of the overlooked opportunity, continue reading below.

What are mid-cap stocks?

Mid-cap stocks are publicly traded companies that have a market capitalization between $2 billion and $10 billion.

Typically, mid-cap companies are more established businesses compared to small-cap companies, possessing a more recognizable brand while earning more in revenues, profit, and free cash flow.

Moreover, mid-caps tend to be less mature than their larger counterparts (large-cap stocks) as they are still benefiting from the favorable tailwinds that are carrying their industry for a few more years to come.

Another way to think of investing in mid-caps is like owning the best of both worlds since you buy more predictable businesses with higher earnings power while also having the potential to generate superior returns compared to large caps.

For this reason, investors often flock to these stocks when they are trying to capture higher returns without increasing their risk exposure in the process.

All-in-all, mid-cap stocks are a great tool to help diversify your portfolio.

How Does Market Capitalization Work?

If you’re not familiar with the term market capitalization, or market cap for short, it’s simply a measure of the total value of a company’s outstanding shares of stock.

To calculate the market cap, all you have to do is multiply the number of outstanding shares by the current market price of each share (aka the stock price).

For example, if a company had 50 million outstanding shares and the current value of the stock price is $20 per share, then the market cap would be $1 billion (50 million shares x $20 per share).

This metric is quite useful for investors because it helps them differentiate stocks by giving them an idea of a company’s size and position in the market.

Furthermore, market capitalization can be used to compare a company’s intrinsic value to its market value, which will help determine whether the business is overpriced or undervalued in the current market.

Overall, it’s an effective tool and something every investor should consider.

To learn more about what makes a stock overvalued or undervalued, check out the attached article.

What is the Difference between Mid-Cap and Large-Cap Stocks?

The main difference between mid-cap and large-cap stocks is the size of the companies and their market caps; large-cap stocks have a market cap greater than $10 billion, while mid-cap stocks trade between $2 billion and $10 billion.

Generally, large-cap stocks are more established and mature companies, with more predictable earnings and less market volatility.

As such investors typically consider them to be more conservative and lower-risk investments.

This is in contrast to mid-cap companies which are for the most part still growing and expanding but may not yet be established as market leaders.

Fortunately, this can often lead to them achieving a higher growth potential, with a little more risk, depending on the economics and the financial health of the business.

To learn more about large-cap companies, check out our large-cap beginner’s guide.

What is the Difference between Mid-Cap and Small-Cap Stocks?

Similarly, the main difference between mid-cap and small-cap stocks is the size of the companies and their market caps; small-cap stocks have a market cap between $300 million, while mid-cap stocks trade between $2 billion and $10 billion.

Without going into too much detail, you can essentially think of all the comparisons we mentioned in the last section and apply them to small-cap companies and mid-caps.

In this case, mid-caps would possess similar characteristics to large caps, while small-caps would possess similar characteristics as mid-caps.

However, one thing to keep in mind is that small-cap stocks will typically be riskier compared to any asset larger than them.

But other than that, most of their attributes are the same in comparison to mid-caps and large-caps.

To learn more about small caps, check out our small-cap beginner’s guide.

What are the Advantages of Investing in Mid-Cap Stocks?

There are many advantages to investing in mid-cap companies, including:

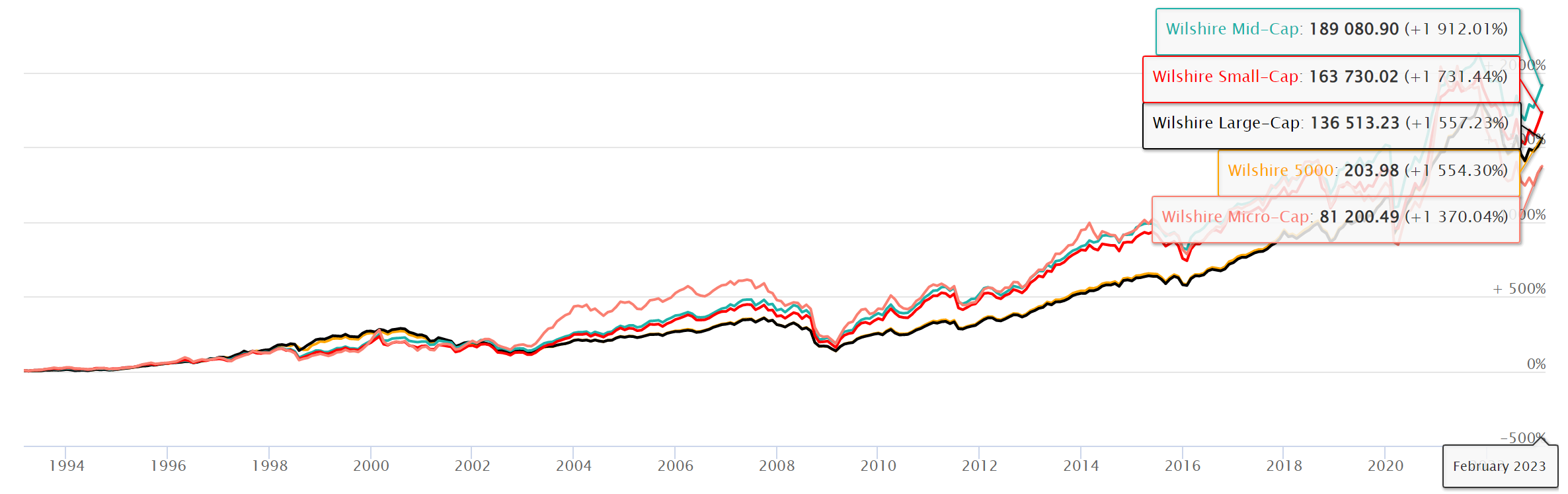

Greater Growth Potential than Large Cap Companies

With a smaller market cap and more room to spare, mid-cap stocks have the potential to outpace large caps tenfold.

If you think about it, there are some companies today that have surpassed the trillion-dollar market cap, and rightfully so.

Those who eclipse this milestone are some of the best companies in the world, boasting some of the strongest MOATs of all time.

These stocks include prestigious names like Apple, Saudi Aramco, Microsoft, Alphabet, Google, and Amazon.

But there is a catch.

Although they likely continue to grow into the future, the reality is that there is only so much space for growth given the limitations of the economy and the capital that is in circulation.

The best example of this is Apple which has a market of over $2 trillion.

For the company to double once, it would require them to create another $2 trillion in value for customers.

Though this is possible, it’s likely to take a significant amount of time, meaning that you will generate a lower ROI.

However, if you found a mid-cap of the same caliber for growth, you could easily generate a return two times, five times, or even 100 times your original investment because the market cap is so small in comparison.

So, while many may argue that large-cap companies are safer, it doesn’t hurt to invest in mid-caps that are more profitable if they are excellent companies.

It all depends on the stocks you buy and the price you pay for them.

More Stability than Small Cap Companies

With a firmer grip on their market and more liquidity flowing in and out, mid-caps tend to be more stable than smaller companies.

This allows investors to better predict the future earnings growth and revenue growth of a business while also determining a more accurate intrinsic value for the stock.

Though nothing is guaranteed in the stock market, having greater stability in your investment portfolio is typically desired by investors as it means you will be less likely to fall victim to your emotions if stock prices swing.

Therefore, if you would rather your investments be calm and steady more often, then mid-caps are the way to go.

Better Opportunities for Retail Investors

Similar to small-cap companies, mid-caps often go unnoticed by large institutional investors like mutual funds and hedge funds.

This is because, in most instances, investing in mid-cap companies would provide only marginal returns for their shareholders.

As such, these institutions tend to focus solely on large-cap stocks since they get more bang for their buck.

Fortunately for us little guys, this means that we can pile our money into the best small and mid-cap businesses before they even have a chance.

Once they do, we will benefit greatly from the added capital flowing in.

What are the Risks of Investing in Mid-Cap Stocks?

Though there are several advantages to investing in mid-caps, it’s also smart to be aware of their associated risks.

Here are a couple of the most common mid-cap risks:

Greater Volatility than Large Caps

In a similar fashion as small caps, mid caps are likely to be more volatile than large caps because they are less liquid.

This means that there will be periods where the stock price fluctuates more sporadically and in an unpredictable manner.

If you’re an investor that desires a super stable portfolio, then your best bet is to invest in large-cap stocks only.

Keep in mind that the best opportunities arise when a great company’s stock price falls below what the business is worth.

If a mid-cap stock is more volatile than large caps, then that would imply that there would be more opportunities to buy the business at a discount than there are with a large-cap stock.

Therefore, if you’re trying to make substantial gains in your portfolio, your better bet is to find excellent mid-cap stocks and buy them when they’re cheap.

Limited Financial Resources

As smaller companies, this often implies that mid-caps have less capital at their disposal.

This can sometimes make it difficult to compete with larger businesses if they have greater economies of scale.

When analyzing a mid-cap company, you will want to pay close attention to the types of businesses they compete against.

If they face multiple formidable opponents, then it may be difficult for them to increase their market share and thus their competitive advantage as well.

The best opportunities arise in those markets where everything is relatively unscathed.

How do you find the best mid-cap stocks to invest in?

To find the best mid-cap stocks to invest in, you will need to use a variety of tools to help narrow down your search.

The most efficient way to do so is by using a stock screening tool that helps you filter any bad companies or unwanted industries.

In general, we will want to find companies that possess a low P/E ratio (less than 20), a low Debt to Equity Ratio (less than 0.5), and a high ROE (greater than 20%).

Once you have a list of businesses you will then need to analyze each to determine which are the best of the bunch.

We will discuss that more in the next section, but for now, we will touch on a few other ways to find mid-cap stock ideas.

These sources include but are not limited to, website blogs, YouTube channels, podcasts, etc.

Though these sources typically provide limited financial information, they make up for it in that they are a great way to discover new and exciting companies that you may have never heard of before.

Not only that, but these media outlets may even offer a new perspective on a company you already had an opinion about.

In general, the more exposure you have to mid-cap stocks, the better idea you’ll have about what makes one an excellent investment.

To learn more about the best investing YouTube and Podcast channels, check out the attached articles.

How to Evaluate Top Mid-Cap Stocks?

When evaluating top mid-cap stocks, you will need to consider a few important factors before investing in protecting yourself from making costly investment mistakes.

-

Find Easily Understandable Businesses

First, you will want to find a business that you can easily understand and that possesses a durable competitive advantage or two.

Stock market crashes are real, and they happen often. The last thing you want is to be stuck with a business that you don’t understand well and are considering selling to spare your losses.

Instead, if you find yourself owning mid-caps that you know well, then you have nothing to fear because you’re comfortable with how the asset will perform in the long run, regardless of short-term stock price swings.

In fact, you may even buy more if that asset goes on sale at a cheaper price.

-

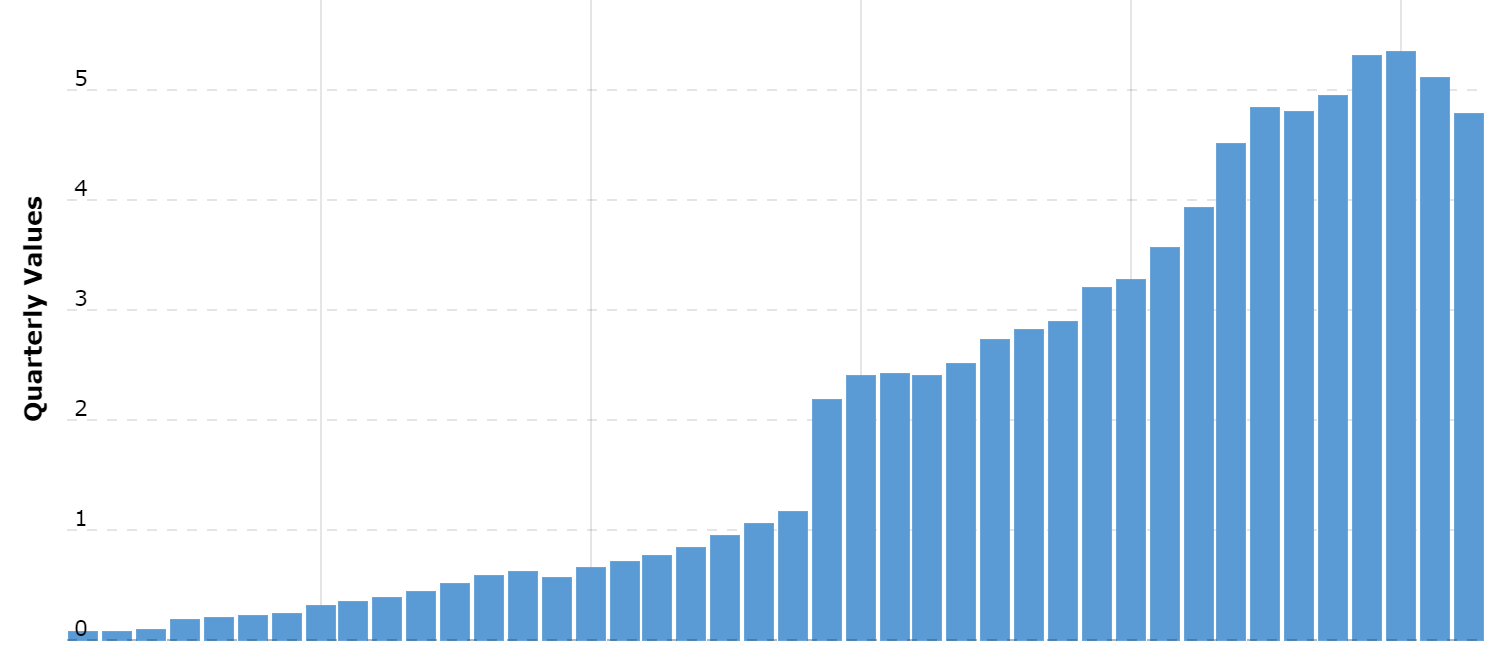

Analyze the Financials

A business’s competitive advantages are best demonstrated by a company’s financial metrics.

When analyzing the financial statements of a mid-cap, look for companies whose revenues, net income, book value, free cash flow, ROIC, and ROE are all trending upwards, ideally growing above 10% YoY.

Then, you will need to make sure that the business hasn’t taken on too much debt because it can be detrimental to the company in times of uncertainty and strife.

Our preferred measure for evaluating the severity of debt is the Long-term Debt to Free Cash Flow ratio because it calculates the number of years it will take to pay off the current levels.

For example, if a company has $5 billion in long-term debt and it generated free cash flows of $300 million that year, this would imply that it would take 16.67 years to pay off its debt at the current annual rate.

Ideally, we want this number to be under three years as this is an easily attainable number that reduces the threat of being over-leveraged and going bankrupt.

Once you have found a company with the ideal characteristics, the next step is to study its management team.

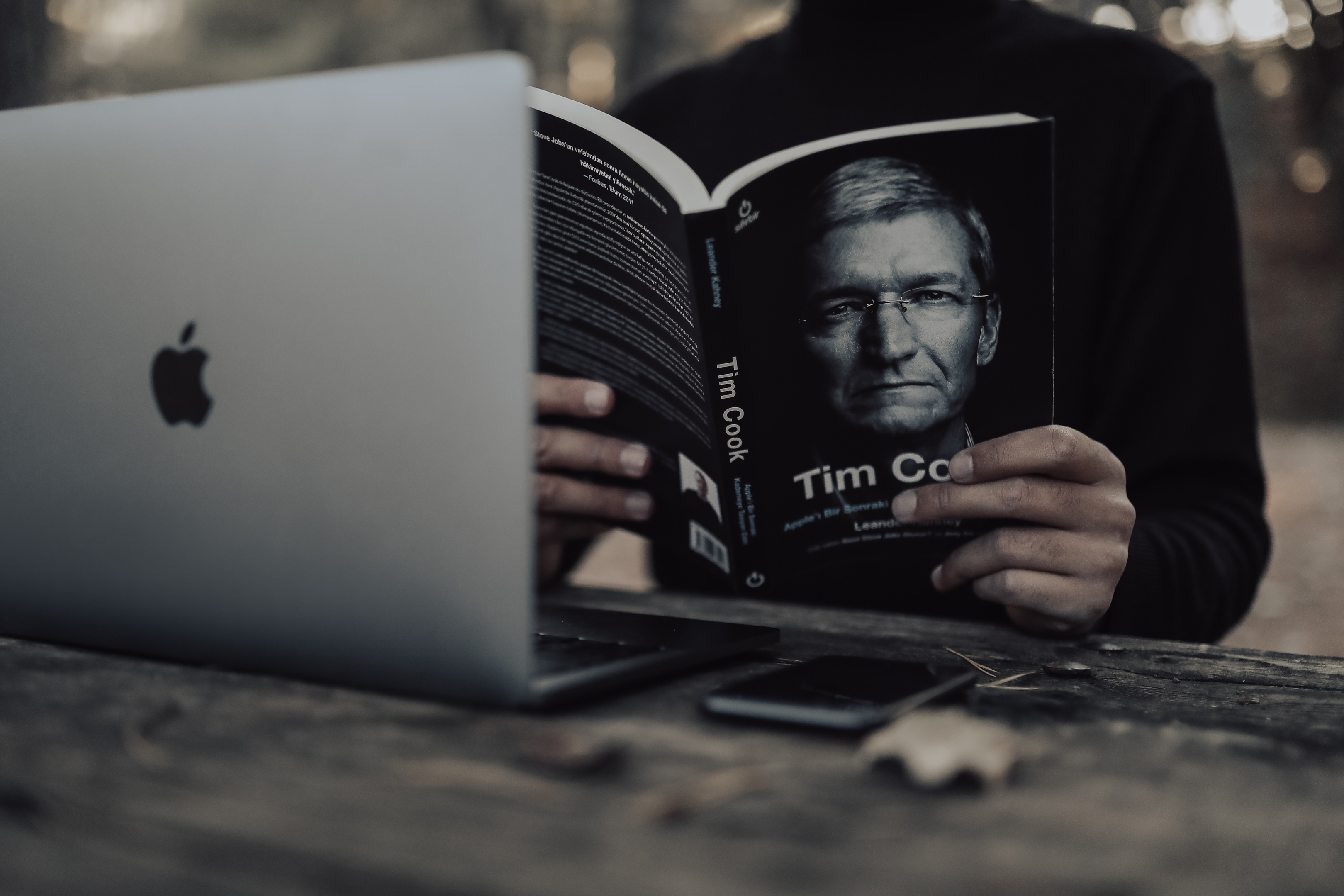

3: Who Runs the Company?

Judging a human’s character can be difficult, but it’s a valuable skill set to have in investing.

While it’s great to have a charismatic and visionary leader, these qualities do not necessarily produce spectacular results.

Instead, you want to find companies whose leaders are decisive, long-term oriented, motivated, realistic, accountable, and focused.

Because through these characteristics, you will gain a leader who is closely aligned with your interests as a shareholder and not someone that prioritizes getting rich off their company.

To gauge the management team’s character read through the company’s annual reports and listen to their quarterly earnings calls.

If the CEO doesn’t sugarcoat anything, is accountable for their mistakes, and never overpromises, then this is a positive sign.

To help guide you, we highly recommend reading Warren Buffett’s Annual Shareholder letters, as they are a treasure trove of information and an excellent example of how the leader of a company should act.

Oh, and one more thing, it doesn’t hurt to find a business whose leader owns a significant portion of the company.

If their financial fate is tied to the company and its shareholders, it means that they will avoid being careless and will prioritize the long-term success of the company over anything else.

After all, it’s their net worth and reputation on the line.

4: Buy the Stock at a Discount

Once you have analyzed the company and determined that it’s a worthy investment, the final step to being a successful mid-cap investor is to buy the company at a discount.

Not only does a company trading for cheap give you greater returns on your investment, but it also protects your downside risk since there is an implied margin of safety.

There are multiple ways to value a mid-cap company, including a Discounted Cash Flow model or the comparables method.

We cover both of these methods in greater detail in our how to value growth stocks article.

Final Thought: Is It Worth Investing in Mid-Cap Stocks?

Investing in mid-cap stocks is a great way to diversify your portfolio and strengthen your investment strategy.

Since mid-caps offer investors the opportunity to capitalize on the best of both large-cap and small-cap stocks, they are a worthwhile investment for any retail investor looking to make greater returns on their assets.

As always, be careful when investing in mid-cap stocks, or any stocks for that matter, because there are both good and bad businesses out there, and you don’t want to get caught up in a poor investment.

But, if you follow the steps we mentioned earlier, and focus only on the best businesses, then it’s likely that you will find success in this market.

Remember, investing is about being patient and staying disciplined.

All you need is a few great investments to change your life forever.

Happy investing.

Want to learn more about how we view the growth stock market today? Check out our recent YouTube Video.